|

市场调查报告书

商品编码

1641903

凝胶涂层 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Gelcoat - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

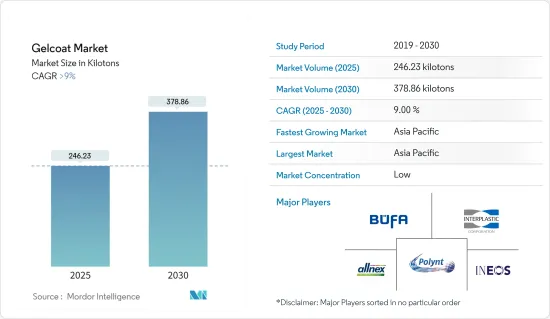

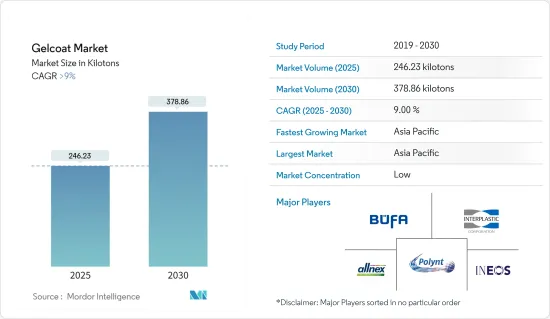

预计 2025 年凝胶涂层市场规模为 246.23 千吨,到 2030 年将达到 378.86 千吨,预测期内(2025-2030 年)的复合年增长率将超过 9%。

由于经济和商业活动减少,预计 COVID-19 疫情将在 2020 年和 2021 年影响凝胶涂层市场。由于建筑业和工业生产减少,需求仍然低迷,但随着贸易和政府指南的恢復,预计需求将会復苏。

关键亮点

- 汽车和运输业对凝胶涂层的需求不断增加将推动市场成长。由于汽车製造商正努力使用复合材料生产更轻的汽车,以符合政府提高燃油效率和减少二氧化碳 (CO2)排放的指南,因此这一领域在凝胶涂层市场占据主导地位。凝胶涂层是改善这些复合部件美观度的关键。

- 聚酯胶衣广泛应用于各个行业,尤其是运输和海洋领域。它在海洋工业中广受欢迎是因为其具有防水、防紫外线和耐腐蚀等优异的性能。对聚酯胶衣的需求不断增长,促进了市场的成长。

- 苯乙烯是聚酯树脂基凝胶涂层的主要单体,由于其广泛使用而引发了安全和健康问题。因此,市场扩张面临挑战,因为许多政府正在实施严格的法规以减少凝胶涂层和树脂的苯乙烯排放,从而限制预测期内的市场成长。

- 亚太地区在全球整体凝胶涂层市场占据主导地位,其中印度和中国等国家的消费量最高。

凝胶涂层市场趋势

汽车和运输(包括航太和船舶)领域引领市场

- 根据OICA称,全球汽车产业目前正处于大幅成长的轨道上,2022年将比2021年成长6%。 2022年,中国、德国、韩国、加拿大、英国、义大利等全球各已开发国家及新兴国家的汽车产量均增加。 2022年,汽车产量超过8,500万辆。

- 根据美国国家船舶製造商协会 (NMMA) 的报告,美国休閒船舶产业的销售额预计在 2022 年累计2,303 亿美元。

- 根据印度投资局统计,2021年1月,印度海洋产业总合161个计划竣工,投资额为120亿美元;另有178个计划竣工,投资额为19,657.8亿印度卢比(265.95亿美元)。中。

- 国际航空运输协会预计,2023年航空总收入将达8,030亿美元,与前一年同期比较成长9.7%。这是自 2019 年(当时收益达 8,380 亿美元)以来,该产业首次突破 8,000 亿美元的阈值。预计成本成长率仍仅8.1%。

- 所有这些因素都可能在预测期内快速推动市场发展。

亚太地区主导凝胶涂层市场

- 亚太地区占据全球市场占有率的主导地位。航太、汽车、船舶和建筑等终端用户行业的投资和生产的增加正在推动该地区对凝胶涂层市场的需求。

- 由东芝公司、日立公司、中船工业公司和JFE钢铁公司组成的财团计划在日本福岛近海建造世界上最大的离岸风力发电。该计划将配备多达 143 台浮体式涡轮机,预计将于 2025 年投入运作,可能会增加对凝胶涂层的需求。

