|

市场调查报告书

商品编码

1641916

巨量资料安全-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Big Data Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

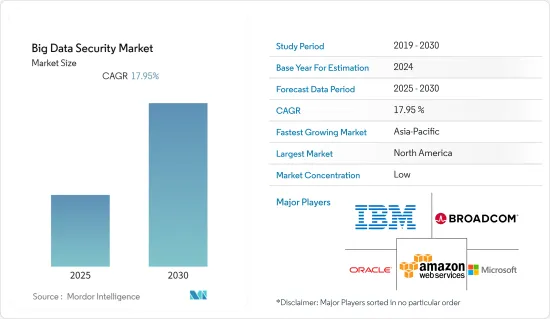

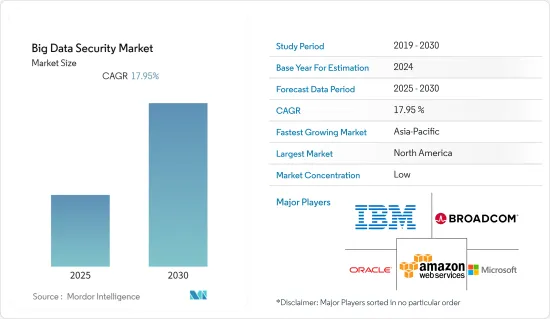

预测期内,巨量资料安全市场预计将实现 17.95% 的复合年增长率

关键亮点

- 当网路犯罪分子追逐大型资料集时,其回报通常值得为渗透安全层所付出的努力。因此,巨量资料对于企业和网路犯罪分子来说都具有巨大的潜力。因此,如果没有适当的安全措施,企业一旦遭受网路攻击,损失将更大。

- 许多企业,尤其是处理大量资料的企业,需要传统的资料探勘和网路攻击防御工具和技术。因此,网路安全专业人士越来越多地转向巨量资料分析。巨量资料环境对于入侵者来说是脆弱且有价值的目标,因为资料从 CRM 和感测器等资料到资料储存和分析需要经过迂迴的路径。

- 当企业使用 Hadoop开放原始码框架和其他来源部署巨量资料平台时,该框架需要製定全面的安全计画。固有机制有局限性,有时需要比资料加密更高的安全性。许多科技公司已将云端解决方案推向市场来解决这个问题。例如,McAfee Enterprise 于 2021 年 8 月宣布 MVISION Cloud 将提供名为 MVISION Unified Cloud Edge (UCE) 的安全存取服务边际(SASE)。此解决方案利用无摩擦、基于 API 的云端原生方法扩展了 Dynamics 365 的功能,满足了企业巨量资料的安全需求。

- 新冠疫情为全球市场带来了福音。新冠疫情发生后,巨量资料安全产业可望崛起。随着冠状病毒在全球迅速蔓延,许多组织被迫转为在家工作。随着网路活动的增加和网路攻击频率的上升,大量的新原始资料被产生,推动了巨量资料安全市场的成长。

根据网路风险管理部门统计,去年上半年美国资料外洩事件达817起。在同一时期,超过 5,300 万人受到资料外洩、破坏、暴露或其他资料窃取的影响。除了新冠疫情之外,越来越多的人在家工作,却没有像在办公室工作的人一样享有同等程度的防护和威慑(例如网路安全)。

巨量资料安全市场趋势

製造业对资料安全的高需求正在推动市场成长

- 根据 IBM X-Force 威胁情报的研究,此类攻击的频率仅次于 SQL 注入,在某些情况下甚至可能出于政治动机。

- 网路攻击是一场席捲製造业的数位流行病,使企业损失了数十万美元的收入和生产週期。去年第三季度,製造业占企业勒索事件的68%。此外,Dragos 发现製造业遭受的工业勒索软体攻击比食品和饮料产业多七倍。去年的网路攻击迫使44%的公司暂时停止生产线。

- 例如,製造风力发电机的大型公司Nordex去年4月其网路遭受了Conti勒索软体攻击。为了阻止恶意软体的传播并限制对公司内部网路的损害,该公司禁用了对控制风力发电机的系统和 IT 系统的远端存取。

- 德国、美国、中国和印度等地区的政府正致力于透过提高自动化和工业控制系统 (ICS) (SCADA、DCS、PLC 等) 来发展智慧製造技术。这些技术利用来自感测器和其他工业控制的资料,创建互联的自动化环境,以改善工作方式。

