|

市场调查报告书

商品编码

1641924

Edge Analytics:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Edge Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

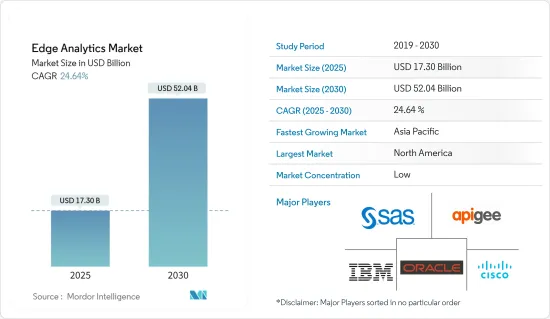

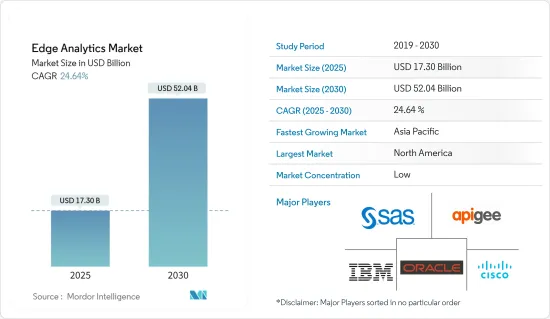

边缘分析市场规模预计在 2025 年达到 173 亿美元,预计到 2030 年将达到 520.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 24.64%。

边缘分析是一项新兴技术,有望透过更接近资料来源来减轻云端伺服器的负载。边缘分析可以即时分析资料,从而可以更好地依赖云端服务。製造业、医疗保健和零售业等行业预计将受益最多,因为处理后的资料将即时可用,从而实现即时决策,提高效率。

主要亮点

- 边缘分析是一种资料收集和分析策略,它对边缘、节点、网路交换器和其他网路端点的资料执行自动分析计算,而不是等待资料被继电器集中式资料储存。

- 随着网路和云端运算的不断渗透,全球边缘分析产业未来前景广阔。此外,日益增长的自动化需求正在推动市场成长。

- 借助连网设备产生的大量资料推动了边缘分析市场的成长,而即时智慧则成为网路设备上边缘分析成长的催化剂,边缘分析的采用是提高扩充性和成本优化。

- 然而,缺乏安装和管理基于边缘的解决方案的熟练人员阻碍了市场的发展。预计网路节点效率的提高将为预测年份内边缘分析市场规模的扩大提供有利的前景。

- COVID-19 疫情对边缘分析市场产生了积极影响,因为 COVID-19 封锁期间远端工作和员工缺勤的趋势促使了对自动化和物联网解决方案的需求。已显示出显着的增长。此外,疫情过后,由于数位化技术的普及,市场也实现了快速成长。

边缘分析市场趋势

透过连网设备增加资料传输将推动市场成长

- 边缘分析的需求是由每天产生并储存在云端中的大量资料所驱动。据Cisco称,拉丁美洲每月消费者控制的互联网通讯协定(IP) 流量资料预计将从 2017 年的每月 0.7Exabyte增长到 2022 年的每月 1.92Exabyte。

- 根据 Errision 的数据,2021 年透过固定无线存取 (FWA) 的每月资料流量为 16.6 Exabyte ,高于 2020 年的 9.7 Exabyte 。预计未来几年将出现强劲成长,到 2028 年每月 FWA资料流量将达到约 130 Exabyte。 FWA 是一种透过 5G、4G 和 3G 实现固定宽频连线的技术,即使在基础设施有限的地区也能提供宽频连线。 2021 年,FWA资料流量超过 5G行动连线,但预计 2024 年 5G 行动流量将超过 FWA 流量。

- 此外,大量资料被储存在边缘,希捷估计到 2025 年物联网设备将产生超过 90 Zetta位元组的资料。预计响应资料对于物联网、人工智慧和区块链等下一代技术将极为重要。

- 此外,边缘分析是智慧城市等新概念的核心,它会自动即时分析和计算收集的资料,而不是将资料发送回集中式资料储存或伺服器,因此对智慧城市技术的投资也一个关键驱动因素。边缘分析应用程式数量的增加预计将推动边缘分析市场的发展,从而为最终用户提供更快、更快回应的服务。

- 边缘运算作为一种提高网路效能的技术已经存在了一段时间。边缘运算使资料分析部分依赖网路频宽,并将资料储存在更靠近资料来源的地方。边缘运算还将资料处理和储存从孤岛设定移出,更靠近最终用户,在设备、雾层和边缘资料中心进行处理。

北美预计将创下最大市场规模

- 由于政府法规和合规性支援以及中小企业的接受度不断提高,美国仍然是边缘分析的主要市场。此外,由于边缘分析服务集中在製造业和通讯业,边缘分析市场也显着成长。边缘分析的需求与云端流量直接相关。由于云端流量的大幅增加,市场将显着成长。

- 北美保险公司正在改变其使用云端运算的方式。产物保险和意外险以及寿险公司都采用了云端运算来提高灵活性、提高业务效率、吸引新人才并降低业务成本,但保险公司也开始将云端运算视为一项商业资产。 。使用分散式边缘运算架构可以显着降低云端运营成本。边缘设备可以协同处理云端设备无法单独处理的关键操作,从而减少对云端的依赖。

