|

市场调查报告书

商品编码

1641872

可携式发电机:市场占有率分析、行业趋势和成长预测(2025-2030 年)Portable Generator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

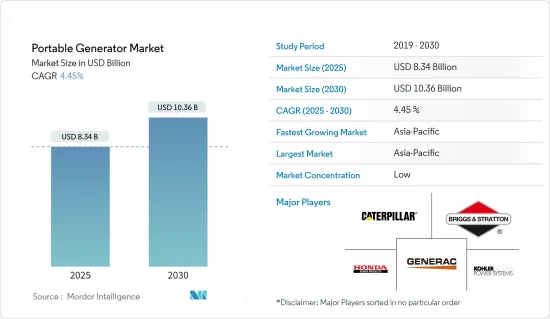

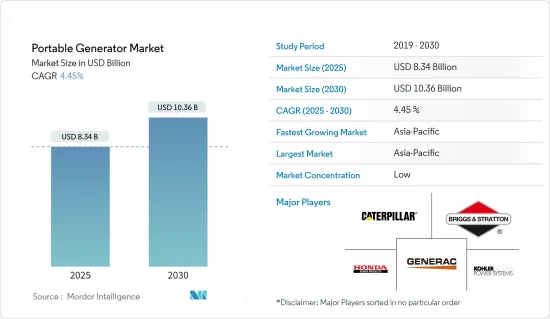

可携式发电机市场规模预计在 2025 年为 83.4 亿美元,预计到 2030 年将达到 103.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.45%。

关键亮点

- 从中期来看,不断增长的电力需求、缺乏可靠的电网基础设施、对紧急备用电源解决方案的需求以及对稳定电源供应的需求等因素正在推动可携式发电机市场的发展。

- 另一方面,可携式发电机面临来自电池储存系统的激烈竞争。更清洁的备用电源预计也会阻碍可携式发电机市场的发展。

- 新兴经济体商业和工业领域、新兴经济体住宅领域以及国防活动对电力的需求日益增长,预计在不久的将来为市场参与企业创造巨大的商机。

- 预计北美将占据主要市场占有率,大部分需求来自美国和加拿大等国家。

可携式发电机市场趋势

工业领域预计将成为关键市场领域

- 在建立电力供应之前,可携式发电机是工业场所的绝佳选择。当现场需要大量电力时,紧急应变也经常使用它们。

- 由于基础设施建设、都市化进程加快以及对可靠备用电源的需求不断增长,预计未来对工业可携式发电机的需求将保持强劲。柴油引擎驱动的可携式发电机由于其高能量密度和在各种条件下运行的能力,很可能成为主导燃料类型。

- 世界上大多数国家都正在进行多个基础设施建设计划。这导致钢铁需求增加。 2023年钢铁总产量将达到约18.92亿吨,高于2019年的18.78亿吨。

- 沙乌地阿拉伯已宣布计划向水务领域投资约 380 亿美元。此外,未来几年私人企业可能会投资 100 亿美元用于该产业的发展。此外,沙乌地阿拉伯于2023年8月宣布了12,000公里计划计画。

- 沙乌地阿拉伯的基础设施发展领先世界。沙乌地阿拉伯 NEOM 等计划预计将对可携式发电机产生巨大的需求。在 NEOM计划下,沙乌地阿拉伯可能会透过几个未来计划开发西北地区。

- 此外,根据“2030愿景”,沙乌地阿拉伯计划在医疗保健和能源基础设施方面投资近666.7亿美元。因此,所有这些建设活动都可能为发电机创造机会,这些发电机可用作沙乌地阿拉伯各地无电和偏远地区的主要电源。

- 此外,全球范围内还有可再生能源、製造业、食品和饮料以及其他几个行业的开发计划。这些行业的扩张可能会产生对建筑工地使用的可携式发电机的需求。

预计北美将占据较大的市场占有率

- 可携式发电机在北美,尤其是美国和加拿大被广泛使用。它们受到需要在传统电网无法覆盖的地区或停电期间使用电力的住宅、小型企业主和承包商的欢迎。

- 2024年上半年,美国电力消耗量约1.95兆度。商业部分占期间总用电量约34.6%。商业部门包括办公、零售、教育、公共和政府设施、水、通讯设备以及户外和公共街道照明等公共。根据美国能源资讯署的数据,电脑、办公设备和冷冻合计占电力消耗量的最大份额。

