|

市场调查报告书

商品编码

1641909

产业分析:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Industrial Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

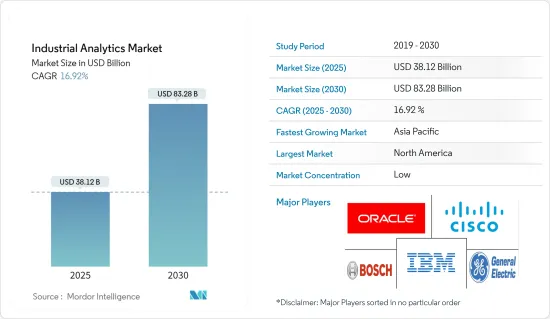

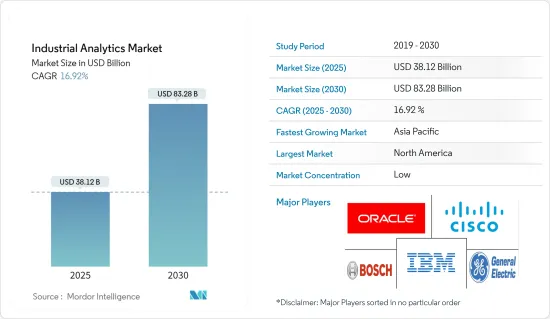

预计 2025 年工业分析市场规模将达到 381.2 亿美元,预计到 2030 年将达到 832.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 16.92%。

预测期内,工业 4.0 的兴起将推动市场发展。物联网 (IoT) 和工业物联网 (IIoT) 的采用数量不断增加是全球市场工业分析的关键推动因素。生产线上来自多个来源的资料(包括感测器、机器视觉系统和 PLC)的增加正在使产业从资料测量模型转变为资料分析模型。

主要亮点

- 工业分析涉及工业运作产生的资料的收集、分析和使用。它涵盖了从设备和来源获取的广泛资料,无论是资产还是生产过程。任何带有感测器的东西都会产生资料,工业分析会检查所有这些资料。

- 工业分析与巨量资料分析系统的不同之处在于,它们的设计旨在满足业务在产业的严格标准。这涉及处理来自众多来源的大量时间序列资料并将其转化为可操作的见解。工业分析与任何生产或销售实体产品的企业相关。

- 在典型的传统工业分析方法中,资料科学家建立分析模型。资料科学家需要了解使用案例场景并收集、转换、优化和载入资料到开发的资料模型中。完成的资料模型提供了第一个问题的答案。

- 然而,这种方法使得组织依赖资料科学家,并导致解决方案需要由主题专家(SMEs)(工程师和操作员)充分理解。此外,过去几年来,市场自助服务应用的趋势日益增长。这款新一代软体使用先进的搜寻演算法、机器学习 (ML) 和模式识别技术,使查询工业资料变得像使用 Google 一样简单。

- 工业分析解决方案专注于自助服务并为日常工厂运作带来益处。这包括增强的根本原因分析、准确的效能预测、自动监控、知识保留等。与使用者共用分析见解使他们能够在趋势出现时立即采取行动,直接有助于提高各个生产层面的整体工厂绩效。

- 新冠肺炎疫情迫使全球企业调整策略,以在「新常态」下生存。顾客的优先考虑也发生了变化。许多顾客开始在网路上购物,或发现他们曾经经常光顾的商店现在只提供送货上门服务。儘管企业发现某些产品的需求激增,但由于新冠疫情导致的停工对市场产生了负面影响,整个行业实际上已经停工。

工业分析市场趋势

预测期内製造业将主导市场

- 工业 4.0 正在推动世界向未来製造业转变,彻底改变製造业。随着工业 4.0 在製造业的出现,工厂正在采用 IIoT、AI、ML 和机器人等数位技术来增强、自动化和现代化其整个流程。

- 各种技术的整合因其可带来显着的优势而变得越来越流行。利用上述技术进行新的商业实务是工业4.0的关键要素,有助于企业取得竞争优势、提高盈利和扩充性。

- 工业IoT等技术可望连结数百万件事物,实现整个价值链的自动化。将分析技术引入製造业将能够即时收集这些技术产生的大量资料,为製造商提供切实可行的见解,减少机器停机时间并提高生产率。

