|

市场调查报告书

商品编码

1641836

海上石油和天然气通讯:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Offshore Oil & Gas Communications - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

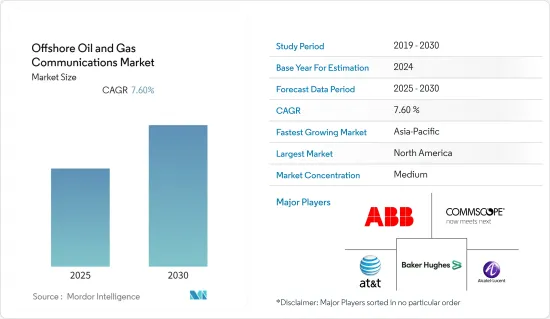

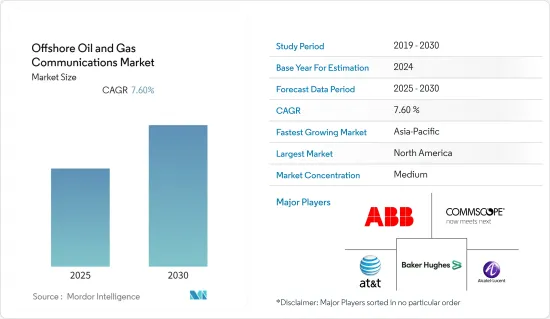

预计预测期内海上石油和天然气通讯市场复合年增长率将达到 7.6%。

主要亮点

- 从石油钻井平台到海上平台,拥有良好的石油和天然气通讯设备对于安全和效率至关重要。良好的通讯系统不仅用于在海上和陆地之间传输资料。

- 海上钻机的安装、操作和维护相对较困难。他们必须应对强劲的洋流和非常偏远的环境等环境因素。大多数钻机都是在深水区域作业的深水钻机。在这些偏远地区,通讯在监控多个组件以及与岸上设施保持联繫以进行报告和紧急援助方面发挥着重要作用。

- 如今,有多种通讯技术可以单独或作为系统运作来解决海上通讯问题。卫星通讯需要在海上站点配备 VSAT,并用于偏远地区和移动船隻,是与海上人员通话的最常见方式。随着大量资金投入到海上油田的基础设施开发中,它们现在拥有了行动电话网路。

- 然而,对资料保护不足、资料传输风险、资产安全以及网路攻击的便利性的担忧可能会减缓海上石油和天然气田通讯业的发展。油价波动可能会进一步抑製油田通讯产业的成长。维护此过程的高成本可能会进一步限製油田通讯业务的扩展。

- COVID-19 也影响了石油和天然气产业。每个人都必须适应,从被迫休假的员工到必须从根本上重新考虑其长期计划的企业。公司必须重新考虑他们的长期策略。对于海上石油钻井平台来说,影响就更加明显。新冠肺炎疫情扰乱了海上石油钻机的开发与维护。疫情过后,产业正在扩张,采用新技术和新的工作方式,企业也正在适应这些新情况。

海上石油和天然气通讯市场趋势

基于通讯的技术进步推动市场成长

- 直到几年前,海上设施和岸上基地之间的通讯还仅限于双向无线对讲机频道和每日报告。驻扎在海上的油田工人实际上与世界其他地区的联繫被切断了。然而,通讯技术的进步已经改变了海上工业的工作。

- 借助微波通讯技术,资料可以在波长小于一公尺的范围内传输。对于彼此靠近的位置,请选择此类微波解决方案。光纤通讯将安装在北海和美国墨西哥湾等交通繁忙的地区。

- 技术的进步改进了通讯系统,彻底改变了整个海底开发以及无人海洋产业在偏远地区的工作方式。石油和天然气产业对网路安全威胁的脆弱性不断增加,这是油田通讯市场成长要素。对云端基础的服务的需求日益增长以及对采用有效通讯技术的日益重视将加剧对油田通讯的需求。网路基础设施投资的增加以及石油和天然气行业的扩张和成长可能为油田通讯市场提供更盈利的成长前景。

- 随着世界各地越来越多的石油和天然气计划建设,海上石油和天然气通讯市场预计将成长。贝克休斯称,截至去年,亚太地区持有最多的海上石油和天然气钻井平台。

预计北美将占据最大市场占有率

- 该地区对通讯设备的需求可能会受到美国新页岩油的发现和加拿大石油和天然气计划的成长的推动。

- 该地区是该市场的先驱,因为它也是最大的石油和天然气生产国。贝克休斯称,北美是全球持有石油和天然气钻井平台最多的地区,持有14 个海上石油和天然气钻井平台。此外,随着越来越多的公司寻求海上油田营运的先进数位解决方案,市场预计还会扩大。

