|

市场调查报告书

商品编码

1641966

LED 晶片 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)LED Chips - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

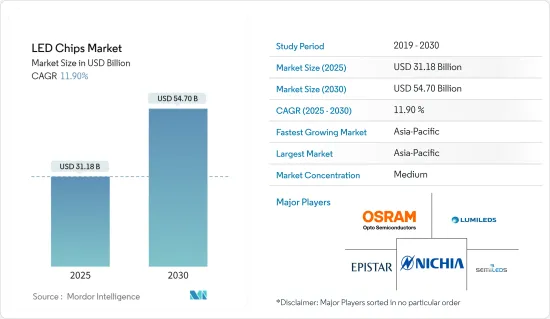

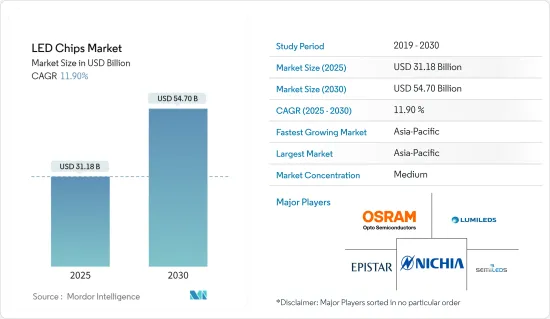

预计 2025 年 LED 晶片市场规模为 311.8 亿美元,到 2030 年将达到 547 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.9%。

成本、节能照明需求的不断增长以及其他各种因素正在推动对 LED 晶片的需求。因此,LED晶片市场的许多新兴市场都在寻求提供更有效率、更先进、更亮、耗电量更低的产品。

关键亮点

- 汽车产业在公司内部和外部采用 LED 照明方面处于领先地位。欧司朗是一家领先的照明製造商和汽车行业照明製造的先驱,为多家製造商供应照明设备。 3D列印技术的出现帮助供应商减轻了车载模组的重量。不过,此类应用仅限于豪华轿车。

- 此外,根据 LEDinside 最近的一份报告,Micro LED 技术在亮度和对比度方面的表现优于 OLED,同时具有快速响应时间、低功耗和可靠性,使其成为行动和汽车应用的热门选择。最好的选择。考虑到这些趋势,供应商正在增加对 Micro LED 生产的投资。例如,LED解决方案供应商友达光电于2023年4月宣布,计划将其位于台湾的LCD 5A晶圆厂改建为microLED生产线。据该公司称,新生产线预计将于 2025 年投入运作,并将瞄准可穿戴显示器、电视和指示牌显示器以及车载显示器等应用。

- 印度政府最近批准了一项在全国范围内向各类终端用户推出低成本 LED 的计划。据印度政府称,采用 LED 每年将节省超过 33.5 亿千瓦时的能源,并避免超过 6,725 兆瓦的尖峰需求。因此,这一趋势预计将促进该国对 LED 晶片製造的投资。

- 此外,全球LED晶片成长的另一个主要驱动力是渔业、医疗、海洋、园艺和港口照明等LED利基照明的进步。标誌和讯号越来越多地使用 LED 晶片。它们可以利用太阳能或电力运行,并可用于控制路口的车辆和行人交通。标誌和号誌灯采用低功耗的 LED 技术。

- 企业不断向新产品投入资金,以扩大LED在高端应用领域的使用。 2022年4月,Ams Osram宣布将投资8.5亿美元扩建位于马来西亚居林的LED生产厂。新厂将在8吋晶圆上生产LED晶片和Micro LED晶片。

- 然而,LED晶片对热敏感,这会降低其效率和寿命,尤其是在工业单位和製造工厂。

- 此外,俄罗斯和乌克兰之间持续的衝突可能会对电子产业产生重大影响。这场衝突已经加剧了半导体和能源供应链中的问题,晶片短缺已经影响这些产业。这种中断可能导致所需原材料价格波动和材料短缺。此外,由于中国是 LED 晶片的主要供应国之一,因此预计美国之间的贸易争端也将影响研究市场的成长。

