|

市场调查报告书

商品编码

1641885

大规模 MIMO -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Massive MIMO - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

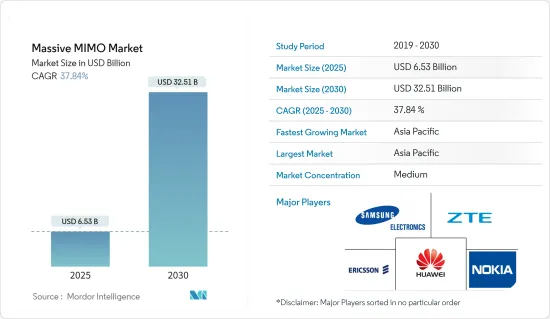

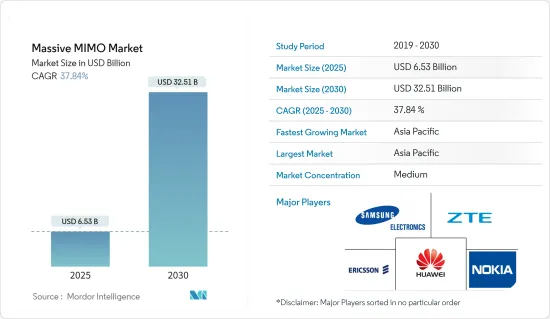

大规模 MIMO 市场规模在 2025 年预计为 65.3 亿美元,预计到 2030 年将达到 325.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 37.84%。

目前,全球约有52.5亿人使用互联网,占全球人口的66.2%。北美的网路普及率最高,为93.4%,其次是欧洲,为88.4%。据称,全球54.4%的网路流量是由行动电话用户消耗的。行动电话用户和上网需求的快速增长给现有网路带来了压力。为了减轻这种负担,电信业者正在采用 MIMO 等解决方案,为消费者提供更快、不间断的服务。

关键亮点

- 从 LTE 到 5G 等网路技术的进步也创造了对不间断连接的需求。 MIMO引进网路将使市场持续受益于现有的4G FDD网络,同时提升5G FDD网路的效能。通讯业者越来越注重推广 5G 服务,预计这将在预测期内推动 Massive MIMO 市场的成长。

- 在新冠肺炎疫情期间,网路使用量显着增加。从线上教育和在家工作到远距咨询和网路购物,对高速网路服务的需求很大。电讯认识到更高频宽的需求,从而产生了对 MIMO 等解决方案的需求以实现更好的连接。

- Wi-Fi 和行动电话网路采用 MIMO 技术来提高频谱效率、最大资料传输速率和网路运算容量。 MU-MIMO 仅对快速移动设备有效,因为形成过程复杂且效率低。因此,MU-MIMO 对于频繁在公司网路间漫游的设备来说并不有效。

大规模多输入多输出的市场趋势

5G 部署增加可能推动市场成长

- 大规模 MIMO 是 MIMO 的扩展,透过在基地台安装更多的天线实现超越旧有系统的扩展。增加天线数量有助于集中能量,进而大幅提高吞吐量和效率,确保5G顺利运作。

- 2022 年 10 月 - 英国电信集团 (BT Group) 的网路服务供应商EE 与爱立信合作,利用爱立信开发的超轻量级无线电技术在英国各地提供 5G 能源效率和网路效能。爱立信表示,该技术节能,可减少高达 40% 的能耗,并且是目前最轻、最小的 Massive MIMO 无线电,有助于实现更广泛的永续性目标。 EE 计划首先在伦敦推出,然后扩展到更多都市区。

- 2022 年 9 月-NEC 和 Mavenir 部署 Massive MIMO Orange 5G 独立 (SA) 实验网络。 5G SA mMIMO 的部署是开发 Open RAN 和从虚拟向云端化网路过渡的重要里程碑。这样的合作展示了多供应商、云端原生、基于标准的方法的潜力。

北美占据主要市场占有率

- 根据GSMA的报告,预计2025年美国将成为全球5G采用率第二高的国家。 5G连线将占北美所有行动连线的64%,到2025年达到2.8亿。随着通讯业者加大中频段频谱部署,美国和加拿大的 5G 覆盖率预计将大幅提升,预计到 2025 年,加拿大的 5G 人口覆盖率将达到 92%,美国将达到 100%。

