|

市场调查报告书

商品编码

1641948

招生管理软体-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Admission Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

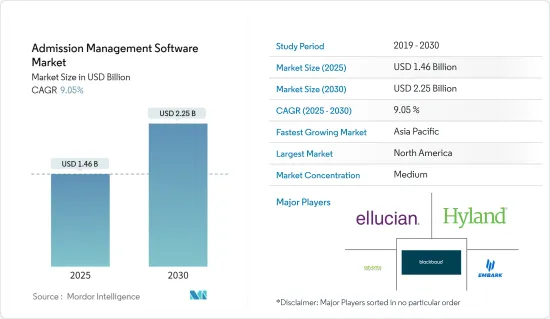

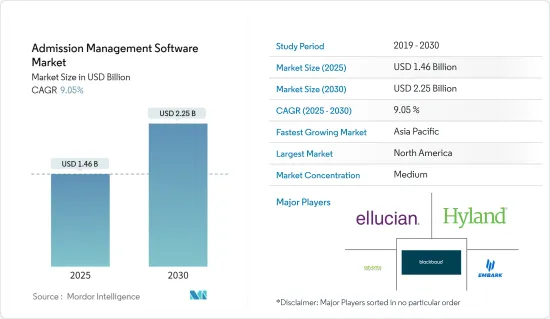

招生管理软体市场规模预计在 2025 年达到 14.6 亿美元,预计到 2030 年将达到 22.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.05%。

关键亮点

- 随着越来越多的学生寻求进入学校、学院和大学等教育机构,招生管理变得更具挑战性。手动且及时地完成此过程变得越来越困难。资料层面的管理也变得越来越繁琐。因此,招生管理软体的需求正在上升。

- 预计各大学的入学申请人数将持续增加,这将推动研究市场的发展。例如,康乃尔大学招生办公室表示,该校连续第三年申请新生人数创下历史新高。去年,入学申请人数为 51,328 人,比前一年的 47,038 人增加。

- 不同的公司提供一系列招生管理软体工具,以满足教育机构的不同需求。例如,我们开发的招生管理软体schooladmin 就是为了帮助教育机构成功。该系统策略性地将计费、註册和入学考试功能整合到一个平台上。这使得私立 K-12 学校能够吸引理想的家庭。透过提供无纸化招生,schooladmin 是实现这一目标的方法之一。该程式包含灵活和动态的形式,可以帮助提高转换率。自动化和客製化的录取使得录取过程变得轻鬆无忧。客製化的费用表和自动提醒使学校能够相对快速地获得资金。

- 招生管理软体可将招生流程和相关功能自动化。学生管理系统、ERP 系统、学校/学院会计模组或教育机构管理软体通常与招生管理软体结合。教育机构越来越多地采用技术解决方案、提高效率的需求不断增长以及降低营运成本是推动招生管理软体市场扩张的关键因素。

- 然而,通货膨胀率上升和乌克兰与俄罗斯衝突造成的持续混乱可能会对招生管理软体市场收益产生不利影响。由于文具和其他学习用品等必需品的价格上涨,新兴和欠发达经济体的人们可能需要帮助付款孩子的教育费用。这可能导致高中和大学的入学率大幅下降、辍学率上升。

- 冠状病毒大流行导致学生出席率急剧下降。儘管如此,COVID-19 疫情为招生管理软体业务创造了一些有趣的机会。疫情带来的一个重大影响是各个组织(包括教育部门)对数位科技的使用增加。由于学校、学院和大学关闭,线上申请已在很大程度上取代了线下面对面的入学流程。因此,招生管理软体变得越来越受欢迎。

入学考试管理软体的市场趋势

学校部门预计提供重大商机

- 随着多年来学校的申请人数不断增加,预计受调查市场的学校部分将为招生管理软体提供庞大的商机。中小学根据某些即时参数评估申请者的潜力后提供优先选择变得越来越困难。

