|

市场调查报告书

商品编码

1641864

聚丁二烯橡胶 (PBR):市场占有率分析、行业趋势和成长预测(2025-2030 年)Polybutadiene Rubber (PBR) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

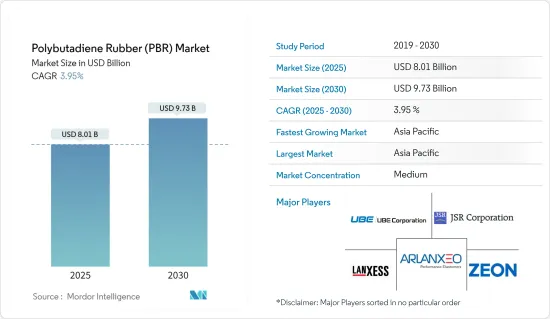

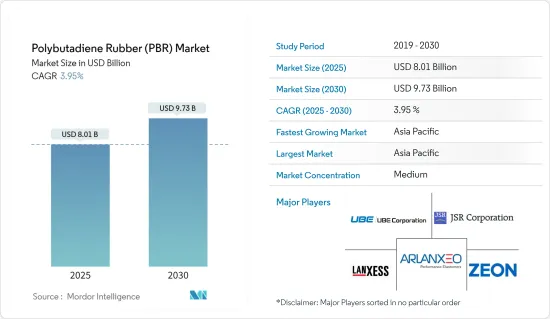

聚丁二烯橡胶(PBR) 市场规模估计并预测到2025 年将达到80.1 亿美元,预计到2030 年将达到97.3 亿美元,在预测期内(2025-2030 年)的复合年增长率为3.95% 。

COVID-19 疫情对聚丁二烯橡胶市场产生了不利影响。全国范围的封锁和严格的社交距离措施导致汽车生产陷入停滞,从而影响了聚丁二烯橡胶市场。然而,在新冠疫情爆发后,一旦限制措施解除,市场就恢復良好。由于轮胎製造、鞋类和运动配件应用对聚丁二烯橡胶的需求增加,市场出现强劲復苏。

关键亮点

- 汽车行业需求的不断增长和合成橡胶行业的增长预计将推动聚丁二烯橡胶市场的发展。

- 严格的环境法规和有关接触聚丁二烯的健康问题预计将阻碍市场的成长。

- 预计消费者即将转向电动车,这将在预测期内为市场创造机会。

- 预计亚太地区将主导市场。此外,轮胎製造、鞋类和运动配件应用对聚丁二烯橡胶的需求不断增加,预计在预测期内将实现最高的复合年增长率。

聚丁二烯橡胶市场趋势

轮胎製造应用领域占据市场主导地位

- 丁二烯用于製造合成橡胶和合成橡胶,例如聚丁二烯橡胶 (PBR)、苯乙烯-丁二烯橡胶(SBR)、丁腈橡胶 (NR) 和聚氯丁二烯 (氯丁橡胶)。

- PBR用于製造轮胎。聚丁二烯主要用于生产汽车轮胎。据估计,轮胎製造过程消耗了全球70%以上的聚丁二烯产量。聚丁二烯主要用于轮胎侧壁,以减少驾驶过程中不断弯曲造成的疲劳。丁二烯也用于多种其他汽车零件。

- 在美国和其他国家,轮胎出货量正在增加,推动了聚丁二烯橡胶市场的发展。根据美国轮胎工业协会 (USTMA) 的数据,预计 2023 年轮胎总出货量将达到 3.342 亿条,而 2022 年为 3.32 亿条,2019 年为 3.327 亿条。

- 此外,根据美国轮胎工业协会(USTMA)的数据,2023年乘用车轮胎、轻型卡车轮胎和卡车轮胎的OEM(原始设备)出货量预计将变化2.3%、1.3%和-0.6%。总合销量将增加100万台。因此,汽车OEM产业不断增长的需求正在推动当前的研究市场的发展。

- 汽车产量的增加推动了用于轮胎製造的聚丁二烯橡胶市场的发展。根据OICA预测,2022年全球汽车产量将达8,500万辆,而2021年为8,020万辆,成长率为6%。中国、美国和印度是全球最突出的汽车市场。

- 近年来对电动车的需求不断增加以及消费者即将转向电动车,预计将在预测期内为聚丁二烯橡胶 (PBR) 轮胎创造商机。在欧洲,德国、英国等国的电动车产量正在增加。

- 在德国,汽车製造商正在大力投资电动车的生产。例如,2023年6月,福特宣布科隆电动车中心正式落成,这是位于德国的高科技生产工厂,将为数百万欧洲客户生产福特新一代电动乘用车。根据福特介绍,科隆中心的年产能将达到25万辆电动车。因此,预计电动车产量的增加将推动当前的研究市场。

- 因此,预计轮胎製造应用领域将在预测期内占据市场主导地位。

亚太地区占市场主导地位

- 预计预测期内亚太地区将主导聚丁二烯橡胶市场。由于轮胎製造、工业橡胶製造和鞋类等应用的需求不断增加,预计中国、印度和日本等国家市场将呈指数级增长。

- 中国是全球产销最大的汽车市场。根据国际汽车结构组织(OICA)预测,2022年中国汽车产量将达2,702万辆,较2021年同期成长3%。

- 在中国,随着消费者越来越多地转向电池驱动的汽车,汽车产业正在经历趋势的转变。根据乘联会的预测,2022年电动车和插电式汽车销量将达到567万辆,较2021年成长近一倍。这些趋势将增加该国对汽车轮胎的需求,推动目前研究的市场发展。

- 此外,根据中国橡胶工业协会的数据,到2025 年,中国轮胎年产量预计将达到7.04 亿条,其中包括5.27 亿条乘用车子午线轮胎和5.27 亿条一次性轮胎。 148% 。 5.4万条。因此,预计该国对聚丁二烯橡胶的需求将会成长。

- 印度也是亚太地区最大的橡胶生产国和消费国之一。印度橡胶产业由橡胶生产部门和快速成长的橡胶製品製造和消费部门组成。

- 根据汽车轮胎工业协会 (ATMA) 的数据,到 2032 财年,印度轮胎产业的收益预计将达到 220 亿美元,而 2022 财年为 90 亿美元。因此,预计轮胎需求的增加将推动所研究市场的发展。

- 在印度,大约12%的橡胶用于鞋类生产。国际品牌的渗透加上都市化正在推动该国鞋类市场的发展。印度政府正在「印度製造」计画下大力推动製鞋业的发展。目前,其鞋类产量约占全球年产量的 9%。印度的製鞋业是该地区继中国之后最大的製鞋业之一。

- 由于这些因素,该地区的聚丁二烯橡胶市场预计将在预测期内成长。

聚丁二烯橡胶产业概况

聚丁二烯橡胶市场部分整合。市场的主要企业包括(不分先后顺序)ENEOS Materials Corporation、Arlanxeo、Zeop Co.、Lanxees 和 UBE Co.

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 汽车产业需求增加

- 合成橡胶工业的成长

- 其他驱动因素

- 限制因素

- 严格的环境法规

- 接触聚丁二烯的健康问题

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章 市场区隔(以金额为准的市场规模)

- 应用

- 轮胎製造

- 鞋类

- 运动配件

- 其他应用(化学、聚合物改质等)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 印尼

- 马来西亚

- 泰国

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 俄罗斯

- 北欧国家

- 土耳其

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- ARLANXEO

- Indian Oil Corporation Ltd

- ENEOS Materials Corporation

- KUMHO PETROCHEMICAL

- LANXESS

- LG Chem

- Reliance Industries Limited

- SABIC

- SIBUR International GmbH

- Synthos

- Trinseo

- UBE Corporation

- THE YOKOHAMA RUBBER CO., LTD

- ZEON CORPORATION

- KURARAY CO., LTD.

- Versalis SpA

第七章 市场机会与未来趋势

- 未来消费者将转向电动车

- 其他机会

The Polybutadiene Rubber Market size is estimated at USD 8.01 billion in 2025, and is expected to reach USD 9.73 billion by 2030, at a CAGR of 3.95% during the forecast period (2025-2030).

The COVID-19 pandemic had negatively impacted the market for polybutadiene rubber market. The nationwide lockdowns and strict social distancing measures had resulted in a halt in automotive vehicle manufacturing, thereby affecting the market for polybutadiene rubber. However, post-COVID pandemic, the market recovered well after the restrictions were lifted. The market recovered significantly, owing to the rise in demand for polybutadiene rubber in tire manufacturing, footwear, and sports accessories applications.

Key Highlights

- The increasing demand from the automobile industry and the growth in the synthetic rubber industry are expected to drive the polybutadiene rubber market.

- The stringent environmental regulations and the health concerns regarding exposure to polybutadiene are expected to hinder the market's growth.

- The upcoming consumer shift to electric vehicles is expected to create opportunities for the market during the forecast period.

- The Asia-Pacific region is expected to dominate the market. It is also expected to register the highest CAGR during the forecast period due to rising demand for polybutadiene rubber in tire manufacturing, footwear, and sports accessories applications.

Polybutadiene Rubber Market Trends

Tire Manufacturing Application Segment to Dominate The Market

- Butadiene is used in the manufacturing of synthetic rubbers and elastomers that include polybutadiene rubber (PBR), styrene-butadiene rubber (SBR), nitrile rubber (NR), and polychloroprene (Neoprene), all of which are used in the production of other goods and materials.

- PBR is used in the manufacturing of tires. Polybutadiene is primarily utilized in the production of automotive tires. It is estimated that the tire manufacturing process consumes over 70% of the world's polybutadiene production. It is primarily utilized in tires as a sidewall to reduce fatigue caused by continual flexing throughout the run. Butadiene is also used in a variety of other automotive components.

- In countries like the United States, the shipment of tires is increasing, which is driving the market for Polybutadiene rubber. According to the U.S. Tire Manufacturers Association (USTMA), the total shipments of tires are expected to reach 334.2 million units in 2023, as compared to 332.0 million units in 2022 and 332.7 million units in 2019.

- Furthermore, according to the U.S. Tire Manufacturers Association (USTMA), in 2023, Original Equipment (OE) shipments for passenger, light truck, and truck tires are expected to change by 2.3%, 1.3% and -0.6%, respectively, with a total increase of 1.0 million units. Thus, the increasing demand for automotive OEM industries will drive the current studied market.

- The increasing production volume of automotive vehicles is driving the market for Polybutadiene Rubber used in tire manufacturing. According to OICA, global automotive vehicle production reached 85 million in 2022, as compared to 80.2 million manufactured in 2021, at a growth rate of 6%. China, the United States, and India are the most prominent automotive vehicle markets globally.

- The rising demand for electric vehicles in recent years, as well as an impending consumer shift to electric vehicles, are expected to provide opportunities for polybutadiene rubber (PBR) tires during the forecast period. In Europe, the production volume of electric vehicles is increasing in countries like Germany and the United Kingdom.

- In Germany, automakers are investing heavily in producing electric vehicles in the country. For instance, In June 2023, Ford announced the inauguration of the Cologne Electric Vehicle Center, a hi-tech production facility in Germany that will build Ford's new generation of electric passenger vehicles for millions of European customers. According to Ford, the Cologne Center has an annual production capacity of 250,000 electric vehicles. Thus, the increasing production of electric vehicles is expected to drive the current studied market.

- Thus, the tire manufacturing application segment to dominate the market during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market for polybutadiene rubber during the forecast period. In countries like China, India, and Japan, the market is expected to grow exponentially owing to the increasing demand from applications such as tire manufacturing, industrial rubber manufacturing, and footwear.

- China is the world's biggest automobile market in terms of both production and sales. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), vehicle production in China reached a total of 27.02 million units in 2022, which is an increase of 3% over 2021 for the same period.

- In China, the automotive industry is witnessing switching trends as the consumer inclination toward battery-operated vehicles is higher. As per the China Passenger Car Association, the country sold 5.67 million EVs and plug-ins in 2022, almost double the sales figures achieved in 2021. These trends will increase the demand for automotive tires in the country, thereby driving the current studied market.

- Furthermore, according to the China Rubber Industry Association (CRIA), the country is projected to produce 704 million tires per year by 2025, including 527 million passenger radial tires, 148 million truck/bus radial tires, 29 million bias truck tires, 20,000 extra-large industrial tires, 12 million agricultural tires, and 54,000 aircraft tires. Thus, the demand for polybutadiene rubber is expected to grow in the country.

- India is also one of the largest producers and consumers of rubber in the Asia-Pacific region. The Indian rubber industry exhibits the co-existence of the rubber production sector and the fast-growing rubber products manufacturing and consuming sector.

- According to the Automotive Tire Manufacturers' Association (ATMA), the Indian tire industry revenue is expected to reach USD 22 billion by FY 2032, as compared to USD 9 billion registered in FY 2022. Thus, the increase in demand for tires is expected to drive the market for the current studied market.

- In India, about 12% of rubber is used to produce footwear. The penetration of international brands, coupled with urbanization, has driven the footwear market in the country. The government has focused on the footwear industry under the 'Make in India' initiative. The country is currently producing around 9% of the global annual production of footwear. The footwear sector in India is one of the largest in the region, behind China.

- Due to all such factors, the market for polybutadiene rubber in the region is expected to grow during the forecast period.

Polybutadiene Rubber Industry Overview

The polybutadiene rubber market is partially consolidated in nature. Some of the major players in the market include (not in any particular order) ENEOS Materials Corporation, Arlanxeo, Zeop Co., Lanxees, and UBE Co., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand From the Automobile Industry

- 4.1.2 Growth in the Synthetic Rubber Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Enviornmental Regulations

- 4.2.2 Health Concerns Regarding Exposure to Polybutadiene

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Tire Manufacturing

- 5.1.2 Footwear

- 5.1.3 Sports Accessories

- 5.1.4 Other Applications (Chemicals, Polymer Modification, etc.)

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Indonesia

- 5.2.1.6 Malaysia

- 5.2.1.7 Thailand

- 5.2.1.8 Vietnam

- 5.2.1.9 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Spain

- 5.2.3.6 Russia

- 5.2.3.7 NORDIC Countries

- 5.2.3.8 Turkey

- 5.2.3.9 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Qatar

- 5.2.5.4 UAE

- 5.2.5.5 Nigeria

- 5.2.5.6 Egypt

- 5.2.5.7 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ARLANXEO

- 6.4.2 Indian Oil Corporation Ltd

- 6.4.3 ENEOS Materials Corporation

- 6.4.4 KUMHO PETROCHEMICAL

- 6.4.5 LANXESS

- 6.4.6 LG Chem

- 6.4.7 Reliance Industries Limited

- 6.4.8 SABIC

- 6.4.9 SIBUR International GmbH

- 6.4.10 Synthos

- 6.4.11 Trinseo

- 6.4.12 UBE Corporation

- 6.4.13 THE YOKOHAMA RUBBER CO., LTD

- 6.4.14 ZEON CORPORATION

- 6.4.15 KURARAY CO., LTD.

- 6.4.16 Versalis S.p.A.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Upcoming Consumer Shift to Electric Vehicles

- 7.2 Other Opportunities