|

市场调查报告书

商品编码

1851587

情境感知计算:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Context Aware Computing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

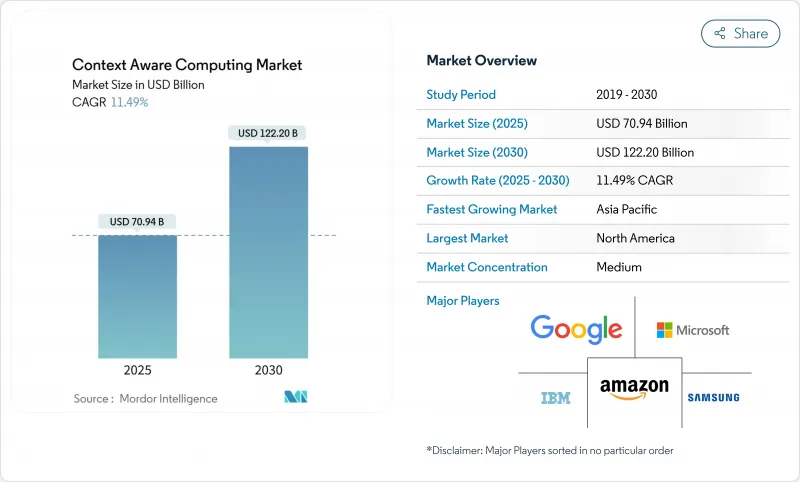

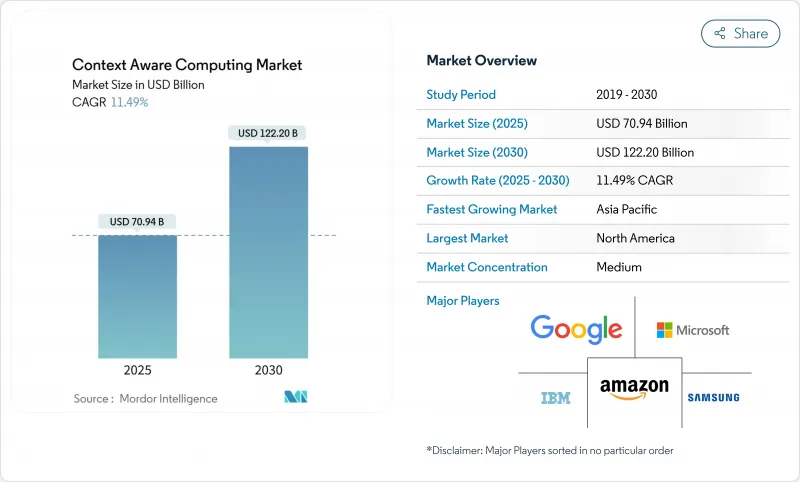

预计到 2025 年,情境感知计算市场规模将达到 709.4 亿美元,到 2030 年将达到 1,222 亿美元,年复合成长率为 11.49%。

这种前景反映了数位体验从被动响应式向预测式、意图驱动型服务的根本性转变,后者能够在用户明确输入之前就预判其需求。人工智慧推理引擎的广泛部署、边缘硬体成本的下降以及5G在全国范围内的普及,使得跨越数十亿个终端进行即时情境分析成为可能。企业对高度个人化的互动、营运效率以及以隐私为先的架构(确保敏感资料在地化)的需求日益增长。儘管硬体仍然是收入的主要驱动力,但软体编配层正成为情境感知市场竞争优势的主要来源。

全球情境感知计算市场趋势与洞察

人工智慧驱动的意图预测可提升使用者体验。

智慧型手机、汽车和零售终端内建的大规模语言模型和机器学习管道能够预测使用者目标,并提案下一步或自动执行任务。 Apple Intelligence 分析装置内的行为、周围环境和通讯风格,从而产生提示并自动执行工作流程。部署类似模型的公司由于其直觉且便利的使用者体验,用户留存率更高。随着每次互动不断完善模型并增强网路效应,其价值迅速增长。人工智慧基础设施的资本投资正呈指数级增长, Oracle和 OpenAI 斥资 300 亿美元合作开发高密度 GPU丛集便是最好的例证。随着预测准确度的提高,消费者将越来越期望现役成为情境感知运算市场的基础功能。

边缘运算成本下降推动了其普及。

领先的 3nm 和 4nm 製程节点降低了每兆次运算的成本,并提高了每瓦效能。高通最新的骁龙平台整合了专用 NPU,支援在电池供电设备上进行多模态情境分析,因此无需持续连接云端。更低的整体拥有成本使得中小企业能够轻鬆部署,例如智慧零售货架、工厂自动化和现场服务穿戴式装置。不断扩大的市场规模将加速感测器和网关的出货,从而增强产业情境感知运算的需求。

