|

市场调查报告书

商品编码

1641956

云端运算技术 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Cloud-Enabling Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

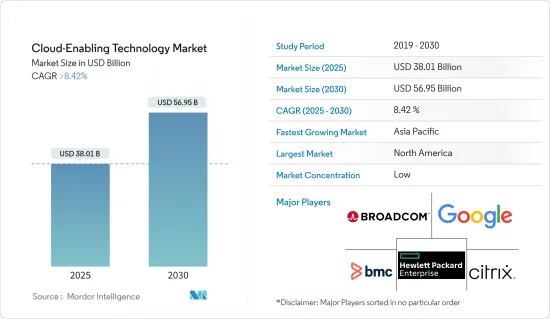

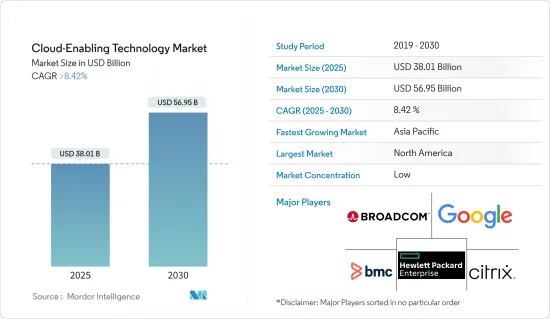

云端运算技术市场规模预计在 2025 年为 380.1 亿美元,预计到 2030 年将达到 569.5 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 8.42%。

随着物联网和巨量资料分析的范围不断扩大,对业务自动化程度提高的需求也日益增长。因此,云端技术对于确保无缝功能至关重要。

关键亮点

- 随着自动化在各个领域变得越来越普遍,主要是为了提高生产力,对云端运算的需求也不断增加。随着资料消费和分析以及关键储存和安全需求的指数级增长,云端运算技术将迎来大幅增长。

- 先进的云端服务现已满足大量客户的需求并帮助企业降低成本。云端运算技术领域的前景光明,因为云端技术具有敏捷性并能适应市场变化,使企业能够专注于核心竞争力,从而促进整体成长。

- 此外,在公共云端环境中提供可配置共用运算的私有云端部署模型由于其增强的隐私功能而越来越受欢迎,这对于资料敏感的组织尤其具有吸引力。

- 然而,安全仍然是首要问题,阻碍了市场的成长。许多国家的资料居住法规要求某些资料必须保留在国境内,这可能会限制资料中心位于海外的云端服务。

- 随着技术的进步,人工智慧有望与云端运算一起成为重要趋势。领先的科技公司正积极将人工智慧融入巨量资料处理中,以改善其部门和产出。透过利用AI解决方案,云端平台可以提高业务效率,实现更智慧的内部流程管理,并更容易适应不断变化的业务环境。

云端运算技术的市场趋势

资料中心技术将占据主要市场占有率

- 云端供应商严重依赖资料中心技术来支撑其基础设施和服务。截至 2024 年 2 月,德国以 522 个资料中心领先欧洲。资料中心本质上是集中组织 IT业务的专用建筑。美国在资料中心领域占据主导地位,在全球整体拥有超过 5,000 个资料中心。云端运算技术市场充满活力,不断出现创新和趋势。

- 现代软体技术围绕着云端资料中心展开,对于增强业务能力至关重要。随着劳动力越来越多地从办公室转向以行动为中心,对云端基础的资料中心的需求超过了传统设置。

- 在当今资料主导的业务中,了解客户行为、销售、市场动态等至关重要。企业利用先进的IT服务,利用资料中心和云端运算来优化其业务应用。在零售业中,资料中心主要管理资料流。

- 资料中心的主要优势之一是其可扩展性,使其能够快速回应不断变化的网路流量和业务需求。如果配置正确,这些调整可以无缝进行,并且对您的客户造成的干扰最小。此外,资料中心技术将整合人工智慧和机器学习,以增强预测分析、优化效能并自动执行日常任务。

- 虚拟技术是云端运算的基石,可以创建虚拟伺服器、储存和网路实例,并促进高效的资源分配和管理。

北美占有最大市场占有率

- 北美云端运算技术市场是一个重要的技术产业。该市场包括一系列技术、解决方案和服务,以促进企业和组织采用和使用云端运算。

- 云端管理编配工具在北美很重要,因为它们简化了云端资源的配置、管理和最佳化。该地区的公司经常投资此类解决方案以提高效率和成本效益。

- 北美的许多企业都选择混合和多重云端策略,将公共云端服务与私有云端基础设施或来自多个云端供应商的服务结合。这种方法需要先进的云端技术进行整合和管理。

- 环境永续性越来越受到北美关注。许多企业正在采用绿色资料中心技术并寻求支援其永续性的云端解决方案。

- 该地区的组织正在将 AI 和 ML 整合到他们的云端环境中,以增强分析能力、自动化任务并改善使用者体验。人工智慧和机器学习技术越来越多地被融入到云端解决方案中。