- 物联网 (IoT) 和自带设备 (BYOD) 等使製造业更加精简的工业趋势也倍增了网路攻击的可能性。此类攻击可能透过网路间谍、分散式阻断服务 (DDOS)、Web 应用程式攻击等方式严重破坏製造公司的声誉。如果违规行为足够严重,公司可能无法弥补未采取适当的资料安全措施而造成的损失。

製造业面临的网路安全风险包括因实体损坏、产品诈欺以及知识产权和机密资料被盗而导致的营运中断。预计工业 4.0 实践在製造业的扩展将在预测期内为巨量资料分析提供更大的空间,然而,安全威胁仍然是製造业的主要担忧。上述因素可能阻碍企业采用数位化能力,进而为巨量资料安全解决方案创造空间。

北美占有最大市场占有率

- 包括英特尔等该地区科技巨头在内的大型企业正越来越多地拥抱巨量资料环境。白宫也投资超过 2 亿美元用于巨量资料计划,以增强美国抵御威胁的脆弱性。资料外洩事件也呈现上升趋势,使得该地区对巨量资料安全的需求相当大。

- 巨量资料安全的需求与巨量资料的安全性成正比,因此巨量资料产生的越多,巨量资料安全市场的需求就越高。此外,该地区也是最大的Start-Ups中心(拥有约 20,000 家活跃的Start-Ups)。由于领先的科技公司大量采用巨量资料安全和云端服务,预计预测期内加拿大对巨量资料安全的需求将会成长。

- 全部区域各行各业都在拥抱巨量资料安全。该国的超级市场零售连锁店正在使用巨量资料收集有关客户的参考信息,并为他们提供附加价值服务和促销活动,例如折扣和特别优惠。预计2025年加拿大的巨量资料市场将翻倍,使该地区成为仅次于美国的第二大市场。

- 远距工作的兴起,以及全国数千家企业缺乏适当的保障措施,导致不良行为者在许多行业中蓬勃发展。例如,2021 年 5 月,大众汽车供应商发生资料外洩事件,影响了北美 330 多万名客户,其中包括有关贷款资格的资讯以及出生日期记录和社会安全号码。令人惊讶的是,已确认身分的骇客愿意以约 5,000 美元的价格出售资料库内容。

此外,该地区的各个市场参与企业正在采取各种策略来增加竞争并扩大市场占有率。例如,去年 8 月,微软和巴克莱银行宣布,巴克莱将采用 Microsoft Teams 作为其主要协作平台,使全球主要地区的 12 万多名员工和服务合作伙伴能够进行协作。根据协议,巴克莱银行将整合其现有的连接和协作能力,采用 Teams 取代先前整个组织使用的多点解决方案。

巨量资料安全产业概况

大力投资研发和进行先进的技术创新以最大限度地减少恶意攻击是市场领先供应商获得竞争优势的主要方法。主要参与企业包括甲骨文公司、微软公司、博通公司、赛门铁克公司、IBM 公司和亚马逊网路服务公司。市场竞争激烈,由几个主要企业组成。占有较大市场份额的参与企业正致力于扩大不同地区的基本客群。

2022 年 7 月,Seclore 宣布与全球 IT 解决方案聚合商 TD SYNNEX 建立合作关係。透过此次合作,企业将获得一套完整的解决资料来解决其资料保护挑战,提供对授权和未授权资料操作的即时追踪和可视性。立即解决安全权限问题,甚至完全删除它们以防止资料遗失。

Anaconda 是全球最受欢迎的资料科学平台的製造商,最近宣布与 Oracle 云端基础设施合作,在 OCI 机器学习和人工智慧服务上整合并允许 Anaconda 储存库,提供安全、描述开放原始码Python 和R 工具和套件。

2022 年11 月,Kyndryl 将支援更高的可见性、威胁情报和更快的威胁情报执行速度,以帮助组织减少侦测和解决重大事件的时间和成本,并最大限度地减少网路事件造成的停机时间。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 采用市场驱动因素与限制因素

- 市场驱动因素

- 来自各种来源的业务资料类型和数量不断增加

- 网路攻击日益增多 对高度可扩展、高安全性解决方案的需求

- 电子商务产业的成长

- 市场限制

- 缺乏资料安全意识

- 资料安全预算低,解决方案实施成本高

- 安全专业知识和熟练人力短缺

- 产业吸引力-波特五力分析

- 购买者/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响

第五章 市场区隔

- 按组件

- 解决方案

- 按服务

- 按组织规模

- 中小企业

- 大型企业

- 按最终用户产业

- 银行、金融服务和保险(BFSI)

- 製造业

- 资讯科技/通讯

- 航太和国防

- 医疗

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 澳洲

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲国家

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 公司简介

- Oracle Corporation

- IBM Corporation

- Microsoft Corporation

- Amazon Web Services

- Broadcom Inc.(Symantec Corporation)

- Hewlett Packard Enterprise

- Thales Group(Gemalto NV)

- Cloudera Inc.

