|

市场调查报告书

商品编码

1641900

弹道复合材料:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Ballistic Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

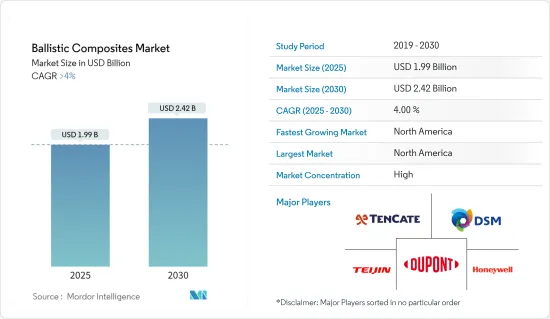

2025 年防弹复合材料市场规模预估为 19.9 亿美元,预计到 2030 年将达到 24.2 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 4%。

COVID-19 疫情对防弹复合材料市场来说是一个动盪的时期。虽然它带来了供应链中断、需求波动和经济不确定性等挑战,但它也刺激了创新,凸显了安全和永续性方面的新机会,并鼓励製造业采用有益技术。一进程的可能性。儘管疫情的长期影响仍然明显,但市场的适应能力和对高性能防护材料的持续需求表明未来充满希望。

主要亮点

- 现代战争需要轻便、舒适的防护衣,既要能提供足够的防弹保护,又不能影响机动性,因此国防和航太工业的需求不断增长,推动着市场的发展。

- 另一方面,防弹复合材料的加工和製造通常需要复杂且劳力密集的技术。这可能会增加成本并阻碍所研究市场的成长。

- 许多国家的国防费用和预算不断增加,对防御弹道威胁的轻量材料的需求不断增加,这可能会在预测期内带来机会。

- 北美占据全球市场主导地位,最大的消费国是美国和加拿大等国家。

弹道复合材料市场趋势

车辆装甲需求不断增加

- 防弹复合材料市场对车辆装甲的需求正在稳定成长。这背后有许多因素,包括日益增长的安全问题、技术进步和不断扩大的应用。

- 装甲运兵车、战斗车辆甚至一些军用卡车越来越多地使用防弹复合材料进行防护。

- 陆战车辆受到足以抵御机关枪射击和高空炮火的装甲保护。这些车辆包括一个外部装甲套件,其中包括玻璃纤维增强支撑板。加固的底盘可以保护车内的人员免受地雷的伤害。外部装甲设计通常包括由陶瓷面编织芳香聚酰胺製成的模组化扩展装甲系统面板。屋顶内部采用模製芳香聚酰胺增强复合复合材料製成,内部方面采用模製 S 玻璃纤维增强复合复合材料製成。

- 直升机底部也需要装甲防护,以抵御小型武器的地面攻击。直升机机身需要很轻,因此机身底部通常更容易受到地面小型武器的射击。这使船员处于危险之中。直升机底部的轻型装甲已经使用多年。

- 全球战争的增加导致军舰所需军用车辆的需求增加,这可能会在预测期内增加对车辆装甲的需求。

- 国防开支和安全预算的增加导致对装甲车和先进装甲技术的投资增加。

- 中国的国防工业正在崛起,许多中国公司取代了西方国防强国。该国正在大力投资升级其军队,使得 8 家国防相关企业跻身世界前 25 名。

- 目前,中国每年生产军用飞机约300架。随着中国军事工业的不断发展,中国国产军用飞机的需求和供应可能会大幅增加。此举可望带动中国军用飞机製造业的快速发展。

- 2021 年 6 月,印尼宣布了另一项计划,到 2040 年代中期斥资 1,250 亿美元升级和现代化其军队。总期限包括五个策略计画期,每个计画期为五年。第一个战略计划将涵盖 2020 年至 2024 年期间,与最低基本部队 (MEF) 计划的最后阶段相吻合。该文件提案在未来25年内花费790亿美元用于国防装备,325亿美元用于维护,剩余的134亿美元用于支付外国贷款利息。

- 在日本,国防费用的增加、下一代武器的采购增加以及军事通讯中先进技术的采用正在推动日本整个市场的成长。根据斯德哥尔摩国际和平研究所(SIPRI)2022年报告,日本国防预算为460亿美元,是全球第十大国防费用。它已核准2023财年514亿美元的国防费用。