LED晶片市场趋势

汽车预计将占据主要市场占有率

- 汽车製造业在全球范围内蓬勃发展,这也对汽车照明产业产生了积极影响。由于燃料成本降低和有害环境排放减少,电动车产量的增加对汽车照明市场的收益产生了重大影响。随着救护车和警车越来越依赖照明系统进行讯号传输,对高品质汽车照明解决方案的需求也日益增长。此外,政府有关道路安全的规定也促使汽车製造商采用 LED 等更高品质的照明解决方案。

- 根据中国中央政府的数据,到2025年中国汽车产量预计将达到3,500万辆。随着汽车产量的增加,对LED晶片的需求也预计将增加,这反过来有望对研究市场的成长产生正面影响。

- 同样,全球汽车产量的成长将推动对汽车 LED 晶片的需求。例如,根据OICA的数据,2023年全球汽车产量将达到约9,400万辆。这一数字与前一年同期比较增长了约6%。

- 考虑到不断增长的需求,供应商正在提出创新的解决方案。例如,2024年5月,达科电子(Daktronics)推出了最新的覆晶COB(Chip On Board)LED显示技术。达科电子窄像素间距 (NPP) 产品系列的最新成员,像素间距窄至 0.9 毫米,提高了耐用性、可靠性并降低了功耗。这些进步旨在改善客户体验。预计这些发展将进一步推动研究市场的成长。

- LED灯通常只消耗白炽灯十分之一的电力。因此,欧盟已正式认定 LED 头灯为节能产品。这就是欧司朗等公司为汽车产业提供各种 LED 的原因。例如,奥迪在新款奥迪 A8 车型的头灯中使用了欧司朗 LED。对于通用照明,欧司朗供应几乎所有 0.1W 至 5W 的 SMD LED,包括 3030、5050、5630 和 2835 等所有封装尺寸。

预计亚太地区将实现最高成长

- 亚太地区对家用电子电器和汽车的需求很高,由于技术创新的快速发展,这些设备和汽车也变得越来越复杂。因此,预计高功率和中功率LED 的需求将会成长。由于可支配收入的增加、都市化的快速发展以及消费习惯的改变,该地区已成为最大的家用电子电器市场,也是 LED 晶片的主要采用地区之一。例如,根据 IBEF 的数据,印度家用电子电器产业上年度的价值为 98.4 亿美元,预计到 2025 年将成长一倍以上,达到 1.48 兆印度卢比(211.8 亿美元)。

- 此外,印度政府正在积极推出倡议,进一步推动照明和能源效率的转型。例如,EESL 计划到 2024 年在印度农村地区街道照明国家计划 (SLNP) 下吸引总计 800 亿印度卢比(10.9 亿美元)的投资。该公司计划安装和维修约3000万盏LED路灯。预计此类投资将进一步推动市场成长。

- 同样,2022 年 11 月,浦那市政公司 (PMC) 宣布计划投资约 2 亿印度卢比(242 万美元)更换约 27,500 个旧的公共照明灯具。各地区和国家政府的此类措施预计将推动LED照明解决方案的采用,为研究市场的成长创造良好的前景。

- LED照明解决方案的采用正在增加,但最近美国之间的贸易争端正在阻碍中国LED晶片製造业的发展。例如,2023年1月,荷兰、日本等国加入美国行列,限制华半导体製造设备出口。不过,最近的事态发展已经使得一些中国晶片製造商在发展晶片製造能力方面取得了积极进展。预计这将对预测期内中国研究市场的成长产生正面影响。

LED晶片产业概况

LED晶片市场竞争适中,有几家大型企业。就市场占有率而言,只有少数大型企业占有重要地位。製造商专注于产品差异化以获得竞争优势。此外,製造商正试图透过强调其产品的卓越品质来增加销售量。主要市场参与企业包括 OSRAM Opto Semiconductors GmbH、Nichia Corporation 和 Lumileds Holding BV。

