|

市场调查报告书

商品编码

1641931

Hadoop巨量资料分析 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Hadoop Big Data Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

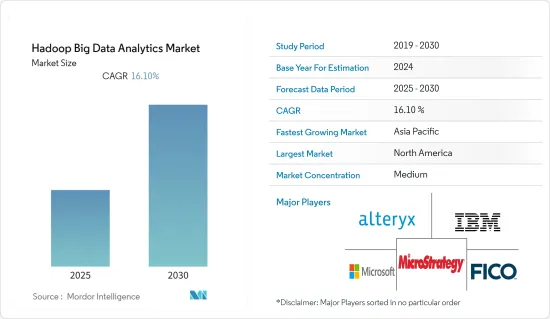

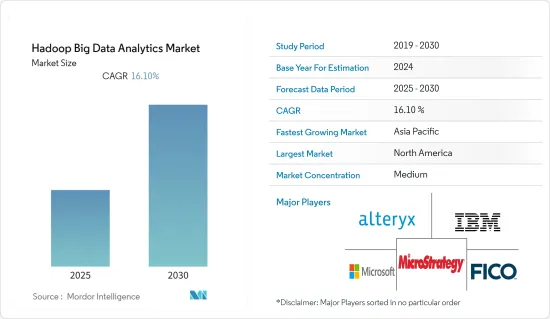

预测期内,Hadoop巨量资料分析市场预计将以 16.1% 的复合年增长率成长

关键亮点

- 巨量资料收集、储存和处理的自动化程度不断提高有望重塑和加强巨量资料分析市场的成长。

- 各行各业的公司都在进行数位转型并增加更多的自助服务解决方案。因此,非结构化资料(文字、文件、图像、照片)的数量正在呈指数级增长,从资料到Terabyte再到Petabyte。然而,RDBMS 等传统工具可能无法提供预期的结果,企业可能无法充分受益于每天产生的大量资料。这就是为什么随着企业转向Terabyte资料,像 Hadoop 这样的资料平台越来越受欢迎的原因。

- 各行业越来越多地采用工业 4.0 实践,这将为预测期内巨量资料分析的采用提供更大的空间。预计到2023年智慧製造收益将达到2,166.3亿美元,巨量资料分析可望成为智慧製造策略的一部分,以提高流程效率和产品效能。

- 缺乏意识和安全问题是阻碍市场成长的主要原因。如今,在这个快节奏的世界里,保护个人资料安全已经成为即使是中小型企业的首要任务。网路攻击的增多给组织带来了巨大的损失,同时也阻碍了品牌身分验证。公司可能不愿意采用巨量资料环境,因为资料库和视觉化仪表板使它们更容易受到攻击。

- COVID-19 正在影响技术领域的每个要素,由于硬体供应链中的分销和製造活动减少,IT基础设施的成长放缓。

Hadoop巨量资料分析市场趋势

零售业呈现成长态势

- 在先进的分析和巨量资料技术推动下,零售业正在经历重大转型。随着电子商务和网路购物的成长以及客户忠诚度竞争的加剧,零售商开始转向巨量资料分析以保持市场竞争力。

- 在零售业,巨量资料分析应用于零售的每个阶段,以了解客户行为、预测需求、最佳化定价等。巨量资料在零售业的众多用途包括全系统成本降低、改善线上和店内客户体验、资料主导的自适应供应链以及即时分析和定位。

- MapR Technologies 等供应商正在开发大数据巨量资料,使企业能够储存、整合和分析各种资料,包括线上和离线客户资料、电子商务交易、点选流资料、电子邮件、社交媒体和客服中心记录,在一个中央储存库中。

