|

市场调查报告书

商品编码

1641944

聚氨酯添加剂:市场占有率分析、行业趋势、统计和成长预测(2025-2030 年)Polyurethane Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

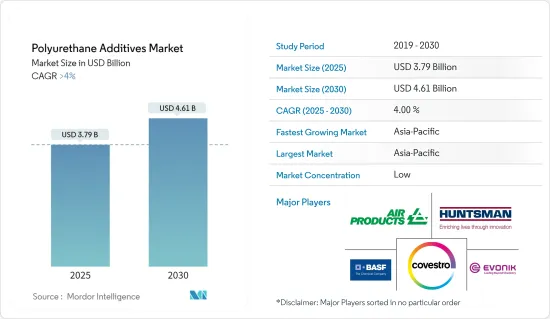

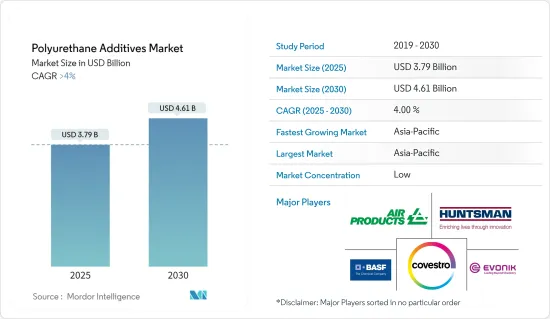

聚氨酯添加剂市场价值预计在 2025 年达到 37.9 亿美元,预计到 2030 年将达到 46.1 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 4%。

新冠肺炎疫情为市场带来了负面影响。生产和流动放缓,由于遏制措施和经济动盪,各行各业被迫推迟生产。现在,市场正从疫情中復苏。预计2022年市场将达到疫情前的水准并持续稳定成长。

主要亮点

- 建设产业对聚氨酯的需求不断增长预计将推动添加剂的消费。最大的应用之一是使用硬质聚氨酯泡棉作为墙壁和屋顶的隔热材料、隔热板以及门窗周围的缝隙填充材。这将促进市场成长。

- 另一方面,替代添加剂可用于与 PU 添加剂相同的应用。例如,有机硅和丙烯酸添加剂都是聚氨酯泡沫的有效添加剂。

- 对更具创新性和成本效益的添加剂的需求不断增长,预计将在未来几年为市场提供机会。

- 预计亚太地区将占据最大份额并在预测期内实现最高的成长率。

聚氨酯添加剂市场趋势

汽车产业需求不断成长

- 汽车产业是展示PU材料多样化应用的最佳例子之一。几乎所有类型的 PU 产品均用于汽车终端用户产业。

- 柔性聚氨酯发泡体用于汽车、飞机、火车、巴士等的座椅、头枕、扶手、暖通空调和其他内部系统。 PU涂料为汽车外部提供高光泽、耐用性、抗刮伤性和耐腐蚀性。 PU 涂层也用于挡风玻璃和窗户嵌装玻璃上,以增加强度并具有防雾功能。

- PU合成橡胶有助于防止轮胎穿孔,也可用于避震器等模製部件。热塑性聚氨酯材料用于製造许多汽车零件,包括车身外部零件、后行李箱衬里、防锁死煞车系统、正时皮带和燃油管路。 PU合成橡胶的独特性能使其专门用于垫圈、 O 型环和其他密封件。

- 座椅是聚氨酯在汽车产业的最大应用。许多汽车座椅製造商正在寻求在其产品中使用生物基多元醇。然而,在全球大多数聚氨酯市场中,「绿色」聚氨酯的市场渗透才刚开始。

- 在全球整体,超过 90% 的车辆采用单组分 PU 密封剂来将挡风玻璃和后玻璃黏合在一起。汽车产业是反应射出成型(RIM) PU 零件的最大终端用户产业。 RIM 用于汽车挡泥板、保险桿和扰流板,以最大限度地吸收衝击力,而不会增加重量或体积。

- 根据国际汽车製造商组织(OICA)的数据,2022 年全球汽车产量约为 8,502 万辆。这一数字比上年增长了约6%。 2022 年,中国、日本和德国将成为最大的汽车和商用车生产国,这将推动聚氨酯添加剂市场的发展。

- 然而,随着人们对汽油和柴油汽车造成的环境污染的担忧日益加剧,电动车产量预计将在未来五年内復苏。这可能会在预测期内刺激所研究市场的需求。

- 2023 年 8 月,总部位于密西根州的全球科技公司 Altair 和汽车研究中心 (CAR) 凭藉聚氨酯泡棉,将 Marelli 评选为 2023 年 Enlighten Awards 未来轻量化类别奖项。