- 儘管存在复杂的电网基础设施且全国 100% 可连接电力,但停电和备用电源需求增加等问题预计将推动美国备用发电市场的需求。停电每年平均造成美国约 180 亿至 330 亿美元的损失。因此,备用发电机或UPS被认为是保持业务运作不间断的最可行选择。

- 此外,客户对备用电源的功能和优点以及个人使用的最佳设备组合的认识不断提高,推动了对可携式发电机的需求,尤其是在住宅和商业领域。

- 美国正经历日益恶劣的天气模式,包括严重的风暴、飓风和气旋。令人震惊的是,全国 80% 的停电都是由这些极端天气事件引起的。

- 德克萨斯州、密西根州、加州和北卡罗来纳州是美国停电时间最长的州之一。 2024 年 7 月,飓风贝丽尔严重影响了市场,导致约 300 万户家庭和企业断电。此外,2024 年 5 月,德克萨斯州遭遇雷暴袭击,近 60 万客户断电。因此,在这些州,这样的天气条件对可携式发电机等备用电源解决方案产生了需求。

- 此外,加州等地因极端天气事件而频繁遭遇天灾。 2024 年 2 月,加州遭受严重风暴袭击,引发近 475 起土石流和山崩。因此,该国的这种情况对可携式发电机产生了巨大的需求。

- 因此,由于上述发展,北美的可携式发电机市场将在预测期内呈现成长。

可携式发电机行业概况

可携式发电机市场较为分散。该市场的主要企业(不分先后顺序)包括 Generac Holdings Inc.、Caterpillar Inc.、Kohler Power Systems、Honda Siel Power Products Limited 和 Briggs & Stratton Corporation。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 至2029年的市场规模及需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 电力需求不断成长

- 限制因素

- 对电池储存系统和其他清洁备用电力源的需求不断增加

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 投资分析

第五章 市场区隔

- 额定功率

- 小于5kW

- 5~10kW

- 10kW以上

- 燃料类型

- 气体

- 柴油引擎

- 其他燃料

- 最终用户

- 工业的

- 商业的

- 住宅

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 印度

- 中国

- 日本

- 澳洲

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Generac Holdings Inc.

- Caterpillar Inc.

- Honda Siel Power Products Ltd

- Briggs & Stratton Corporation

- Kohler Power Systems

- Wacker Neuson SE

- Atlas Copco AB

- Eaton Corporation PLC

- Yamaha Motor Co. Ltd

- 市场排名/份额分析

- 其他知名公司名单

第七章 市场机会与未来趋势

- 新兴国家不断成长的商业和工业部门

简介目录

Product Code: 61058

The Portable Generator Market size is estimated at USD 8.34 billion in 2025, and is expected to reach USD 10.36 billion by 2030, at a CAGR of 4.45% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the ever-increasing demand for power, lack of reliable grid infrastructure, the need for emergency backup power solutions, and the demand for steady power supply are driving the portable generators market.

- On the other hand, portable generators face tough competition from battery storage systems. Other cleaner standby power sources are also expected to hinder the portable generators market.

- Nevertheless, the commercial and industrial sectors of emerging economies, the residential sector of developed economies, and the increasing need for power in defense operations are expected to create significant opportunities for market participants in the near future.

- North America is expected to hold a significant market share, with most of the demand coming from countries such as the United States and Canada.

Portable Generator Market Trends

Industrial Sector Projected to be a Significant Market Segment

- Portable generators are an excellent choice for industrial sites before an electrical supply is established. They are also frequently used by emergency responders when a large amount of power is needed on location.

- The demand for portable industrial generators is expected to remain strong over the coming years, driven by increasing infrastructure development, urbanization, and the growing need for reliable backup power. Diesel-powered portable generators are likely to be the dominant fuel type due to their high energy density and performance in various conditions.

- The majority of the countries worldwide have several infrastructure development projects in the works. Hence, the demand for steel is increasing. In 2023, total steel production was around 1.892 billion tonnes, having increased from 1.878 billion tonnes in 2019.

- Saudi Arabia has announced plans to invest around USD 38 billion in the water sector. Further, private parties are likely to invest USD 10 billion in the development of the sector over the coming years. In addition, in August 2023, Saudi Arabia announced 12,000 km of planned water projects.