- 复合材料逐渐进入海军舰艇和陆战车的装甲系统。复合材料已经取代了钢、铝甚至钛合金,部分原因是由于弹道效率的提高(类似于结构材料比强度和刚性重量比的重大进步)以及其重量轻。复合部件可以作为主装甲的一部分,对抵御手榴弹、迫击炮、火炮和其他爆炸物产生的弹片特别有效。该车辆可以使用 S 玻璃或编织凯夫拉装甲层压板。

- 在车辆装甲领域,防弹复合复合材料具有以下优点:减轻车辆重量、提高机动性、减少装甲所需零件、提高燃油效率、延长车辆寿命。

北美占据市场主导地位

- 由于航太和国防工业活动的成长以及降低成本、降低碳排放和减少燃料消费量的不断增长的需求,北美地区占据了全球市场占有率的主导地位。

- 美国是受调查市场中最大的消费国家。美国国防部(DoD)2022财年的预算权限约为7,220亿美元,比2020财年的7,050亿美元增加170亿美元。相较之下,总统对2023财年的预算要求为国防部拨款7,730亿美元。该预算主要是为了实现空中、海上和陆战领域能力的现代化,以及技术创新,以增强国家的竞争优势。

- 到 2023 年,海军可能增加 16,900 名人员,海军陆战队可能增加 1,400 名人员,空军可能增加 13,700 名人员,使现役军人总数达到 1,365,500 人。

- 该法案还包括投资 65 亿美元增加欧洲的坦克和装甲车等作战装备,这是五角大厦安抚欧洲盟友计画的一部分。

- 截至 2022 年 10 月,美国和 BAE 系统公司正在合作寻找加速生产新型装甲多用途车辆的方法,以更快取代老化的 M113 装甲运兵车。

- 据美国国会研究服务处称,AMPV(装甲多用途车)的年产量计划到 2024 财年将增至 131 辆,并至少在 2027 财年保持这一水平。据报道,2020 年生产延迟之前发布的 AMPV 计画文件要求到 2024 财年 AMPV 的年产量达到 190 辆。

- 俄乌战争爆发后,美国向乌克兰运送了大规模武器,乌克兰国防部门也开始大举采购。为了更好地应对俄罗斯的威胁,空军正在扩大采购。例如:

- 近日,2022年3月,美国请求拨款110亿美元,用于2023财年购买61架洛克希德·马丁公司的F-35闪电II飞机。其采购计画中约45%用于战斗机(83.89亿美元),23%用于现役平台的改装(42.57亿美元)。

- 由于上述因素,该地区的防弹复合材料市场预计将在预测期内显着增长。

弹道复合材料产业概况

防弹复合材料市场因其性质而部分整合。主要企业(不分先后顺序)包括杜邦、DSM、Honeywell国际、Tencate Protective Fibers、帝人。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 增加国防费用

- 航太和国防工业对轻量材料的需求不断增加

- 其他驱动因素

- 限制因素

- 加工製造成本高

- 原物料供应不稳定

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章 市场区隔(以金额为准的市场规模)

- 依纤维类型

- 芳香聚酰胺

- 超高分子量聚乙烯 (UHMWPE)

- S-玻璃

- 其他纤维类型(生物基纤维、奈米复合材料等)

- 按矩阵类型

- 聚合物

- 聚合物陶瓷

- 金属

- 按应用

- 车辆装甲

- 防弹衣

- 头盔和脸部防护

- 其他应用(航空和海洋防护、高性能运动器材等)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- ArmorCore

- BAE Systems

- Barrday Inc

- Coherent Corp.

- DSM

- DuPont

- Gaffco Ballistics

- Gurit Holding AG

- Honeywell International Inc.

- Integris

- MKU LIMITED

- Morgan Advanced Materials

- Plastic Reinforcement Fabrics Ltd

- Roihu Inc.

- Southern States, llc

- Teijin Limited

- TenCate Protective Fabrics

第七章 市场机会与未来趋势

- 防弹地形自适应车辆的开发

- 生物基防弹纺织品的开发

The Ballistic Composites Market size is estimated at USD 1.99 billion in 2025, and is expected to reach USD 2.42 billion by 2030, at a CAGR of greater than 4% during the forecast period (2025-2030).