- 此外,印度新可再生能源部(MNRE)已设定目标,到2030年安装30吉瓦的离岸风力发电。风力发电机和潮汐涡轮叶轮以及叶片的保护涂层经常需要使用模内稳定的凝胶涂层。

- 根据劳氏船级社报道,到2030年,中国将成为航运业的重要航运强国。为此,中国计划在此期间建造40艘邮轮,一部分供应国内市场,一部分供应国际市场。

- 在I2U2高峰会上,两国领导人透露,阿联酋将拨款20亿美元在印度各地打造综合食品园区网路。此外,该集团也确认了在印度古吉拉突邦开展混合可再生能源计划的意图。该计划将产生 300 兆瓦(MW)的风能和太阳能,并辅以电池储存系统。

- 据印度投资局子部门,到 2025 年,印度建筑业预计将达到 1.4 兆美元。个全球创新建筑提交的文件中所确定的技术,人们相信印度建筑业将开始一个新时代。

- 此外,主要在中国的建筑业蓬勃发展是推动建筑业对胶衣需求的主要因素。

凝胶涂布产业概况

凝胶涂层市场较为分散。主要企业(不分先后顺序)包括 Allnex GMBH、INEOS、Polynt SpA、Interplastic Corporation 和 BUFA Composite Systems GmbH &Co.KG。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 建筑业蓬勃发展

- 汽车和运输业的需求不断增长

- 聚酯基凝胶涂层利用率高

- 其他驱动因素

- 限制因素

- 政府对凝胶涂层製造商的严格监管

- 过渡至封闭式成型工艺

- 胶衣开裂问题

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(市场规模(基于数量))

- 树脂类型

- 聚酯纤维

- 环氧树脂

- 乙烯基酯

- 其他的

- 最终用户产业

- 海洋

- 汽车和运输

- 建造

- 风力发电

- 医疗

- 饮食

- 电气和电子

- 其他(航太、零售)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- Akzo Nobel NV

- Allnex GMBH

- Ashland

- Atul Ltd

- Bang & Bonsomer

- BUFA Composite Systems GmbH & Co. KG

- Eastman Chemical Company

- GRP Factors Ltd

- Gurit Services AG

- HK Research Corporation

- INEOS

- Interplastic Corporation

- LyondellBasell Industries Holdings BV

- Poliya

- Polynt SpA

- Reichhold LLC

- Scott Bader Company Ltd.

- Seahawkpaints.com

- Sika AG

第七章 市场机会与未来趋势

- 风力发电和航太领域的需求不断增长

- 涂料领域的技术创新取得进展

The Gelcoat Market size is estimated at 246.23 kilotons in 2025, and is expected to reach 378.86 kilotons by 2030, at a CAGR of greater than 9% during the forecast period (2025-2030).

The COVID-19 pandemic is expected to impact the Gelcoat Market in 2020 and 2021, driven by reduced economic and commercial activities. Declines in construction and industrial output will keep demand low, but recovery is anticipated with revived trade and government guidelines.

Key Highlights

- Growing demand for gelcoat in the automotive and transportation industry is set to drive market growth. This sector dominated the gelcoat market due to automakers' efforts to produce lightweight vehicles with composites, aligning with government guidelines for improved fuel efficiency and reduced carbon dioxide (CO2) emissions. Gelcoats are key to enhancing the aesthetics of these composite components.

- Polyester Gelcoats are extensively used in various industries, particularly in the transportation and marine sectors. Their popularity in the marine industry is due to their excellent properties, including water resistance, UV protection, and corrosion resistance. This rising demand for polyester gelcoats contributes to market growth.

- Styrene, the predominant monomer in polyester resin-based gelcoats, has raised safety and health concerns due to its extensive use. This poses challenges for market expansion as many governments have implemented strict regulations to reduce styrene emissions from gelcoats and resins, consequently limiting market growth in the forecast period.

- Asia-Pacific dominated the Gelcoat Market across the globe with the largest consumption in a country such as India, China, etc.

Gelcoat Market Trends

Automotive and Transportation (including Aerospace and Marine) segment to lead the Market

- As per OICA, the Global Automotive Industry is currently growing at a substantial rate of 6% in 2022 over 2021. In 2022, various developed and developing countries across the world, including China, Germany, South Korea, Canada, the United Kingdom, and Italy, experienced an increase in automotive production. In 2022, over 85 Million Units of Motor vehicles were manufactured.

- The National Marine Manufacturers Association (NMMA) reports that the recreational boating industry in the U.S. generated an estimated US230.3 billion in sales in 2022.

