|

市场调查报告书

商品编码

1641905

塑合板-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Particle Board - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

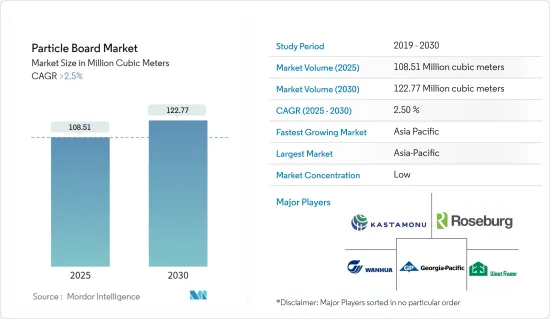

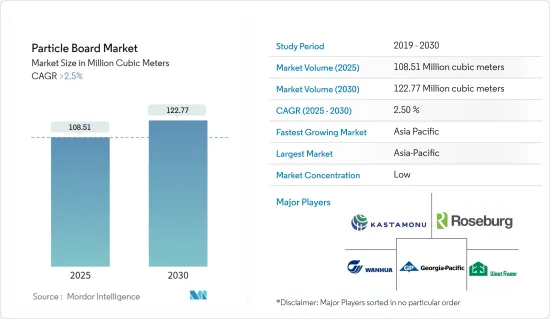

塑合板市场规模预计在 2025 年为 1.0851 亿立方米,预计到 2030 年将达到 1.2277 亿立方米,预测期内(2025-2030 年)的复合年增长率将超过 2.5%。

新冠疫情阻碍了塑合板市场的发展。由于建筑计划被推迟或推迟,以及经济不确定性减少了消费者在家具上的支出,塑合板的需求最初下降。然而,在疫情过后,随着人们待在家里的时间增加并进行 DIY计划,住宅计划对塑合板的需求将会增加。

关键亮点

- 塑合板原料的供应以及家具对塑合板的需求不断增加等因素正在推动全球塑合板市场的成长。

- 然而,替代中密度纤维板(MDF)的威胁和塑合板的耐久性差预计将抑制塑合板市场的成长。

- 塑合板生产新方法的开发和即将实施的基础设施建设计划预计将在未来几年为塑合板市场提供有利的机会。

- 预计预测期内亚太地区将主导塑合板市场。

塑合板市场趋势

建筑业占据市场主导地位

- 塑合板广泛用于建筑领域,作为室内应用的建筑材料,例如墙板、地板覆盖、屋顶衬垫和门芯。塑合板的多功能性使其成为建筑商和承包商的热门选择。

- 模组化建筑日益流行,尤其是在住宅和商业计划中,这推动了对塑合板製成的预製建筑部件的需求。这些组件为您的建筑计划提供了经济高效的解决方案。

- 预计,由于新办公大楼的建设,对地板、隔间、墙板、假天花板、门和家具的需求增加将推动塑合板市场的发展。此外,旧办公大楼的重建和整修预计也将有助于未来刺激对产品的需求。

- 在家具业,中国、美国和德国占最大的市场。中国是欧洲木质家具的主要出口国。

- 根据美国人口普查局发布的资料,美国住宅支出将从2018年的5,706亿美元增加到2022年的8,819亿美元。

- 根据加拿大统计局6月发布的资料,2023年全球整体建筑业投资成长0.4%,其中非住宅领域投资成长3.4%至59亿美元。

- 此外,《中东经济》报道称,2023 年前 10 个月,杜拜房地产交易量较去年同期成长 37%。这笔金额超过了 5,000 亿迪拉姆(1,362 亿美元)。

- 因此,预计上述因素将在预测期内推动全球塑合板市场的发展。

亚太地区占市场主导地位

- 鑑于中国和印度等国家的建筑和家具行业的成长,预计亚太地区的塑合板市场将出现强劲成长。

- 随着人口成长、收入提高和都市化加快,中国已成为亚太地区最广泛的市场基础。因此,该国的基础设施发展预计将继续增加。

- 根据战略与国际研究中心(CSIS)2023年4月发布的资料,印度政府正在竭尽全力推动住宅建设,以便为约14亿人提供住房。预计未来七年住宅投资约1.3兆美元,将建造6,000万套新住宅。