云端运算技术产业概览

云端运算技术市场高度细分,主要参与者包括 BMC Software Inc.、Broadcom Inc.(CA Technologies)、Citrix Systems Inc.、Hewlett Packard Enterprise Development LP 和 Google LLC。市场参与企业正在采取联盟和收购等策略来加强其产品供应并获得可持续的竞争优势。

2024年4月,富士通与甲骨文合作提供主权云端和AI功能,以满足日本企业和公共部门的数位主权需求。透过 Oracle Alloy,富士通将扩展其富士通 Uvance 的混合 IT 产品,帮助客户业务并解决社会挑战。富士通将在其日本资料中心独立营运 Oracle Alloy,从而增强其对营运的控制权。

2024 年 3 月,塔塔咨询服务公司 (TCS) 与丹麦数位连接和通讯提供商 Nuuday 签署了一份价值数百万美元的合同,用于其云端转型,以建立 Nuuday 的IT基础设施并将其迁移到TCS 的混合云端。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 购买者/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场动态

- 市场驱动因素

- 云端采用服务的兴起

- 业务生产力重点

- 市场限制

- 资料安全和隐私

第六章 技术简介

第七章 市场区隔

- 依部署类型

- 民众

- 私人的

- 杂交种

- 按服务类型

- PaaS(Platform-as-a-Service)

- SaaS(Software-as-a-Service)

- IaaS(Infrastructure-as-a-Service)

- 按技术和类型

- 宽频网路与网际网路架构

- 资料中心技术

- 虚拟技术

- Web 技术

- 多租户技术

- 按最终用户产业

- 银行、金融服务和保险(BFSI)

- 製造业

- 医疗

- 零售

- 通讯和 IT

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 亚洲

- 日本

- 中国

- 印度

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

- 北美洲

第八章 竞争格局

- 公司简介

- BMC Software Inc.

- Broadcom Inc.(CA Technologies)

- Citrix Systems Inc.

- Hewlett Packard Enterprise Development LP

- Google LLC

- IBM Corporation

- Tata Consultancy Services Limited

- Domo Inc.

- Adaptive Computing

- Fujitsu Ltd.

- Oracle Corporation

- Dell Technologies

- Microsoft Corporation

- Amazon Web Services

第九章投资分析

第十章 市场机会与未来趋势

The Cloud-Enabling Technology Market size is estimated at USD 38.01 billion in 2025, and is expected to reach USD 56.95 billion by 2030, at a CAGR of greater than 8.42% during the forecast period (2025-2030).

The expanding scope of IoT and big data analytics drives the need for enhanced automation in business operations. Consequently, cloud-enabling technologies are pivotal for seamless functionality.

Key Highlights

- As automation gains traction across diverse sectors, primarily to boost productivity, the demand for cloud computing is escalating. With a surge in data consumption and analysis and the critical need for storage and security, cloud-enabling technologies are poised for significant growth.

- Advanced cloud services now cater to many customers, aiding companies in cost reduction. Cloud technology's agility in adapting to market shifts allows businesses to concentrate on their core competencies, fostering overall growth and painting a positive outlook for the cloud-enabling technology sector.

- Moreover, the private cloud deployment model, offering configurable shared computing within a public cloud environment, is gaining popularity for its enhanced privacy features, especially appealing to organizations with data sensitivity.

- However, security remains a paramount concern, impeding the market's growth. Data residency regulations in many countries require that certain data remains within national borders, potentially limiting cloud services with data centers located abroad.

- As technology progresses, AI is poised to be a pivotal trend in tandem with cloud computing. Major tech players actively integrate AI into big data processing, aiming to elevate business functions and outputs. By leveraging AI solutions, cloud platforms enhance operational efficiency, enable smarter internal process management, and facilitate easier adaptation to evolving business landscapes.

Cloud-Enabling Technology Market Trends

Data Center Technology to Hold Significant Market Share

- Cloud providers heavily rely on data center technology to underpin their infrastructure and services. As of February 2024, Germany boasted 522 data centers, leading the pack in Europe. Data centers, essentially specialized buildings, centralize an organization's IT operations. The US dominates the data center landscape, housing over 5,000 facilities globally. The market for cloud-enabling technologies is dynamic, witnessing frequent innovations and trends.

- Modern software technology revolves around cloud data centers, pivotal in enhancing enterprise capabilities. As the workforce increasingly shifts from office-centric to mobile, the demand for cloud-based data centers surpasses that of traditional setups.