- According to Invest India, during January 2021, a total of 161 projects in the marine industry, at a cost of US$12 billion, have been completed, and 178 projects at a cost of INR 1,96,578 Crores (US$ 26,595 million) are under implementation.

- As per IATA, it expects a year-over-year increase in total revenues of 9.7% to reach USD 803 Billion in 2023. This marks the first instance of industry revenues surpassing the USD 800 Billion threshold since 2019 when it reached USD 838 Billion. The growth in expenses is projected to be limited to an 8.1% annual rise.

- All these factors are likely to rapidly drive the market during the forecast period.

Asia-Pacific Region to Dominate the Gelcoat Market

- Asia-Pacific region dominated the global market share. The increasing investments and production in end-user industries, aerospace, automotive, marine, construction, etc, are driving the demand for Gelcoat Market in the region.

- A consortium involving Toshiba, Hitachi, Zosen Corp, and JFE Steel is set to construct the world's largest offshore wind farm off the Fukushima coast in Japan. This project, featuring as many as 143 floating turbines and expected to become operational after 2025, is likely to boost the demand for gelcoats.

- Moreover, the Indian Ministry of New and Renewable Energy (MNRE) has set targets for offshore wind installations, aiming for 30 GW by 2030. The use of an in-mold stable gelcoat is frequently required for the protective coating on blades, as well as wind and tidal turbine rotor blades

- According to Lloyd's Register, by 2030, China is poised to become a prominent maritime powerhouse in the shipping industry. To accomplish this, China plans to construct 40 cruise ships, with a portion intended for the domestic market and others for international markets, during this period.

- At the I2U2 Summit, the leaders disclosed that the UAE will allocate $2 billion for the establishment of a network of comprehensive food parks throughout India. Additionally, the group has confirmed its intention to move forward with a hybrid renewable energy project in India's Gujarat State. This initiative will encompass 300 megawatts (MW) of wind and solar capacity, enhanced by a battery energy storage system.

- As per Invest India, the construction industry in India is expected to reach USD 1.4 Trillion by 2025, and the construction industry in India works across 250 sub-sectors with linkages across sectors and over 54 global innovative construction technologies identified under a Technology Sub-Mission of PMAY-U to start a new era in Indian Construction Sectors.

- Furthermore, the rapidly growing construction industry, primarily in China, is a major factor driving the demand for gelcoat in the construction industry.

Gelcoat Industry Overview

The Gelcoat Market is fragmented in nature. The major players (not in any particular order) include Allnex GMBH, INEOS, Polynt S.p.A., Interplastic Corporation, and BUFA Composite Systems GmbH & Co. KG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Surge in the Construction Industry

- 4.1.2 Increasing Demand in the Automotive and Transportation Industry

- 4.1.3 High Utilization of Polyester-Based Gelcoat

- 4.1.4 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Government Regulations for Gelcoat Manufacturers

- 4.2.2 Transition to Closed Molding Processes

- 4.2.3 Cracking Issues in Gelcoat

- 4.2.4 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Resin Type

- 5.1.1 Polyester

- 5.1.2 Epoxy

- 5.1.3 Vinyl Ester

- 5.1.4 Others

- 5.2 End-User Industry

- 5.2.1 Marine

- 5.2.2 Automotive and Transportation

- 5.2.3 Construction

- 5.2.4 Wind Energy

- 5.2.5 Healthcare

- 5.2.6 Food and Beverage

- 5.2.7 Electrical and Electronics

- 5.2.8 Others (Aerospace. Retail)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 UAE

- 5.3.5.7 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)** /Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Allnex GMBH

- 6.4.4 Ashland

- 6.4.5 Atul Ltd

- 6.4.6 Bang & Bonsomer

- 6.4.7 BUFA Composite Systems GmbH & Co. KG

- 6.4.8 Eastman Chemical Company

- 6.4.9 GRP Factors Ltd

- 6.4.10 Gurit Services AG

- 6.4.11 HK Research Corporation

- 6.4.12 INEOS

- 6.4.13 Interplastic Corporation

- 6.4.14 LyondellBasell Industries Holdings B.V.

- 6.4.15 Poliya

- 6.4.16 Polynt S.p.A.

- 6.4.17 Reichhold LLC

- 6.4.18 Scott Bader Company Ltd.

- 6.4.19 Seahawkpaints.com

- 6.4.20 Sika AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand in the Wind Energy and Aerospace Sectors

- 7.2 Increasing Innovations in the Coatings Sector