- 最近,时尚零售商H&M开始使用巨量资料来调整实体店的商品行销。时尚零售商使用演算法从退货、收据和会员集点卡资料中获取见解,以提高收益。

预计北美将出现显着成长

- 范例包括 IBM Corporation、Microsoft Corporation、SAS Institute, Inc.、Alteryx, Inc.、Fair Isaac Corporation 和 Microstrategy Incorporated。最近,微软扩大了与 Hortonworks 的合作,以协助将开放原始码巨量资料分析和 Apache Hadoop 引入云端。预计这些领先公司为增强其产品供应而进行的合作将在预测期内积极推动市场成长。

- 在美国,新商业洞察力的成长正在促进巨量资料分析市场的扩张。巨量资料正在帮助该地区的许多企业取得直接转化为更好业务绩效的成果,例如改善客户体验、增强行销以及识别诈欺和浪费。

- 在美国,出现了许多新工具,使得资料越来越容易取得。利用巨量资料所需的许多技术和创建工作环境所需的专业知识都很复杂。然而,终端用户友好的解决方案日益涌现,使得公司能够使用现成的封装,而不需要大量的硬体整合或编码技能。

Hadoop巨量资料分析产业概览

Hadoop巨量资料分析市场的竞争适中,由几家主要企业组成。目前,一些竞争对手在市场占有率份额上占据主导地位。然而,随着託管服务分析市场的发展,新的竞争对手正在新兴市场中获得市场占有率,从而扩大其贸易领域。

- 2022 年 10 月-Alteryx 宣布推出其 Alteryx Analytics Cloud 平台的新开发成果。 Alteryx Analytics Cloud 平台在云端提供统一、易于理解的端对端分析。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场动态

- 市场驱动因素

- 非结构化资料的成长

- 物联网和工业4.0的出现

- 市场限制

- 安全问题和技能差距

第六章 市场细分

- 解决方案

- 资料发现和视觉化 (DDV)

- 高级分析(AA)

- 最终用户

- BFSI

- 零售

- 资讯科技/通讯

- 医疗保健和生命科学

- 製造业

- 媒体娱乐

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Alteryx Inc.

- Fair, Isaac, and Company(FICO)

- IBM Corporation

- Microsoft Corporation

- Micro Strategy Incorporated

- SAS Institute Inc.

- Tibco Software

- Amazon Inc.(AWS)

- Salesforce.com Inc.(Tableau Software Inc.)

- QLIK Tech International

- SISENSE Inc.

- Dell Technologies Inc.

- Hitachi Consulting

- Hewlett Packard Company

- Splunk Inc.

第八章投资分析

第九章 市场机会与未来趋势

简介目录

Product Code: 62360

The Hadoop Big Data Analytics Market is expected to register a CAGR of 16.1% during the forecast period.

Key Highlights

- The increasing automation for the Big Data collection, storage, and processing is expected to reshape and enhance the growth of the Big Data analytics market.

- Enterprises across industries are undergoing digital transformation and adding more self-service solutions. Therefore, the amount of unstructured data in text, files, images, and pictures is increasing significantly, with data volume increasing from gigabytes to terabytes and petabytes, traditional tools like RDBMS. Fail to give desired results, and the enterprise may not entirely benefit from the extensive data generated daily. Therefore, data platforms like Hadoop are gaining traction as enterprises progress toward terabytes of data.

- The growth in the industrial 4.0 practices across industries provides more scope for accepting Big Data analytics over the forecast period. With revenues from smart manufacturing expected to reach USD 216.63 billion by 2023, Big Data analytics is expected to become a part of the smart manufacturing strategies, as it offers improved efficiency of the process and performance of the product.

- Lack of awareness and security concerns are the significant reasons that challenge market growth. Presently, storing personal data securely in this fast-paced world has become the most important task, even for SMEs. Increasing cyber-attacks cost organizations a fortune and also hamper their brand identity. As databases and visual dashboards add to the vulnerability of the enterprise, the enterprises may hesitate to deploy Big Data environments.

- COVID-19 has impacted all the elements of the technologies sector; it has slowed down the IT infrastructure owing to the distributions in the hardware supply chain and reduced manufacturing activities.