- Saudi Arabia is leading in terms of infrastructure development worldwide. Projects like NEOM in Saudi Arabia are expected to create immense demand for portable generators. Under the NEOM project, Saudi Arabia is likely to develop its northwest region with several futuristic projects.

- Additionally, under Vision 2030, the country is likely to invest nearly USD 66.67 billion in healthcare and energy infrastructure. Hence, all such construction activities are likely to create opportunities for generators that can be utilized as prime power sources in off-grid or remote locations across Saudi Arabia.

- Further, globally, there are several development projects related to renewable, manufacturing, food and beverage, and several other industries. Expansion in these industries is likely to create demand for portable generators that are used on construction sites.

North America Projected to Hold a Significant Market Share

- Portable generators are widely used in North America, particularly in the United States and Canada. They are popular among homeowners, small business owners, and contractors who need access to power in locations where a traditional power grid is not available or during power outages.

- In H1 2024, the electricity consumption in the United States was about 1.95 trillion kWh. The commercial segment accounted for approximately 34.6% of the total electricity consumed in the period. The commercial segment includes offices, retail, educational, public, and government facilities and public services, such as water supply, telecommunications equipment, and outdoor and public street lighting. According to EIA, computers, office equipment, and refrigeration combined accounted for the largest share of electricity consumption.

- Despite the presence of a complex electricity grid infrastructure and 100% electricity access nationwide, problems like power outages and increasing demand for standby power sources are expected to drive the demand for the backup power generation market in the United States. Power outages cost an average of about USD 18 billion to USD 33 billion per year in the United States. Therefore, backup generators and UPS are considered the most viable options for making business operations run continuously without any interruption.

- Moreover, increasing awareness among customers about the features and benefits of backup power, as well as the best-suited equipment combination for personal use, is driving the demand for portable generators, especially in the residential and commercial segments.

- The United States has been grappling with increasingly severe weather patterns, including storms, hurricanes, and cyclones. A staggering 80% of power outages in the country are attributed to these extreme weather events.

- Texas, Michigan, California, and North Carolina are among regions across the United States that recorded the highest hours of power outages. In July 2024, Hurricane Beryl severely impacted the market, knocking out power for around 3 million homes and businesses. Further, Texas experienced a thunderstorm in May 2024, during which nearly 600,000 consumers were without electricity in the region. Hence, such weather conditions have created demand for backup power solutions like portable generators in these states.

- Additionally, places like California face frequent natural disasters due to extreme weather conditions. In February 2024, California faced a storm, with extreme rainfall leading to nearly 475 mudslides or debris flows. Hence, such conditions in the country have created significant demand for portable generators.

- Thus, owing to the abovementioned developments, North America is set to witness growth in the portable generators market during the forecast period.

Portable Generator Industry Overview

The portable generators market is semi-fragmented. Some of the key players in this market (in no particular order) include Generac Holdings Inc., Caterpillar Inc., Kohler Power Systems, Honda Siel Power Products Limited, and Briggs & Stratton Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand for Power

- 4.5.2 Restraints

- 4.5.2.1 Increasing Demand for Battery Storage Systems and Other Cleaner Sources of Standby Power

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Power Rating

- 5.1.1 Below 5 kW

- 5.1.2 5-10 kW

- 5.1.3 Above 10 kW

- 5.2 Fuel Type

- 5.2.1 Gas

- 5.2.2 Diesel

- 5.2.3 Other Fuel Types

- 5.3 End User

- 5.3.1 Industrial

- 5.3.2 Commercial

- 5.3.3 Residential

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Spain

- 5.4.2.5 NORDIC

- 5.4.2.6 Turkey

- 5.4.2.7 Russia

- 5.4.2.8 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Malaysia

- 5.4.3.6 Thailand

- 5.4.3.7 Indonesia

- 5.4.3.8 Vietnam

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Nigeria

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Generac Holdings Inc.

- 6.3.2 Caterpillar Inc.

- 6.3.3 Honda Siel Power Products Ltd

- 6.3.4 Briggs & Stratton Corporation

- 6.3.5 Kohler Power Systems

- 6.3.6 Wacker Neuson SE

- 6.3.7 Atlas Copco AB

- 6.3.8 Eaton Corporation PLC

- 6.3.9 Yamaha Motor Co. Ltd

- 6.4 Market Ranking/Share Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Commercial and Industrial Sectors of Emerging Economies

02-2729-4219

+886-2-2729-4219