|

市场调查报告书

商品编码

1641890

复合材料:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Composite Material - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

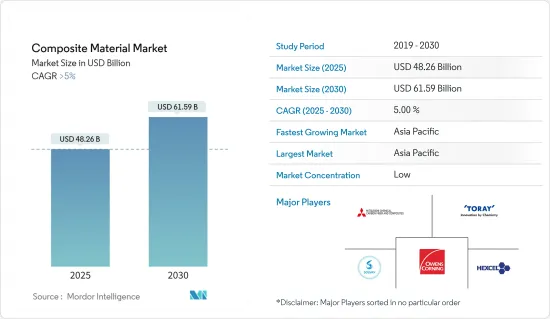

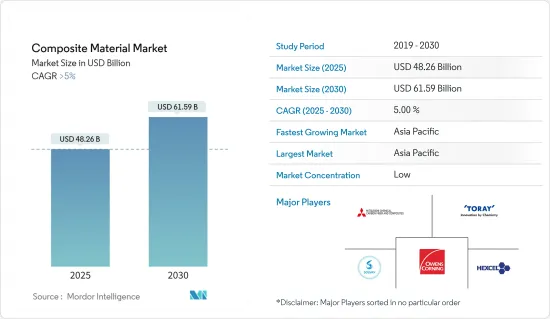

复合材料市场规模在 2025 年预计为 482.6 亿美元,预计到 2030 年将达到 615.9 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 5%。

2021年的市场相对于2020年来说有所成长。随着多个国家解除封锁措施、许多製造业和建筑计划恢復,市场已部分摆脱新冠疫情带来的不利影响。

主要亮点

- 复合材料製造领域的最新技术进步(如奈米技术、非高压釜固化等)预计将推动市场成长。

- 另一方面,高製造成本预计将导致终端用户市场价格上涨,从而阻碍市场成长。

- 预计在预测期内,交通运输应用将占据研究市场的主导地位。

- 亚太地区占据全球整体的最大份额。预计该地区在预测期内也将呈现最高的成长率。

复合材料市场趋势

运输业需求增加

- 复合材料是由两种或两种以上具有不同物理和化学性质的材料构成的。长期以来,聚合物复合材料一直被提案是汽车行业中较重金属部件的替代品,因为它们可以减轻重量,同时保持机械强度等其他理想特性。碳纤维是最适合此应用的聚合物复合材料。

- 碳纤维是一种先进的复合材料,用途广泛,从汽车到体育用品,以及航太和国防等尖端产业。

- 由于各市场的需求量大,碳纤维製造商的数量每年都在增加。例如,美国碳纤维製造商从十年前的17家增加到2021年的58家。

- 复合材料由于其高比强度和模量一直被誉为未来材料,成为飞机应用的一个有吸引力的选择。最新的波音787梦幻飞机由50%的复合材料製成。

- 根据OICA预测,全球汽车产量将从2022年的8,483万辆增至2023年的9,354万辆,年与前一年同期比较10.3%。

- 全球努力在 2050 年实现零排放,这也是汽车产业复合材料发展的关键驱动力,从而推动电动车 (EV) 的快速发展、创新和生产。

- 为了因应气候变化,英国政府最近承诺在2030年将二氧化碳排放减少68%。为了实现这一目标,所有新的汽油和柴油汽车都将被禁止,并且同年英国近一半的汽车必须是电动车。这意味着要用电动车 (EV) 取代 1,610 万辆汽车,但目前英国註册的电动车仅有 20 万辆左右。

- 因此,由于上述因素,运输业在预测期内预计将呈现最高的成长率。

亚太地区成长最快

- 由于建筑、汽车、电气和电子、航太和国防以及工业等终端用户产业的需求旺盛,亚太地区占据了复合材料市场的最高份额。

- 由于中国、印度和日本等国家工业化的快速发展,亚太地区对复合材料的需求正在急剧增长。

- 由于复合材料在各行业的应用日益增多,其需求量也逐年增加。根据《复合材料世界》报道,到2021年,中国先进复合纤维碳纤维的供应量将达到约19,250吨。

- 根据OICA预测,2023年中国汽车产量约3,016万辆,与前一年同期比较成长11.6%达到约2,702万辆。在研究期间,汽车产业的稳定成长可能会推动复合材料市场的成长。

