|

市场调查报告书

商品编码

1641949

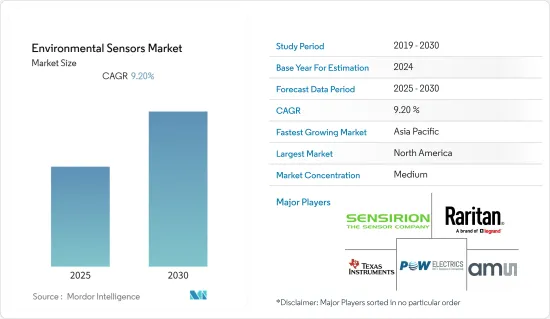

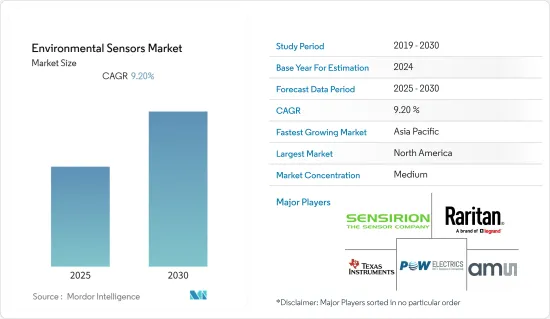

环境感测器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Environmental Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预测期内环境感测器市场预计复合年增长率为 9.2%

关键亮点

- 世界人口的成长同时促进了工业的发展和活跃。各行各业不可持续的做法导致全球土壤、空气和水质迅速恶化,导致有助于检测环境变化的设备的需求增加。

- 政府为控制环境污染而采取的措施不断增多,环境感测器市场也因此受到支持。例如,世界各国政府更加重视监测生态污染和减少气体污染造成的死亡,预计将增加对环境感测器的需求。

- 此外,随着工业4.0的发展,环境感测器预计将从多项创新且令人兴奋的城市计画中共同受益。例如,机器对机器 (M2M) 将包括製造流程和增强安全性的技术(例如工厂车间感测器)之间的交互作用。

- 为了满足各种需求,公司专注于提供专用于化学工业的工业感测器。例如,Sensortech Systems 提供其 RF 系列湿度感测器,其中包括粉状化学产品的湿度测量。该公司还提供红外线系列水分分析仪,可进行非接触式、连续、线上水分测量。此系列感测器提高了化学工业的自动化程度。

- 然而,缺乏意识、采用新技术的预算限制以及规律性模型阻碍了环境感知的发展。

- 儘管疫情加剧了工业领域的担忧,但却减少了全球的污染。冠状病毒大流行造成的最具体、最直接的环境变化之一是由于空气污染物排放减少而改善了空气品质。这是因为全球停工和关闭减少了能源消耗、运输使用和石油需求。例如,根据 5 月发表在《空气品质、大气与健康》杂誌上的一项研究,中国的 NO2(二氧化氮)排放从 1 月到 2 月下降了 70%。印度的降幅达20-30%。

环境感测器市场趋势

温度感测器推动环境感测器市场

- 智慧温度感测器是由温度感测器、偏压电路和类比数位转换器(ADC)组成的整合系统。温度感测器测量热量以确保製程保持在特定范围内,这在安全应用或处理极端高温、危险或无法接近的测量点时是必要的。

- 对可靠、高性能和低成本感测器的需求不断增长,推动了微技术、奈米技术等新技术的发展。由于成本低、体积小、使用方便,感测器已广泛应用于汽车、住宅、医疗、环境、食品加工和化学等各个行业。

- 在智慧家庭中加入温度感测器可以帮助住宅根据居住调节室内供暖,从而提高能源效率。远端恆温控制器等配备感测器的设备可以捕获每个房间的即时温度资料。

- 温度感测器整合在智慧摄影系统中,旨在为各个环节提供精确、非接触式的温度监控。应用包括製造过程控制、产品开发、废弃物管理、设施维护、排放气体监测以及环境、健康和安全 (EHS) 改进。