- 工业分析应用可望逐步提高整个供应链的生产过程的生产力和效率。例如,製造过程将能够自我管理,智慧机器和设备可以采取纠正措施以避免机器故障。根据即时资料自动补充各个零件。

- 製造业的资料主导公司已经在利用物联网产生的资料来输入现有的分析管道,透过降低可变成本来提高业务控制和效率。

- 物联网 (IoT) 和高阶分析相关技术的可用性为创新提供了重大机会。製造商越来越熟悉在工厂中利用物联网技术,联网感测器可以实现更好的规划和预测性维护。许多製造商目前正在投资基于5G的行动专用网络,用于内部边缘云。此策略具有显着的优势:速度快、延迟低、可靠性高、容量大、安全性强。在公开通报的150多个基于4G/5G的私有网路中,四分之一已经采用了5G。製造业使用了其中的约40%。物联网和基于5G的工业应用可以从这个基于5G的云端中受益匪浅。预计这些因素将在预测期内推动市场成长率。

北美占据主要市场占有率

- 云端运算、人工智慧、巨量资料、分析、行动/社群媒体、网路安全和物联网等新兴技术正在推动创新和转型,刺激北美商业生态系统的成长。这些技术正在将传统的商业方法转变为现代方法。此外,随着潜在经济体对数位化的投资不断增加,该地区正迅速成为数位转型市场的新热点。这些趋势预计将推动该地区所有行业更多地采用工业分析。

- 例如,由于美国将主导全球工业 4.0 市场。工业 4.0 技术提高了业务效率、增加了生产力、优化了成本并减少了停机时间。该国大多数工厂已经配备了使用工业分析的最新机械和智慧工厂技术。这将使我们能够从每个行业的技术采用中收集可行的见解。

- 此外,各行业日益广泛地部署先进通讯技术预计将为该地区采用工业分析创造重大机会。据 GSMA 称,去年 5G 连线预计将占北美所有行动连线的 14%。到2025年,预计将达到所有连接的46%。快速、安全的 5G 连接有望实现敏捷营运和灵活生产,从而推动自动化仓库、自动化组装、互联物流、包装和产品处理、自动推车等技术的发展。

- 例如,根据GSMA的数据,2018年北美物联网专业服务收益达到250亿美元,物联网连接收益达到80亿美元,预计2025年将达到1,010亿美元和160亿美元。中小企业在将新技术融入现有系统方面变得更加灵活,而大型製造商则在数位化方面投入了大量预算,从而推动了该地区的工业分析。

工业分析行业概览

主要企业包括英特尔、Cisco、IBM、通用电气、亚马逊、Oracle公司、惠普、微软公司和 Genpact。工业4.0的采用以及为提高业务绩效而投入的巨额研发费用,导致领先企业之间的竞争异常激烈,市场也变得分散。因此,预计市场集中度较低。

- 2022 年 8 月-总部位于柏林的 Industrial Analytics 被英飞凌科技股份公司收购。英飞凌将加强其人工智慧软体和服务业务,为机械和工业设备提供预测分析。英飞凌将收购该业务所有已发行股。基于对振动的收集和评估,Industrial Analytics 开发了用于监控工厂的人工智慧系统,例如用于提前发现关键进展。工业分析 AI 解决方案可以分析资料并为预测性维护提出可行的提案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 资讯科技领域对巨量资料的需求日益增加

- 电子商务领域的需求增加

- 市场限制

- 各行业专业工程师短缺

第六章 市场细分

- 按部署

- 本地

- 云

- 按组件

- 软体

- 按服务

- 按类型

- 预测分析

- 指示性分析

- 说明分析

- 按最终用户产业

- 建设业

- 製造业

- 矿业

- 运输

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Cisco Systems

- IBM Corporation

- General Electric Company

- Amazon Web Services Inc.

- Oracle Corporation

- Hewlett-Packard Enterprise

- Robert Bosch GmbH

- Microsoft Corporation

- SAP SE

- ABB Ltd.

