|

市场调查报告书

商品编码

1641843

海事资讯 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Maritime Information - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

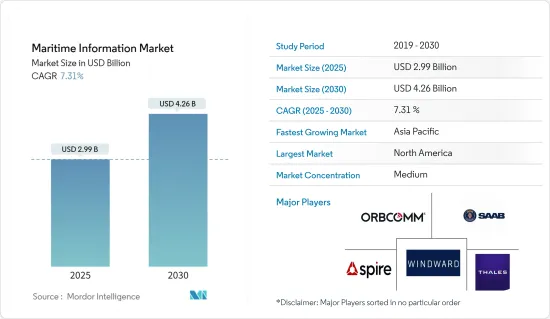

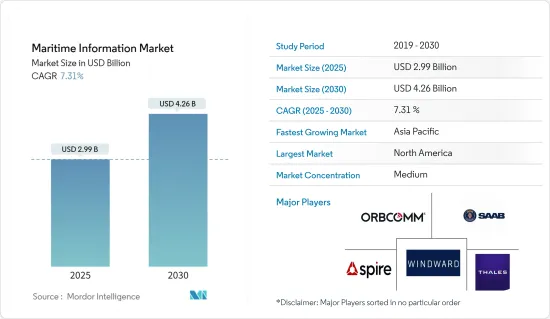

预计 2025 年海事智能 (AIS) 市场规模为 29.9 亿美元,到 2030 年将达到 42.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.31%。

航海资讯市场在全球航海业务中发挥着至关重要的作用,使航海物流和船舶追踪能够得到高效管理。我们整合自动辨识系统 (AIS)、合成孔径雷达 (SAR) 和卫星影像等多种技术,提供即时资料,提高安全性和业务效率。该市场服务于广泛的相关人员,包括政府机构、商船公司和港口营运商,并在航运业中发挥不可或缺的作用。

海事资讯系统的采用主要是为了满足船舶安全和合规性日益增长的需求。这些系统对于监控航线、识别风险和确保遵守国际海事法规至关重要。随着航运业的发展,公司正在使用先进的资料分析来优化航线、降低燃料消费量并提高业务效率。港口物流和海上交通分析的投资不断增加,进一步推动了市场扩张。

船上安全和合规的重要性日益增加

关键亮点

- 增强船上安全性:海事资讯系统透过提供船舶状态的即时资料彻底改变了船舶安全管理。这使得机组人员能够快速识别潜在的安全隐患。 AIS,即船舶识别和追踪技术,有助于监控船隻移动,尤其是在拥挤水域,从而减少发生事故和碰撞的可能性。

- 确保遵守国际标准监管合规性,尤其是国际海事组织 (IMO) 制定的监管合规性,变得越来越重要。海事资讯系统透过提供准确的营运资料、降低不合规处罚风险以及确保船舶适航性来帮助满足这些标准。

- 透过资料优化节省成本这些技术使船东能够规划最佳航线,降低燃料消费量和营运成本。合规优势也延伸到成本控制,使得该系统对相关人员具有吸引力。

- 监管力道加大推动需求:国际监理机构越来越重视遵守国际海事安全标准,鼓励整个航运业更广泛地采用这些技术。

网路安全问题威胁海上业务

关键亮点

- 网路安全威胁日益增加:随着航运业务日益数位化,网路攻击的风险也日益增加。船舶管理软体和海事资料分析平台容易受到骇客攻击,导致全球贸易遭受严重破坏。违规行为可能会影响航运路线、延误交货,甚至导致事故。

- 复杂的全球航运网络:全球航运网络非常复杂,涉及港口当局、船舶运营商和资料提供商等多个相关人员,为网路犯罪分子提供了多个切入点。船舶追踪系统的滥用或卫星通讯网路的破坏可能会产生深远的后果。

- 更重视网路安全框架:政府和产业领导者优先考虑网路安全投资以保护海事资料。目前正在开发改进的通讯系统和网路防御机制,以保护敏感的贸易资讯并维持海上业务的连续性。