- 根据国家教育统计中心的数据,从 2016 年到 2028 年,全国入学人数预计将增加 1.6%。入学人数的增加为本地和国际招生管理软体提供者创造了机会,可以开发新的解决方案来获得市场占有率并扩大其在各州的影响力。

- 同样,根据文部科学省的数据,截至去年5月,日本全国共有约4,800所高中,其中大部分是地方政府设立的公立学校。此外,根据法国国家教育、高等教育和研究部的数据,到2021年,法国公立小学的数量将达到4,3904所。

- 教育机构可以藉助招生管理软体接触更多的学生和家长。类似的特征有助于负责人保持学生的参与、保持管道畅通、并最终选择他们的学校。这也适用于续签录取。此外,这对教育机构也很有用,因为行销计划是学校扩张的决定性因素之一。此外,此类软体解决方案可为教育机构提供关键资料。这可以帮助学校进行招生管理流程并增强招生体验。

- 在国际上,经济合作暨发展组织(OECD)正在製定一项倡议,以确定「2030年教育和技能的未来」。预计此类计划将在预测期内推动所研究市场的需求。

预计北美将占据主要份额

- 预计预测期内北美将主导招生管理市场。人工智慧、巨量资料和数位转型通常是推动这一浪潮的技术发展过程的一部分。北美拥有最先进的招生解决方案。随着招生管理的好处越来越明显,公司越来越频繁地采用这种方法。学生和学校当局之间建立信任和安全框架的需求日益增长,这也促进了该地区市场的成长。

- 加州有几项管理学生资讯隐私的法律。 《学生网路个人资讯保护资料》(SOPIPA)将合规责任赋予了教育科技产业,并明确解决了学校科技使用的演变问题,而学校是美国最全面的学生教育。隐私法。 SOPIPA 明确禁止主要用于 K-12 教育目的的网站、线上服务或行动应用程式的营运商将涵盖的学生资料收集商业化。这包括出售学生资料、利用学生资料向学生及其家人发送广告或出于其他非教育原因收集学生资料。

- 伊利诺伊州《学生线上个人保护法案》(SOPPA)最近颁布,以取代 2017 年签署成为法律的原始法律。 HB 3606 主要被视为对严重资料外洩的回应,它强调学生资讯使用的透明度,为家长提供更大的资料使用控制权,并要求教育科技提供者(或「运营商」):),规定了义务对高等教育机构、地方教育委员会和其他相关人员。

- 美国教育机构对教育科技科技的采用正在加速,这些机构也用更现代、更有效的方法取代过时的方法。在 K-12 教育和成人学习中,从数位学习到人工智慧学习应有尽有。这些发展有可能显着改变美国教育格局,预计该行业将在审查期间迅速扩张。预计此类发展将增加入学人数并推动研究市场的发展。

- 云端基础的软体是向消费者在线上提供功能的软体服务。预计易于访问、适应性和可负担性等优势将在整个预测期内推动云端基础的招生管理软体市场的成长。职场和教育领域对行动性的需求不断增长,以及企业对云端运算的采用不断增加,预计将在未来几年推动市场成长。预计云端运算采用的这些好处将推动该地区市场的发展。

入学考试管理软体行业概况

招生管理软体市场竞争激烈,因为有许多大大小小的参与企业,并且分布在不同地点。市场集中度适中,主要企业采用产品和服务创新和扩张的策略。该市场的主要参与企业包括 Ellucian Company LP、BlackBaud Inc. 和 Hyland Software Inc.

- 作为 Workday AMS 合作伙伴,UST 将于 2023 年 4 月为 Workday 客户提供持续的功能、技术和管理支援。 Workday Financial Management 和 Workday HCM 支援基于财务和人才的流程,提供即时业务视觉性以及适应业务成长和变化的速度和灵活性。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 采用市场驱动因素与限制因素

- 市场驱动因素

- 优化组织的业务效率

- 对可扩展性的需求不断增加

- 市场限制

- 有关消费者资讯的潜在安全威胁

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 按应用

- 小学和国中

- 大学

- 研究所

- 培训机构

- 按部署

- 云

- 本地

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- Ellucian Company LP

- BlackBaud Inc.

