|

市场调查报告书

商品编码

1641951

行动加速器 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Mobile Accelerator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

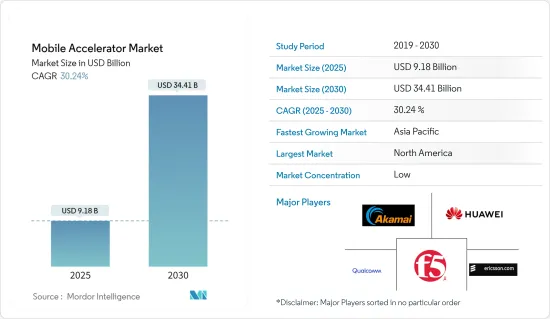

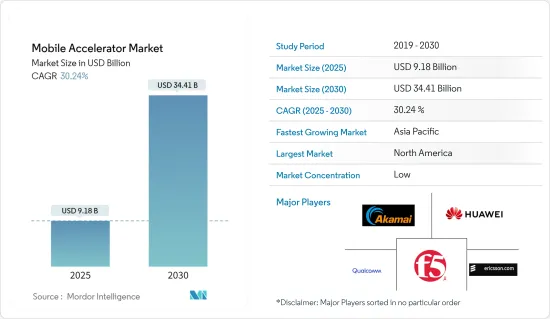

行动加速器市场规模预计在 2025 年为 91.8 亿美元,预计到 2030 年将达到 344.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 30.24%。

行动加速器使用多种技术来提高应用程式效能,包括资料压缩、内容优化和快取。它还有助于减少行动应用程式使用的资料量,这对于有限资料方案的用户尤其有用。

关键亮点

- 随着行动装置的使用增加以及行动应用在企业中变得越来越重要,对行动加速器的需求也随之成长。随着越来越多的企业依赖行动应用程式与消费者互动,对行动加速器来优化应用程式效能的需求也越来越大。

- 近年来,行动流量呈指数级增长,推动了行动加速器市场的发展。随着越来越多的人使用智慧型手机和平板电脑访问互联网,一些国家的行动流量现已超过桌面流量。此次市场扩张强调行动行销策略和方法,以吸引不断增长的受众。

- 行动加速器旨在加速和优化网路、内容、网路和应用程序,以获得商业优势并改善用户体验。为了降低行动用户的复杂性,该技术可协助网路营运商克服延迟、往返时间(RTT)等问题,并提高可扩展性、可用性和效能。

- 由于资料与第三方供应商共用,行动加速器市场面临重大的安全挑战。这些挑战可能会抑制市场成长,并阻碍企业和个人采用行动加速器。

- 在 COVID-19 疫情期间,行动加速器计划透过向新兴企业提供虚拟支援适应了新常态。疫情也导致数位技术的采用增加,为行动加速器计画创造了新的机会,以支持和指导行动应用领域的企业家。

行动加速器市场趋势

行动流量的增加和行动行销趋势预计将推动市场成长

- 随着行动装置的使用和采用的增加,对行动加速器的需求也不断增加。为了让您在竞争中占据优势,行动加速器可以帮助您优化应用程式效能并改善对您的业务至关重要的用户体验。

- 无线技术日益广泛的使用和行销正在推动对行动加速器的需求。行动加速器是一种软体工具,可以帮助应用程式在您使用的装置上更快、更有效率地运作。爱立信预计,全球 5G 用户数量将从 2019 年的 1,200 万增加到 2030 年的 40 亿。预计东北亚、东南亚、印度、尼泊尔和不丹的订阅数量将会增加。

- 行动装置已成为我们日常生活中不可或缺的一部分,用于通讯、娱乐、购物和社交媒体等各种用途。因此,对行动应用程式的需求不断增长,企业正在加紧开发这些应用程式以接触他们的客户。

- 此外,行动广告是任何数位行销策略的重要组成部分。它使用简讯、行动应用程式和网站等不同管道在智慧型手机和平板电脑等行动装置上推广服务和产品。

- 行动加速器用于确保行动应用程式以最佳方式运作。这些加速器有助于减少行动应用程式的载入时间,提高效能并提供更好的用户体验。它还优化了行动装置资源(如 CPU、记忆体和电池)的使用,从而延长了电池寿命并减少了资料使用量。

亚太地区预计成长最快

- 亚太地区行动加速器市场是一个快速成长的市场,涵盖一系列行动技术、应用程式和服务。行动加速器是指旨在增强行动应用程式和服务效能的技术。这些技术优化了行动装置和网路的效能,使得行动应用程式和服务运作得更顺畅、更有效率。

- 此外,随着行动技术的日益普及以及对高效能应用程式和服务的需求,亚太地区无线加速器市场预计将在未来几年快速成长。预计中国、印度和韩国等全球最大、最发达的无线市场国家将引领这一市场。