- 投资网路安全解决方案:航运业对数位系统的依赖需要强大的网路安全措施。为了降低风险,企业和政府越来越关注安全的通讯网路和网路防御机制。

海事资讯市场趋势

市场主导的自动辨识系统

- AIS 在海上业务中的重要角色:自动识别系统 (AIS) 对于世界海上船舶的安全和业务效率至关重要。 AIS 技术提供即时船舶追踪和通讯,帮助海事当局和营运商做出更好的决策。随着全球航运变得越来越复杂,准确的船舶追踪和资料分析至关重要。

- 监管合规要求推动 AIS 的采用:许多政府要求某些类型的船隻使用 AIS,从而推动对 AIS 技术的需求。全球贸易量的不断增长和对高效船舶管理系统的需求进一步推动了这一趋势。国际海事组织等监管机构正在推动这项进程。

- AIS 系统的技术进步:AIS 的发展包括与支援预测分析、船队管理和网路安全的更广泛的海事资讯系统的整合。这些整合将使航运公司能够优化营运、降低成本并预测维护需求,从而改善 AIS 技术的市场前景。

- AIS 技术稳定成长:随着公共和私人对海上基础设施的投资增加,AIS 市场预计将扩大。全球航运数位化将进一步推动AIS的发展,并将继续成为提高海上运输安全性和效率的核心。

亚太地区成长强劲

- 亚太地区在全球贸易中的战略重要性:亚太地区由于其在全球贸易和不断扩大的港口基础设施中的作用,将主导海事情报市场。中国、日本和韩国等国家正大力投资AIS和先进的港口物流系统等海事技术。这些投资对于管理该地区庞大的航运量和刺激市场成长至关重要。

- 投资海上基础设施:中国在该地区引领投资港口技术和船舶追踪系统,以加强其广泛的海上贸易路线。东南亚国家正在升级其海上基础设施,强调效率、永续性和遵守国际标准。这些基础设施建设正在推动该地区市场的进一步发展。

- 先进的港口交通系统:亚太港口是世界上最繁忙的港口之一,依靠先进的海事资讯系统来适应不断增长的贸易量。海上交通分析和资料驱动工具正在帮助港口更有效地管理物流、减少瓶颈并提高业务效率。

- 环境和网路安全问题:该地区的政府越来越重视环境永续性,并致力于采用绿色技术来减少排放。网路安全问题也推动了安全海事资讯系统的采用,增强了该地区在全球市场的优势。

航海资讯产业概况

海事情报市场是半一体化的,专业公司和大型国防集团都发挥关键作用。虽然没有一家公司能够主导市场,但主要企业正在透过海事资料分析和通讯系统的创新来塑造产业的未来。

专注于进阶分析和连接:Windward Limited、SAAB Group、Thales Group、ORBCOMM Inc. 和 Spire Global 等公司是市场上的主要企业。这些公司在卫星通讯、资料分析和国防技术方面拥有优势,为海事领域提供全面的解决方案。这些公司的先进平台可对海上活动进行即时监控,有助于提高业务效率和安全性。

推动成长的趋势:对即时追踪、增强的安全通讯协定和资料主导的决策的需求正在再形成市场。对于希望提高全球航运透明度和降低风险的相关人员来说,基于卫星的海事解决方案和人工智慧平台正变得至关重要。

未来成功的策略投资要想在这个市场取得成功,公司必须在整合巨量资料和人工智慧的同时继续开发安全的通讯系统。随着航运业的发展,提供强大的网路安全和即时资料解决方案的能力将成为保持竞争力的关键。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 车载安全和合规性日益重要

- 市场问题

- 网路安全问题威胁海上业务

第六章 市场细分

- 按应用

- 自动辨识系统

- 合成孔径雷达

- 船舶识别与追踪

- 卫星影像

- 其他的

- 按最终用户

- 政府

- 商业的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Windward Limited

- SAAB group

- Thales Group

- ORBCOMM Inc.