- 此外,温度感测器还可以在医学领域实现精确的非接触式温度测量。医生使用基于物联网的温度追踪器来测量耳朵、前额和皮肤的温度。此外,一些公司正在引入 IIoT 感测器来推动化学工业的自动化进程。例如,2021 年 1 月,Asystom 宣布推出 Asystom Sentinel EX,这是一款针对化学工业的组合式 3 轴振动、声学和超音波感测器。

亚太地区预计将创下最高成长率

- 亚太地区是全球经济成长最快的地区。该地区正在迅速采用智慧技术,例如智慧城市、自动驾驶汽车、物联网应用、家庭自动化、工业自动化和智慧处理技术。预计这些因素将推动市场成长。

- 近年来,亚太地区的连网型设备,包括联网汽车、智慧家庭设备、穿戴式装置和自动化机器。预计预测期内,对连网型设备的需求将推动环境感测器市场的发展。

- 印度是世界上发展最快的国家之一,政府正在大力投资先进技术和更具创新性的基础设施。这种快速发展使得中国的感测器在智慧型手机、汽车和医疗设备中广泛应用于。家用电子电器中最常见的感测器包括运动感测器、温度感测器和压力感测器。

- 施耐德表示,“印度的智慧家庭市场正在快速发展。”最初,智慧家庭主要被推销为配备有先进安全功能的住宅。如今,市场已转向照明系统、气体洩漏侦测器、火灾侦测系统、娱乐系统和能源效率系统等新的领域。因此,智慧家庭的成长可能会为环境感测器市场带来积极的前景。

- 此外,政府倡议控制环境污染水平,增加政府对污染控制和监测的资金投入,不断安装环境监测站,以及加大发展环保产业的倡议,这些都是推动全球成长的主要因素。

- 例如,2021年7月,印度政府地球科学部提案了一项深海任务,旨在探勘海洋资源并开发深海技术以可持续利用海洋资源,并获得了内阁经济事务委员会的核准。该计划预计五年内耗资约 407.7 亿印度卢比(约 4.925 亿美元)。

环境感测器产业概况

环境感测器市场主要企业较多,市场竞争适中。环境感测器市场的主要企业包括 AMS AG、Powelectrics Limited、德州仪器公司、欧姆龙公司、霍尼韦尔国际、Bosch Sensortec 和德州仪器。环境感测器市场的主要企业正在透过合作、创新、收购小型公司以及在全球范围内投资技术先进的产品系列来满足需求。

- 2022 年 9 月 - Sensirion 推出 STS4xA,这是一系列专为汽车应用设计的高度可靠的数位温度感测器。此感测器平台支援自动光学检查,并具有先进的机载诊断系统。

- 2022 年4 月- 全球光学解决方案公司AMS 宣布,绿色雷射二极体为平整、扫描、生物科学和点投影等应用提供了比红色雷射更亮、更易于使用、更可靠且更具成本竞争力的替代方案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

第五章 市场动态

- 市场驱动因素

- 政府加大污染监测与控制力度

- 发展环境友善产业

- 市场限制

- 污染治理改革薄弱

第六章 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第七章 COVID-19 的市场影响

第 8 章市场细分

- 依产品类型

- 固定式

- 可携式的

- 依感测类型

- 湿度

- 温度

- 气体

- 压力

- 按最终用户

- 医疗

- 家用电子电器

- 工业的

- 车

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 其他的

- 北美洲

第九章 竞争格局

- 公司简介

- AMS AG

- Powelectrics Limited

- Raritan Inc.

- Texas Instruments Inc.

- Sensirion Holding AG

- Eurotech SpA

- Omega Engineering Inc.

- Nesa SRL

- Eko Instruments BV

第十章 投资分析

第十一章 市场机会与未来趋势

The Environmental Sensors Market is expected to register a CAGR of 9.2% during the forecast period.