- 根据日本监管事务专业协会估计,日本医疗设备市场规模约300亿美元,位居全球第三。因此,新冠疫情后对医疗设备的依赖增加可能会进一步促进复合材料市场的发展。

- 据锂电池製造商Inverted 称,印度的ESDM(电子系统设计和製造)产业预计到2025 年将达到2,200 亿美元,电子製造业是「印度製造」计画的关键驱动力。关键组成部分政府措施包括「数位印度」和「Start-Ups印度」。这被认为代表了所研究市场的一个潜在的成长机会。

- 据JEC Korea称,韩国拥有强大的复合材料产业,拥有本土加工商和碳纤维和树脂供应商,该国很可能继续处于复合材料和施工方法创新的前沿。韩国政府正投入大量资源加强碳纤维产业的发展。

- 预计更严格的环境法规和永续目标(SDG)及《巴黎协定》等环境框架的升级将刺激轻质且极硬的碳纤维的使用。据称亚洲的需求正在增加,特别是在体育和户外、工业和航空领域。

- 由于这些市场趋势,预计亚太地区将主导全球市场。

复合材料产业概况

复合材料市场相当分散,市场占有率被多家参与者瓜分。市场的主要企业(不分先后顺序)包括东丽、欧文斯科宁、三菱化学、赫氏、索尔维和帝人。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 材料科学的技术进步

- 复合复合材料在航太和国防工业的应用日益广泛

- 其他驱动因素

- 限制因素

- 复合材料高成本

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章 市场区隔(以金额为准的市场规模)

- 依基质材料

- 聚合物基复合材料 (PMC)

- 热固性树脂

- 热塑性树脂

- 陶瓷/碳基复合材料 (CMC)

- 其他基质(金属复合材料)

- 聚合物基复合材料 (PMC)

- 透过增强纤维

- 玻璃纤维

- 碳纤维

- 酰胺纤维

- 其他纤维

- 按最终用途

- 汽车与运输

- 风力发电

- 航太和国防

- 管道和储罐

- 建筑学

- 电气和电子

- 运动休閒

- 其他最终用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 泰国

- 马来西亚

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 土耳其

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- DuPont

- DIT BV

- COMPOSITES UNIVERSAL GROUP

- Hexcel Corporation

- Materion Corporation

- Mitsubishi Chemical Group Corporation

- Owens Corning

- SGL Carbon

- Solvay

- TEIJIN LIMITED.

- TORAY INDUSTRIES, INC.

第七章 市场机会与未来趋势

The Composite Material Market size is estimated at USD 48.26 billion in 2025, and is expected to reach USD 61.59 billion by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

The market increased in 2021 compared to 2020. After the lifting of lockdowns in several countries and the resumption of many manufacturing and construction projects, the market has partially recovered from the negative effects of the COVID-19 pandemic.

Key Highlights

- Recent improvements in technological advancements such as Nanotechnology, Out-of-Autoclave (OOA) Curing, and others in composite material manufacturing are expected to drive the growth of the market.

- On the other hand, high manufacturing costs, which result in a higher price for the end-user market, are expected to hinder market growth.

- Transportation application is expected to dominate the market studied in the forecasted period.

- Asia-Pacific has the largest share across the globe. The region is also expected to have the highest growth rate during the forecasted period.

Composite Materials Market Trends

Rising Demand from Transportation sector

- Composites are made up of two or more materials that have diverse physical and chemical characteristics. Polymer composites have long been proposed as a replacement for heavier metal components in the automobile industry, offering weight savings while retaining other desirable features such as mechanical strength. Carbon Fibre is the most preferred polymer composite for this application.

- Carbon Fiber is an advanced composite material used in a wide range of applications from Automotive to sports equipment and even in the most advanced industries such as Aerospace, Defense, and other industries.

- The number of carbon fiber manufacturers are increasing year on year due to its heavy demand in various markets. For instance, in 2021, there were 58 carbon fiber producers in the United States, up from 17 in the previous decade.

- Because of their high specific strength and/or modulus, composites have long been hailed as the materials of the future, making them appealing choices for aircraft applications. In the latest Boeing 787 Dreamliner aeroplane, the amount of composites has climbed to 50%.

- According to OICA, global automotive production increased from 84.83 million units in 2022 to 93.54 million units in 2023 with a y-o-y growth of 10.3%.

- Global efforts towards zero emissions by 2050 is another significant driver for composites in automotive industry, which in turn is leading to rapid development, innovation, and production of electric vehicles (EVs)

- In an effort to combat climate change, the UK government recently pledged to decrease 68% of CO2 emissions by 2030. To achieve this goal, new petrol and diesel automobiles woulds be be prohibited, and almost half of the UK's vehicles must be electric by the same year. This entails to replacing 16.1 million automobiles with electric vehicles (EVs), with only about 200,000 EVs now registered in the UK.