- 此外,GSMA 强调,T-Mobile 是最大的 5G 供应商,到 2022 年第一季将拥有 90 万 FWA用户,并计划在 2025 年达到约 700 万用户。加拿大通讯业者也正在探索5G FWA市场,尤其是在农村地区。

- 随着大多数通讯业者对 5G 技术进行大量投资,预计在预测期内,Massive MIMO 在该地区的采用率将会增加。

- 2022 年 2 月-美国Open RAN 公司 Parallel Wireless 计画在加拿大开设研发实验室。该公司希望在渥太华拥有一支强大的研发团队,并期待开发与大规模 MIMO、系统结构、无线电设计等相关的新产品。

大规模多投入多产产业概述

由于公司数量众多,大规模多输入多输出 (MIMO) 市场竞争激烈。为了实现产品阵容多样化、扩大地理覆盖范围并最终保持市场竞争力,公司正在实施产品创新、合併和收购等方法。市场的主要企业包括 Verizon Communications Inc.、三星电子、Telefonaktiebolaget LM Ericsson 和华为技术有限公司。

- 2022 年 6 月—恩智浦推出氮化镓 (GaN) 电晶体,以扩大 5G 大规模 MIMO 覆盖范围。此电晶体将促进城市和郊区的5G MIMO部署。这些电晶体将提高驱动蜂窝天线所需的功率,以便通讯服务供应商能够提供高中频频宽并在全国范围内提供强大的 5G 体验。

- 2022 年 9 月-华为开始在菲律宾推出第三代 5G Massive MIMO。 Meta AAU产品将提升37%的流量效能,提升上传下载速度,让更多用户能够使用5G。 5G网路覆盖菲律宾首都地区90%人口。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 工业影响评估

第五章 市场动态

- 市场驱动因素

- 行动装置的兴起

- 增加5G部署

- 市场问题

- 设备高成本

第六章 市场细分

- 依技术分类

- LTE

- 5G

- 依天线类型

- 16T16R

- 32T32R

- 64T64R

- 128T128R 或更高版本

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第七章 竞争格局

- 公司简介

- Samsung Electronics Co. Ltd

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co. Ltd

- Nokia Corporation

- ZTE Corporation

- Texas Instruments Incorporated

- Qorvo Inc.

- NEC Corporation

- Qualcomm Technologies Inc.

- Intel Corporation

第八章投资分析

第九章:市场的未来

The Massive MIMO Market size is estimated at USD 6.53 billion in 2025, and is expected to reach USD 32.51 billion by 2030, at a CAGR of 37.84% during the forecast period (2025-2030).

Approximately 5.25 billion people, i.e, 66.2% of the world's population, use the internet today. North America and Europe have the highest internet penetration of, 93.4% and 88.4%, respectively. It is believed that 54.4% of all internet traffic worldwide is consumed by mobile phone users. This surging demand for mobile subscribers and online usage is putting a burden on existing networks. To ease this pressure, telecom companies are adopting solutions, like MIMO, to provide uninterrupted services to their consumers with enhanced speeds.

Key Highlights

- The technological advancement in network generations like LTE to 5G also creates a demand for uninterrupted connectivity. With the introduction of MIMO in the networks, the market can continue to benefit from existing 4G FDD networks while enhancing the performance of 5G FDD networks. Since telcos focus more on promoting 5G services, it is expected to drive the growth of the massive MIMO market over the forecast period.

- The intensity of internet usage has increased substantially during the COVID-19 Pandemic. From online education, work from home to teleconsultation, online shopping demands high-speed internet services. Telecom operators realized the need for high bandwidth, which created the demand for solutions like MIMO for better connectivity.

- Wi-Fi and cellular networks employ MIMO technology to enhance a computer's spectrum efficiency, maximum data transmission rate, and network capability. It only works well with fast-moving devices because the beam-forming process is more complicated and less efficient. Therefore, MU-MIMO does not benefit devices that frequently roam your corporate network.