- Centrify Corporation

- Mcafee, LLC

- Check Point Software Technologies Ltd.

- Imperva, Inc.

- Dell Technologies

第七章投资分析

第八章 市场机会与未来趋势

The Big Data Security Market is expected to register a CAGR of 17.95% during the forecast period.

Key Highlights

- When cybercriminals target large data sets, the payoff is frequently well worth the effort required to breach security layers, which is why big data has major potential for businesses and cyber criminals. They have a lot more to gain when they go after such a massive data set. As a result, companies lose a lot more if they are subjected to a cyberattack without adequate security measures.

- Many companies, especially those that deal with huge amounts of data, need traditional data mining and cyber-attack protection tools and techniques.As a result, cybersecurity professionals are increasingly turning to big data analytics. With data being routed through a circuitous path from a data source (such as CRM or sensors) to data storage and analysis, the big data environment is vulnerable and a valuable target for intruders.

- Although enterprises deploy big data platforms using the Hadoop open-source framework or other sources, the frameworks need comprehensive security plans. The inherent mechanisms have limitations that may need to be secured more than just by data encryption; many tech companies are bringing cloud solutions to the market to solve this issue. For instance, in August 2021, McAfee Enterprise announced that MVISION Cloud is a secure access service edge (SASE) offering called MVISION Unified Cloud Edge (UCE). This solution extends the capabilities of Dynamics 365 by utilizing a frictionless API-based cloud-native approach; this demands the security of big data in enterprises.

- The worldwide COVID-19 pandemic benefited the global market. The big data security industry was predicted to rise following the COVID-19 pandemic, as many organizations were forced to switch to working from home and remote working modes due to the fast spread of coronavirus around the globe. As a result of increasing online activity and growth in cyber-attack frequency, masses of new raw data were created, propelling the growth of the big data security market.

According to Cyber Risk Management, the amount of data compromises in the U.S. reached 817 in the first half of last year. During the same period, over 53 million people were harmed by data thefts, including data leaks, breaches, and exposure. In addition to the COVID pandemic, more people are working from home because they don't have the same level of protection or deterrent measures as those who work in an office (e.g., internet security).

Big Data Security Market Trends

High Demands for Data Security in Manufacturing Sector to Drive the Market Growth

- At the application level, a security breach can happen to any company that has a large online presence.Denial-of-service attacks on a company's website or apps are common and can have a big effect on operations all along the supply chain.According to the IBM X-Force Threat Intelligence study, these attempts are second only to SQL injection in frequency, and in some situations, they are even politically driven.

- Cyberattacks are a digital pandemic sweeping the manufacturing industry, costing organizations millions of dollars in sales and hours from the production cycle. In the third quarter of last year, manufacturing accounted for 68% of all business ransomware outbreaks. Furthermore, Dragos revealed that manufacturers experienced seven times the number of industrial ransomware instances in the food and beverage business. Cyberattacks in the last year forced 44% of firms to temporarily shut down their manufacturing lines.

- For example, Nordex, a large company that makes wind turbines, saw a Conti ransomware attack on their network in April of last year. This caused many of their systems to go offline across all of their branches.The company disabled remote access to systems that controlled wind turbines and IT systems in order to stop the malware from spreading and limit the damage to their internal network.

- Governments across regions like Germany, the US, China, and India are focusing on smart manufacturing techniques by increasing automation and industrial control systems (ICS) (like SCADA, DCS, and PLCs). Using data from sensors and other industrial control devices, these techniques create a connected, automated environment and improve how well things work.

- The same industry trends that make manufacturing more streamlined, such as the Internet of Things (IoT) and Bring Your Own Device (BYOD), also exponentially increase the potential for cyber attacks. Such attacks, whether through cyber espionage, distributed denial of service (DDOS), or Web application attacks, can wreak havoc on a manufacturing company's reputation. If the breach is severe enough, a company might never regain its losses due to not taking appropriate data security measures.

The cybersecurity risks to the manufacturing sector include operational downtime due to physical damage, product manipulation, and the theft of intellectual property and sensitive data. Although the growth in industrial 4.0 practices across manufacturing industries provides more scope for big data analytics over the forecast period, security threats are reported to be a major concern for manufacturers. The factors mentioned earlier may discourage companies from incorporating digital capabilities, thus creating scope for big data security solutions.