- 根据中国国家统计局发布的资料,中国建筑业增加价值预计将从2018年的6,5493亿元人民币(9,098亿美元)成长到2022年的8,3,383亿元人民币(1,1,583.5亿美元)。

- 泰国住宅产业的成长受到 2021 年第三季开始建造的五个大型住宅计划的推动。这些计划预计将于 2024 年至 2025 年间完工。此外,根据马来西亚统计局的数据,马来西亚 2023 年第四季的建筑建设活动为 165.7854 亿马来西亚林吉特(34.6324 亿美元)。

- 因此,亚太地区塑合板市场的成长受到建设活动的增加和使用工程木製品作为室内装饰的趋势日益增长的推动,这对塑合板的需求产生了积极影响。

塑合板产业概况

由于每个国家都存在几家主要企业,因此塑合板市场本质上是细分的。主要参与企业(不分先后顺序)包括 West Fraser、Roseburg Forest Products、Georgia-Pacific、Wanhua Ecoboard 和 Kastamonu Entegre。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 家具业需求增加

- 原料容易取得

- 限制因素

- 中密度纤维板等替代品的威胁

- 耐久性下降

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(市场规模(基于数量))

- 原料

- 木头

- 锯末

- 刨花

- 薄片

- 尖端

- 渣

- 其他原料(回收原料)

- 木头

- 应用

- 大楼

- 家具

- 基础设施

- 其他用途(包装和运输)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 泰国

- 印尼

- 马来西亚

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 土耳其

- 俄罗斯

- 北欧的

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Associate Decor Ltd

- Boise Cascade

- Century Prowud

- D&R Henderson Pty Ltd

- EGGER Group

- Georgia-Pacific

- Kastamonu Entegre

- Krifor Industries Pvt. Ltd

- Peter Benson(Plywood)Limited

- Roseburg Forest Products

- Shirdi Industries Ltd(ASIS India)

- Siam Riso

- Timber Products Company

- Uniboard

- Wanhua Ecoboard Co. Ltd

- West Fraser

第七章 市场机会与未来趋势

- 新型塑合板製造方法的开发

- 即将进行的建设基础建设计划

The Particle Board Market size is estimated at 108.51 million cubic meters in 2025, and is expected to reach 122.77 million cubic meters by 2030, at a CAGR of greater than 2.5% during the forecast period (2025-2030).

The COVID-19 pandemic hampered the particle board market. The demand for particle boards initially declined as construction projects were delayed or put on hold, and consumer spending on furniture decreased due to economic uncertainty. However, as people spend more time at home after COVID-19 and engage in DIY projects, the demand for particle boards for home improvement projects increases.

Key Highlights

- Factors such as the availability of raw materials for particle boards and an increase in demand for particle boards for furniture are augmenting the growth of the particle board market globally.

- On the flip side, the threat of medium-density fiberboard (MDF) as a substitute and lower durability of particle boards are expected to restrain the growth of the particle board market.

- The development of new methods to manufacture particle boards and upcoming construction and infrastructure projects are expected to act as an opportunity for the particle board market in the future.

- The Asia-Pacific region is expected to dominate the particle board market during the forecast period.

Particle Board Market Trends

Construction Segment to Dominate the Market

- Particle board is widely used in construction as a building material for interior applications such as wall panels, flooring underlayment, roofing substrates, and door cores. The versatility of particle board makes it a popular choice for builders and contractors.

- The growing trends of modular construction, especially in residential and commercial projects, have increased the demand for prefabricated building components made from particle boards. These components offer cost-effective and efficient solutions for construction projects.

- The particle board market is expected to be stimulated by the increase in demand for flooring, cubical partitioning, wall panels, false ceilings, doors, and furniture as new office buildings are being built. In addition, it is expected that the demand for products will be stimulated in the coming period by renovation and refurbishment of old office buildings.

- China, the United States, and Germany hold the largest markets in the furniture industry. China is a significant exporter of wood furniture to Europe.