- 全球原油价格不断上涨,预计在预测期内将达到危机前的水平,这将推动上游石油和天然气活动,从而增加石油和天然气产业对海上通讯的需求。

- 由于使用更先进的技术,大型油田和海上对这些技术的需求不断增加,以及该地区油气天然气田钻探活动的蓬勃发展,预计预测期内市场将实现成长。

海上石油和天然气通讯业概况

海上石油和天然气通讯市场有几家主要参与者,包括 ABB 有限公司、阿尔卡特朗讯公司、贝克休斯公司、康普公司和 AT&T 公司。市场参与者正在透过伙伴关係、合併、投资和收购来改进他们的产品并获得持续的竞争优势。

2022 年 7 月,贝克休斯宣布将收购 Access SP,后者是人工举升解决方案先进技术的领先供应商之一。 AccessESP 的 GoRigless ESP 系统不使用钻机和将生产油管拉入井下,而是使用标准轻型干预设备(有线、挠曲油管、井拖拉机等)进行钻井。即可操作电动潜水帮浦(ESP)。这些解决方案显着降低了 ESP 更换修井的成本和停机时间,这在海上和孤立环境中至关重要。

阿尔卡特朗讯企业是特定产业通讯、云端和网路解决方案的领先供应商之一,该公司于 2022 年 11 月宣布推出 Purple on Demand。 Purple On Demand 是一款以订阅方式销售的新型商业产品,专注于在私人环境中为最终用户提供安全的商业通讯。开始数位转型的企业正在寻求简单性、灵活性、安全性和数位主权。 Purple On Demand 透过提供商业通讯服务来满足这些需求,包括软体、电话机、会议设备、周边设备设备和其他可依订阅模式提供的设备。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 对海上油田通讯解决方案的需求不断增加

- 基于电讯的技术成长

- 市场限制

- 资料传输的风险

第六章 市场细分

- 按解决方案

- 上游通讯系统

- 中游通讯系统

- 下游通讯系统

- 透过通讯网路技术

- 蜂窝通讯网络

- 甚小孔径终端通讯网络

- 通讯网路

- 微波通讯网路

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- ABB Ltd

- Alcatel Lucent SA

- Baker Hughes Incorporated

- CommScope Inc.

- AT&T Inc.

- Redline Communications Inc.

- Harris CapRock Communications Inc.

- Hughes Network Systems LLC

- Huawei Technologies Co. Ltd.

- Siemens AG

第八章投资分析

第九章 市场机会与未来趋势

The Offshore Oil & Gas Communications Market is expected to register a CAGR of 7.6% during the forecast period.

Key Highlights

- From the oil rig to the offshore platforms, it's important to have good oil and gas communication equipment for safety and efficiency. A good communication system does more than just send data between businesses that are offshore and those that are onshore.

- Offshore rigs are comparatively hard to establish, operate, and maintain. They must deal with environmental factors, including strong ocean currents and highly remote environments. Most of them are deep-water rigs that operate at great depths. In such remote locations, communications play a major role in monitoring several components and staying in contact with onshore establishments for reporting and assistance in emergencies.

- Several different communication technologies can now work alone or as a system to solve communication problems offshore. Satellite communications, which require a VSAT at the offshore site and are used by ships in remote places or that are moving, are the most common way to talk to people while offshore. Cellular networks are now being used in offshore oil fields because more money is being put into infrastructure there.

- Still, the offshore oil and gas field communications industry will be slowed down by worries about not enough data protection, risks in data transfer, asset security, and the difficulty of cyberattacks. Oil price volatility would even further slow the oil field communications sector's growth. The high expenses of maintaining this procedure will further limit the expansion of the oil field communications business.

- COVID-19 had an impact on the oil and gas industry as well. Everyone has had to adjust, from people being placed on leave to businesses having to radically rethink their long-term plans. Businesses must rethink their long-term strategies. When it comes to offshore oil rigs, the effect is more evident. The COVID-19 pandemic hindered offshore oil rig development and maintenance. Post-epidemic, the industry is expanding as it adopts new technology and new working methods, with companies adjusting to these new circumstances.