- 此外,中国政府正在大力投资先进的行动基础设施,包括推出 5G 网络,这可能会在未来几年进一步推动行动加速器服务的市场成长。

- 根据中国国家统计局 (NBSC) 的数据,截至 2023 年 2 月,中国行动电话用户约为 16.9 亿。根据政府官方统计,中国行动上网普及率为99.7%。中国企业和社会已经实现了先进的数位化。

- 由于行动技术的日益普及以及对高效能行动应用程式和服务的需求不断增长等因素,市场预计将继续增长。市场的发展导致了新技术和新服务的出现,从而进一步提高了该领域应用和服务的效能。

行动加速器产业概览

参与企业加速器市场由 Akamai Technologies Inc.、Qualcomm Inc.、Telefonaktiebolaget LM Ericsson、华为技术有限公司和 F5 Networks Inc.伙伴关係。获得可持续的竞争优势。

- 2023 年 11 月 - 高通宣布推出 Qualcomm Cloud AI 100 Ultra,这是一款专为生成式 AI 和大规模语言模型 (LLM) 构建的全新云端人工智慧 (AI) 推理卡产品组合。

- 2023年6月 - 除了这些创新实践,华为创造性将智能通讯业者核心网,并在创新的基础上成为构建智能、极简、弹性网络的参考。提供更好的服务成果,激发服务创新,实现体验收益,并加速5G经营模式的演进。从语音和视讯服务到差异化和智慧网路管理,核心网路的几乎每个方面都由这些实践提供支援。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 购买者/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 行动流量和行动行销趋势的增加

- 市场限制

- 与第三方供应商共用资料的安全挑战

第六章 市场细分

- 按设备

- 智慧型手机

- 药片

- 其他设备

- 按类型

- 内容/Web 应用程式

- 加速内容传输网路

- 广域网路优化

- 行动应用加速器

- 设备/用户端加速

- 其他的

- 按应用

- 游戏应用

- 行动商务应用

- 定位服务应用程式

- 社交网路应用程式

- 音乐和通讯软体

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Akamai Technologies Inc.

- Qualcomm Inc.

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co. Ltd.

- F5 Networks Inc.

- Juniper Networks Inc.

- Riverbed Technologies Inc.

- Ascom Holding AG

- Rockstart Inc.

- Flash Networks Inc.

- Mobidia Technology Inc.

第八章投资分析

第九章 市场机会与未来趋势

The Mobile Accelerator Market size is estimated at USD 9.18 billion in 2025, and is expected to reach USD 34.41 billion by 2030, at a CAGR of 30.24% during the forecast period (2025-2030).

Mobile accelerators use various techniques to improve app performance, including data compression, content optimization, and caching. They can also help reduce the amount of data mobile apps use, which can be particularly useful for users with limited data plans.

Key Highlights

- The rising use of mobile devices and the growing relevance of mobile apps for organizations drive the need for mobile accelerators. As more businesses rely on mobile applications to interact with consumers, the demand for mobile accelerators to optimize app performance will increase.

- Mobile traffic has increased drastically in recent years, which drives the mobile accelerator market. Mobile traffic has exceeded desktop traffic in several nations as more people use smartphones and tablets to access the internet. This development has emphasized mobile marketing strategies and approaches to target this expanding audience.

- In order to increase the business's strength and user experience quality, Mobile Accelerator is designed to accelerate and optimize web, content, network and applications. In order to reduce the complexity of mobile users, the technology helps network operators to overcome problems such as latency, round trip timeRTT, and to improve scalability, availability and performance, thereby reducing the complexity of mobile users.

- The mobile accelerator market faces significant security challenges as data is shared with third-party vendors. These challenges can restrain the market's growth and hinder businesses' and individuals' adoption of mobile accelerators.

- During the COVID-19 pandemic, mobile accelerator programs adapted to the new normal by offering virtual support to startups. The pandemic has also alloed to led to increased adoption of digital technology, creating new opportunities for mobile accelerator programs that support and guide entrepreneurs in the field of mobile applications.

Mobile Accelerator Market Trends

Increasing Mobile Traffic and Mobile Marketing Trends is Expected to Drive the Market Growth

- Demand for mobile accelerators is increasing as a result of an increase in the use and promotion of mobiles. In order to stay ahead of the competition, mobile accelerators help optimise application performance and improve user experience which is essential for businesses.

- There is a growing demand for Mobile Accelerators due to the increasing use and marketing of wireless technologies. Mobile accelerators are software tools that help your apps run faster and more effectively on the devices you use. According to Ericsson, the number of 5G subscriptions worldwide is projected to grow from 12 million in 2019 to 4 billion by 2030. In North East Asia, South East Asia, India, Nepal and Bhutan, the number of subscriptions is expected to increase.

