|

市场调查报告书

商品编码

1641863

先进复合材料:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Advanced Composite Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

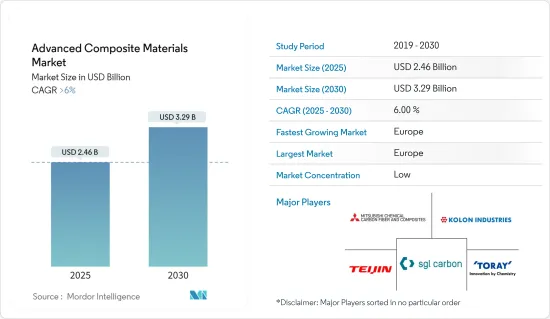

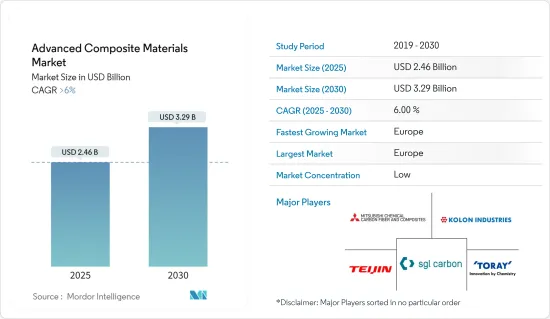

先进复合材料市场规模预计在 2025 年为 24.6 亿美元,预计到 2030 年将达到 32.9 亿美元,在预测期内(2025-2030 年)的复合年增长率将超过 6%。

COVID-19 疫情对先进复合材料市场产生了不利影响。全国范围的封锁和严格的社交距离措施导致飞机和汽车製造工厂关闭,从而影响了先进复合材料市场。然而,在新冠疫情过后,限制措施解除后市场已恢復良好。由于航太和国防、风力发电和汽车终端用户产业对先进复合材料的消费增加,市场出现强劲復苏。

航太和国防工业对轻量材料的需求不断增加以及对省油和轻型汽车的需求不断增长预计将推动市场的发展。

预计原物料价格上涨将阻碍市场成长。

预计预测期内先进复合材料的回收和奈米复合材料的需求不断增加将为市场创造机会。

预计北美地区将占据市场主导地位。此外,航太和国防、风力发电、汽车和船舶终端用户产业对先进复合材料的需求不断增加,预计在预测期内将出现最高的复合年增长率。

先进复合材料的市场趋势

航太和国防终端用户产业占据市场主导地位

- 航太工业对复合材料的需求日益增加。民用运输飞机大量使用复合材料,因为减轻飞机重量可以提高燃油效率,从而降低营运成本。

- 先进复合材料具有多种热性能和化学性能,包括高强度、高刚性、耐热性、耐化学性、导电性等。因此,航太和国防工业越来越多地使用先进的复合材料。

- 根据国际航空运输协会(IATA)的预测,2021年全球商业航空收入预计将达到4,720亿美元,2022年预计将达到7,270亿美元,与前一年同期比较增43.6%。预计到 2023年终将达到 7,790 亿美元。由于这些因素,预计未来几年航太零件製造对先进复合材料的需求将会增加。

- 全球最大飞机製造商之一波音公司宣布,2022年总合交付480架飞机,较2021年全球整体总合架飞机成长41%。因此,预计新飞机交付的增加将推动对先进复合材料的需求。

- 美国是北美的飞机製造地。空中巴士和波音是全国最大的飞机製造商。例如,2022年,空中巴士交付了661架民航机,截至年终的新订单为1,078架。同样,波音公司已订单57 架 737 Max 8喷射机,预计将于 2025 年交付。因此,预计飞机需求的增加将推动先进复合材料市场的发展。

- 在欧洲,尤其是法国和德国等国家的飞机产量不断增加,预计将推动对先进复合材料的需求。 2023 年 5 月,飞机製造商 VoltAero 宣布计画在法国建立混合动力飞机製造工厂。因此,该地区新飞机产量的增加将推动该地区对先进复合材料的需求。

- 许多国家都致力于发展国内国防工业,同时也当地生产硬体。预计这些因素将在预测期内推动对先进复合材料的需求。因此,由于上述因素,预计航太和国防应用领域将在预测期内占据市场主导地位。

北美占据市场主导地位

- 预计预测期内北美地区将主导先进复合材料市场。美国、加拿大和墨西哥等国家在航太和国防、汽车和电子工业领域对先进复合材料的需求日益增加。

- 根据美国运输统计局的资料,2022年美国航空公司的客运量将达到8.53亿人次,较2021年的6.74亿人次成长率为30%。因此,一些航空公司正在扩大持有并采购具有先进功能的飞机,以满足日益增长的航空旅行需求。例如,2022年2月,美国航空向波音公司订购了30架737 Max 8。因此,预计民航机需求的不断增长将推动当前的研究市场。

