|

市场调查报告书

商品编码

1641875

特种和高性能薄膜:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Specialty and High Performance Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

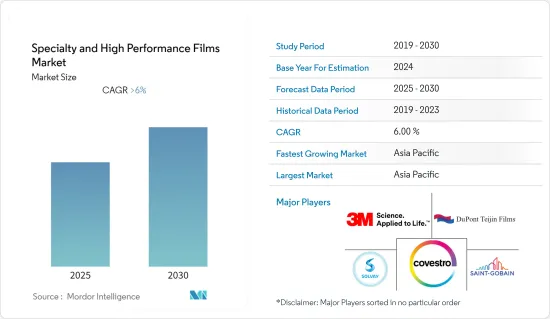

预计预测期内特种薄膜市场复合年增长率将超过 6%。

主要亮点

- 预计建设产业和包装行业对特种薄膜和高性能薄膜的使用将推动市场成长。

- 然而,预计特种薄膜和高性能薄膜的高成本将在预测期内阻碍市场成长。

- 在预测期内,在产品类型中,阻隔膜预计将占据最高的市场占有率。

- 亚太地区占据全球市场主导地位,其中中国、印度和日本等国家占最大的消费量。

特种高性能薄膜市场趋势

建设产业需求增加

- 预计特种和高性能薄膜市场将受到中国、印度和美国等国家建设活动的增加的推动。

- 随着新兴国家工业化的迅速发展,这些薄膜正被用于建筑领域,以实现安全、保全和光线控制等美观和功能目的。

- 此外,北美和欧洲等国家也普遍进行復苏工作。因此,预计住宅和非住宅建筑中薄膜使用的增加将推动对特殊和高性能薄膜的需求。

- 受科技、电子商务、银行和金融服务公司的需求推动,商业建筑建设活动正在大幅成长。例如中国是正在大力兴建购物中心的国家之一。中国目前约有 4,000 家购物中心,预计到 2025 年还将有 7,000 家购物中心开幕。这使得建筑业对特种高性能薄膜的需求庞大。

- 此外,美国的建筑业正在扩张。根据美国人口普查局的数据,2021年美国每年的新建筑投资将达到16,264亿美元,而2020年为1,4996亿美元。因此,在预测期内支持所研究市场的成长。

- 因此,由于上述因素,预计预测期内建筑业的扩张将推动特种和高性能薄膜市场的发展。

亚太地区占市场主导地位

- 过去几年来,亚太地区一直是最大的特殊薄膜和高性能薄膜市场。

- 东南亚国家对特殊高性能薄膜的需求在阻隔膜、装饰膜等应用领域显着成长。

- 亚太地区各国建筑业的成长正在推动亚太地区所研究市场的发展。

- 根据中国国家统计局的数据,预计2021年全国建筑业总产值将达到25.92兆元人民币(3.82兆美元),而2020年为23.27兆元人民币(3.43兆美元),这将拉动市场需求。

- 此外,根据韩国统计局统计,2021年国内外建筑公司订单的工程订单总额为2,459亿美元,与前一年同期比较增加31兆韩元。

- 此外,中国和印度包装行业的成长、汽车产量的增加以及大型电子製造业预计将推动对特种和高性能薄膜的需求。

- 根据电子和资讯技术部「扩大和深化电子製造业行动呼吁」研究,印度计划在 2026 年在电子製造业中创造 3,000 亿美元的产值。

- 因此,由于上述原因,亚太地区很可能在预测期内主导研究市场。

特种高性能薄膜产业概况

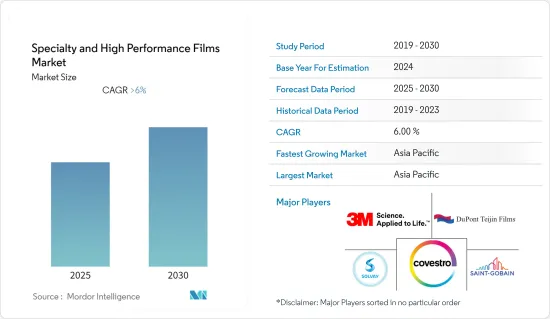

全球特种和高性能薄膜市场具有整合的本质。市场的主要企业包括(不分先后顺序)3M、圣戈班、杜邦帝人薄膜、索尔维和科思创股份公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 包装产业的需求不断增长

- 在建设产业的使用增加

- 限制因素

- 氟树脂成本高

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章 市场区隔(以金额为准的市场规模)

- 依材料类型

- 聚酯纤维

- 氟树脂

- 尼龙

- 聚碳酸酯

- 聚酰亚胺

- 其他材料

- 依产品类型

- 阻隔膜

- 安全防护膜

- 装饰膜

- 微孔薄膜

- 其他产品类型

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- American Durafilm

- Bemis Associates Inc.

