|

市场调查报告书

商品编码

1641833

神经网路软体:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Neural Network Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

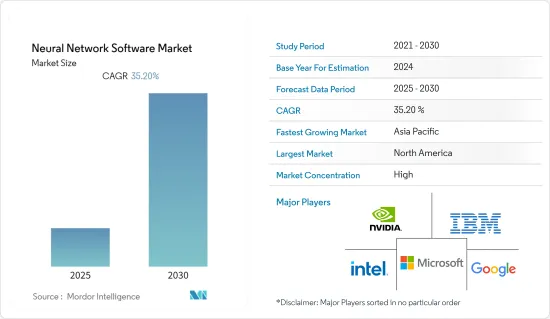

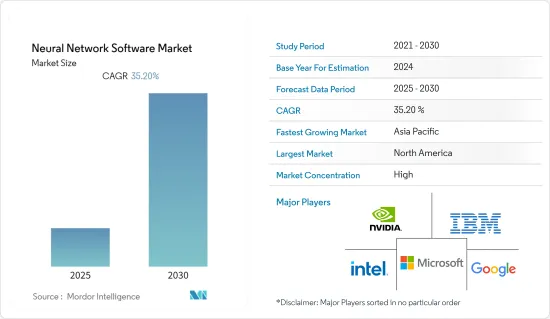

预测期内,神经网路软体市场预计将以 35.2% 的复合年增长率成长。

主要亮点

- 人工神经网路在人工智慧发展的早期阶段被完全忽视。它逐渐得到认可,并成为引领人工智慧(AI)发展趋势的大规模演算法。

- 物联网和连网型设备的采用将产生大量资料。然而,新兴的分析工具填补了这一空白并推动了神经网路软体市场的需求。

- 此外,在分析领域,预测性和规范性分析(而非说明分析)的趋势正在推动神经网路软体市场的成长。这一趋势是由神经网路软体针对不同应用提供完全客製化功能所推动的。

- 全球工业自动化的提高正在推动机器学习及其在几乎所有行业的应用的发展。然而,缺乏全球专业知识正在减缓适应营运挑战的速度并限制市场成长。

- 然而,全球神经网路软体市场正在扩大。许多挑战阻碍着进步。解释熟练的动作模式、同步课程和延迟使用技术是此类障碍的典型例子。此外,只有少数人能够使用智慧型设备,迫使他们即时参与、学习和调整。

- 神经网路软体市场正在全球扩张。该领域的进一步成长将取决于多种因素。这些可能性包括扩展人工智慧,增强大脑学习和识别模式并与智慧行为同步的能力。智慧型设备等现代技术有许多用途。这些都是促进成长的机会。

- 由于各国广泛实施封锁措施以遏制病毒传播,COVID-19 疫情在疫情初期对神经网路市场的成长产生了重大影响。然而,由于对地理资料、分析工具和各种云端基础的预测解决方案的需求增加,神经网路领域预计将在疫情后復苏。

神经网路软体市场趋势

医疗保健产业强劲成长

- 医疗保健机构正在利用人工神经网路 (ANN) 来改善医疗服务并降低成本。 ANN 在诊断中的应用是众所周知的,但它们也越来越多地用于医疗管理决策。

- 医疗保健拥有复杂的资料环境。肺分割使用深度学习来从其余解剖结构中分割并精确细化肺部区域。虽然骨骼评估是一个难以直接观察的领域,但深度学习可用于追踪操作,帮助医生实际观察骨骼并做出决定。

- IBM 表示,随着电子健康记录和 DNA 序列等医疗保健资料收集数位化的进步,医疗机构正在寻求透过分析每天收集的大量数位资讯来改善服务并降低成本。

- 神经网路软体也有助于提高标准电脑处理如此大量资料的效能。英特尔与飞利浦合作,为 X 光和电脑断层扫描 (CT) 扫描的深度学习推理带来高效能和效率,而无需 GPU丛集等加速器。全球人工智慧投资集中在垂直产业(AI+)、视觉、巨量资料、资讯服务、智慧机器人等领域。