- Hence, owing to the above-mentioned factors, tranportation sector is expected to witness the highest growth rate during the forecast period.

Asia-Pacific to Witness the Highest Growth Rate

- Asia-Pacific region accounts for the highest share of composite material market owing to high demand from end-user industries like construction, automotive, electrical & electronics, aerospace & defense, Industrial, etc.

- The demand for composite material in the Asia-Pacific region is growing at a staggering rate as a result of rapid industrialization in countries such as China, India, and Japan.

- The demand for composite materials is surging every year with the increase in its application in various industries. In China the supply of Carbon fiber, which is an advanced composite fiber, amounted to around 19,250 metric tonnes in the year 2021 according to CompositesWorld.

- According to OICA, automotive production in China was at around 30.16 million units in 2023, with a y-o-y growth of 11.6% from the previous year, where the production was at around 27.02 million units. The steady increase in the Automotive sector would promote the growth of the composite market during the studied period.

- According to the Regulatory Affairs Professional Society, Japan's medical device market, with an estimated value of around USD 30 billion, ranks as the third biggest across the globe. Thus, increasing dependancy on medical equipments post COVID-19 would further boost the composite market.

- As per Inverted, a lithium battery manufacturer, India's ESDM (Electronics System Design & Manufacturing) sector is expected to reach USD 220 billion by 2025 and electronics manufacturing has been a crucial component of several government initiatives, including "Make in India," "Digital India," and "Start-up India." This factor would act as a potential growth opportunity for the studied market.

- According to JEC Korea, South Korea has a strong composites sector, with local processors and carbon fibre and resin suppliers, and the nation will continue to be at the forefront of composite material and method innovations. The government of South Korea has committed substantial resources to bolstering the country's carbon fibre sector.

- Increased usage of lightweight and extremely stiff carbon fibre is predicted to be stimulated by more rigorous environmental restrictions and the upgrading of environmental frameworks, such as the Sustainable Development Goals (SDGs) and the Paris Agreement. Asia's demand is said to be increasing, particularly in the domains of sports and outdoor activities, industrial, and aircraft.

- Owing to these prevailing market trends, the Asia-Pacific region is expected to dominate the global market.

Composite Materials Industry Overview

The composite material market is moderately fragmented as the market share is divided between many players. Some of the key players in the market (not in any particular order) include TORAY INDUSTRIES, INC., Owens Corning, Mitsubishi Chemical Corporation, Hexcel Corporation, Solvay and Teijin Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Technological Advancement in the Field of Material Science

- 4.1.2 Increasing Use of Composites in the Aerospace and Defense Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Cost of Composite Materials

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Matrix Material

- 5.1.1 Polymer Matrix Composites (PMC)

- 5.1.1.1 Thermoset Resins

- 5.1.1.2 Thermoplastic Resins

- 5.1.2 Ceramic/Carbon Matrix Composites (CMCs)

- 5.1.3 Other Matrices (Metal Matrix Composites)

- 5.1.1 Polymer Matrix Composites (PMC)

- 5.2 Reinforcement Fiber

- 5.2.1 Glass Fiber

- 5.2.2 Carbon Fiber

- 5.2.3 Aramid Fiber

- 5.2.4 Other Fibers

- 5.3 End-use Application

- 5.3.1 Automotive and Transportation

- 5.3.2 Wind Energy

- 5.3.3 Aerospace and Defense

- 5.3.4 Pipes and Tanks

- 5.3.5 Construction

- 5.3.6 Electrical and Electronics

- 5.3.7 Sports and Recreation

- 5.3.8 Other End-use Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Thailand

- 5.4.1.6 Malaysia

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Turkey

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Qatar

- 5.4.5.5 Egypt

- 5.4.5.6 United Arab Emirates

- 5.4.5.7 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 DuPont

- 6.4.3 DIT B.V.

- 6.4.4 COMPOSITES UNIVERSAL GROUP

- 6.4.5 Hexcel Corporation

- 6.4.6 Materion Corporation

- 6.4.7 Mitsubishi Chemical Group Corporation

- 6.4.8 Owens Corning

- 6.4.9 SGL Carbon

- 6.4.10 Solvay

- 6.4.11 TEIJIN LIMITED.

- 6.4.12 TORAY INDUSTRIES, INC.