Key Highlights

- The growth of the global population has led to increased industrial development and activity simultaneously. The unsustainable practices across industries have resulted in rapid degradation of soil, air, and water quality worldwide, which has, in turn, led to an increase in the demand for devices that can help detect environmental changes.

- The environmental sensor market is supported by the growing number of government initiatives for curbing environmental pollution. For instance, the government's increasing focus worldwide on monitoring ecological pollution and reducing the number of deaths due to gaseous pollution is anticipated to increase environmental sensors' demand.

- Further, with the Industry 4.0 developments, environmental sensors are expected to collectively reap the benefits of multiple innovative and brilliant city initiatives. For instance, machine-to-machine (M2M) is scheduled to include interaction between technologies (such as factory floor sensors) to enhance manufacturing processes and safety.

- Companies are focused on providing industrial sensors dedicated to the chemical industry to cater to various needs. For instance, Sensortech Systems offers RF Series moisture sensor that includes moisture measurement for powdered chemical products. The company also gives IR Series moisture analyzers that provide a non-contact continuous online moisture measurement. This line of sensors further automation in chemical industries.

- However, lack of awareness, budgetary constraints to adopting new technology, and regularity models are the restraints to the growth of environmental sensing.

- Though the pandemic has increased concerns in the industrial sector, it has decreased pollution across the globe. One of the most tangible and immediate environmental manifestations of the coronavirus pandemic has been ameliorated air quality due to reduced air pollutant emissions. This is because lockdowns and closures worldwide led to reduced energy consumption, transportation use, and oil demand. In China, for instance, the emission of NO2 (nitrogen dioxide) dropped by 70% between January and February, according to a study published in May in the multidisciplinary journal Air Quality, Atmosphere, and Health. In India, a reduction of 20-30% was noted.

Environmental Sensors Market Trends

Temperature Sensors to Drive the Environmental Sensors Market

- A smart temperature sensor is an integrated system consisting of a temperature sensor, bias circuitry, and an analog-to-digital converter (ADC). A temperature sensor measures heat to ensure a process stays within a specific range, providing safe application usage or meeting a necessary condition when dealing with extreme heat, hazards, or inaccessible measuring points.

- The demand for reliable, high-performance, and low-cost sensors is increasing, leading to the development of new technologies, such as microtechnology and nanotechnology. The low cost, small size, and ease of use led the sensors to widespread use in various industries, such as automobile, residential, medical, environmental, food processing, and chemical.

- Integrating temperature sensors into smart homes help homeowners enhance their energy efficiency, as the heating inside the property is adjusted based on the occupancy. Sensor-equipped devices, such as remote thermostat controllers, get real-time temperature data from inside every house room.

- Temperature sensors are being incorporated into intelligent camera systems designed to offer accurate and non-contact temperature monitoring across various disciplines. The applications include manufacturing process control, product development, waste management, facilities maintenance, emissions monitoring, and environmental, health, and safety (EHS) improvements.

- Additionally, temperature sensors enable accurate non-contact temperature measurement in healthcare. Physicians use IoT-based temperature trackers to measure ear, forehead, or skin temperature. Moreover, Multiple companies are launching IIoT sensors to drive the automation of the chemical industry. For instance, in January 2021, Asystom announced the launch of AsystomSentinel EX, a combination of triaxial vibration, sound, and ultrasound sensors to cater to the chemical industry.

Asia-Pacific is Expected to Register the Highest Growth Rate

- The Asia-Pacific is the fastest-growing economic region in the world. The region is witnessing the rapid proliferation of smart technologies, such as smart cities, autonomous vehicles, IoT applications, home automation, industrial automation, intelligent processing technologies, and others. Such factors are expected to drive market growth.

- In recent years, the APAC region witnessed a notable surge in the usage of connected devices, including connected cars, smart home devices, wearables, and autonomous machines. Demand for connected devices is expected to drive the Environmental Sensors Market during the forecast period.