北美占有最大市场占有率

- 北美是神经网路市场发展最大的地区。基础设施和研发的不断发展正在推动对问题识别、预测和製定应用的神经网路软体的需求。

- 美国是该地区技术最先进的国家,其在银行、金融服务、国防、医疗保健和物流等行业的市场正在成长。神经网路软体在评估贷款申请和预测股票市场指数方面在 BFSI 领域表现出了颠覆性的性能。

- 例如,对于纳斯达克股票价格预测,发现具有三个隐藏层的网络是最佳化网络,在检验资料集上的准确率为 94.08%。

- 此外,该地区继续保持着作为专注于流程优化的最尖端科技的早期用户的声誉。凌华科技采用英特尔的 OpenVino,透过整合机器学习工具进行製造流程指导、识别、测量和检查。

- 此外,该地区的汽车和製造业等行业正在大力投资采用人工智慧来优化流程,从而增加了神经网路软体市场的机会。

神经网路软体产业概况

神经网路软体市场由英特尔和 Nvidia 等少数公司主导。儘管出现了许多根据最终用户提供可自订软体的参与者,但预计同样的趋势仍将在整个预测期内持续下去。

2022 年 6 月,Qualcomm Technologies Inc.将目前一流的 AI 软体集成为套件 Qualcomm AI Stack,进一步加强了其在 AI 和连网智慧边缘领域的领导地位。这将使 Qualcomm Technologies 的OEM客户和开发者在 Qualcomm Technologies 硬体上创建、优化和部署 AI 应用时能够充分利用 Qualcomm AI Engines 的效能。

2022 年 10 月,IBM 宣布发布三个新库,扩展其可嵌入式 AI 软体产品组合。这些程式库旨在让 IBM 生态系统合作伙伴、客户和开发人员能够更简单、更快速、更经济地创建自己的 AI 解决方案并推向市场。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 空间资料和分析工具的可用性

- 对预测解决方案的需求不断增加

- 市场限制

- 缺乏专业知识和其他营运挑战

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 按应用

- 诈欺侦测

- 硬体诊断

- 财务预测

- 影像优化

- 其他用途

- 按行业

- BFSI

- 卫生保健

- 零售

- 防卫厅

- 媒体

- 后勤

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 韩国

- 澳洲

- 其他亚太地区

- 世界其他地区

- 北美洲

第六章 竞争格局

- 公司简介

- IBM Corporation

- NVIDIA Corporation

- Intel Corporation

- Microsoft Corporation

- Clarifai Inc.

- Alyuda Research LLC

- Neural Technologies Ltd.

- GMDH LLC

- Neural Designer

- Neuralware

- AND Corporation

- Swiftkey

第七章 市场机会与未来趋势

第八章投资分析

The Neural Network Software Market is expected to register a CAGR of 35.2% during the forecast period.

Key Highlights

- The artificial neural network was completely neglected in the early stage of artificial intelligence development. Gradually recognized and became a large-scale algorithm leading the artificial intelligence (AI_ development trend.

- The adoption of IoT and connected devices generate vast structure and unstructured data available to the companies, which is tedious to process. Still, the emerging analytical tools covered the gap and drove the demand for the neural network software market.

- Moreover, in the analytics field, the trend towards predictive and prescriptive analytics passing over descriptive analytics is driving the growth of the neural network software market. The trend is booming as the neural network software offers complete customization according to the application.

- The increasing industrial automation across the sectors globally is boosting the development of machine learning and its applications in almost all industries. However, due to the lack of global expertise, slow adaptation to operational challenges restricts the market growth.

- However, the global market for neural network software is increasing. Many challenges are standing in the way of advancement. Explaining clever movement patterns, lesson synchronization, and delayed technology use are typical examples of these obstacles. Additionally, only some have access to smart devices that could force them to participate, learn, and adjust in real time.

- The market for neural network software is increasing globally. The ability of the sector to grow further depends on numerous factors. These possibilities include expanding artificial intelligence and enhancing the brain's capacity to learn and recognize patterns and synchronize with intelligent behaviors. The newest technology, like smart devices, has many different uses. These are the opportunities that encourage growth.

- Due to the widespread use of lockdowns in numerous nations worldwide to stop the spread of the virus, the COVID-19 outbreak significantly impacted the neural network market growth during the initial stages of the pandemic. However, with the increase in demand for geographical data and analytical tools and various cloud-based & prediction solutions, the neural network sector is anticipated to recover post-pandemic.