- 此外,全球电动车市场正在大幅扩张,这对所研究的市场有利。例如,2022年全球电池电动车(BEV)和插电式混合动力车(PHEV)的销量将达到约1,050万辆,高于去年的677万辆,成长率为55%。

- 预计所有上述因素都将在预测期内推动市场发展。

中国可望主宰亚太地区

- 在亚太地区,中国是GDP最大的经济体。 2022年中国GDP占世界经济比重将达7.73%,GDP成长率与前一年同期比较3%。

- 中国是世界上最大的经济体之一,其建筑业的成长速度几乎让所有其他行业都相形见绌。 2022年,建筑业占中国国内生产总值比重与前一年同期比较6.9%,中国建筑业增加价值年增5.5%左右。

- 中国家具製造业的快速成长,很大程度上得益于不断增长的国内需求以及强劲的海外市场需求。

- 2022年,中国占全球家具产量的近53%。国内需求的成长和对欧洲国家的出口导致产量进一步增加。

- 根据OICA统计,中国自2009年起已成为全球最大的汽车製造国和市场。中国每年的汽车产量占全球总产量的32%以上,超过欧盟、美国和日本汽车产量的总和。

- 然而,预计未来几年电动车在该国的普及将推动对聚氨酯添加剂的需求。中国政府计画在2025年引进至少5,000辆燃料电池电动车,到2030年引进100万辆。预计在预测期内,政府对电动、混合动力汽车和燃料电池汽车的推广将推动市场研究。

- 由于这些因素,预计该国对聚氨酯添加剂的需求将会增加。

聚氨酯添加剂产业概况

聚氨酯添加剂市场因其性质而部分分散。主要参与者(不分先后顺序)包括 Evonik Industries AG、Air Products Inc.、Covestro AG、Huntsman International LLC 和BASF SE。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 建设产业对聚氨酯的需求不断增加

- 汽车产业需求增加

- 永续聚氨酯产品需求不断成长

- 限制因素

- 替代添加剂的可用性

- 严格的政府法规

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章 市场区隔(以金额为准的市场规模)

- 按类型

- 发泡

- 催化剂

- 阻燃剂

- 界面活性剂

- 其他添加剂(填料、乳化剂、交联剂)

- 按应用

- 黏合剂和密封剂

- 被覆剂

- 软质发泡成型

- 硬质泡沫

- 其他应用(合成橡胶、纤维、复合材料、医疗设备)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Air Products Inc.

- Covestro AG

- BASF SE

- Dow

- GEO Specialty Chemicals Inc.

- Huntsman International LLC

- Eastman Chemical Company

- Evonik Industries AG

- Momentive Performance Materials Inc.

- KAO Corporation

- Specialty Products Inc.

- Tosoh Corporation

第七章 市场机会与未来趋势

- 对更具创新性和成本效益的添加剂的需求不断增加

- 其他机会

The Polyurethane Additives Market size is estimated at USD 3.79 billion in 2025, and is expected to reach USD 4.61 billion by 2030, at a CAGR of greater than 4% during the forecast period (2025-2030).

The market was negatively impacted by the COVID-19 pandemic as there was a slowdown in production and mobility wherein industries were forced to delay their production due to containment measures and economic disruptions. Currently, the market has recovered from the pandemic. The market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

Key Highlights

- The rising demand for polyurethane in the construction industry will likely propel additives' consumption. One of the largest applications is the use of rigid PU foam as wall and roof insulation, insulated panels, and gap fillers for the space around doors and windows. Thereby augmenting the market's growth.

- On the flip side, the alternative additives can be used in some of the same applications as PU additives. For example, silicon additives and acrylic additives are both effective additives against PU foams.

- The increasing demand for more innovative and cost-effective additives is projected to act as an opportunity for the market in the future.

- The Asia-Pacific region is expected to account for the largest share and register the highest growth rate over the forecast period.

Polyurethane Additives Market Trends

Increasing Demand from the Automotive Industry

- The automotive industry provides one of the best examples of the diverse applications of PU materials. Nearly every type of PU product is used in the automotive end-user industry.

- Flexible PU foams are used in seating, headrests, armrests, HVAC, and other interior systems for automotive, like in airliners, trains, and buses. PU coatings provide a vehicle's exterior with high gloss, durability, scratch resistance, and corrosion resistance. PU coatings are also used for glazing windshields and windows, increasing strength and providing fog resistance.

- PU elastomers protect against tire punctures and are used in other molded components, such as shock absorbers. Thermoplastic PU materials are used to manufacture many automotive parts, including exterior body parts, trunk liners, anti-lock brake systems, timing belts, and fuel lines. The unique properties of PU elastomers contribute to their exclusive usage in gaskets, O-rings, and other seals.