- According to the data released by the US Census Bureau, the spending on residential construction in the United States increased from USD 570.6 billion in 2018 to USD 881.9 billion in 2022.

- According to data published by Statistics Canada in June 2023, the investment in building construction increased globally by 0.4% in 2023, with the growth of the non-residential sector by 3.4% to USD 5.9 billion.

- Furthermore, according to the Middle East Economy, in Dubai, the value of real estate transactions increased by 37% annually during the first ten months of 2023. This exceeded the value of AED 500 billion (USD 136.2 billion).

- Thus, the above factors are expected to drive the global particle board market during the forecast period.

Asia-Pacific Region to Dominate the Market

- In view of the growing construction and furniture industry in countries such as China, India, and others, the Asia-Pacific region is expected to experience strong market growth for particle boards.

- As a result of the growing number of its people, increased income, and rapid urbanization, China is Asia Pacific's most extensive market base. Therefore, there will be a continuous increase in infrastructure development in the country.

- According to the data published by the Center for Strategic and International Studies (CSIS) on April 2023, in order to provide a home for approximately 1.4 billion people, the Indian government has been doing all that it can to boost housing construction. In the next seven years, approximately USD 1.3 trillion of investments in housing are expected to be made, and 60 million new homes will be built in the country.

- According to the data released by the National Bureau of Statistics of China, the value added in the Chinese construction industry increased from Yuan 6,549.3 billion (USD 909.8 billion) in 2018 to Yuan 8,338.3 billion (USD 1158.35 billion) in 2022.

- The propelling growth in Thailand's residential sector resulted from five major residential projects that started construction in the third quarter of 2021. The timelines for the completion of these projects revolve around 2024 to 2025. Moreover, according to the Department of Statistics of Malaysia, the value of building construction activities in Malaysia as of the fourth quarter of 2023 was MYR 16,578.54 million (USD 3,463.24 million).

- Thus, the growth of the particle board market in the Asia-Pacific region is driven by growing construction activity and an increasing trend to use engineered wood products as interior furniture, which has a positive impact on demand for particle boards.

Particle Board Industry Overview

The particle board market is fragmented in nature due to the presence of several major players in different countries. The major players (not in any particular order) include West Fraser, Roseburg Forest Products, Georgia-Pacific, Wanhua Ecoboard Co. Ltd, and Kastamonu Entegre.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Furniture Industry

- 4.1.2 Easy Availability of Raw Materials

- 4.2 Restraints

- 4.2.1 Threat of Medium-density Fiberboard (MDF) as a Substitute

- 4.2.2 Lower Durability

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Raw Material

- 5.1.1 Wood

- 5.1.1.1 Sawdust

- 5.1.1.2 Shavings

- 5.1.1.3 Flakes

- 5.1.1.4 Chips

- 5.1.2 Bagasse

- 5.1.3 Other Raw Materials (Recycled Content)

- 5.1.1 Wood

- 5.2 Application

- 5.2.1 Construction

- 5.2.2 Furniture

- 5.2.3 Infrastructure

- 5.2.4 Other Applications (Packaging and Shipping)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Thailand

- 5.3.1.6 Indonesia

- 5.3.1.7 Malaysia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Turkey

- 5.3.3.7 Russia

- 5.3.3.8 NORDIC

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 UAE

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Associate Decor Ltd

- 6.4.2 Boise Cascade

- 6.4.3 Century Prowud

- 6.4.4 D&R Henderson Pty Ltd

- 6.4.5 EGGER Group

- 6.4.6 Georgia-Pacific

- 6.4.7 Kastamonu Entegre

- 6.4.8 Krifor Industries Pvt. Ltd

- 6.4.9 Peter Benson (Plywood) Limited

- 6.4.10 Roseburg Forest Products

- 6.4.11 Shirdi Industries Ltd (ASIS India)

- 6.4.12 Siam Riso

- 6.4.13 Timber Products Company

- 6.4.14 Uniboard

- 6.4.15 Wanhua Ecoboard Co. Ltd

- 6.4.16 West Fraser

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of New Methods to Manufacture Particle Boards

- 7.2 Upcoming Construction and Infrastructure Projects