第八章投资分析

第九章:市场的未来

The Industrial Analytics Market size is estimated at USD 38.12 billion in 2025, and is expected to reach USD 83.28 billion by 2030, at a CAGR of 16.92% during the forecast period (2025-2030).

The rising Industry 4.0 will drive the market in the forecast period. An increasing number of IoT and IIoT installations are the primary enablers of industrial analytics in the global market. The growing data available from multiple sources across the production line, such as sensors, machine vision systems, PLCs, etc., are moving industries from data metrics models to data analytics models.

Key Highlights

- Industrial analytics includes collecting, analyzing, and using data generated in industrial operations. It covers a wide range of data captured from devices and sources, whether an asset or a production process. Anything with the sensor creates data, and industrial analytics examines all this data.

- Industrial analytics differs from Big Data analytics systems in that they are designed to meet the exacting standards of the industry in which they work. It includes processing vast quantities of time series data from numerous sources and turning it into actionable insights. Industrial analytics is relevant to any company that manufactures and sells physical products.

- The typical and traditional approach to industrial analytics involves data scientists building an analytics model. Data scientists must understand the use case scenario and then gather, transform, optimize, and load the data in the developed data model, which needs to be validated, optimized, and trained. The completed data model delivers answers to the initial questions.

- However, this approach leaves organizations dependent on their data scientists and results in a solution that subject matter experts (SMEs) (engineers and operators) might need to fully understand. Moreover, the market witnessed a growing trend toward self-service applications in the past few years. This next generation of software uses advanced search algorithms, machine learning (ML), and pattern recognition technologies to make querying industrial data as easy as using Google.

- An industrial analytics solution focuses on self-service, resulting in benefits to day-to-day plant operation. It includes enhanced root cause analysis, accurate performance prediction, automated monitoring, and knowledge retention. By sharing analytics insights with users, they can take immediate action when a trend appears and directly contribute to improving overall plant performance at all production levels.

- The COVID-19 outbreak forced companies worldwide to adjust their strategies to survive in the 'new normal.' Customers have changed their priorities, too. Many are shopping online or have found that the stores they frequented in person not so long ago only provide deliveries. Businesses witnessed surges in demand for some products, while entire industries virtually ceased operations due to COVID-19 shutdowns impacting the market adversely.

Industrial Analytics Market Trends

Manufacturing Sector to Dominate the Market Over the Forecast Period

- Industry 4.0 is transforming the manufacturing industry by leaps and bounds by enabling them to make a global shift toward the futuristic manufacturing sector. With the advent of industry 4.0 in the manufacturing industry, various plants adopt digital technologies, such as IIoT, AI, ML, Robotics, and many more, to enhance, automate, and modernize the whole process.

- Integrating different technologies is becoming prevalent, as it provides exceptional benefits. Leveraging the technologies, as mentioned earlier, into a new way of doing business is a crucial factor in Industry 4.0 for companies to gain a competitive edge and be more profitable and scalable.

- Technologies like Industrial IoT are expected to connect millions of things to ensure that automation can be achieved across the entire value chain. Implementing analytics in the manufacturing industry is expected to boost customization and automation by collecting the vast amount of data generated by these technologies in real time, providing actionable insights to the manufacturers, reducing machine downtime, and enhancing productivity.

- The industrial analytics application is expected to gradually improve production processes' productivity and efficiencies throughout the supply chain. For instance, the manufacturing processes would be capable of administering themselves, using intelligent machines and devices that can take corrective action, to avoid machine breakdowns. Individual parts would be automatically replenished based on real-time data.

- Data-driven companies in the manufacturing sector are already using IoT-generated data by feeding them into their existing analytical pipeline and improving operational management and efficiencies by reducing variable costs.