- 该地区的传感器技术也正在显着增长。感测器技术的创新与硬体成本的降低相结合可以建立边缘到云端的范式。具有处理单元的感测器可以帮助在不一致的云端环境中采取关键操作,然后与云端同步。

- 加拿大以快速采用新技术而闻名。当今大多数新技术都是资料密集型的。由于创建、处理和传输的资料如此之多,我们目前的资料中心和云端基础设施已接近最大容量。

- 随着目前产生和使用的新资料量不断增加,这些基础设施不太可能满足客户的需求。在所有相关参数中,延迟可能是对您的业务最关键的因素。

边缘分析产业概览

边缘分析市场高度分散,主要企业包括思科系统公司、甲骨文公司、SAS 研究所、IBM 公司和 Apigee 公司。市场参与者正在采用合作、创新和收购等策略来增强其产品供应并获得永续的竞争优势。

- 2022 年 6 月 - 领先的IT基础设施基础架构服务供应商 Kyndryl 与思科将利用思科解决方案和 Kyndryl 託管服务协助企业客户加速向资料主导组织的转型。

- 2022 年 6 月 - 先锋合作伙伴 SAS 和 ClearBlade 帮助製造业、石油和天然气以及运输业等资产密集型行业的营运经理以更简单、更具成本效益的方式对所有流资料做出更明智的决策。最大限度地提高操作技术的效率 (透过解锁价值来获得「OT」装备。合作伙伴将在物联网连接资产上利用人工智慧 (AI) 和机器学习,使 OT 高管能够存取、分析和处理边缘和云端的串流资料,而无需依赖 IT 或资料科学家来加速流程。 。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 技术简介

- 说明分析

- 预测分析

- 指示性分析

- 诊断分析

- 产业价值链分析

- COVID-19 对市场的影响

第五章 市场动态

- 市场驱动因素

- 物联网中连接设备的数量不断增长

- 透过连网设备增加资料传播

- 市场限制

- 边缘技术的采用尚处于早期阶段

- 资料安全和安全威胁

第六章 市场细分

- 依部署类型

- 本地

- 云

- 按组件

- 解决方案

- 服务(专业服务、主机服务)

- 按最终用户产业

- 银行、金融服务和保险(BFSI)

- 资讯科技/通讯

- 製造业

- 卫生保健

- 零售

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 日本

- 中国

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Cisco Systems Inc.

- Oracle Corporation

- SAS Institute Inc.

- IBM Corporation

- Apigee Corporation

- Predixion Software

- AGT International Inc.

- Foghorn Systems

- CGI Group Inc.

- Intel Corporation

- Greenwave Systems

- Microsoft Corporation

第八章投资分析

第九章:市场的未来

The Edge Analytics Market size is estimated at USD 17.30 billion in 2025, and is expected to reach USD 52.04 billion by 2030, at a CAGR of 24.64% during the forecast period (2025-2030).

Edge Analytics is an emerging technology expected to ease the load on cloud servers as it is closer to the data source. Edge Analytics can analyze data in real-time, enabling higher dependencies on cloud services. Industries like Manufacturing, healthcare, and retail are expected to benefit the most from the real-time availability of processed data, enabling them to achieve higher efficiencies using real-time decision-making.

Key Highlights

- Edge analytics is a data collecting and analysis strategy in which an automated analytical calculation is done on data at the edge of a node, network switch, or another network endpoint instead of waiting for the data to be relayed back to centralized data storage.

- An increase in internet and cloud adoption offers enormous prospects for the global edge analytics industry in the future. Moreover, the rising need for automation boosts the market growth.

- The proliferation of a large amount of data with the help of connected devices is driving the growth of the edge analytics market, with real-time intelligence acting as a catalyst for the growth of edge analytics on network devices and adopting edge analytics, increasing scalability and cost optimization.

- However, the lack of skilled personnel to install and manage edge-based solutions hinders market development. The increasing network node efficiency is predicted to provide lucrative prospects for advancing the edge analytics market size throughout the forecast year.

- The COVID-19 pandemic had a positive impact on the edge analytics market, which exhibited significant growth during the period, owing to remote working trends and employee unavailability during the period of COVID-19 lockdowns, which prompted the need for automation and IoT solutions during the period, assisting in the growth of the edge analytics market during the period. Post-pandemic also, the market is growing rapidly with the increased adoption of digitization technologies.

Edge Analytics Market Trends

Rising Propagation of Data Over Connected Devices Drives the Market Growth

- The need for Edge Analytics is further driven by the massive amount of data generated on everyday, which is stored on the cloud. According to Cisco Systems, the data on consumer-managed Internet Protocol (IP) monthly traffic in Latin America was 0.7 exabytes per month in 2017, expected to grow to 1.92 exabytes in 2022.

