|

市场调查报告书

商品编码

1641942

工业地板材料:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Industrial Flooring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

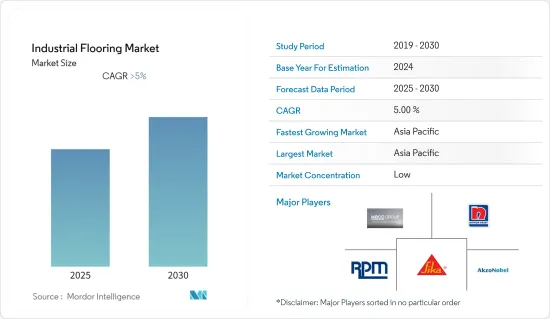

预计预测期内工业地板材料市场的复合年增长率将超过 5%。

2020 年,新冠疫情对市场产生了负面影响。不过,目前市场已经恢復到了疫情前的水准。随着监管的放宽,预计未来几年建设活动将会加速。

主要亮点

- 短期内,人们对工业地板材料优势的认识不断提高预计将推动市场成长。

- 有关地板材料排放的挥发性有机化合物(VOC)的严格规定可能会阻碍市场的成长。

- 环保生物地板材料的日益普及和聚天冬胺酸基涂料的良好性能有望为未来的市场成长带来机会。

- 亚太地区在工业地板材料消费中占有重要份额。在工业活动成长的推动下,该地区预计在预测期内经历最快的成长。

工业地板材料的市场趋势

食品和饮料行业的需求不断增长

- 食品加工厂的地板会接触到各种不同的食品,包括热油、脂肪、血液、糖溶液和天然食品酸。其中一些产品具有腐蚀性,可能会对您的地板造成严重损坏。

- 除此之外,食品和饮料产业还存在因溢出而导致微生物生长的高风险。结果,这些污染物最终降低了加工食品的纯度。

- 为了避免这些问题,食品和饮料行业使用各种树脂和相关被覆剂,包括环氧树脂、聚氨酯、聚天冬氨酸和 MMA,以防止污染物渗透到混凝土基材中并提供卫生的表面处理。设备必须提供保护屏障,以确保表面清洁。

- 全球食品安全倡议(GFSI)、食品标准局 (FSA) 和欧洲食品安全局 (EFSA) 发布法规,帮助食品工厂维持最高的处理和生产标准。

- 2022 年 5 月,北美食品和饮料产业的资本计划公告增加。例如,加拿大食品和饮料行业植物蛋白製造商 Phyto Organics Foods 即将完成其最大的计划,即位于亚伯达斯特拉斯莫尔的一座价值2.25 亿美元的工厂,用于将黄豌豆加工成高纯度蛋白分离物。火鸡加工企业 West Liberty Foods 也宣布计划在爱荷华州建造一座价值 1 亿美元的加工厂。

- 此外,泰森食品于 2022 年 1 月宣布将投资 3.55 亿美元在京畿道鲍灵格林建造一座最先进的培根工厂。该计划是泰森致力于满足零售和餐饮对培根产品日益增长的需求的一部分。新工厂将创造 450 个就业机会,预计 2023 年底投入生产。

- 宾堡集团是墨西哥 2021 年净收入最高的食品公司,收入超过 3,450 亿墨西哥比索(170.2 亿美元)。

- 百事可乐是 2021 财年北美销量最高的食品和饮料公司。非洲大陆加工食品和饮料的销售额超过 476 亿美元。同年,百事公司全球营运净收入为794.7亿美元。

- 所有上述因素都表明,预测期内工业地板材料在食品和饮料行业的使用前景乐观。

中国主导亚太市场

- 亚太地区在全球市场占据主导地位,预计在预测期内仍将保持这一地位。中国是亚太地区主要国家之一,受经济成长推动,建设活动发展。

- 过去二十年来,该国化学工业呈指数级增长,与该国的整体增长及其主要产业的潜在增长保持一致。中国约占全球化学品需求的三分之一。

- 中国是全球最大的化学品製造国,2021 年占全球化学品销售额的 43%,达到 17,290 亿欧元(20,180 亿美元)。到2021年,中国占全球化学品市场销售额的份额将从2011年的28.3%扩大到43.0%。

