|

市场调查报告书

商品编码

1641906

定向纤维板(OSB):市场占有率分析、产业趋势与成长预测(2025-2030 年)Oriented Strand Board (OSB) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

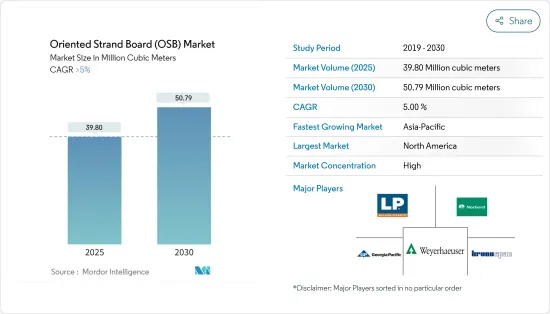

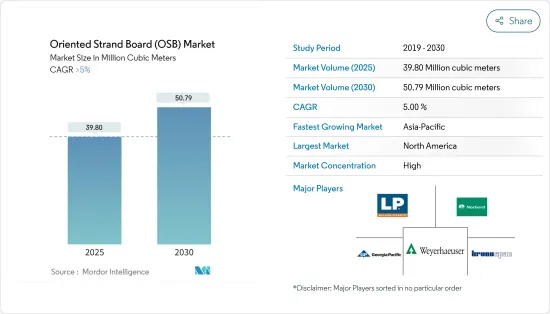

定向纤维板(OSB) 市场规模预计在 2025 年为 3980 万立方米,预计到 2030 年将达到 5079 万立方米,预测期(2025-2030 年)的复合年增长率将预测…5%。 …

COVID-19 对市场产生了负面影响。疫情导致建设活动中断,尤其是在停工初期。许多建筑计划被推迟或取消,导致建筑业对OSB的需求下降。随着门禁限制的放宽和疫苗接种的进展,建设活动开始復苏,导致建筑业对 OSB 产品的需求增加。

关键亮点

- OSB作为胶合板替代品的重要性日益增加以及建筑业的成长等因素预计将推动定向板市场的发展。

- 另一方面,甲醛等挥发性有机化合物(VOC)的排放可能会减缓市场成长。

- OSB在结构绝缘板中的应用越来越广泛,以及欧洲建筑业的復苏可能会在未来带来机会。

- 北美占据全球市场主导地位,其中美国占消费量最大。

定向纤维板的市场趋势

建筑业占据市场主导地位

- 定向纤维板广泛用于建筑领域,例如地板、墙壁、屋顶衬垫和地板等。它的多功能性使其适合于各种建筑计划,包括住宅,商业和工业。

- 定向纤维板具有优异的结构强度与尺寸稳定性,适合承重应用。 OSB可以承受严苛的施工要求,并在各种环境条件下提供持久的性能。

- 根据欧盟委员会的资料,2023年12月整个欧元区的建筑业产量较2022年12月成长1.9%,整个欧盟的建筑业产量较2022年12月成长2.4%。 2023年与2022年相比,建筑产量平均成长率为欧元区0.2%,欧盟0.1%。

- 据欧盟统计局称,2023年欧元区建筑年均产量与2022年相比增长0.2%,欧盟增长0.1%。

- 根据国家统计局的数据,中国建筑业商务活动指数(BASI)从2023年11月的55.9上升至12月的56.9。 BASI 分数高于 50 表示行业成长,2023 年 10 月的 BASI 分数为 53.5。

- 预计到 2025 年,印度建筑业规模将成长至 1.4 兆美元。到2030年,预计将有6亿人居住在城市中心,从而需要额外2500万套中高端住宅。根据国家投资计画(NIP),印度的基础设施投资预算为1.4兆美元,其中24%用于可再生能源、道路、高速公路和城市基础设施,12%用于铁路。

- 根据国土交通省 2024 年 1 月发布的最新估计,2023 年日本将开工约 366,800 栋独户房屋住宅和 37,971 栋公寓。

- 因此,未来几年,定向纤维板市场预计将受到各地区建筑市场成长的推动。

北美占据市场主导地位

- 北美建筑业蓬勃发展,住宅、商业和工业建筑计划对定向纤维板等建材的需求很高。该地区庞大的人口和都市化趋势正在推动持续的建设活动,并有助于定向板市场的主导地位。

- 北美建筑实践通常青睐木质建筑材料,因为它们易于供应、具有成本效益且易于施工。 OSB 是符合这些偏好的工程木产品,广泛应用于各种建筑应用。

- 美国拥有庞大的建筑业,在建立企业、工业、机构、住宅、基础设施、能源和公共工程方面发挥关键作用。该国2022年1月至12月的年度建筑支出预计为16772亿美元。此外,美国2 月建筑支出成长了 1.3%,而 2022 年 1 月经季节性已调整的的年率为 1.677 兆美元。