- According to Errision, Monthly data traffic through fixed wireless access (FWA) was measured at 16.6 exabytes in 2021, up from 9.7 exabytes in 2020. Strong growth is expected over the coming years, with monthly FWA data traffic forecast to reach almost 130 exabytes by 2028. FWA is a technology enabling a fixed broadband connection via 5G, 4G, or 3G and can provide broadband connections in areas with limited infrastructure. FWA data traffic outstripped that of 5G mobile connections in 2021, though 5G mobile traffic is expected to surpass FWA traffic by 2024.

- Moreover, a large amount of data is stored on the Edge, and Seagate estimates that the IoT devices will generate more than 90 zettabytes of data by 2025. Data readiness is expected to be critical for next-generation technologies like IoT, AI, and blockchain.

- Also, the edge analytics capabilities of automatic analytical computation of collected data in real-time, instead of sending the data back to the centralized data store or server, will be the core of new concepts, like smart cities, due to which increased investment in smart cities technology is expected to boost the market for edge analytics that will provide faster and responsive services to end user.

- Edge Computing has been in the technological space for some time, surging network performance. Due to edge computing, data analytics partly relies on the network bandwidth to save data close to the data source. Also, edge computing makes data handled and stored away from the silo setup closer to end users, with processing in the device, the fog layer, or the edge data center.

North America is Expected to Register the Largest Market

- The United States remains a prominent market for Edge Analytics due to the increasing acceptance of edge analytics among small and medium-scale firms, supported by government regulations and compliance. Additionally, the significant growth of the edge analytics market can be attributed to the high concentration of manufacturing and telecommunication industries that majorly adopt edge analytics services. The demand for edge analytics is directly related to cloud traffic. Due to the huge increase in cloud traffic, significant growth in the market can be observed.

- North American Insurance companies are changing the way they utilize cloud computing. While both property & casualty and life insurers have employed the cloud to increase agility, increase operating efficiency, attract new talent and reduce operating costs, there is an emerging trend in insurers viewing the cloud as a business asset. Cloud operations cost can be significantly reduced by using a distributed edge computing architecture, where edge devices together process a critical operation, which a cloud device cannot process independently, thereby reducing cloud dependency.

- Also, significant growth in sensor technology can be witnessed in the region. By combining sensor technology innovations with reducing hardware costs, the edge-to-cloud paradigm can be established. Sensors with processing units can help take critical actions in an inconsistent cloud environment and later synchronize with the cloud.

- Canada is known to be an early adopter of new technologies. Most new technologies at present are data intensive. They create, process, and transfer large amounts of data, due to which the current infrastructure, consisting of data centers and the cloud, is inching toward its maximum capacity.

- With the amount of new data generated and used at present, these infrastructures won't support the needs of their customers. Of all the parameters involved, latency will be the most crucial factor for the business.

Edge Analytics Industry Overview

The edge analytics market is highly fragmented with the presence of major players like Cisco Systems Inc., Oracle Corporation, SAS Institute Inc., IBM Corporation, and Apigee Corporation. Players in the market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- June 2022 - Kyndryl, one of the leading providers of IT infrastructure services, and Cisco announced a technological partnership to assist corporate clients in accelerating their transition into data-driven organizations driven by Cisco solutions and Kyndryl managed services.

- June 2022 - Pioneering partners SAS and ClearBlade are assisting operations managers in asset-intensive industries such as manufacturing, oil and gas, and transportation in maximizing the effectiveness of their operational technology (OT) equipment by unlocking the value of all streaming data in a simpler and cost-effective manner. The partners are leveraging artificial intelligence (AI) and machine learning on IoT-connected assets to enable OT executives to access, analyze, and act on streaming data at the Edge and in the Cloud without relying on IT or data scientists, shortening the process from months to weeks.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.3.1 Descriptive Analytics

- 4.3.2 Predictive Analytics

- 4.3.3 Prescriptive Analytics

- 4.3.4 Diagnostic Analytics

- 4.4 Industry Value Chain Analysis

- 4.5 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Number of Connected Devices in IoT

- 5.1.2 Rising Propagation of Data Over Connected Devices

- 5.2 Market Restraints

- 5.2.1 Adoption of Edge Technology in Nascent stage

- 5.2.2 Threat of Data Safety and Security

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 On-Premises

- 6.1.2 Cloud

- 6.2 By Component

- 6.2.1 Solutions

- 6.2.2 Services (Professional and Managed Services)

- 6.3 By End User Industry

- 6.3.1 Banking, Financial Services, and Insurance (BFSI)

- 6.3.2 IT and Telecommunication

- 6.3.3 Manufacturing

- 6.3.4 Healthcare

- 6.3.5 Retail

- 6.3.6 Other End-user Industry

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 Japan

- 6.4.3.2 China

- 6.4.3.3 India

- 6.4.3.4 Rest of Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Oracle Corporation

- 7.1.3 SAS Institute Inc.

- 7.1.4 IBM Corporation

- 7.1.5 Apigee Corporation

- 7.1.6 Predixion Software

- 7.1.7 AGT International Inc.

- 7.1.8 Foghorn Systems

- 7.1.9 CGI Group Inc.

- 7.1.10 Intel Corporation

- 7.1.11 Greenwave Systems

- 7.1.12 Microsoft Corporation