- 中国的食品加工行业正在走向成熟并经历缓慢的成长。饮料业正出现一种新兴的消费趋势,即饮冰沙、果汁和优格更健康、天然、方便。

- 华北地区约有 42,577 家食品和饮料製造商,年销售额超过 2,000 万元人民币(295 万美元)。中国加工食品的消费量持续成长。

- 中国是世界第二大医药市场。随着中产阶级的壮大和老化、收入水准的提高和都市化进程的加快,医药市场正在快速成长。

- 预计2021年中国医药产业总销售额将超过3.3兆元(4,870亿美元),年增率约20%。中国医药产业的两大支柱是药品製剂生产和中国专利药品生产。

- 由于这些因素,预计预测期内该地区的工业地板材料市场将会成长。

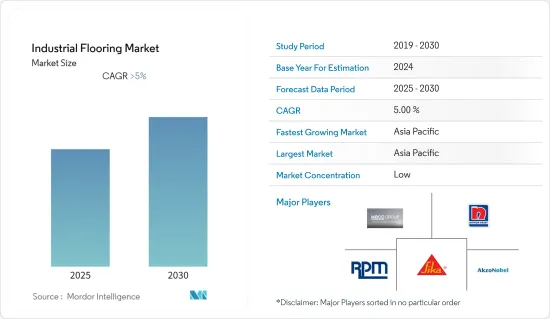

工业地板材料产业概况

全球工业地板材料市场本质上高度分散。市场的主要企业(不分先后顺序)包括 Sika AG、RPM International Ltd.、AkzoNobel NV、MBCC Group 和 Nippon Paint Holdings。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 提高对工业地板材料益处的认识

- 食品和饮料行业的需求不断增长

- 限制因素

- 严格规定地板材料VOC排放

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章 市场区隔(以金额为准的市场规模)

- 依树脂类型

- 环氧树脂

- 聚天冬酰胺

- 聚氨酯

- 丙烯酸纤维

- 其他树脂类型

- 按应用

- 混凝土的

- 木头

- 其他用途

- 按最终用户产业

- 饮食

- 化学

- 交通运输和航空

- 卫生保健

- 其他最终用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3TREESGROUP

- Akzo Nobel NV

- Axalta Coating Systems

- MBCC Group

- Florock

- Fosroc Inc.

- JOTUN

- LATICRETE International Inc.

- Michelman Inc.

- Nippon Paint Holdings Co. Ltd

- PPG Industries Inc.

- RPM International Inc.

- Sika AG

- Teknos Group

- The Sherwin-Williams Company

第七章 市场机会与未来趋势

- 环保生物地板材料越来越受欢迎

- 聚天门冬胺酸涂料性能优异

The Industrial Flooring Market is expected to register a CAGR of greater than 5% during the forecast period.

COVID-19 negatively impacted the market in 2020. However, the market now reached pre-pandemic levels. With the easing of regulations, construction activities are expected to pick up pace in the coming years.

Key Highlights

- Over the short term, growing awareness about the advantages of industrial flooring is expected to drive market growth.

- Stringent regulations on VOCs released on the flooring will likely hinder the market's growth.

- The increasing popularity of eco-friendly bio-based flooring and the promising performance of polyaspartic coatings are projected to provide opportunities for future market growth.

- Asia-Pacific holds the major share in the consumption of industrial flooring. The region is also expected to witness the fastest growth during the forecast period, powered by the growth in industrial activities.

Industrial Floorings Market Trends

Increasing Demand from the Food and Beverage Industry

- The floor in the food processing facility is exposed to all sorts of food byproducts, like hot oils, fats, blood, sugar solutions, and natural food acids. Some of these byproducts are corrosive, which can cause serious damage to the floor.

- Besides this, the food and beverage industry includes a high risk of microbial growth due to spillage. Consequently, these contaminants ultimately degrade processed food's purity.

- To avoid such problems, the food and beverage industry requires various resins and related coatings, such as epoxy, polyurethane, polyaspartic, and MMA, to provide a protective barrier to help prevent contaminants from permeating the concrete substrate and ensure a hygienic surface.

- The Global Food Safety Initiative (GFSI), the Food Standards Agency (FSA), and the European Food Safety Authority (EFSA) have issued stipulations to ensure food factories maintain the highest standards of handling and production.