- Seating is the largest application of PU in the automotive industry. Many automotive seating manufacturers demand products made with bio-based polyols. However, the market penetration of "green" PU is still emerging in most global PU markets.

- Globally, more than 90% of automobiles are produced with bonded windshields and rear windows using one-component PU sealants. The automotive industry is the largest end-user industry for reaction injection molding (RIM) PU parts. RIM is used to maximize the shock absorption of vehicle fenders, bumpers, and spoilers without adding weight or bulk.

- In 2022, according to the Organisation Internationale des Constructeurs d'Automobiles (OICA), around 85.02 million motor vehicles were produced worldwide. This figure translates into an increase of around 6% compared with the previous year. China, Japan, and Germany were the largest producers of cars and commercial vehicles in 2022, which is driving the PU additive market.

- However, with growing concerns about environmental pollution from petrol- and diesel-based vehicles, the production of electric vehicles is expected to pick up over the next five years. This is likely to drive the demand in the market studied over the forecast period.

- In August 2023, Global technology company Altair and the Center for Automotive Research (CAR), both based in Michigan, named Marelli as the 2023 Enlighten award winner in the Future of Lightweighting category for its polyurethane foam for interior products.

- Further, the global electric vehicle market is expanding significantly, which is benefitting the market studied. For instance, in 2022, around 10.5 million units of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) were sold across the globe, witnessing a growth rate of 55% compared to 6.77 million units sold in the previous year.

- All the factors above are expected to drive the market during the forecast period.

China is Expected to Dominate the Asia-Pacific Region

- In Asia-Pacific, China is the largest economy in terms of GDP. The GDP value of China represents 7.73% of the world economy in 2022 and has a 3% GDP growth compared to the previous year.

- China is one of the largest countries in the world, where the construction sector dominates almost all other sectors in growth. In 2022, the construction industry accounted for around 6.9% of China's gross domestic product, and the value added to the Chinese construction industry increased by about 5.5% compared to the previous year.

- The rapid growth of the furniture manufacturing industry in the country is majorly fueled by the increasing domestic demand, coupled with significant demand from the foreign market.

- China accounted for almost 53% of the global furniture production in 2022. The production was further increased rapidly due to the increase in domestic demand and exports to European countries.

- According to the OICA, China remains the world's largest automotive manufacturing country and automotive market since 2009. Annual vehicle production in China accounted for more than 32% of worldwide vehicle production, which exceeds that of the European Union or that of the United States and Japan combined.

- However, the popularity of electric vehicles in the country is expected to propel the demand for PU additives in the coming years. The Chinese government plans to have a minimum of 5,000 fuel-cell electric vehicles by 2025 and 1 million by 2030. The government promoting the use of electric, hybrid, and fuel-cell electric vehicles is expected to drive the market studied during the forecast period.

- Such factors are expected to increase the demand for polyurethane additives in the country.

Polyurethane Additives Industry Overview

The polyurethane additives market is partially fragmented in nature. The major players (not in any particular order) include Evonik Industries AG, Air Products Inc., Covestro AG, Huntsman International LLC, and BASF SE. among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand for Polyurethane in the Construction Industry

- 4.1.2 Increasing Demand from the Automotive Industry

- 4.1.3 Growing demand for sustainable Polyurethane products

- 4.2 Restraints

- 4.2.1 Availability of Alternative Additives

- 4.2.2 Stringent Government Regulations

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Blowing Agents

- 5.1.2 Catalysts

- 5.1.3 Flame Retardants

- 5.1.4 Surfactants

- 5.1.5 Other Additives( Filler, Emulsifiers, and Crosslinking Additives)

- 5.2 Application

- 5.2.1 Adhesives and Sealants

- 5.2.2 Coatings

- 5.2.3 Flexible Molded Foams

- 5.2.4 Rigid Foams

- 5.2.5 Other Applications (Elastomers, Fibers, Composites, and Medical Devices)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Air Products Inc.

- 6.4.2 Covestro AG

- 6.4.3 BASF SE

- 6.4.4 Dow

- 6.4.5 GEO Specialty Chemicals Inc.

- 6.4.6 Huntsman International LLC

- 6.4.7 Eastman Chemical Company

- 6.4.8 Evonik Industries AG

- 6.4.9 Momentive Performance Materials Inc.

- 6.4.10 KAO Corporation

- 6.4.11 Specialty Products Inc.

- 6.4.12 Tosoh Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for More Innovative and Cost-effective Additives

- 7.2 Other Opportunities