- 在北美,尤其是美国,电子产业预计将经历温和成长。预计未来几年对新技术产品的需求不断增加将有助于市场扩张。

- 在美国,电子产业技术进步和研发活动创新步伐的加快,导致对更新、更快的电子产品的需求增加。据美国消费技术协会称,美国家用电子电器技术销售的零售收入预计将在 2022 年达到 5,050 亿美元,而 2021 年为 4,610 亿美元。

- 据美国先进医疗技术协会(AMTA)称,美国医疗技术公司在为患者诊断和提供优质治疗方法、改善健康结果、降低医疗成本和推动经济成长方面发挥着至关重要的作用。美国是全球最大的医疗设备市场,占全球医疗设备市场的40%以上。

- 根据OICA预测,2022年美国汽车产量将从2021年的915万辆达到1,006万辆,成长率为9%。因此,预计汽车产量的增加将推动该地区先进复合材料市场的发展。

- 由于这些因素,该地区先进复合材料市场预计将在预测期内实现成长率。

先进复合材料产业概况

先进复合材料市场较为分散。市场的主要企业包括东丽工业公司、可隆工业公司、西格里碳素公司、三菱化学碳纤维及复合材料公司和帝人株式会社(不分先后顺序)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 航太和国防工业对轻量材料的需求不断增加

- 省油、轻量化汽车的需求日益增加

- 其他驱动因素

- 限制因素

- 原物料价格上涨

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章 市场区隔(以金额为准的市场规模)

- 复合材料类型

- 陶瓷基质材料 (CMC)

- 金属复合材料(MMC)

- 聚合物基复合材料 (PMC)

- 核心材质

- 光纤类型

- 酰胺纤维

- 玻璃纤维

- 碳纤维

- 最终用户产业

- 航太和国防

- 风力发电

- 运输

- 海洋

- 消费品

- 其他最终用户产业(医疗、电子等)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3B-the fibreglass company

- Dow

- Henkel Corporation

- Hexcel Corporation

- HYOSUNG ADVANCED MATERIALS

- Kolon Industries Inc.

- Mitsubishi Chemical Carbon Fiber and Composites Inc.

- Owens Corning

- SGL Carbon

- Solvay

- TEIJIN LIMITED

- Toray Industries Inc.

- Yantai Tayho Advanced Materials Co. Ltd

第七章 市场机会与未来趋势

- 先进复合材料的回收利用

- 奈米复合材料的需求不断增加

The Advanced Composite Materials Market size is estimated at USD 2.46 billion in 2025, and is expected to reach USD 3.29 billion by 2030, at a CAGR of greater than 6% during the forecast period (2025-2030).

The COVID-19 pandemic had negatively impacted the market for advanced composite materials. The nationwide lockdowns and strict social distancing measures resulted in the closure of airplane and automotive manufacturing facilities, thereby affecting the market for advanced composite materials. However, post-COVID pandemic, the market recovered well after the restrictions were lifted. The market recovered significantly, owing to the rise in consumption of advanced composite materials in aerospace and defense, wind energy, and automotive end-user industries.

The increasing demand for lightweight materials in the aerospace and defense industries and the rising demand for fuel-efficient and lightweight vehicles are expected to drive the market.

The increasing prices of raw materials are expected to hinder the market's growth.

The recycling of advanced composites and the increasing demand for nanocomposites are expected to create opportunities for the market during the forecast period.

The North American region is expected to dominate the market. It is also expected to register the highest CAGR during the forecast period due to rising demand for advanced composite materials in aerospace and defense, wind energy, automotive, and marine end-user industries.

Advanced Composite Materials Market Trends

Aerospace and Defense End-user Industry to Dominate the Market

- The demand for composite materials is increasing in the aerospace industry. The use of composite materials in commercial transport aircraft is massive because reduced airframe weight enables better fuel economy and, therefore, lowers operating costs.

- The advanced composite materials include high strength, stiffness, heat and chemical resistivity, electrical conductivity, and various other thermal and chemical properties. Thus, the usage of advanced composites is increasing in the aerospace and defense industry.

- According to the International Air Transport Association (IATA), the global revenue for commercial airlines was valued at USD 472 billion in 2021 and USD 727 billion in 2022, registering a growth rate of 43.6% Y-o-Y. Furthermore, the revenue is expected to reach USD 779 billion by the end of 2023. Such factors are likely to increase the demand for advanced composite materials from aerospace parts manufacturing in the years to come.

- Boeing, one of the largest global aircraft manufacturers, announced it delivered a total of 480 aircraft in 2022, which is an increase of 41% compared to the total of 340 aircraft across the world in 2021. Thus, the increasing deliveries of new aircraft are expected to drive the demand for advanced composites.