- The North American food and beverage sector saw an uptick in capital project announcements in May 2022. For instance, Phyto Organix Foods, a Canadian maker of plant-based protein for the food and beverage industry, announced the largest project of a USD 225 million facility to process yellow peas into high-purity protein isolate in Strathmore, Alberta. Turkey processor West Liberty Foods also announced plans for a USD 100 million processing facility in its native Iowa.

- Furthermore, in January 2022, Tyson Foods announced it would invest USD 355 million to build a state-of-the-art bacon plant in Bowling Green, Ky. The project is part of Tyson's commitment to meet increasing retail and food service demand for bacon products. The new facility is expected to create 450 jobs, with production beginning in late 2023.

- Grupo Bimbo was the Mexican food company with the largest net revenue in 2021, over MXN 345 billion (USD 17.02 billion).

- Pepsico was North America's leading food and beverage company overall in the 2021 financial year. The corporation had over USD 47.6 billion in sales from food and beverages processed on the continent. In the same year, Pepsico had a net revenue of USD 79.47 billion from its global operations.

- All the factors above depict a positive outlook on using industrial flooring in the food and beverage industry during the forecast period.

China to Dominate the Market in the Asia-Pacific Region

- The Asia-Pacific region dominated the global market, expected to continue during the forecast period. China is one of the major countries in Asia-Pacific, with ample construction activities supported by the growing economy.

- The chemical industry in the country grew drastically over the past two decades, in line with the overall growth of the country and the fundamentals of the key industries. China represents about one-third of the worldwide demand for chemicals.

- China is the world's largest manufacturer of chemicals, accounting for 43% of worldwide chemical sales in 2021, with a value of EUR 1,729 billion (USD 2,018 billion). From the 28.3% reported in 2011, China's global chemicals market sales share increased to 43.0% in 2021.

- The food processing industry is moving toward maturity in the country, witnessing moderate growth. The consumption trend of healthy, natural, and convenient ready-to-drink smoothies, juices, and yogurts is emerging in the beverage industry.

- In North China, there are about 42,577 food and beverage manufacturers, accounting for annual sales of over CNY 20 million (USD 2.95 million). There is continuous growth in the country's consumption of processed food products.

- China is the second-largest market for pharmaceuticals globally. The pharmaceutical market is growing rapidly, owing to the increasing middle-class and aging society present in the country, rising income levels, and increasing urbanization.

- China's pharmaceutical sector made over CNY 3.3 trillion (USD 487 billion) in total sales in 2021, an increase of about 20% yearly. The two main pharmaceutical industries in the nation are those that produce pharmaceutical preparations and Chinese patent medicines.

- Owing to all these factors, the region's industrial flooring market is projected to rise during the forecast period.

Industrial Floorings Industry Overview

The global industrial flooring market is highly fragmented in nature. Some major players in the market (not in any particular order) include Sika AG, RPM International Inc., Akzo Nobel NV, MBCC Group, and Nippon Paint Holdings Co. Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Awareness about the Advantages of Industrial Flooring

- 4.1.2 Increasing Demand from the Food and Beverage Industry

- 4.2 Restraints

- 4.2.1 Stringent Regulations on VOCs Released on Flooring

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Epoxy

- 5.1.2 Polyaspartic

- 5.1.3 Polyurethane

- 5.1.4 Acrylic

- 5.1.5 Other Resin Types

- 5.2 Application

- 5.2.1 Concrete

- 5.2.2 Wood

- 5.2.3 Other Applications

- 5.3 End-user Industry

- 5.3.1 Food and Beverage

- 5.3.2 Chemical

- 5.3.3 Transportation and Aviation

- 5.3.4 Healthcare

- 5.3.5 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3TREESGROUP

- 6.4.2 Akzo Nobel NV

- 6.4.3 Axalta Coating Systems

- 6.4.4 MBCC Group

- 6.4.5 Florock

- 6.4.6 Fosroc Inc.

- 6.4.7 JOTUN

- 6.4.8 LATICRETE International Inc.

- 6.4.9 Michelman Inc.

- 6.4.10 Nippon Paint Holdings Co. Ltd

- 6.4.11 PPG Industries Inc.

- 6.4.12 RPM International Inc.

- 6.4.13 Sika AG

- 6.4.14 Teknos Group

- 6.4.15 The Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Popularity of Eco-friendly Bio-based Flooring

- 7.2 Promising Performance of Polyaspartic Coatings