Offshore Oil and Gas Communications Market Trends

Telecom-based Technological Advancements to Drive the Market Growth

- A few years ago, communications between offshore facilities and onshore locations were limited to a two-way radio channel and daily reports. Oilfield workers stationed offshore were virtually cut off from the rest of the world. However, with the technological advancements in communication technologies, offshore industry work has been transformed.

- With the help of microwave communications technology, data is sent over wavelengths that are less than one meter long.These microwave solutions are chosen for locations that are close to each other. Fiber-optic telecommunications are chosen for locations in high-traffic areas, such as the North Sea or the US Gulf of Mexico.

- Technological advancements have allowed improved communication systems that have transformed total subsea developments and the way the remote, unmanned offshore industry works. The increasing vulnerability to cyber security threats in the oil and gas sector is a significant growth driver for the oil field communications market. The growing need for cloud-based services and a greater emphasis on adopting effective communication technology will exacerbate the demand for oil field communications. Increasing investments in network infrastructure and the expansion and growth of the oil and gas sector will generate more profitable growth prospects for the oil field communications market.

- With more oil and gas projects being built around the world, the offshore oil and gas communications market is expected to grow. Baker Hughes says that as of last year, Asia Pacific had the most offshore oil and gas rigs.

North America is Expected to Hold the Largest Market Share

- One of the biggest markets for offshore oil and gas communications is North America.The demand for communication equipment in this area is likely to be driven by the discovery of new shale resources in the United States and the growth of oil and gas projects in Canada.

- This region is said to be the pioneer in this market because it is also the largest oil and gas producer. According to Baker Hughes, North America hosts the most oil and gas rigs globally and has 14 offshore oil and gas rigs. Moreover, the market is expected to grow, with companies seeking advanced digital solutions for offshore field operations.

- Globally increasing crude oil prices that are expected to reach pre-crisis levels over the forecast period are expected to increase upstream oil and gas activity, leading to an increase in demand for offshore communications in the oil and gas industry.

- During the time frame of the projection, the market would grow because more advanced technologies would be used, there would be more demand for these technologies in large oilfields and offshore locations, and oil and gas field excavation activities in the region would grow quickly.

Offshore Oil and Gas Communications Industry Overview

There are a few big players in the offshore oil and gas communications market, such as ABB Ltd., Alcatel Lucent SA, Baker Hughes Incorporated, CommScope Inc., and AT&T Inc.Players in the market are using partnerships, mergers, investments, and acquisitions to improve their products and gain a competitive edge that will last.

In July 2022, Baker Hughes announced that it was buying AccessESP, which was one of the leading providers of advanced technology for artificial lift solutions. This was done to modernize oil and gas operations by lowering operating costs and downtime, which would make them much more efficient.AccessESP's "GoRigless ESP System" has its own solutions that make it possible to set up and take down an electrical submersible pump (ESP) with standard, light-duty intervention equipment (like a wireline, coiled tubing, or well tractor) instead of a rig or pulling well production tubing.These solutions greatly reduce the cost and downtime of ESP replacement workovers, which are becoming more important in offshore and isolated settings.

Alcatel-Lucent Enterprise, one of the top providers of communications, cloud, and networking solutions for specific industries, announced Purple on Demand in November 2022. Purple on Demand is a new commercial product that is sold on a subscription basis and focuses on offering secure business communications to end users in a private setting. Businesses that start on a digital transition seek simplicity, flexibility, security, and digital sovereignty. Purple on Demand provides business communication services, including software available through a subscription model and gear, such as phone sets, conferencing devices, and peripherals, to satisfy these demands.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Demand for Offshore Oilfield Communication Solutions

- 5.1.2 Telecom-based Technological Growth

- 5.2 Market Restraints

- 5.2.1 Risk in Data Transfer

6 MARKET SEGMENTATION

- 6.1 By Solution

- 6.1.1 Upstream Communication Systems

- 6.1.2 Midstream Communication Systems

- 6.1.3 Downstream Communication Systems

- 6.2 By Communication Network Technology

- 6.2.1 Cellular Communication Network

- 6.2.2 VSAT Communication Network

- 6.2.3 Fiber Optic-based Communication Network

- 6.2.4 Microwave Communication Network

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Alcatel Lucent SA

- 7.1.3 Baker Hughes Incorporated

- 7.1.4 CommScope Inc.

- 7.1.5 AT&T Inc.

- 7.1.6 Redline Communications Inc.

- 7.1.7 Harris CapRock Communications Inc.

- 7.1.8 Hughes Network Systems LLC

- 7.1.9 Huawei Technologies Co. Ltd.

- 7.1.10 Siemens AG