- 根据美国人口普查局发布的估计,2023年美国建筑业总建设活动将增加1,310亿美元以上。

- 此外,美国人口普查局发布的估计数字显示,2024年1月,美国将新建约140万套私人住宅。

- 所有上述因素预计将推动北美市场的成长。

定向纤维板(OSB) 产业概览

定向纤维板(OSB)市场本质上是整合的,五大主要企业占据了全球市场的很大一部分。市场的主要企业包括 Norbord Inc.(West Fraser)、Louisiana-Pacific Corporation、Kronospan Limited、Georgia-Pacific Wood Products LLC 和 Weyerhaeuser Company。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- OSB作为胶合板的替代品正变得越来越受欢迎。

- 建筑业成长

- 限制因素

- 甲醛等挥发性有机化合物 (VOC) 的排放

- 其他限制因素

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(按数量分類的市场规模)

- 按年级

- OSB/1

- OSB/2

- OSB/3

- OSB/4

- 最终用户应用程式

- 家具

- 住宅

- 商业的

- 建筑学

- 地板和屋顶

- 墙

- 门

- 柱子和横樑

- 楼梯

- 其他结构(隔间)

- 包装

- 饮食

- 工业的

- 药品

- 化妆品

- 其他包装(可重复使用的包装)

- 家具

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 泰国

- 印尼

- 马来西亚

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 土耳其

- 俄罗斯

- 北欧的

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 埃及

- 卡达

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)分析

- 主要企业策略

- 公司简介

- Arbec Forestry Products Inc.

- Coillte

- EGGER

- Georgia-Pacific Wood Products LLC

- Huber Engineered Woods LLC

- Kronospan Limited

- Louisiana-Pacific Corporation

- Norbord Inc.(West Fraser)

- RoyOMartin

- Sonae Arauco

- SWISS KRONO Group

- Tolko Industries Ltd

- Weyerhaeuser Company

第七章 市场机会与未来趋势

- 扩大 OSB 在结构绝缘板 (SIPS) 中的应用

The Oriented Strand Board Market size is estimated at 39.80 million cubic meters in 2025, and is expected to reach 50.79 million cubic meters by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

COVID-19 negatively impacted the market. The pandemic caused disruptions in construction activity, particularly during the initial phases of lockdowns. Many construction projects were postponed or canceled, leading to decreased demand for OSB in the construction sector. As lockdown restrictions eased and vaccination efforts progressed, construction activity began to rebound, leading to increased demand for OSB products in the construction sector.

Key Highlights

- Factors such as the growing importance of OSB as a substitute for plywood and the growth of the construction sector are expected to drive the oriented board market.

- On the other hand, emissions of volatile organic compounds (VOCs) like formaldehyde are likely to slow the growth of the market.

- Increasing applications of OSB in structural insulated panels and the recovering European construction industry are likely to act as opportunities in the future.

- North America dominated the market across the world, with the most significant consumption coming from the United States.

Oriented Strand Board Market Trends

The Construction Segment to Dominate the Market

- Oriented strand boards are widely used in the construction sector for applications such as flooring, walls, roof sheathing, and subflooring. Their versatility makes them suitable for various residential, commercial, and industrial construction projects.

- Oriented strand boards offer excellent structural strength and dimensional stability, making them suitable for load-bearing applications. OSBs can withstand the rigors of construction and provide long-lasting performance in various environmental conditions.

- According to data from the European Commission, construction production grew by 1.9% in December 2023 compared to December 2022 across the euro area and 2.4% across the European Union. The year-on-year average increase in construction production in 2023 compared to 2022 was 0.2% for the euro area and 0.1% for the European Union.

- According to Eurostat, the annual average production of buildings in the euro area and the European Union increased by 0.2% and 0.1%, respectively, in 2023 compared to 2022.

- According to the National Bureau of Statistics (NBS), in China, the construction industry's business activity index (BASI) rose to 56.9 as of December 2023 from 55.9 in November 2023. A BASI score above 50 indicates growth in the industry, and the October 2023 BASI score was 53.5.

