|

市场调查报告书

商品编码

1641896

陶瓷油墨:市场占有率分析、行业趋势和成长预测(2025-2030 年)Ceramic Inks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

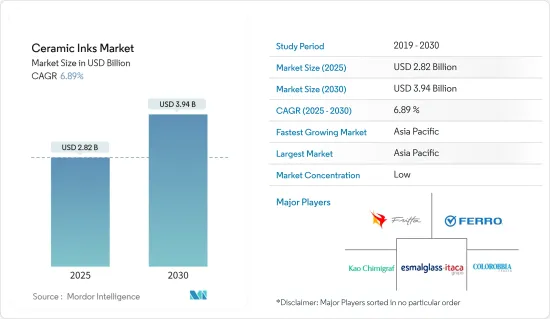

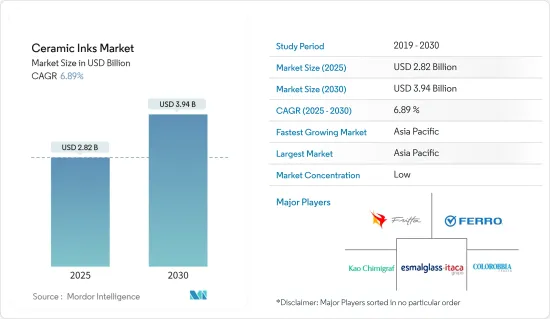

陶瓷油墨市场规模预计在 2025 年为 28.2 亿美元,预计到 2030 年将达到 39.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.89%。

新冠肺炎疫情为市场带来了负面影响。这是因为製造设施和工厂由于封锁和限製而关闭。供应链和运输中断进一步扰乱了市场。但2021年,产业復苏,市场需求回归。

主要亮点

- 短期内,装饰玻璃和瓷砖需求的上升是市场成长的驱动因素。

- 相反,从类比技术到数位技术的转变所带来的高成本可能会阻碍市场成长。

- 然而,数位印刷技术的进步预计很快将为市场带来机会。

- 预计预测期内亚太地区将主导全球陶瓷油墨市场。

陶瓷墨水市场趋势

瓷砖是成长最快的细分市场

- 陶瓷油墨市场成长最快的应用是瓷砖。有必要改善建筑的美观以满足客户的功能需求。

- 磁砖因具有高耐久性、耐磨性和持久性色彩等特性,已成为最常用的材料。

- 过去几年,由于全球对瓷砖的需求不断增加,住宅建筑支出大幅增加。例如,根据英国土木工程师学会(ICE)的一项研究,到2030年,全球建筑业规模预计将达到8兆美元,主要由中国、印度和美国推动。因此,由于建设产业的成长而导致的对瓷砖的需求不断增长,预计将在未来几年进一步推动对陶瓷油墨市场的需求。

- 预计印度仍将是亚太地区二十国集团经济体中成长最快的国家。印度政府宣布,2023-2025年三年期间的基础设施投资目标为3,765亿美元。其中包括投资1205亿美元用于发展27个工业丛集,投资753亿美元用于公路、铁路和港口连通计划。

- 此外,沙乌地阿拉伯正在进行一些商业计划,这可能会导致商业建筑的增加。耗资 5000 亿美元的未来特大城市“Neom”计划,红海计划- 第一阶段预计将于2025 年完工,将包括14 家豪华和超豪华酒店,共有3,000 间客房,分布在五个岛屿和两个内陆度假村。度假村包括 Qiddiya 娱乐城、超豪华健康旅游目的地 Amaala 和让·努维尔在埃尔奥拉的 Shara'an 度假村。因此,预计商业建筑投资的增加将推动陶瓷油墨市场的需求。