North America to Hold the Largest Market Share

- Large enterprises, including big tech companies in the region like Intel, increasingly embrace a big data environment. In addition, for Big Data projects, the White House has invested more than USD 200 million to make them vulnerable to threats. Data breaches are also on the rise, so the region's need for big data security is substantial.

- As the demand for big data security is directly proportional to the security of big data, the more big data generated, the higher the demand for the big data security market. Moreover, the region is the biggest start-up hub (with approximately 20,000 active start-ups). The need for Canada's big data security is increasing over the forecast period due to the high adoption rate of big data security and cloud services in major tech companies.

- Industries across the region are adopting big data security. The country's supermarket retail chain uses big data to learn more about its customers and offer value-added services and promotions, such as discounts and rewards. With the big data market expected to double by 2025 in Canada, the region is expected to be a substantial market after the United States.

- With the rise of remote work and the fact that thousands of businesses across the country didn't have the right protections, there were many bad actors in many industries.For example, in May 2021, a data breach at a vendor of Volkswagen came to light, which impacted more than 3.3 million customers in North America and included information about loan eligibility, as well as date-of-birth records and Social Security numbers. Surprisingly, the hacker identified was looking to sell the contents of the database for around USD 5,000.

Furthermore, various market players in the region are involved in various strategies to gain a competitive edge and increase their market share. For instance, in August last year, Microsoft Corp. and Barclays Bank PLC announced that Barclays had chosen Microsoft Teams as its primary collaboration platform, enabling collaboration for over 120,000 employees and service partners in critical locations worldwide. Barclays is consolidating its existing connectivity and collaboration capabilities under the arrangement, with Teams replacing multiple-point solutions previously in use throughout the organization.

Big Data Security Industry Overview

High investment in research and development and advanced technological innovations to minimize malicious attacks is the key approach taken by major market vendors to gain a competitive edge. A few major players include Oracle Corporation, Microsoft Corporation, Broadcom Inc. (Symantec Corporation), IBM Corporation, and Amazon Web Services. The market is highly competitive and consists of several major players-the players with a major share of the market focus on increasing their customer base across different regions.

In July 2022, Seclore announced a partnership with global IT solutions aggregator TD SYNNEX. This partnership will enable enterprises to access complete solutions to solve their data protection challenges with real-time tracking and visibility of both authorized and unauthorized activity on the data to identify suspicious behavior, evolve data security policies, take immediate action on security permissions, and even complete removal to prevent data loss.

Anaconda Inc., which makes the most popular data science platform in the world, recently announced a partnership with Oracle Cloud Infrastructure to deliver safe, open-source Python and R tools and packages by integrating and allowing Anaconda's repository over OCI Machine Learning and Artificial Intelligence Services.Customers can use Anaconda services from OCI without the need for a separate business license.

In November 2022, Kyndryl collaborated with AWS on processes and technologies to support greater visibility, threat intelligence, and faster execution of threat intelligence to minimize and reduce time and money to detect and resolve a major incident and the downtime of a cyber event.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Variety And Volume of Business Data Generated from Various Sources

- 4.3.2 Increasing Cyber-Attacks Demand for Scalable High Security Solutions

- 4.3.3 Growth of E-Commerce Industry

- 4.4 Market Restraints

- 4.4.1 Lack of Data Security Awareness

- 4.4.2 Low Data Security Budget And High Installation Cost of Solution

- 4.4.3 Lack of Security Expertise And Skilled Personnel

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers/Consumers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of COVID-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Organization Size

- 5.2.1 Small & Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 By End-user Industry

- 5.3.1 Banking, Financial Services, & Insurance (BFSI)

- 5.3.2 Manufacturing

- 5.3.3 IT & Telecommunication

- 5.3.4 Aerospace & Defense

- 5.3.5 Healthcare

- 5.3.6 Other End-users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Australia

- 5.4.3.3 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Mexico

- 5.4.4.3 Rest of Latin America

- 5.4.5 Middle-East & Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle-East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Oracle Corporation

- 6.1.2 IBM Corporation

- 6.1.3 Microsoft Corporation

- 6.1.4 Amazon Web Services

- 6.1.5 Broadcom Inc. (Symantec Corporation)

- 6.1.6 Hewlett Packard Enterprise

- 6.1.7 Thales Group (Gemalto NV)

- 6.1.8 Cloudera Inc.

- 6.1.9 Centrify Corporation

- 6.1.10 Mcafee, LLC

- 6.1.11 Check Point Software Technologies Ltd.

- 6.1.12 Imperva, Inc.

- 6.1.13 Dell Technologies