以隐私为先的法规限制了资料的使用。

GDPR式的强制规定要求用户明确同意、资料最小化以及拥有删除权,这遏制了行动应用中曾经普遍存在的无限资料收集。为了合规,企业目前正在寻求联邦学习、差分隐私和本地推理等技术,但这些技术往往会降低模型精度并延缓部署速度。能够提供隐私设计框架的供应商可以获得信任优势,但必须承担更高的工程成本。监管的影响使一些公司变得谨慎,限制了情境感知计算市场近期的成长。

细分市场分析

到2024年,硬体将占总收入的52%,这主要得益于支援推理工作负载的感测器、边缘网关和智慧穿戴装置。运动感测器、生物辨识感测器和环境感测器是最大的细分市场。网关聚合这些输入并执行初步分析,从而缩短情境感知运算市场的回馈週期。同时,软体的成长速度将超过硬件,到2030年将以13.20%的复合年增长率成长。情境管理中介软体协调不同的资料流,分析引擎将原始讯号转换为预测性建议。专业服务收入反映了企业在协调资料管道、安全性和合规性方面所面临的陡峭学习曲线。随着企业将日常营运外包以专注于业务逻辑,託管服务的采用率正在不断提高。

如今,软体驱动着终端用户价值的创造。中间件供应商将模式映射、身分解析和策略执行等功能捆绑在一起,使平台选择成为一项策略决策。人工智慧推理库透过将工作负载分配到 CPU、GPU 和 NPU 资源上来优化功耗。这些技术突破使开发人员能够创建精细化的体验,例如自适应车载资讯娱乐系统,而无需为每个晶片组重写程式码。这将促进上游感测器和网关的出货量,从而扩大整合解决方案的情境感知运算市场规模。

区域分析

2024年,北美将占全球营收的39%,这主要得益于强劲的创投、5G的早期部署以及云端运算的普及。美国企业正在开发以情境为基础的客户旅程,以提高客户留存率和交叉销售率。在加拿大,公共部门的数位化策略将推动对以隐私为先的部署方案的需求。

预计到2030年,亚太地区将以14.80%的复合年增长率实现最高成长。各国5G普及率、设备製造地以及数位原民人口规模将推动情境感知计算市场的发展。中国25.7亿个物联网终端机展现了本地生态系参与者可取得的丰富情境数据。政府对智慧城市、医疗健康和产业升级计划的奖励策略将进一步加速情境感知运算的普及。

欧洲正以差异化的优先事项推动发展,力求在创新与严格的隐私合规之间取得平衡。整合用户授权管理和资料本地化的供应商正在赢得企业合约。中东地区正利用沙乌地阿拉伯的NEOM等智慧城市计划,试验大规模情境感知平台。在非洲,云端原生行动服务展现出巨大的潜力,即使在传统基础设施匮乏的地区,它们也能提供切实可行的解决方案。南美洲的智慧型手机普及率正在稳定成长,通讯业者正大力推广边缘运算节点,以支援低延迟的情境感知应用。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 人工智慧驱动的意图预测可提升使用者体验。

- 边缘运算成本下降推动了其普及。

- 5G的部署实现了即时情境数据。

- 物联网终端的激增造成了资料洪流。

- 车载资讯娱乐系统个人化需求

- 面向小型企业应用的上下文即服务 API

- 市场限制

- 以隐私为先的法规限制了资料的使用。

- 与传统IT系统高度整合复杂

- 情境推论中模型偏差的风险

- 穿戴式装置的电池续航力有限。

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按类型

- 硬体

- 感应器

- 边缘网关

- 智慧型穿戴装置

- 软体

- 内容管理中介软体

- 分析与推理引擎

- 服务

- 专业服务

- 託管服务

- 硬体

- 按供应商

- 设备製造商

- 行动网路营运商

- 线上社交平臺

- 独立软体供应商

- 按最终用户行业划分

- BFSI

- 消费性电子产品

- 媒体与娱乐

- 车

- 卫生保健

- 电讯

- 物流/运输

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- IBM Corporation

- Microsoft Corporation

- Cisco Systems Inc.

- Google LLC(Alphabet)

- Oracle Corporation

- Amazon Web Services Inc.

- Verizon Communications Inc.

- Samsung Electronics Co. Ltd.

- Intel Corporation

- Apple Inc.