- 由于生活方式的改变和人口收入的增加,这些瓷砖在市场上获得了巨大的需求,尤其是在新兴经济国家。因此,与其他地板材料和墙壁装饰相比,消费者越来越喜欢瓷砖。

- 因此,预计预测期内它将推动对陶瓷油墨的需求。

亚太地区可望引领陶瓷油墨市场

- 亚太地区占据全球市场占有率的主导地位。随着印度、中国、菲律宾、越南和印尼等国家对住宅和商业建筑的投资不断增加,陶瓷油墨市场预计将在未来几年内实现成长。

- 中国庞大的建筑业对陶瓷油墨产生了巨大的需求。而中国近年来也是全球基础设施的主要投资者之一,并做出了重大贡献。例如,根据中国国家统计局(NBS)的数据,2022年中国建筑业产值将达到人民币27.63兆元(41,085.81亿美元),比2021年增加6.6%。

- 此外,印度的住宅产业正在崛起,政府的支持和倡议进一步刺激了需求。据印度品牌股权基金会(IBEF)称,住房与城市发展部(MoHUA)已在2022-2023年预算中拨款98.5亿美元,用于资助住宅建设和完成停滞的计划。

- 印度的食品印刷领域拥有庞大的市场,其中包括食品储存和运输的包装。陶瓷油墨广泛用于食品容器和玻璃上的印刷。例如,根据印度品牌股权基金会(IBEF)的数据,印度食品加工产业发展迅速,过去五年的复合年增长率达到 8.3%。

- 此外,到 2023 年,食品加工市场预计将创造 9,630 亿美元的收入,从 2023 年到 2027 年的复合年增长率为 7.23%。因此,预计陶瓷油墨市场将见证食品包装需求的上升。

- 因此,随着各个应用领域的需求不断增加,预计预测期内该地区的陶瓷油墨市场将进一步成长。

陶瓷墨水行业概况

陶瓷油墨市场比较分散。市场的主要企业(不分先后顺序)包括 Ferro Corporation、FRITTA、Colorobbia Italia SpA、Kao Chimigraf、Esmalglass-Itaca Grupo 等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 装饰玻璃和瓷砖的需求不断增加

- 建筑业快速成长

- 市场限制

- 从类比技术转变为数位技术的高成本

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章 市场区隔(以金额为准的市场规模)

- 依产品类型

- 功能墨水

- 装饰油墨

- 依印刷技术

- 数位印刷

- 类比印刷

- 按应用

- 磁砖

- 住宅

- 非住宅

- 玻璃印刷

- 食品容器印刷

- 其他用途

- 磁砖

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Colorobbia Italia SpA

- Esmalglass-Itaca Grupo

- Ferro Corporation

- FRITTA

- INKCID

- Kao Chimigraf

- Rex-Tone Industries Ltd

- Sicer SPA

- Sun Chemical

- TECGLASS

- Torrecid

- ZSCHIMMER & SCHWARZ CHEMIE GMBH

第七章 市场机会与未来趋势

- 数位印刷方法的技术进步

- 其他机会

The Ceramic Inks Market size is estimated at USD 2.82 billion in 2025, and is expected to reach USD 3.94 billion by 2030, at a CAGR of 6.89% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the market. It was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, increasing demand for decorative glass and tiles are some factors driving the studied market's growth.

- Conversely, high-cost involvement in shifting from analog to digital technology will likely hinder the market's growth.

- However, technological advancements in digital printing are projected to act as an opportunity for the market shortly.

- Asia-Pacific is expected to dominate the global ceramic ink market during the forecast period.

Ceramic Inks Market Trends

Ceramic Tiles is the Fastest Growing Segment

- The fastest-growing application of the ceramic ink market is ceramic tiles. There is a need to improve the aesthetics of buildings to address the functional requirement of the customers.

- Ceramic tiles became the most popular materials that are being used, owing to properties such as high durability, resistance to wear, color permanence, etc.

- Over the past few years, there is a significant increase in residential construction spending, owing to which there is a rise in the demand for ceramic tiles across the globe. For instance, according to a study by the Institution of Civil Engineers (ICE), the global construction industry is expected to reach USD 8 trillion by 2030, primarily driven by China, India, and the United States. Therefore, the growing construction industry is expected to include an upside demand for ceramic tiles which further will boost the demand for ceramic inks market in the coming years.

- India is anticipated to remain the fastest-growing G20 economy in the Asia-Pacific region. The Indian government announced a target of USD 376.5 billion in infrastructure investment over three years (2023-2025), including USD 120.5 billion for developing 27 industrial clusters and USD 75.3 billion for road, railway, and port connectivity projects.