The COVID-19 pandemic was a mixed bag for the Ballistic Composites Market. While it presented challenges due to supply chain disruptions, demand fluctuations, and economic uncertainty, it also spurred innovation, highlighted new opportunities in security and sustainability, and potentially accelerated the adoption of beneficial technologies in manufacturing. The long-term impact of the pandemic is evident, but the market's adaptability and the ongoing need for high-performance protection materials suggest a promising future.

Key Highlights

- One of the major factors driving the market is the increasing demand from the defense and aerospace industries, as modern warfare emphasizes lightweight and comfortable body armor that provides adequate ballistic protection without compromising mobility.

- On the flip side, the processing and manufacturing of ballistic composites often involve complex and labor-intensive techniques. It drove up the costs and may act as a hindrance to the growth of the market studied.

- The rise in defense expenditures and budgets of many countries and the demand for lightweight materials for protection against ballistic threats are likely to act as opportunities in the forecast period.

- North America dominated the market across the world, with the most significant consumption from countries such as the United States and Canada.

Ballistic Composites Market Trends

Increasing Demand for Vehicle Armors

- The demand for vehicle armor in the ballistic composites market is definitely on the rise. It is driven by a multitude of factors, such as growing security concerns, technological advancements, expanding applications, and many more.

- Armored personnel carriers, combat vehicles, and even some military trucks are increasingly utilizing ballistic composites for protection.

- Land combat vehicles are protected by armor sufficient to withstand heavy machinegun fire and overhead artillery fire. These vehicles include external armor kits, which include glass fiber-reinforced support plates. A strengthened undercarriage protects the personnel inside from mines. Exterior armor design generally includes modular expandable armor system panels made with ceramic-faced woven aramid. The roof interiors consist of molded-woven aramid reinforced composites, and the interior sides contain molded, S-fiberglass-reinforced composites.

- Armor protection against ground fire from small arms is also required on the bottom of helicopters. As the fuselage of helicopters needs to be light, the base portion is generally vulnerable to small-arms fire from the ground. It puts the occupants at risk. Lightweight armor for the bottom of helicopters is in use for many years.

- Increasing warfare across the world is increasing the demand for military vehicles required in warships, which is likely to increase the demand for vehicle armor during the forecast period.

- Increased defense spending and security budgets are leading to more significant investment in armored vehicles and advanced armor technologies.

- China's defense industry is increasing, with many Chinese firms displacing Western defense powerhouses. The country invests heavily to upgrade its military, thus making its eight defense firms among the top 25 in the world.

- Currently, the annual output of Chinese military aircraft is around 300. As China's military industry continues to grow, the demand for and supply of Chinese military aircraft will increase substantially. It will drive the rapid development of China's military aircraft manufacturing industry.

- In June 2021, Indonesia unveiled another plan to spend USD 125 billion through the mid-2040s to upgrade and modernize its military arsenal. The total period runs through a period of five strategic plans, each lasting five years. The first strategic plan runs from 2020 to 2024 and coincides with the final phase of the Minimum Essential Force (MEF) program. The document proposes funding of USD 79 billion for defense equipment during these 25 years, USD 32.5 billion for sustainment, and the remaining USD 13.4 billion for interest payments on foreign loans.

- In Japan, an increase in defense expenditure, rising procurement of next-generation weapons, and adoption of advanced technologies in military communication drive the growth of the market across Japan. According to the report published by the Stockholm International Peace Research Institute (SIPRI) in 2022, Japan was the tenth largest defense spender in the world, with a defense budget of USD 46 billion. The country approved USD 51.4 billion in defense spending in FY2023.

- Composite materials gradually crept into armor systems for naval vessels and land combat vehicles. They displaced steel, aluminum, and even titanium alloys, partly due to improved ballistic efficiencies similar to the significant advancements in specific strength and stiffness made in structural materials, as well as being lightweight. Composite parts can be part of the primary armor, especially effective against fragmentation, originating from grenades, mortars, artillery, and other explosive devices. Vehicles can use armor laminates of either S-glass or Kevlar fabric.

- In the area of vehicle armor, ballistic composites provided the following benefits: reduced the weight of a vehicle, increased mobility, decreased number of components required to armor, increased fuel efficiency, and increased life of the vehicle.