- Innovative opportunities are significantly increased by the technology availability related to the Internet of Things (IoT) and advanced analytics. Manufacturers are accustomed to utilizing IoT technology in their factories, where networked sensors allow for better planning and predictive maintenance. Many manufacturers currently invest in 5G-based mobile private networks for their on-premises edge cloud. Significant benefits of this strategy include speed, low latency, reliability, capacity, and strong security. A quarter of the more than 150 4G/5G-based private networks that have been publicly reported employ 5G. Manufacturers use about 40% of all of these. IoT and 5G-based industrial applications may greatly benefit from these 5G-based clouds. These factors are analyzed to boost the market growth rate during the forecast period.

North America to Account for Significant Market Share

- The advanced technologies used, such as cloud computing, AI, big data and analytics, mobility/social media, cybersecurity, and IoT, have led to innovation and transformation, thereby stimulating growth in the business ecosystem of North America. These technologies have transformed the legacy approach to business into a modern approach. Also, the region is becoming a new hotspot in the digital transformation market due to rising investments in digitalization across potential economies. Such trends are expected to boost the adoption of industrial analytics across the industries in the region.

- The United States, for instance, is expected to dominate the Industry 4.0 market globally, as the companies in the country are rapidly adopting the concept of smart manufacturing. Industry 4.0 technologies provide improved operational efficiency, enhanced productivity, optimization of costs, and reduction in downtime. Most of the factories in the country are already equipped with modern machines and smart factory technology, which uses industrial analytics. It enables them to gather actionable insights by deploying technologies across their industries.

- Further, the growth in the advanced communication technologies deployment across industries is expected to create significant opportunities for adopting industrial analytics in the region. According to GSMA, in the previous year, 5G connections were forecast to account for 14% of all mobile connections in North America. By 2025, it is expected to reach 46% of the total connectivity. Since fast and secure 5G connectivity is expected to enable agile operations and flexible production, the technology is expected to facilitate automated warehouses, automated assembly, connected logistics, packing and product handling, and autonomous carts.

- For example, according to GSMA, IoT professional services revenue and IoT connectivity revenue in North America amounted to USD 25 billion and USD 8 billion in 2018 and are forecasted to reach USD 101 billion and 16 billion in 2025. SMEs are becoming increasingly flexible in incorporating new technologies with their existing systems, whereas large manufacturers have heavy budgets for digitization, thus giving momentum to industrial analytics in the region.

Industrial Analytics Industry Overview

The major players include Intel, Cisco Systems, IBM, General Electric, Amazon.com, Oracle Corporation, Hewlett-Packard, Microsoft Corporation, and Genpact, amongst others. The market is fragmented since there is high competition among major players due to the adoption of industry 4.0 and the companies spending heavily on R&D for better operational activities. Therefore, the market concentration will be low.

- August 2022-Industrial Analytics, a firm based in Berlin, was acquired by Infineon Technologies AG. Infineon is enhancing its artificial intelligence software and services business to perform predictive analysis on machinery and industrial equipment. Infineon is acquiring all outstanding shares of the business. Based on the collection and evaluation of vibrations, Industrial Analytics creates artificial intelligence systems that, for instance, monitor plants for the early detection of significant developments. Industrial Analytics' AI solutions analyze data for predictive maintenance and make actionable suggestions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Big-Data in Information Technology Sector

- 5.1.2 Rising Demand from the E-commerce Sector

- 5.2 Market Restraints

- 5.2.1 Lack of Skilled Professional Across Industries

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premises

- 6.1.2 Cloud

- 6.2 By Component

- 6.2.1 Software

- 6.2.2 Services

- 6.3 By Type

- 6.3.1 Predictive Analytics

- 6.3.2 Prescriptive Analytics

- 6.3.3 Descriptive Analytics

- 6.4 By End User Industry

- 6.4.1 Construction

- 6.4.2 Manufacturing

- 6.4.3 Mining

- 6.4.4 Transportation

- 6.4.5 Other End User Industry

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems

- 7.1.2 IBM Corporation

- 7.1.3 General Electric Company

- 7.1.4 Amazon Web Services Inc.

- 7.1.5 Oracle Corporation

- 7.1.6 Hewlett-Packard Enterprise

- 7.1.7 Robert Bosch GmbH

- 7.1.8 Microsoft Corporation

- 7.1.9 SAP SE

- 7.1.10 ABB Ltd.