- Furthermore, Saudi Arabia is working on many commercial projects, likely leading to more commercial buildings. The USD 500 billion futuristic mega-city "Neom" project, the Red Sea Project - Phase 1, is expected to be completed by 2025 and includes 14 luxury and hyper-luxury hotels with 3,000 rooms spread across five islands and two inland resorts. The resorts include Qiddiya Entertainment City, Amaala - the uber-luxury wellness tourism destination, and Jean Nouvel's Sharaan resort in Al-Ula. Therefore, increasing investments in commercial constructions is expected to create an upside demand for the ceramic inks market.

- These ceramic tiles gained huge demand in the market, especially in developing economies with the changing lifestyle trend and increasing population income. As a result of this, consumers are preferring ceramic tiles over other flooring and wall decoration options.

- It, in turn, is expected to drive the demand for ceramic inks over the forecast period.

The Asia-Pacific Region is Expected to Lead the Ceramic Inks Market

- The Asia-Pacific region dominated the global market share. With growing investments in residential and commercial construction in the countries such as India, China, the Philippines, Vietnam, and Indonesia, the market for ceramic inks is expected to grow in the coming years.

- China's massive construction sector generated significant demand for ceramic inks. Moreover, China is a huge contributor, as it is one of the leading investors in infrastructure worldwide over the past few years. For instance, according to the National Bureau of Statistics (NBS) of China, in 2022, the output value of construction works in China amounted to CNY 27.63 trillion (USD 4108.581 billion), an increase of 6.6% compared with 2021.

- Moreover, the residential sector in India is on an increasing trend, with government support and initiatives further boosting the demand. According to the India Brand Equity Foundation (IBEF), the Ministry of Housing and Urban Development (MoHUA) allocated USD 9.85 billion in the 2022-2023 budget to construct houses and create funds to complete the halted projects.

- The food printing sector in India includes a large market that involves packaging for the storage and transportation of food. Ceramic inks are widely used in food container printing, glass printing, etc. For instance, according to India Brand Equity Foundation (IBEF), the Indian food processing industry grew rapidly, with an average annual growth rate of 8.3% in the past 5 years.

- Moreover, in 2023, the food-processing market will generate USD 963 billion in revenue, and the market is anticipated to expand at a CAGR of 7.23% between 2023-2027. Therefore, this is expected to create an upside demand for the Ceramic inks market from food packaging.

- Hence, with the increasing demand from the various application segments, the ceramic inks market is expected to grow more in the region during the forecast period.

Ceramic Inks Industry Overview

The Ceramic Inks Market is fragmented in nature. The major players in this market (not in a particular order) include Ferro Corporation, FRITTA, Colorobbia Italia SpA, Kao Chimigraf, and Esmalglass-Itaca Grupo.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand for Decorative Glass and Tiles

- 4.1.2 Rapid Growth in the Construction Sector

- 4.2 Market Restraints

- 4.2.1 High-cost Involvement in Shifting of Analog Technology to Digital Technology

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Functional Inks

- 5.1.2 Decorative Inks

- 5.2 Printing Technology

- 5.2.1 Digital Printing

- 5.2.2 Analog Printing

- 5.3 Application

- 5.3.1 Ceramic Tiles

- 5.3.1.1 Residential

- 5.3.1.2 Non-residential

- 5.3.2 Glass Printing

- 5.3.3 Food Container Printing

- 5.3.4 Other Applications

- 5.3.1 Ceramic Tiles

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Colorobbia Italia SpA

- 6.4.2 Esmalglass - Itaca Grupo

- 6.4.3 Ferro Corporation

- 6.4.4 FRITTA

- 6.4.5 INKCID

- 6.4.6 Kao Chimigraf

- 6.4.7 Rex-Tone Industries Ltd

- 6.4.8 Sicer S.P.A.

- 6.4.9 Sun Chemical

- 6.4.10 TECGLASS

- 6.4.11 Torrecid

- 6.4.12 ZSCHIMMER & SCHWARZ CHEMIE GMBH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Digital Printing Methods

- 7.2 Other Opportunities