- Hyland Software Inc.

- Advanta Innovations

- Embark Corporation

- Edunext Technologies Pvt Ltd

- Creatrix Campus

- Campus Cafe

- Dataman Computer Systems Pvt Ltd

- Orell TechnoSystems (India) Pvt Ltd

第七章投资分析

第八章 市场机会与未来趋势

The Admission Management Software Market size is estimated at USD 1.46 billion in 2025, and is expected to reach USD 2.25 billion by 2030, at a CAGR of 9.05% during the forecast period (2025-2030).

Key Highlights

- With an increase in the number of students seeking admission to academic institutions such as schools, colleges, and universities, admissions administration is getting more difficult. It has gotten tough to complete the process on time manually. Data level management has become cumbersome. As a result, the demand for admission management software is increasing.

- The rise in the number of admissions applications in various universities is expected to propel the studied market. For instance, according to its Office of Admissions and Enrollment, Cornell received the most applications for first-year admission in university history for the third year in a row. There were 51,328 candidates for access to the Class of last year, breaking the previous year's record of 47,038 applicants.

- Various firms are providing different admission management software tools to cater to the wide range of educational institutions' needs. For example, Software for enrollment and admissions called schooladmin is made to support the success of educational institutions. The system strategically integrates billing, registration, and admissions capabilities onto a single platform. This makes it possible for private K-12 schools to draw in the ideal families. By providing paperless admissions, schooladmin is one of the ways it makes such possible. The program contains flexible and dynamic forms that can aid in increasing conversion. And due to automated and tailored admissions, the enrolling process is hassle-free. Due to customized fee schedules and automatic reminders, schools can get funds relatively fast.

- Admission software automates the admission process and related features. The student management system, ERP system, school/college accounting module, or institute management software are frequently combined with admission software. The growing acceptance of technological solutions by educational institutions, the rising need for efficiency improvements, and the reduction of operating costs are the key factors projected to fuel the expansion of the admission management software market.

- However, the rising inflation rates, in tandem with the continued disruptions brought on by the conflict between Ukraine and Russia, could have a detrimental effect on the market revenues for admission management software. People in developing and undeveloped economies may need help paying for their children's education because of the growing costs of essential goods like stationery and other school supplies. As a result, the number of admissions may significantly reduce, and there may be an increase in high school and college dropout rates.

- The coronavirus outbreak reduced student attendance dramatically. Despite this, the COVID-19 pandemic has created intriguing opportunities in the admission management software business. One of the critical repercussions of the pandemic has been the rising use of digital technologies across organizations, including the education sector. Due to the closure of schools, colleges, and universities, online applications have replaced mainly offline, in-person admissions processes. As a result, admission management software is more popular.

Admission Management Software Market Trends

School Segment Projected to Offer Significant Opportunities

- The school segment of the market studied is anticipated to offer significant opportunities for admission management software, as the number of applications for schools is increasing every year. It is increasingly becoming challenging for primary and secondary schools to provide the preferred choice after evaluating the applicants' potential based on specific, real-time parameters.

- According to National Center for Education Statistics, Between 2016 and 2028, enrolment is anticipated to rise by 1.6 percent nationwide. Such a rise in enrollment in schools would create an opportunity for the local and international admission management software providers to develop new solutions to capture the market share and expand their presence in different states.

- Similarly, according to the Ministry of Education, Culture, Sports, Science, and Technology, In Japan, about 4.8 thousand upper secondary high schools were operating as of May last year, the bulk of which were public schools founded by the regional government. Further, according to the Ministry of National Education, Higher Education, and Research, the number of public primary schools in France reached 43,904 in 2021.

- Institutions can connect with more students and parents by utilizing admission management software. Similar characteristics can help recruiters keep them interested so they continue in the pipeline and eventually choose their institution. This is true for renewal enrollments as well. Additionally, this is useful for educational institutions because marketing plans are one of the elements that influence a school's expansion. In addition to that, such software solutions can offer crucial data that may be pertinent to institutions. It can assist schools in enhancing the enrollment management process and admissions experience.