- India is one of the fastest developing countries in the world, with the government investing significantly in advanced technologies and more innovative infrastructures. With such rapid developments, sensors in the country are finding widespread applications in smartphones, automobiles, and healthcare. Some of the most common consumer electronics sensors include motion, temperature, and pressure sensors.

- Further, according to Schneider, "The smart homes market is fast evolving in the Indian context.' Initially, smart homes were marketed primarily as homes with advanced security features. The market is now changing into newer areas, like lighting systems, gas leakage detectors, fire detection systems, entertainment systems, and energy efficiency systems. Therefore, the growth of smart homes will lead to a positive outlook in the environmental sensors market.

- Moreover, increasing government initiatives to control environmental pollution levels, increasing government funding for pollution control and monitoring, ongoing installations of environment monitoring stations, and growing initiatives for the development of environment-friendly industries are some key factors driving the growth of the global market.

- For instance, in July 2021, a proposal from the Indian government's Ministry of Earth Sciences to pursue a Deep Ocean Mission to explore the ocean for resources and develop deep-sea technologies for sustainable use of ocean resources was cleared by the Cabinet Committee on Economic Affairs. The project has an estimated cost of about INR 4,077 crore (~USD 492.5 million) for five years.

Environmental Sensors Industry Overview

The environmental sensors market is moderately competitive because of many significant players in the market. The leading companies operating in the environmental sensors market are AMS AG, Powelectrics Limited, Texas Instruments Inc., Omron Corporation, Honeywell International, Bosch Sensortec, and Texas Instruments. Key players in the environmental sensor market are catering to the demand by collaborating, innovating, acquiring small players, and investing in a technologically-advanced product portfolio worldwide.

- September 2022 - Sensirion announces the STS4xA, a highly reliable digital temperature sensor series specifically designed for automotive applications. The sensor platform supports automated optical inspection and comes with an advanced onboard diagnosis system.

- April 2022 - AMS, a global company in optical solutions, has introduced a green laser diode which is a brighter, easier to use, more reliable, and cost-competitive replacement for red lasers in applications such as leveling, scanning, biosciences, and dot projection.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Government Initiatives for Pollution Monitoring and Control

- 5.1.2 Development of Environment-friendly Industries

- 5.2 Market Restraints

- 5.2.1 Weak Pollution Control Reforms

6 Industry Attractiveness - Porter's Five Forces Analysis

- 6.1 Bargaining Power of Suppliers

- 6.2 Bargaining Power of Consumers

- 6.3 Threat of New Entrants

- 6.4 Threat of Substitute Products

- 6.5 Intensity of Competitive Rivalry

7 Impact of COVID-19 on the Market

8 MARKET SEGMENTATION

- 8.1 By Product Type

- 8.1.1 Fixed

- 8.1.2 Portable

- 8.2 By Sensing Type

- 8.2.1 Humidity

- 8.2.2 Temperature

- 8.2.3 Gas

- 8.2.4 Pressure

- 8.3 By End-user

- 8.3.1 Medical

- 8.3.2 Consumer Electronics

- 8.3.3 Industrial

- 8.3.4 Automotive

- 8.3.5 Other End-users

- 8.4 Geography

- 8.4.1 North America

- 8.4.1.1 United States

- 8.4.1.2 Canada

- 8.4.2 Europe

- 8.4.2.1 Germany

- 8.4.2.2 United Kingdom

- 8.4.2.3 France

- 8.4.2.4 Rest of Europe

- 8.4.3 Asia Pacific

- 8.4.3.1 China

- 8.4.3.2 Japan

- 8.4.3.3 India

- 8.4.3.4 Rest of Asia-Pacific

- 8.4.4 Rest of the World

- 8.4.1 North America

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 AMS AG

- 9.1.2 Powelectrics Limited

- 9.1.3 Raritan Inc.

- 9.1.4 Texas Instruments Inc.

- 9.1.5 Sensirion Holding AG

- 9.1.6 Eurotech SpA

- 9.1.7 Omega Engineering Inc.

- 9.1.8 Nesa SRL

- 9.1.9 Eko Instruments BV