- India's construction industry is projected to grow to USD 1.4 trillion by 2025. By 2030, an estimated 600 million people will live in urban centers, resulting in a need for 25 million additional mid- and ultra-luxury units. Under the National Investment Plan (NIP), India has an infrastructure investment budget of USD 1.4 trillion, with 24% of the budget earmarked for renewable energy, roads and highways, and urban infrastructure and 12% for railways.

- According to the latest estimate released by the Ministry of Land, Infrastructure, Transport and Tourism in January 2024, in 2023, construction works for around 366.8 thousand detached houses and 379.71 apartments were launched in Japan.

- Thus, in the upcoming years, the oriented strand boards market is expected to be driven by the growing construction market in all regions.

North America to Dominate the Market

- North America has a robust construction industry, with a high demand for building materials like oriented strand boards in residential, commercial, and industrial construction projects. The region's large population and urbanization trends drive continuous construction activity, contributing to the dominance of the oriented board market.

- North American construction practices often favor wood-based building materials due to their availability, cost-effectiveness, and ease of installation. OSB, being an engineered wood product, fits well with this preference, leading to its widespread use across various construction applications.

- The United States has a massive construction industry, which plays an important role in the establishment of businesses, industries, institutions, homes, infrastructure, energy, and public utilities. The country's annual construction expenditure from January to December 2022 was estimated at USD 1,677.2 billion. In addition, construction spending in the United States increased by 1.3% in February, compared to a seasonally adjusted annual rate of USD 1.677 trillion in January 2022.

- According to the estimate released by the US Census Bureau, the total value of building and construction activities in the United States increased by more than USD 131 billion in 2023.

- Furthermore, according to the estimate released by the US Census Bureau, the number of new privately owned residential houses in the United States was approximately 1.4 million units in January 2024.

- All the factors mentioned above are expected to boost the growth of the market studied in North America.

Oriented Strand Board Industry Overview

The oriented strand board (OSB) market is consolidated in nature, with the top five players accounting for a significant portion of the global market. The major players in the market include Norbord Inc. (West Fraser), Louisiana-Pacific Corporation, Kronospan Limited, Georgia-Pacific Wood Products LLC, and Weyerhaeuser Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Prominence of OSB as a Substitute to Plywood

- 4.1.2 Growth in the Construction Industry

- 4.2 Restraints

- 4.2.1 Emissions of Volatile Organic Compounds (VOCs), such as Formaldehyde

- 4.2.2 Other Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products and Services

- 4.3.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size by Volume)

- 5.1 By Grade

- 5.1.1 OSB/1

- 5.1.2 OSB/2

- 5.1.3 OSB/3

- 5.1.4 OSB/4

- 5.2 End-user Application

- 5.2.1 Furniture

- 5.2.1.1 Residential

- 5.2.1.2 Commercial

- 5.2.2 Construction

- 5.2.2.1 Floor and Roof

- 5.2.2.2 Wall

- 5.2.2.3 Door

- 5.2.2.4 Column and Beam

- 5.2.2.5 Staircase

- 5.2.2.6 Other Constructions (Partitions)

- 5.2.3 Packaging

- 5.2.3.1 Food and Beverage

- 5.2.3.2 Industrial

- 5.2.3.3 Pharmaceutical

- 5.2.3.4 Cosmetics

- 5.2.3.5 Other Packaging (Reusable Packaging)

- 5.2.1 Furniture

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Thailand

- 5.3.1.6 Indonesia

- 5.3.1.7 Malaysia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.2.4 Rest of North America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Turkey

- 5.3.3.7 Russia

- 5.3.3.8 NORDIC

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Egypt

- 5.3.5.5 Qatar

- 5.3.5.6 UAE

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arbec Forestry Products Inc.

- 6.4.2 Coillte

- 6.4.3 EGGER

- 6.4.4 Georgia-Pacific Wood Products LLC

- 6.4.5 Huber Engineered Woods LLC

- 6.4.6 Kronospan Limited

- 6.4.7 Louisiana-Pacific Corporation

- 6.4.8 Norbord Inc. (West Fraser)

- 6.4.9 RoyOMartin

- 6.4.10 Sonae Arauco

- 6.4.11 SWISS KRONO Group

- 6.4.12 Tolko Industries Ltd

- 6.4.13 Weyerhaeuser Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Application of OSB in Structural Insulated Panels (SIPS)