- Internationally, the Organization for Economic Co-operation and Development (OECD) is working on an initiative to determine the Future of Education and Skills 2030 that will help education systems determine the knowledge, skills, attitudes, and values needed to thrive and shape the future. Such projects are expected to drive the demand for the studied market over the forecasted period.

North America is Expected to Hold Major Share

- Over the projected period, North America is anticipated to dominate the admission management market. AI, big data, and digital transformation, in general, are some of the developing technologies courses driving this surge. North America has access to the most cutting-edge entrance solutions. Businesses are adopting this method more frequently as the benefits of admission management become more apparent. The growing requirement to establish a reliable and secure framework between students and school administrations contributes to the regional market's growth.

- California has several laws governing the privacy of student information. The Student Online Personal Information Protection Act (SOPIPA), which places responsibility for compliance on the edtech sector, is widely regarded as the most comprehensive student data privacy law in the United States that expressly tackles the evolving nature of technology usage in schools. Operators of websites, online services, or mobile applications that are primarily used for K-12 educational purposes are expressly forbidden by SOPIPA from commercializing the collection of covered student data, including selling it, using it to target advertisements to students or their families, or collecting it for any other noneducational reason.

- The Student Online Personal Protection Act (SOPPA), Illinois, replaced the original law signed in 2017, which was enacted recently. HB3606, which is primarily seen as a response to significant data breaches, emphasizes transparency in the use of student information, gives parents more control over data use, and imposes obligations on educational technology providers (or "operators"), institutions of higher learning, local school boards, and other stakeholders.

- The adoption of EdTech technology by educational institutions in the USA is accelerating, and these institutions are also replacing antiquated methods with more modern, effective ones. For PreK-12 and adult learning, everything from eLearning to AI-powered learning exists. Numerous of these developments have the potential to alter the American educational landscape significantly, and in the time period under study, the industry is predicted to expand quickly. Such developments are expected to increase admission, driving the studied market.

- Cloud-based software is a software service that gives its consumers capabilities online. It provides advantages like simple access, adaptability, and affordability which are anticipated to fuel the growth of the cloud-based enrollment management software market throughout the forecast period. Over the coming years, market growth is expected to be driven by rising demand for mobility in the workforce and education and rising enterprise cloud computing use. Such advantages of cloud deployments would drive the market in the region.

Admission Management Software Industry Overview

The admission management software market is highly competitive due to the presence of many small and large players operating in various locations. The market is moderately concentrated, with the key players adopting strategies like product and service innovation and expansions. Some of the major players in the market are Ellucian Company LP, BlackBaud Inc., and Hyland Software Inc., among others.

- April 2023, As a Workday AMS Partner, UST will provide ongoing functional, technical, and administrative support to Workday customers. Workday Financial Management and Workday HCM support financial and people-based processes that help provide real-time operational visibility and the speed and agility to adapt to business growth and change.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Optimizing Operational Efficiency of Organizations

- 4.3.2 Increasing Demand for Scalability

- 4.4 Market Restraints

- 4.4.1 Potential Security Threats Regarding Consumer Information

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Primary and Secondary Schools

- 5.1.2 University

- 5.1.3 Research Institute

- 5.1.4 Training Institution

- 5.2 By Deployment

- 5.2.1 Cloud

- 5.2.2 On-premise

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Ellucian Company LP

- 6.1.2 BlackBaud Inc.

- 6.1.3 Hyland Software Inc.

- 6.1.4 Advanta Innovations

- 6.1.5 Embark Corporation

- 6.1.6 Edunext Technologies Pvt Ltd

- 6.1.7 Creatrix Campus

- 6.1.8 Campus Cafe

- 6.1.9 Dataman Computer Systems Pvt Ltd

- 6.1.10 Orell TechnoSystems (India) Pvt Ltd