- The United States is the manufacturing hub for airplanes in the North American region. Airbus and Boeing are the largest manufacturers of airplanes in the country. For instance, in 2022, Airbus delivered 661 commercial aircraft, registering 1,078 gross new orders by the end of the year. Similarly, Boeing Aeroplane OEM company received orders for 57 of the 737 Max 8 jets, with delivery expected through 2025. Thus, the increasing demand for airplanes is expected to drive the market for advanced composite materials.

- In Europe, the rising production of aircraft, mainly in countries such as France and Germany, is expected to drive the demand for advanced composite materials. In May 2023, VoltAero, an aircraft manufacturer, announced plans to build a manufacturing facility for hybrid-electric aircraft in France. Thus, the increasing production of new aircraft in the region will drive the demand for advanced composites in the region.

- Many countries are focusing on growing a domestic defense industry while manufacturing hardware locally. These factors are expected to drive the demand for advanced composite materials during the forecast period. Hence, owing to the factors mentioned above, the aerospace and defense application segment is expected to dominate the market during the forecast period.

North America Region to Dominate the Market

- The North American region is expected to dominate the market for advanced composite materials during the forecast period. The demand for advanced composite materials is increasing in aerospace and defense, automotive, and electronics industries in countries like the United States, Canada, and Mexico.

- According to data from the Bureau of Transportation Statistics, airlines in the United States carried 853 million passengers in 2022 at a growth rate of 30% compared to 674 million passengers in 2021. Thus, several airline companies are expanding their fleet and procuring aircraft with advanced capabilities to cater to the increasing demand for air passengers. For instance, in February 2022, American Airlines ordered 30 new 737 Max 8 jets from Boeing. Thus, the rising demand for commercial airplanes is expected to drive the current studied market.

- In North America, especially in the United States, the electronics industry is expected to grow at a moderate rate. An increase in the demand for new technological products is expected to help the market expansion in the future.

- In the United States, the rapid pace of innovation in terms of the advancement of technologies and R&D activities in the electronics industry is driving the demand for newer and faster electronic products. According to the Consumer Technology Association, the retail revenue from consumer electronics and technology sales in the United States was estimated at USD 505 billion in 2022, compared to USD 461 billion in 2021.

- According to the Advanced Medical Technology Association (AMTA), America's medical technology companies play a crucial role in diagnosing and providing patients with quality treatment options, improving outcomes, reducing healthcare costs, and driving economic growth. The United States is the world's largest medical device market, accounting for over 40% of the global medical device market.

- According to OICA, in 2022, the United States automotive vehicle production reached 10.06 million compared to 9.15 million units manufactured in 2021, at a growth rate of 9%. Thus, the rise in vehicle production will drive the market for advanced composite materials in the region.

- Due to all such factors, the market for advanced composite materials in the region is expected to register a growth rate during the forecast period.

Advanced Composite Materials Industry Overview

The advanced composite materials market is fragmented in nature. Some of the major players in the market include (not in any particular order) TORAY INDUSTRIES INC., Kolon Industries Inc., SGL Carbon, Mitsubishi Chemical Carbon Fiber and Composites Inc., and TEIJIN LIMITED.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Lightweight Materials in the Aerospace and Defense Industry

- 4.1.2 Rising Demand for Fuel Efficient and Lightweight Vehicles

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Increasing Prices of Raw Materials

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Composite Type

- 5.1.1 Ceramic Matrix Composites (CMCs)

- 5.1.2 Metal Matrix Composites (MMCs)

- 5.1.3 Polymer Matrix Composites (PMCs)

- 5.1.4 Core Materials

- 5.2 Fiber Type

- 5.2.1 Aramid Fiber

- 5.2.2 Glass Fiber

- 5.2.3 Carbon Fiber

- 5.3 End-user Industry

- 5.3.1 Aerospace and Defense

- 5.3.2 Wind Energy

- 5.3.3 Transportation

- 5.3.4 Marine

- 5.3.5 Consumer Goods

- 5.3.6 Other End-user Industries (Medical, Electronics, etc.)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Qatar

- 5.4.5.5 Egypt

- 5.4.5.6 UAE

- 5.4.5.7 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3B - the fibreglass company

- 6.4.2 Dow

- 6.4.3 Henkel Corporation

- 6.4.4 Hexcel Corporation

- 6.4.5 HYOSUNG ADVANCED MATERIALS

- 6.4.6 Kolon Industries Inc.

- 6.4.7 Mitsubishi Chemical Carbon Fiber and Composites Inc.

- 6.4.8 Owens Corning

- 6.4.9 SGL Carbon

- 6.4.10 Solvay

- 6.4.11 TEIJIN LIMITED

- 6.4.12 Toray Industries Inc.

- 6.4.13 Yantai Tayho Advanced Materials Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Recycling Advanced Composites

- 7.2 Increasing Demand for Nano Composites