- Today's data-driven businesses rely on insights into customer behavior, sales, market dynamics, and more. Leveraging advanced IT services, companies use data centers and cloud computing to optimize their business applications. In retail, data centers primarily manage the data flow.

- One key advantage of data centers, notably scalability, is that they can swiftly adapt to changing web traffic and business demands. When appropriately configured, these adjustments occur seamlessly, minimizing customer disruptions. Moreover, data center technology integrates AI and machine learning, enhancing predictive analytics, optimizing performance, and automating routine tasks.

- Virtualization technology, a cornerstone of cloud computing, enables the creation of virtual servers, storage, and networking instances, facilitating efficient resource allocation and management.

North America Holds the Largest Market Share

- The North American cloud-enabling technology market is a significant technology industry. It encompasses various technologies, solutions, and services that facilitate businesses and organizations' cloud computing adoption and utilization.

- Cloud management orchestration tools are crucial in North America to streamline cloud resource provisioning, management, and optimization. Companies in the region often invest in these solutions to improve efficiency and cost-effectiveness.

- Many organizations in North America opt for hybrid and multi-cloud strategies, combining public cloud services with private cloud infrastructure or services from multiple cloud providers. This approach requires advanced cloud-enabling technologies for integration and management.

- Environmental sustainability is a growing concern in North America. Many organizations are adopting green data center technologies and looking for cloud-enabling solutions that support sustainability initiatives.

- Organizations in the region are integrating AI and ML into their cloud environments to enhance analytics, automate tasks, and improve user experience. AI and ML technologies are increasingly integrated into cloud-enabling solutions.

Cloud-Enabling Technology Industry Overview

The cloud-enabling technology market is highly fragmented, with major players like BMC Software Inc., Broadcom Inc. (CA Technologies), Citrix Systems Inc., Hewlett Packard Enterprise Development LP, and Google LLC. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

April 2024: Fujitsu Limited and Oracle collaborated to deliver sovereign cloud and AI capabilities that help address the digital sovereignty requirements of Japanese businesses and the public sector. With Oracle Alloy, Fujitsu will expand its Hybrid IT offerings for Fujitsu Uvance, which helps customers grow their businesses and solve societal issues. Fujitsu can operate Oracle Alloy independently in its data centers in Japan and have additional control over its operations.

March 2024: Tata Consultancy Services (TCS) signed a multi-million-dollar deal with Denmark's digital connectivity and communications provider Nuuday in cloud transformation to build Nuuday's IT infrastructure and migrate it to the TCS hybrid cloud.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers/Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in the Adoption of Cloud Deployment Services

- 5.1.2 Focus on Business Productivity

- 5.2 Market Restraints

- 5.2.1 Data Security and Privacy

6 TECHNOLOGY SNAPSHOT

7 MARKET SEGMENTATION

- 7.1 By Deployment Type

- 7.1.1 Public

- 7.1.2 Private

- 7.1.3 Hybrid

- 7.2 By Service Type

- 7.2.1 Platform-as- a-Service (PaaS)

- 7.2.2 Software-as-a-Service (SaaS)

- 7.2.3 Infrastructure-as-a-Service (IaaS)

- 7.3 By Technology Type

- 7.3.1 Broadband Networks and Internet Architecture

- 7.3.2 Data Center Technology

- 7.3.3 Virtualization Technology

- 7.3.4 Web Technology

- 7.3.5 Multitenant Technology

- 7.4 By End-user Industry

- 7.4.1 Banking, Financial Services, and Insurance (BFSI)

- 7.4.2 Manufacturing

- 7.4.3 Healthcare

- 7.4.4 Retail

- 7.4.5 Telecom and IT

- 7.4.6 Other End-user Industries

- 7.5 By Geography

- 7.5.1 North America

- 7.5.1.1 United States

- 7.5.1.2 Canada

- 7.5.2 Europe

- 7.5.2.1 United Kingdom

- 7.5.2.2 Germany

- 7.5.2.3 France

- 7.5.3 Asia

- 7.5.3.1 Japan

- 7.5.3.2 China

- 7.5.3.3 India

- 7.5.4 Australia and New Zealand

- 7.5.5 Latin America

- 7.5.6 Middle East and Africa

- 7.5.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 BMC Software Inc.

- 8.1.2 Broadcom Inc. (CA Technologies)

- 8.1.3 Citrix Systems Inc.

- 8.1.4 Hewlett Packard Enterprise Development LP

- 8.1.5 Google LLC

- 8.1.6 IBM Corporation

- 8.1.7 Tata Consultancy Services Limited

- 8.1.8 Domo Inc.

- 8.1.9 Adaptive Computing

- 8.1.10 Fujitsu Ltd.

- 8.1.11 Oracle Corporation

- 8.1.12 Dell Technologies

- 8.1.13 Microsoft Corporation

- 8.1.14 Amazon Web Services