Hadoop Big Data Analytics Market Trends

Retail Sector to Witness the Growth

- The retail industry is witnessing a significant transformation through advanced analytics and Big Data technologies. With the growth of e-commerce, online shopping, and high competition for customer loyalty, retailers are utilizing Big Data analytics to stay competitive in the market.

- In the retail sector, Big Data analytics is used at every retail stage to understand customer behavior, predict demand, and optimize pricing. Most of the Big Data applications in retail are for system-wide cost reduction, improving online and in-store customer experience, data-driven adaptive supply chains, and real-time analytics and targeting.

- Vendors, such as MapR technologies, are offering a Big Data platform that helps retailers store, integrate and analyze a wide variety of online and offline customer data, e-commerce transactions, clickstream data, email, social media, and call center records, all in one central repository.

- Recently, fashion retailer H&M started using Big Data to tailor its merchandising mix in its brick-and-mortar stores. The fashion retailer uses algorithms to gain insights from returns, receipts, and data from loyalty cards to enhance its bottom line.

North America Region is Expected to Grow at a Significant Rate

- Some include IBM Corporation, Microsoft Corporation, SAS Institute, Inc., Alteryx, Inc., Fair Isaac Corporation, and Microstrategy Incorporated, among others. Recently, Microsoft extended the partnership with Hortonworks, which was instrumental in bringing the open source Big Data analytics and Apache Hadoop to the Cloud. This partnership by major players to enhance their product offerings is anticipated to positively drive the market's growth over the forecast period.

- The growth of new business insights is contributing to the expansion of the Big Data analytics market in the United States. Big Data is helping many companies in the region to improve customer experience, enhance marketing, identify fraud and waste, and achieve other results that directly strengthen business performance.

- Many new tools in the US are making data more and more accessible. Much of the technology required to harness the Big Data and expertise needed to create working environments are complex. However, many end-user-friendly solutions are continuously growing, enabling businesses to start with an off-the-shelf package and with less hardware integration and coding skills needed.

Hadoop Big Data Analytics Industry Overview

The hadoop big data analytics market is moderately competitive and consists of a few major players. Currently, some of the competitors control the market in terms of market share. However, new competitors are expanding their market share and, consequently, their commercial footprint throughout emerging markets as a result of the development in managed service analytics.

- October 2022 - Alteryx has announced introducing new developments on the Alteryx Analytics Cloud platform, which provides unified and approachable end-to-end analytics in the Cloud, where New cloud, machine learning and security advancements accelerate enterprise-wide analytics to deliver business-changing insights.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Gowing Volume of Unstructured Data

- 5.1.2 The advent of IoT and Industry 4.0 Adpotion

- 5.2 Market Restraints

- 5.2.1 Security Concerns and Skills Gap

6 MARKET SEGMENTATION

- 6.1 Solution

- 6.1.1 Data Discovery and Visualization (DDV)

- 6.1.2 Advanced Analytics (AA)

- 6.2 End User

- 6.2.1 BFSI

- 6.2.2 Retail

- 6.2.3 IT and Telecom

- 6.2.4 Healthcare and Life Sciences

- 6.2.5 Manufacturing

- 6.2.6 Media and Entertainment

- 6.2.7 Other End Users

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Alteryx Inc.

- 7.1.2 Fair, Isaac, and Company(FICO)

- 7.1.3 IBM Corporation

- 7.1.4 Microsoft Corporation

- 7.1.5 Micro Strategy Incorporated

- 7.1.6 SAS Institute Inc.

- 7.1.7 Tibco Software

- 7.1.8 Amazon Inc. (AWS)

- 7.1.9 Salesforce.com Inc. (Tableau Software Inc.)

- 7.1.10 QLIK Tech International

- 7.1.11 SISENSE Inc.

- 7.1.12 Dell Technologies Inc.

- 7.1.13 Hitachi Consulting

- 7.1.14 Hewlett Packard Company

- 7.1.15 Splunk Inc.

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219