- Covestro AG

- Dupont Teijin Films

- Eastman Chemical Company

- Evonik Industries AG

- Honeywell International Inc.

- Raven Industries, Inc.

- Saint-Gobain

- Sealed Air

- Solvay

第七章 市场机会与未来趋势

简介目录

Product Code: 61141

The Specialty and High Performance Films Market is expected to register a CAGR of greater than 6% during the forecast period.

Key Highlights

- The increasing use of specialty and high-performance films in the construction and packaging industries is expected to fuel the market's growth.

- On the other hand, the high cost of specialty and high-performance films is expected to hinder the market's growth during the forecast period.

- Among the product types, barrier films will likely account for the highest market share during the forecast period.

- The Asia-Pacific region dominated the global market, with the largest consumption from countries such as China, India, and Japan.

Specialty & High Performance Films Market Trends

Increasing Demand from Construction Industry

- The Specialty and High-Performance Films market is anticipated to be driven by increasing construction activities in nations like China, India, and the United States.

- Owing to rapid industrialization in developing countries, these films are used in the construction sector for aesthetic and functional purposes like safety, security, and light control.

- Furthermore, reconstruction initiatives are common in nations such as North America and Europe. Hence, the demand for Specialty and High-Performance Films is anticipated to be driven by rising film usage in residential and nonresidential structures.

- Commercial building construction activities have increased significantly with the demand from technology, e-commerce, and banking-financial service companies. For example, China is one of the leading countries concerning the construction of shopping centers. China includes almost 4,000 shopping centers, while 7,000 more are estimated to be open by 2025. Thereby creating a huge demand for Specialty and High-Performance Films in the construction sector.

- Furthermore, the construction industry is also expanding in the United States. According to the US Census Bureau, the annual value for new construction put in place in the United States accounted for USD 1,626.4 billion in 2021, compared to USD 1,499.6 billion in 2020. Hence, supporting the growth of the market studied during the forecast period.

- Therefore, owing to the factors above, the growing construction sector is expected to drive the Specialty and High-Performance Films market during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific accounted for the largest specialty and high-performance film market in the past few years.

- There is a significant growth in the demand for specialty and high-performance films from southeast Asian countries for application areas like barrier films, decorative films, etc.

- The growing construction industry in various countries in the Asia-Pacific region is driving the market studied in the Asia-Pacific region.

- According to the National Bureau of Statistics of China, the output value of the construction works in the country accounted for CNY 25.92 trillion (USD 3.82 trillion) in 2021, compared to CNY 23.27 trillion (USD 3.43 trillion) in 2020, thereby enhancing the demand for the market studied.

- Furthermore, according to Statistics Korea, construction orders collected by local builders at home and overseas totaled USD 245.9 billion in 2021, up to KRW 31 trillion from the previous year.

- Moreover, the growing packaging industry, increasing automotive production, massive electronics production industry in China and India, and the demand for specialty and high-performance film are expected to rise significantly.

- According to the Ministry of Electronics and IT's 'A call to action for broadening and deepening electronics manufacturing' study, India intends to generate USD 300 billion in electronics manufacturing by 2026.

- Hence, for the above reasons, Asia-Pacific will likely dominate the market studied during the forecast period.

Specialty & High Performance Films Industry Overview

The global specialty and high-performance films market is consolidated in nature. Some of the major players in the market include 3M, Saint-Gobain, Dupont Teijin Films, Solvay, and Covestro AG, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Packaging Industry

- 4.1.2 Increasing Use in Construction Industry

- 4.2 Restraints

- 4.2.1 High Cost of Fluoropolymers

- 4.2.2 Other Restraints

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Material Type

- 5.1.1 Polyester

- 5.1.2 Fluoropolymers

- 5.1.3 Nylon

- 5.1.4 Polycarbonate

- 5.1.5 Polyimide

- 5.1.6 Other Material Types

- 5.2 Product Type

- 5.2.1 Barrier Films

- 5.2.2 Safety and Security Films

- 5.2.3 Decorative Films

- 5.2.4 Microporous Films

- 5.2.5 Other Product Types

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.2.4 Rest of North America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 American Durafilm

- 6.4.3 Bemis Associates Inc.

- 6.4.4 Covestro AG

- 6.4.5 Dupont Teijin Films

- 6.4.6 Eastman Chemical Company

- 6.4.7 Evonik Industries AG

- 6.4.8 Honeywell International Inc.

- 6.4.9 Raven Industries, Inc.

- 6.4.10 Saint-Gobain

- 6.4.11 Sealed Air

- 6.4.12 Solvay

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219