Massive Multiple-Input Multiple-Output Market Trends

Increasing 5G Deployment May Drive the Market Growth

- Massive MIMO is an extension of MIMO, that expands beyond the legacy systems by installing a significantly greater number of antennas on the base station. Increased number of antennas helps focus energy, which brings drastic improvements in throughput and efficiency for smooth functioning of 5G.

- October 2022 - EE, the internet service provider and part of BT group teamed with Ericsson to deliver 5G energy efficiency and network performance across the UK using the ultra-light radio technology developed by Ericsson. The company claims this to be the lightest and smallest Massive MIMO radio with energy efficient feature reducing up to 40% energy usage, contributing to wider sustainability goals. In the initial stages, EE plans to deploy the equipments in London, there after expanding to more urban and suburban areas.

- September 2022 - NEC and Mavenir deployed massive MIMO Orange's 5G standalone (SA) experimental network. the deployment of 5G SA mMIMO is an important milestone to develop Open RAN and make the switch from virtualized to cloudified networks. Such collaborations will prove the potential of the multi-vendor, cloud-native, standards-based approach.

North America Occupies a Significant Market Share

- According to GSMA's report, the US is expected to have the world's second-highest 5G adoption rate by 2025. The 5G connections will contribute 64% of all mobile connections in North America and will reach 280 million by 2025. US and Canada are expected to perform well in terms of 5G penetration as operators step up deployments of mid-band spectrum, taking overall population coverage to 92% in Canada and 100% in the US by 2025.

- Furthermore, GSMA highlited that T-Mobile is the biggest provider of 5G with 0.9 million FWA subscribers by the first quarter of 2022 and plans to achieve around 7 million subscribers by 2025. The 5G FWA market is also being investigated by Canadian operators, particularly in rural areas.

- With most of the telecom companies investing heavily in 5G technology, massive MIMO is expected to witness an increased rate of adoption in this region, during the forecast period.

- February 2022 - Parallel Wireless the U.S. based Open RAN company planned to open R&D lab in Canada. With a vision to have a stellar R&D team in Ottawa, the company look forward to develop new products related to massive MIMO, system architecture, radio design and more.

Massive Multiple-Input Multiple-Output Industry Overview

Due to numerous companies, the massive multiple-input, multiple-output (MIMO) market is highly competitive. To diversify their product offerings, broaden their geographic reach, and ultimately maintain their competitiveness in the market, the businesses are implementing methods including product innovation, mergers, and acquisitions. Some of the major players in the market are Verizon Communications Inc., Samsung Electronics Co. Ltd, Telefonaktiebolaget LM Ericsson, and Huawei Technologies Co. Ltd, among others.

- June 2022 - NXP launched Gallium Nitride (GaN) transistors to expand 5G Massive MIMO coverage. It will be easy to install 5G MIMO in cities and suburbs with the help of these transistors. These transistors enhance the power needed to drive cellular antennas for communication service providers to offer larger bandwidth of the mid-band to deliver powerful 5G experiences nationwide.

- September 2022 - Huawei began the rollout of third-generation 5G Massive MIMO in the Philippines. The Meta AAU product will increase traffic performance by 37%, and 5G will be accessible to more users with improved upload and download speeds. 5G networks have covered 90 percent of the population in the National Capital Region of the Philippines.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing number of Mobile Devices

- 5.1.2 Increasing 5G Deployment

- 5.2 Market Challenges

- 5.2.1 High Cost of Equipment

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 LTE

- 6.1.2 5G

- 6.2 By Type of Antenna

- 6.2.1 16T16R

- 6.2.2 32T32R

- 6.2.3 64T64R

- 6.2.4 128T128R and Above

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Samsung Electronics Co. Ltd

- 7.1.2 Telefonaktiebolaget LM Ericsson

- 7.1.3 Huawei Technologies Co. Ltd

- 7.1.4 Nokia Corporation

- 7.1.5 ZTE Corporation

- 7.1.6 Texas Instruments Incorporated

- 7.1.7 Qorvo Inc.

- 7.1.8 NEC Corporation

- 7.1.9 Qualcomm Technologies Inc.

- 7.1.10 Intel Corporation