- Qualcomm Inc.

- Ericsson AB

- Huawei Technologies Co. Ltd.

- Bosch Sensortec GmbH(Robert Bosch GmbH)

- Honeywell International Inc.

- SAP SE

- ATandT Inc.

- Telefonica SA

- LG Electronics Inc.

- Baidu Inc.

第七章 市场机会与未来展望

The context-aware computing market size is valued at USD 70.94 billion in 2025 and is forecast to reach USD 122.20 billion by 2030, advancing at an 11.49% CAGR.

This outlook reflects the structural shift from reactive digital experiences toward predictive, intent-driven services that anticipate a user's needs before explicit input. Widespread deployment of AI inference engines, falling edge hardware costs, and nationwide 5G coverage now permit real-time contextual analytics on billions of endpoints. Demand intensifies as enterprises seek hyper-personalised engagement, operational efficiency, and privacy-first architectures that keep sensitive data local. Hardware remains the revenue backbone, yet software orchestration layers are becoming the main source of competitive differentiation in the context aware computing market.

Global Context Aware Computing Market Trends and Insights

AI-powered Intent Prediction Boosts UX

Large language models and machine-learning pipelines embedded in smartphones, vehicles, and retail kiosks now anticipate user goals, suggesting next actions or auto-completing tasks. Apple Intelligence analyses in-device behaviour, ambient conditions, and messaging style to curate prompts and automate workflows. Organisations deploying comparable models gain higher user retention because experiences feel intuitive and effortless. Value scales rapidly because each interaction refines the model, reinforcing network effects. Capital expenditure on AI infrastructure is rising sharply, evidenced by Oracle's USD 30 billion partnership with OpenAI focused on high-density GPU clusters. As predictive accuracy improves, consumers increasingly expect proactive services as a baseline capability in the context aware computing market.

Edge-computing Cost Decline Widens Adoption

Advanced 3 nm and 4 nm process nodes have reduced cost per tera-ops and improved performance-per-watt. Qualcomm's latest Snapdragon platform embeds a dedicated NPU that supports multimodal context analysis on battery-powered devices, eliminating constant cloud calls. Lower total ownership cost unlocks small and medium-enterprise deployment across smart retail shelving, factory automation, and field-service wearables. This broadening addressable base accelerates unit shipments of sensors and gateways, reinforcing demand in the context aware computing industry.

Privacy-first Regulations Restrict Data Use

GDPR-style mandates require explicit consent, data minimisation, and erasure rights that curtail the unfettered data harvesting once common in mobile applications. Firms now pursue federated learning, differential privacy, and on-premises inference to comply, but these techniques often reduce model accuracy and slow roll-outs. Vendors able to deliver privacy-by-design frameworks gain a trust advantage yet must absorb higher engineering costs. The regulatory swing keeps some enterprises cautious, tempering the near-term growth of the context aware computing market.

Other drivers and restraints analyzed in the detailed report include:

- 5G Rollout Enables Real-time Context Data

- Surge in IoT Endpoints Creates Data Deluge

- High Integration Complexity with Legacy IT

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware held 52% revenue share in 2024 on the strength of sensors, edge gateways, and smart wearables that underpin inference workloads. Sensors for motion, biometrics, and environment represent the largest line-item because every contextual decision starts with precise data capture. Gateways aggregate this input and run first-pass analytics, shortening feedback loops in the context aware computing market. Meanwhile, software outpaces hardware growth at 13.20% CAGR through 2030. Context management middleware harmonises disparate streams, while analytics engines transform raw signals into predictive recommendations. Professional services revenue reflects the steep learning curve enterprises face when tuning data pipelines, security, and compliance. Managed services adoption rises as firms outsource daily operations to focus on business logic.

Software now determines end-user value creation. Middleware vendors bundle schema mapping, identity resolution, and policy enforcement, turning platform choice into a strategic decision. AI inference libraries optimise power draw by splitting workloads across CPU, GPU, and NPU resources. These technical breakthroughs let developers craft granular experiences-such as adaptive in-car infotainment-without rewriting code for every chipset. Resulting demand reinforces upstream sensor and gateway shipments, advancing the context aware computing market size for integrated solutions.

The Context Aware Computing Market is Segmented by Type (Hardware, Software), Vendor (Device Manufacturers, Mobile Network Operators, and More), End-User Industry (BFSI, Consumer Electronics, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Size and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America delivered 39% of global revenue in 2024, buoyed by robust venture investment, early 5G rollout, and cloud adoption. Enterprises in the United States deploy context-rich customer journeys to lift retention and cross-sell rates. Canada's public-sector digital strategies add to base demand for privacy-centric deployments.