- Spire Global

- Iridium Communications Inc.

- Inmarsat Global Limited

- Northrop Grumman Corporation

- BAE Systems

- L3 Harris Technologies, Inc.

第八章投资分析

第九章:市场的未来

The Maritime Information Market size is estimated at USD 2.99 billion in 2025, and is expected to reach USD 4.26 billion by 2030, at a CAGR of 7.31% during the forecast period (2025-2030).

The maritime information market plays a pivotal role in global maritime operations, enabling efficient management of marine logistics and vessel tracking. It integrates diverse technologies like Automatic Identification Systems (AIS), Synthetic Aperture Radar (SAR), and satellite imaging to provide real-time data, enhancing safety and operational efficiency. The market serves a wide range of stakeholders, including government agencies, commercial shipping companies, and port operators, underlining its essential role in the maritime industry.

The adoption of maritime information systems is primarily driven by the increasing need for safety and compliance on vessels. These systems are crucial for monitoring routes, identifying risks, and ensuring adherence to international maritime regulations. As the shipping industry grows, companies are using advanced data analytics to optimize routes, reduce fuel consumption, and improve operational efficiency. Increased investments in port logistics and marine traffic analytics further support the market's expansion.

The Growing Importance of On-board Safety and Compliance

Key Highlights

- Enhancing On-board Safety: Maritime information systems have revolutionized safety management on ships by offering real-time data on vessel conditions. This allows crew members to quickly identify potential safety hazards. AIS and Vessel Identification and Tracking technologies help monitor ship movements, particularly in congested waters, thereby reducing accidents and the likelihood of collisions.

- Ensuring Compliance with International Standards: Compliance with regulations, especially those set by the International Maritime Organization (IMO), has gained significance. Maritime information systems aid in meeting these standards by providing accurate data on operational practices, reducing the risk of non-compliance penalties, and ensuring vessels are seaworthy.

- Cost Savings through Data Optimization: These technologies enable shipowners to plan optimal routes, reducing fuel consumption and operational costs. The benefits of compliance extend to cost management, making these systems attractive to stakeholders.

- Stricter Regulations Fueling Demand: Global regulatory bodies increasingly emphasize compliance with international maritime safety standards, pushing for broader adoption of these technologies across the shipping industry.

Cybersecurity Concerns Threaten Maritime Operations

Key Highlights

- Rising Cybersecurity Threats: As maritime operations become more digital, they face increasing risks from cyber attacks. Ship management software and maritime data analytics platforms are vulnerable to hacking, exposing global trade to significant disruptions. A breach could affect shipping routes, delay deliveries, or even lead to accidents.

- Complicated Global Shipping Networks: The complexity of global maritime networks, involving multiple stakeholders such as port authorities, ship operators, and data providers, creates numerous entry points for cybercriminals. Misuse of vessel tracking systems or breaches in satellite communication networks could have far-reaching consequences.

- Growing Focus on Cybersecurity Frameworks: Governments and industry leaders are prioritizing cybersecurity investments to protect maritime data. Improved communication systems and cyber defense mechanisms are being developed to secure sensitive trade information and maintain the continuity of maritime operations.

- Investment in Cybersecurity Solutions: The maritime industry's reliance on digital systems necessitates robust cybersecurity measures. Companies and governments are increasingly focusing on secure communication networks and cyber defense mechanisms to mitigate risks.

Maritime Information Market Trends

Automated Identification Systems to Dominate the Market

- Key Role of AIS in Maritime Operations: Automated Identification Systems (AIS) are critical to global maritime safety and operational efficiency. AIS technology provides real-time vessel tracking and communication, enabling better decision-making for maritime authorities and operators. As global shipping grows more complex, accurate vessel tracking and data analytics become essential.