North American Region to Dominate the Market

- The North American region dominated the global market share due to the growing aerospace and defense industrial activities and the increasing need to bring down costs, lower carbon dioxide emissions, and reduce fuel consumption.

- The United States is the largest consumer of the market studied. For FY 2022, the Department of Defense's (DoD) budget authority is approximately USD 722 billion, an increase of USD 17 billion from USD 705 billion in 2020. In comparison, the FY 2023 President's budget request was USD 773 billion for the DoD. The budget primarily aims to modernize capabilities in the air, maritime, and land warfighting domains and to innovate to strengthen the country's competitive advantage.

- By 2023, the Navy forces may increase by 16,900, the Marine Corps by 1,400, and the Air Force by 13,700, increasing the total active-duty military to 1,365,500 personnel.

- The proposal also includes an investment of USD 6.5 billion to place more tanks, armored vehicles, and other combat equipment in Europe as part of the Pentagon plan to reassure European allies.

- As of October 2022, the US Army and BAE Systems are working together to identify ways to accelerate production of the new Armored Multi-Purpose Vehicle, which would let the service more quickly replace aging M113 armored troop carriers.

- According to the Congressional Research Service, the AMPV(Armored Multi-Purpose Vehicle) annual production rate reportedly, by FY2024, AMPV production rates are planned to increase to 131 vehicles per year and to continue at that level until at least FY2027. Earlier AMPV program planning documents issued before the 2020 production delay had reportedly called for an annual production rate of 190 AMPVs per year by FY2024.

- The country's defense agencies are on a spree of procurements in view of the Russia-Ukraine war that drove significant US weapon supply to Ukraine. To successfully tackle any Russian threat, the Air Force is carrying out growth in procurement. For instance:

- Recently, in March 2022, the Pentagon requested a USD 11 billion fund for 61 Lockheed Martin F-35 Lightning II aircraft for FY2023. About 45% of that procurement plan is for combat aircraft (USD 8.389 billion) and 23% for modifying in-service platforms (USD 4.257 billion).

- Owing to the factors above, the ballistic composites market in the region is expected to increase at a significant rate during the forecast period.

Ballistic Composites Industry Overview

The ballistic composites market is partially consolidated in nature. The major players (not in any particular order) include DuPont, DSM, Honeywell International Inc., TenCate Protective Fibers, and Teijin Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rise in Defense Expenditure

- 4.1.2 Increasing Demand for Lightweight Materials in the Aerospace and Defense Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Processing and Manufacturing Costs

- 4.2.2 Volatile Raw Material Supply

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size In Value)

- 5.1 Fiber Type

- 5.1.1 Aramids

- 5.1.2 Ultra-high-molecular Weight Polyethylene (UHMWPE)

- 5.1.3 S-glass

- 5.1.4 Others Fiber Types (Bio-based Fibers, Nanocomposites, etc. )

- 5.2 Matrix Type

- 5.2.1 Polymer

- 5.2.2 Polymer-ceramic

- 5.2.3 Metal

- 5.3 Application

- 5.3.1 Vehicle Armor

- 5.3.2 Body Armor

- 5.3.3 Helmet and Face Protection

- 5.3.4 Other Applications (Aircraft and Marine Protection, High-Performance Sporting Goods, etc.)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ArmorCore

- 6.4.2 BAE Systems

- 6.4.3 Barrday Inc

- 6.4.4 Coherent Corp.

- 6.4.5 DSM

- 6.4.6 DuPont

- 6.4.7 Gaffco Ballistics

- 6.4.8 Gurit Holding AG

- 6.4.9 Honeywell International Inc.

- 6.4.10 Integris

- 6.4.11 MKU LIMITED

- 6.4.12 Morgan Advanced Materials

- 6.4.13 Plastic Reinforcement Fabrics Ltd

- 6.4.14 Roihu Inc.

- 6.4.15 Southern States, llc

- 6.4.16 Teijin Limited

- 6.4.17 TenCate Protective Fabrics

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Terrain Motor Vehicles with Ballistic Protection

- 7.2 Development of Bio-Based Ballistic Fibers

![防弹复合材料市场:趋势、机会与竞争分析 [2024-2030]](/sample/img/cover/42/default_cover_5.png)