- Mobile devices have become an integral part of one's daily lives, and people are increasingly using them for a variety of purposes, such as communication, entertainment, shopping, and social media. Consequently, there is an increase in demand for Mobile Applications and businesses are increasing their focus on developing these applications with a view to reaching out to customers.

- An essential element of digital marketing strategies has also been mobile advertising. This is to use different channels such as SMS, mobile applications, web sites for the promotion of services and products on mobile devices like smartphones and tablets.

- Mobile accelerators are being used to ensure that mobile applications perform optimally. These accelerators help reduce the load time of mobile applications, improve their performance, and provide a better user experience. They also optimize the use of mobile device resources such as CPU, memory, and battery, which results in increased battery life and reduced data usage.

Asia-Pacific Expected to be the Fastest Growing Region

- The Asia-Pacific Mobile Accelerator Market is a rapidly growing market that includes a range of mobile technologies, applications, and services. Mobile accelerators refer to technologies designed to enhance the performance of mobile applications and services. These technologies help to optimize the performance of mobile devices and networks, making it possible for mobile applications and services to run more smoothly and efficiently.

- In addition, due to the increase in adoption of Mobile technologies and rising demand for high performance applications and services, a rapid growth is expected over the coming years within the Asia Pacific region's wireless accelerator market. Countries, including China, India and South Korea, which have some of the world's largest and advanced wireless markets are expected to be driving this market.

- Moreover, China's government has invested a great deal on the development of its mobile infrastructure, including deployment of 5G networks, which is likely to further increase market growth for mobile accelerator services over the years ahead.

- As National Bureau of Statistics of China,NBSC In China, there were about 1.69 billion mobile phone subscribers as of February 2023. According to official government statistics, the country's mobile internet penetration rate was 99.7 percent. As a result, Chinese businesses and society have attained a high level of digitization.

- The market is expected to continue to grow in the coming future, driven by factors such as the increasing adoption of mobile technologies and the growing demand for high-performance mobile applications and services. New technologies and services which will further improve the performance of applications and services in this area are emerging as a result of market developments.

Mobile Accelerator Industry Overview

The Mobile Accelerator Market is highly fragmented with the presence of major players like Akamai Technologies Inc., Qualcomm Inc., Telefonaktiebolaget LM Ericsson, Huawei Technologies Co. Ltd, and F5 Networks Inc. Players in the market are adopting strategies such as partnerships, innovations, agreements, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In November 2023 - Qualcomm Inc. announce the Qualcomm Cloud AI 100 Ultra, a new member of our portfolio of cloud artificial intelligence (AI) Inference cards, purpose-built for generative AI and large language models (LLMs), The Qualcomm Cloud AI 100 Ultra is a programmable AI accelerator and can support recent advances in AI techniques and data formats.

- In June 2023 - In addition to this innovative practice,Huawei has been creative in introducing intelligence into core networks and on top of that innovation carried out a series of practices with operators aimed at providing references for building intelligent, simplified, flexible networks, stimulating service innovation, enabling experience monetization and speed up the evolution of 5G business models. Almost every aspect of core networks, from voice and video services to differentiation and intelligent network management, has been empowered by these practices.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Mobile Traffic and Mobile Marketing Trends

- 5.2 Market Restraints

- 5.2.1 Security Challenges as the Data is shared with Third-party Vendors

6 MARKET SEGMENTATION

- 6.1 By Device

- 6.1.1 Smartphones

- 6.1.2 Tablets

- 6.1.3 Other Devices

- 6.2 By Type

- 6.2.1 Content/Web Applications

- 6.2.2 Content Delivery Network Acceleration

- 6.2.3 WAN Optimization

- 6.2.4 Mobile Application Accelerator

- 6.2.5 Device/User End Acceleration

- 6.2.6 Other Types

- 6.3 By Application

- 6.3.1 Gaming Applications

- 6.3.2 M-Commerce Applications

- 6.3.3 Location-based Service Applications

- 6.3.4 Social Networking Applications

- 6.3.5 Music and Messaging Applications

- 6.3.6 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Akamai Technologies Inc.

- 7.1.2 Qualcomm Inc.

- 7.1.3 Telefonaktiebolaget LM Ericsson

- 7.1.4 Huawei Technologies Co. Ltd.

- 7.1.5 F5 Networks Inc.

- 7.1.6 Juniper Networks Inc.

- 7.1.7 Riverbed Technologies Inc.

- 7.1.8 Ascom Holding AG

- 7.1.9 Rockstart Inc.

- 7.1.10 Flash Networks Inc.

- 7.1.11 Mobidia Technology Inc.