Asia-Pacific records the highest growth trajectory at 14.80% CAGR through 2030. National 5G coverage, device manufacturing hubs, and sizeable digital-native populations combine to expand the context aware computing market. China's 2.57 billion IoT endpoints demonstrate the depth of contextual data available to local ecosystem players. Government stimulus for smart city, healthcare, and industrial upgrade projects further accelerates uptake.

Europe advances on differentiated priorities, balancing innovation with strict privacy law compliance. Vendors that integrate consent management and data localisation win enterprise contracts. The Middle East leverages smart-city megaprojects-such as NEOM in Saudi Arabia-to trial large-scale context platforms. Africa shows leapfrog potential because cloud-native mobile services offer practical solutions where legacy infrastructure is thin. South America's steady smartphone adoption rounds out global demand, with telcos pushing edge computing nodes to support low-latency contextual apps.

- IBM Corporation

- Microsoft Corporation

- Cisco Systems Inc.

- Google LLC (Alphabet)

- Oracle Corporation

- Amazon Web Services Inc.

- Verizon Communications Inc.

- Samsung Electronics Co. Ltd.

- Intel Corporation

- Apple Inc.

- Qualcomm Inc.

- Ericsson AB

- Huawei Technologies Co. Ltd.

- Bosch Sensortec GmbH (Robert Bosch GmbH)

- Honeywell International Inc.

- SAP SE

- ATandT Inc.

- Telefonica S.A.

- LG Electronics Inc.

- Baidu Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 AI-powered intent prediction boosts UX

- 4.2.2 Edge-computing cost decline widens adoption

- 4.2.3 5G rollout enables real-time context data

- 4.2.4 Surge in IoT endpoints creates data deluge

- 4.2.5 In-car infotainment personalisation demand

- 4.2.6 Context-as-a-Service APIs for SME apps

- 4.3 Market Restraints

- 4.3.1 Privacy-first regulations restrict data use

- 4.3.2 High integration complexity with legacy IT

- 4.3.3 Model bias risks in context inference

- 4.3.4 Limited battery life on wearable devices

- 4.4 Industry Value-Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Hardware

- 5.1.1.1 Sensors

- 5.1.1.2 Edge Gateways

- 5.1.1.3 Smart Wearables

- 5.1.2 Software

- 5.1.2.1 Context Management Middleware

- 5.1.2.2 Analytics and Inference Engines

- 5.1.3 Services

- 5.1.3.1 Professional Services

- 5.1.3.2 Managed Services

- 5.1.1 Hardware

- 5.2 By Vendor

- 5.2.1 Device Manufacturers

- 5.2.2 Mobile Network Operators

- 5.2.3 Online and Social Platforms

- 5.2.4 Independent Software Vendors

- 5.3 By End-User Industry

- 5.3.1 BFSI

- 5.3.2 Consumer Electronics

- 5.3.3 Media and Entertainment

- 5.3.4 Automotive

- 5.3.5 Healthcare

- 5.3.6 Telecommunication

- 5.3.7 Logistics and Transportation

- 5.3.8 Other Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Middle East

- 5.4.4.1 Israel

- 5.4.4.2 Saudi Arabia

- 5.4.4.3 United Arab Emirates

- 5.4.4.4 Turkey

- 5.4.4.5 Rest of Middle East

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Egypt

- 5.4.5.3 Rest of Africa

- 5.4.6 South America

- 5.4.6.1 Brazil

- 5.4.6.2 Argentina

- 5.4.6.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Microsoft Corporation

- 6.4.3 Cisco Systems Inc.

- 6.4.4 Google LLC (Alphabet)

- 6.4.5 Oracle Corporation

- 6.4.6 Amazon Web Services Inc.

- 6.4.7 Verizon Communications Inc.

- 6.4.8 Samsung Electronics Co. Ltd.

- 6.4.9 Intel Corporation

- 6.4.10 Apple Inc.

- 6.4.11 Qualcomm Inc.

- 6.4.12 Ericsson AB

- 6.4.13 Huawei Technologies Co. Ltd.

- 6.4.14 Bosch Sensortec GmbH (Robert Bosch GmbH)

- 6.4.15 Honeywell International Inc.

- 6.4.16 SAP SE

- 6.4.17 ATandT Inc.

- 6.4.18 Telefonica S.A.

- 6.4.19 LG Electronics Inc.

- 6.4.20 Baidu Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment