|

市场调查报告书

商品编码

1641869

超导性材料:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Superconducting Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

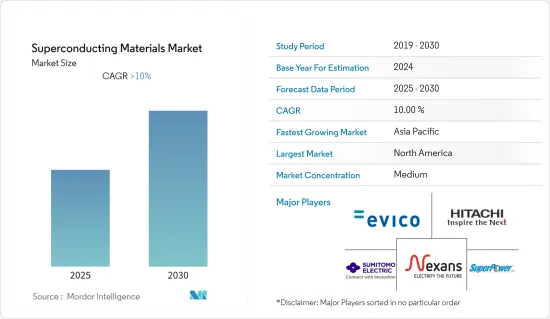

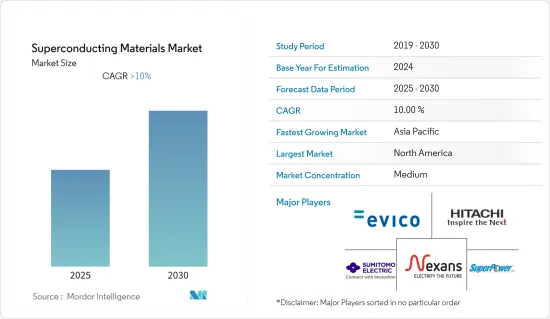

预计预测期内超导性材料市场将以超过 10% 的复合年增长率成长。

COVID-19疫情导致供应链活动严重中断,商品、产品和服务的生产减少,阻碍了全球超导性材料市场的成长。然而,该产业在 2021 年已呈现復苏迹象,导致所研究市场的需求回升。

主要亮点

- 医疗机器和设备支出的增加正在推动市场的发展。

- 另一方面,钇等原料的供应不足阻碍了市场的成长。

- 然而,电力和高场磁体技术的变革潜力可能会在未来创造有利可图的机会。

- 亚太地区占据了最高的市场份额,并且很可能在预测期内继续占据市场主导地位。

超导性材料市场趋势

医疗产业预计将主导市场

- 目前,医疗领域占据全球超导性材料市场的最大份额。

- 近年来,由于世界各地的健康问题和担忧日益增加,磁振造影(MRI)的需求激增。此外, 核磁共振造影系统还需要超导性材料来提供维持大磁场的能量。超导性材料的目标是使电线的电阻几乎为零。

- 由于美国、加拿大等国家老龄人口众多等因素,北美在磁振造影(MRI)市场占有最大的市场占有率。例如,根据美国医疗保险和医疗补助服务中心(CMS)的数据,2021年,美国政府在医疗卫生方面支出4.1兆美元,以改善和维持公共卫生活动。因此,美国和加拿大等国家增加医疗保健支出,预计将使公共医疗保健提供者能够采用先进的 MRI 系统,从而为这些国家的超导性材料市场创造需求。

- 此外,一些新兴国家的政府正在增加医疗保健领域的支出,以提高设备的效率。例如,根据经济合作暨发展组织(OECD)的数据,义大利的磁振造影(MRI)扫描仪数量将在2021年增加169台,比2020年增加9.1%。

- 由于上述因素,预计预测期内医疗保健产业对超导性材料的需求最高。

亚太地区占市场主导地位

- 近年来亚太地区对超导性材料的需求大幅增加。

- 需求的激增主要是由于该地区电气和电子产品的成长。

- 由于政府大力支持电气和电子产业扩大生产,预计中国和印度对超导性材料的需求将强劲成长。例如,2021年,中国电子製造业利润总额达8,283亿元人民币(1,283.5亿美元),与前一年同期比较去年同期成长38.9%。

- 此外,在印度,21财年印度消费性电子产品产量达7,050亿印度卢比(95.3亿美元),与2020年相比下降了12.9%。产量下降是由于冠状病毒大流行的影响。

- 此外,亚太地区的医疗保健产业近年来取得了显着成长,这可能会推动市场的发展。例如,印度医疗保健领域支出从 2020 年的 27.3 亿印度卢比(369.2 亿美元)成长了近 73% 至 2021 年的 47.2 亿印度卢比(638.3 亿美元)。因此,预计卫生部门支出的增加将推动该国对超导性材料的需求。

- 因此,由于上述因素,亚太地区很可能在预测期内达到最高成长率。

超导性材料行业概况

超导性材料市场适度整合。主要公司包括 evico GmbH、日立、NEXANS、SuperPower Inc. 和工业(不分先后顺序)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 增加医疗设备支出

- 电子产业需求不断成长

- 限制因素

- 钇等原料短缺

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 购买者和消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章 市场区隔(以金额为准的市场规模)

- 依产品类型

- 低温超导性材料(LTS)

- 高温超导性材料(HTS)

- 按最终用户产业

- 医疗

- 电子产品

- 其他最终用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 世界其他地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- evico GMBH

- Hitachi, Ltd.

- Hyper Tech Research, Inc.

- JAPAN SUPERCONDUCTOR TECHNOLOGY, INC.(JASTEC)

- MetOx Technologies, Inc.

- NEXANS

- Sumitomo Electric Industries, Ltd.

- Super Conductor Materials Inc.

- Superconductor Technologies Inc.

- SuperPower Inc.

- Western Superconducting Technologies Co,Ltd.

第七章 市场机会与未来趋势

- 改变电力和高场磁体技术的潜力

The Superconducting Materials Market is expected to register a CAGR of greater than 10% during the forecast period.

The COVID-19 pandemic negatively hampered the global superconducting materials market growth due to considerable disruption in the supply chain activities and reduced the production of commodities, goods, and services. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Increasing expenditures on medical machinery and equipment are driving the market.

- On the flip side, inadequate availability of feedstock materials such as Yttrium is hindering the growth of the market studied.

- However, the potential to bring changes to electric power and high-field magnet technology shall create a lucrative opportunity in the future.

- Asia-Pacific accounted for the highest share of the market and is likely to continue dominating the market during the forecast period.

Superconducting Materials Market Trends

Medical Sector is Expected to Dominate the Market

- Currently, the medical sector accounts for the highest market share of the global market for superconducting materials.

- Magnetic resonance imaging (MRI) machines have seen a surge in demand in recent years owing to rising health issues and concerns worldwide. Moreover, superconducting materials are required in MRI machines to provide energy to maintain large magnetic fields. Superconducting materials try to reduce the resistance in the wires to almost zero.

- Due to factors such as a large elderly population in countries such as the United States and Canada, North America includes the largest market share in the magnetic resonance imaging (MRI) market. For instance, in 2021, according to the Center for Medicare and Medicaid Services (CMS), the US government spent USD 4.1 trillion in the healthcare sector to improve and maintain public health activities. Therefore, increased expenditure on healthcare by countries such as the US and Canada, which enable public healthcare providers to adopt advanced MRI systems, is estimated to create demand for the superconducting materials market in the countries.

- Also, governments in several developing countries have increased their medical sector expenditures to improve equipment efficiency. For instance, according to the Organization for Economic Co-operation and Development (OECD), the number of magnetic resonance imaging (MRI) scanners in Italy increased by 169 in 2021, which shows an increase of 9.1% compared with 2020.

- Owing to the abovementioned factors, the medical sector is expected to witness the highest demand for superconducting materials during the forecast period.

Asia-Pacific to Dominate the Market

- In the recent past, there is a significant growth in the demand for superconducting materials in the Asia-Pacific region.

- The surge in demand is largely attributed to the region's increasing electrical and electronics products.

- China and India are expected to witness strong growth in the demand for superconducting materials, owing to favorable government support to increase production in the electrical and electronics industry. For instance, in 2021, the total profit of electronics manufacturing enterprises in China grew by 38.9% from the previous year, reaching CNY 828.3 billion (USD 128.35 billion).

- Moreover, in India, the production value of consumer electronics in India amounted to INR 705 billion (USD 9.53 billion) in the fiscal year 2021, which shows a decrease of 12.9% compared with 2020. The drop in production value was due to the impact of the coronavirus pandemic.

- Additionally, the medical industry in the Asia-Pacific region witnessed major growth in recent years, which is likely to drive the market studied. For instance, India's health sector expenditure increased from INR 2.73 lakh crore (USD 36.92 billion) in 2020 to INR 4.72 lakh crore (USD 63.83 billion) in 2021, an increase of nearly 73%. Therefore, increasing expenditure in the health sector is estimated to create demand for superconducting materials in the country.

- Hence, due to the abovementioned factors, Asia-Pacific will likely witness the highest growth rate during the forecast period.

Superconducting Materials Industry Overview

The superconducting materials market is moderately consolidated in nature. The major companies include (not in a particular order) evico GmbH, Hitachi, Ltd., NEXANS, SuperPower Inc., and Sumitomo Electric Industries, Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Expenditures on Medical Machinery and Equipment

- 4.1.2 Growing Demand from the Electronics Industry

- 4.2 Restraints

- 4.2.1 Inadequate Availability of Feedstock Materials such as Yttrium

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Low-temperature Superconducting Materials (LTS)

- 5.1.2 High-temperature Superconducting Materials (HTS)

- 5.2 End-user Industry

- 5.2.1 Medical

- 5.2.2 Electronics

- 5.2.3 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) ** /Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 evico GMBH

- 6.4.2 Hitachi, Ltd.

- 6.4.3 Hyper Tech Research, Inc.

- 6.4.4 JAPAN SUPERCONDUCTOR TECHNOLOGY, INC. (JASTEC)

- 6.4.5 MetOx Technologies, Inc.

- 6.4.6 NEXANS

- 6.4.7 Sumitomo Electric Industries, Ltd.

- 6.4.8 Super Conductor Materials Inc.

- 6.4.9 Superconductor Technologies Inc.

- 6.4.10 SuperPower Inc.

- 6.4.11 Western Superconducting Technologies Co,Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Potential to Bring Changes to Electric Power and High-field Magnet Technology