Neural Network Software Market Trends

Healthcare Segment to Grow Significantly

- Healthcare organizations are leveraging artificial neural networks (ANN) to improve care delivery at a reduced cost. Applications of ANN to diagnosis are well-known; however, it is increasingly used to inform healthcare management decisions.

- Healthcare has a complex data environment. In lung segmentation, deep learning is used to segment a lung area from the rest of the anatomy so that it can be accurately refined. Whereas bone assessment is a challenging area for direct observation, deep learning is used to keep track of the maneuver, helping the physician actually to observe the bone and make decisions.

- IBM suggested that with increasing capture and digitization of healthcare data such as electronic medical records and DNA sequences, healthcare organizations are taking advantage of analyzing large sets of routinely collected digital information to improve service and reduce costs.

- Neural network software also helps improve the performance of the standard computer in dealing with such a vast amount of data. Intel teamed up with Philips to deliver high-performance, efficient deep-learning inference on x-rays and computed tomography (CT) scans without needing accelerators like GPU clusters. The global investment in AI is focused on the vertical industry (AI+), vision, big data, data service, and intelligent robotics.

North America to Hold the Largest Market Share

- North America is the largest region for developing the Neural Networks market. Increasing infrastructure and Research and development have boosted the demand for Neural Networks software for problem recognition, forecasting, and formulation applications.

- The United States is the most technologically advanced country in this region, with an increasing market for industries, like BFSI, Defense, Healthcare, and Logistics, among others. The neural network software has shown disruptive performance in the BFSI sector in evaluating loan applications and predicting the stock market index.

- For instance, in the NASDAQ stock exchange rate prediction, it was discovered that a network with three hidden layers was the optimized network with an accuracy of 94.08% for the validation dataset.

- Additionally, the region continues to uphold its reputation as an early user of cutting-edge technologies with a focus on process optimization.. ADLINK Technology Inc. adopted Intel's OpenVino for guidance, identification, gauging, and inspection of manufacturing processes by integrating machine learning tools.

- Moreover, industries like Automotives and manufacturing in the region are heavily investing in adopting artificial intelligence for their process optimization, which increases the opportunity for the neural network software market.

Neural Network Software Industry Overview

A few players, like Intel and Nvidia, dominate the neural network software market. Still, the forecast period is expected to follow a similar trend throughout the forecast period even though many players are emerging for offering software with customization capability according to the end-user.

In June 2022, Qualcomm Technologies combined its current best-in-class AI software offerings into a single package, the Qualcomm AI Stack, to further its leadership in AI and connected intelligent edge. This will enable Qualcomm Technologies' OEM clients and developers to fully utilize the performance of our Qualcomm AI Engine when creating, optimizing, and deploying their AI applications on Qualcomm Technologies' hardware.

In October 2022, with the release of three new libraries, IBM announced an increase to its embeddable AI software portfolio. These libraries are intended to make it simpler, quicker, and more affordable for IBM Ecosystem partners, clients, and developers to create and market their own AI-powered solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Availability of Spatial Data and Analytical Tools

- 4.2.2 Increasing Demand for Predicting Solutions

- 4.3 Market Restraints

- 4.3.1 Lack of Expertise and Other Operational Challenges

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Fraud Detection

- 5.1.2 Hardware Diagnostics

- 5.1.3 Financial Forecasting

- 5.1.4 Image Optimization

- 5.1.5 Other Applications

- 5.2 By End-user Vertical

- 5.2.1 BFSI

- 5.2.2 Healthcare

- 5.2.3 Retail

- 5.2.4 Defense Agencies

- 5.2.5 Media

- 5.2.6 Logistics

- 5.2.7 Other End-user Verticals

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 South Korea

- 5.3.3.3 Australia

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 NVIDIA Corporation

- 6.1.3 Intel Corporation

- 6.1.4 Microsoft Corporation

- 6.1.5 Clarifai Inc.

- 6.1.6 Alyuda Research LLC

- 6.1.7 Neural Technologies Ltd.

- 6.1.8 GMDH LLC

- 6.1.9 Neural Designer

- 6.1.10 Neuralware

- 6.1.11 AND Corporation

- 6.1.12 Swiftkey