- Demand for Regulatory Compliance Driving AIS Adoption: Many governments have mandated AIS use for certain vessel types, boosting the demand for AIS technologies. The rise in global trade and the need for efficient vessel management systems further support this trend. Regulatory bodies like the IMO are instrumental in pushing these advancements.

- Technological Advancements in AIS Systems: The evolution of AIS includes its integration with broader maritime information systems that support predictive analytics, fleet management, and cybersecurity. These integrations allow shipping companies to optimize operations, cut costs, and predict maintenance needs, enhancing the market outlook for AIS technologies.

- Steady Growth of AIS Technology: The AIS market is projected to expand as public and private investments in maritime infrastructure increase. The digitalization of global shipping further supports the growth of AIS, which remains central to improving safety and efficiency in marine transport.

Asia Pacific to Witness the Significant Growth

- Strategic Importance of Asia-Pacific in Global Trade: The Asia-Pacific region is set to dominate the maritime information market, driven by its role in global trade and expanding port infrastructure. Countries such as China, Japan, and South Korea are investing heavily in maritime technologies, including AIS and advanced port logistics systems. These investments are crucial for managing the region's vast shipping traffic and driving market growth.

- Investments in Maritime Infrastructure: China leads the region in investing in port technologies and vessel tracking systems to enhance its extensive maritime trade routes. Southeast Asian nations are upgrading their maritime infrastructure, focusing on efficiency, sustainability, and compliance with international standards. This infrastructure development fuels further market growth in the region.

- Advanced Port Traffic Systems: Asia-Pacific ports, being among the busiest globally, rely on sophisticated maritime information systems to handle the increasing volume of trade. Marine traffic analytics and data-driven tools help ports manage logistics more effectively, reducing bottlenecks and improving operational efficiency.

- Environmental and Cybersecurity Concerns: Governments in the region are increasingly prioritizing environmental sustainability, focusing on green technologies to reduce emissions. Cybersecurity concerns are also driving the adoption of secure maritime information systems, reinforcing the region's dominance in the global market.

Maritime Information Industry Overview

Semi Consolidated Market: The maritime information market is Semi consolidated, with both specialized companies and large defense conglomerates playing pivotal roles. Although no single company dominates the market, leading firms shape the industry's future through innovations in maritime data analytics and communication systems.

Focus on Advanced Analytics and Connectivity: Companies such as Windward Limited, SAAB Group, Thales Group, ORBCOMM Inc., and Spire Global are key players in the market. These companies excel in satellite communication, data analytics, and defense technologies, providing comprehensive solutions for the maritime sector. Their advanced platforms offer real-time monitoring of shipping activities, helping improve operational efficiency and security.

Trends Driving Growth: The demand for real-time tracking, enhanced safety protocols, and data-driven decision-making is reshaping the market. Satellite-based maritime solutions and AI-powered platforms are becoming essential for stakeholders aiming to enhance transparency and reduce risks in global shipping.

Strategic Investment for Future Success: To thrive in this market, companies must continue developing secure communication systems while integrating big data and AI. As the maritime industry evolves, the ability to offer robust cybersecurity and real-time data solutions will be key to staying competitive.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Importance of On-board Safety and Compliance

- 5.2 Market Challenges

- 5.2.1 Cybersecurity Concerns Threaten Maritime Operations

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Automatic Identification Systems

- 6.1.2 Synthetic Aperture Radar

- 6.1.3 Vessel Identification and Tracking

- 6.1.4 Satellite Imaging

- 6.1.5 Other Applications

- 6.2 By End-user

- 6.2.1 Government

- 6.2.2 Commercial

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Windward Limited

- 7.1.2 SAAB group

- 7.1.3 Thales Group

- 7.1.4 ORBCOMM Inc.

- 7.1.5 Spire Global

- 7.1.6 Iridium Communications Inc.

- 7.1.7 Inmarsat Global Limited

- 7.1.8 Northrop Grumman Corporation

- 7.1.9 BAE Systems

- 7.1.10 L3 Harris Technologies, Inc.