2023 年 7 月,高亮度蓝光和白光 LED 领先製造商日亚化学推出了 E11A(1.1mmX1.1mm)红色、亮红色和绿色,扩展了其可直接安装晶片的高通量密度解决方案产品组合。该公司希望,扩展的色彩组合将为照明灯具设计提供更大的灵活性,并扩大应用范围。

2023年7月,指示器的重点照明,以及仪錶群的功能和状态指示器。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- 评估宏观经济趋势对市场的影响

第五章 市场动态

- 市场驱动因素

- 设备背光应用推动LED晶片市场

- 研发投资和政府倡议

- LED 晶片功率效率

- 市场问题

- OLED 在家用电子电器产品的应用日益广泛

第六章 市场细分

- 按应用

- 背光

- 照明

- 车

- 标誌和信号

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- OSRAM Opto Semiconductors GmbH

- Nichia Corporation

- Lumileds Holding BV

- Epistar Corporation

- SemiLEDS

- Bridgelux Inc.

- TOYODA GOSEI Co.

- Seoul Viosys Co. Ltd

- Samsung Electronics. Co. Ltd

- Cree Inc.

- Formosa Epitaxy

第八章投资分析

第九章:市场的未来

The LED Chips Market size is estimated at USD 31.18 billion in 2025, and is expected to reach USD 54.70 billion by 2030, at a CAGR of 11.9% during the forecast period (2025-2030).

The increasing demand for cost, energy-efficient lighting, and various other factors drive up demand for LED chips. As a result, most developments in the LED chip market aim to provide more efficient and advanced products that offer more brightness and consume less power.

Key Highlights

- The automotive enterprise is at the forefront of LED lighting adoption, both internally and externally. OSRAM, a leading lighting manufacturer and pioneer in producing lighting for the automotive industry has supplied lighting equipment to several manufacturers. The ability to 3D print resulted in a lightweight module for automotive applications, aiding vendors. However, such applications have been limited to high-end vehicles.

- Moreover, a recent report published by LEDinside stated that Micro LED technology offers excellent performance in brightness and contrast that surpasses OLED and has a fast response time, low power consumption, and reliability, making it a perfect option for mobile and automotive applications. Considering such trends, vendors are increasing their investment in Micro LED production. For instance, in April 2023, AUO, a provider of LED solutions, announced its plans to convert its LCD 5A fab in Taiwan into a microLED production line. According to the company, the new production line is anticipated to go live by 2025 and will target applications such as wearable displays, TVs & signage displays, and automotive displays.

- The Government of India recently supported a plan to deploy low-cost LEDs nationwide among various end users. According to the Indian government, LED adoption drives annual energy savings of over 3,350 million kWh, avoiding over 6,725 MW of peak demand. Hence, such trends are anticipated to drive investment in LED chip manufacturing in the country.

- Furthermore, the other primary driver behind global LED chip growth is the advancement of LED niche lighting in fishing, healthcare, marine, horticulture, and harbor lighting. For signs and signals, LED chips are increasingly being used. These can operate on solar power or electricity and can be used to control both vehicle and pedestrian traffic at intersections. The Signs and Signal lights use LED technology with shallow power consumption values.

- Companies keep putting money into new products to increase the number of ways LEDs can be used in high-end applications. In April 2022, Ams Osram announced a USD 850 million investment to expand its LED production plant in Kulim, Malaysia. The new fab will produce LED chips and microLED chips on 8-inch wafers.

- However, a higher heat sensitivity of LED chips, which reduces their efficiency and life span, especially in industrial units and manufacturing plants, remains among the major challenging factors for the studied market's growth.

- Further, the ongoing conflict between Russia and Ukraine will significantly impact the electronics industry. The conflict has already exacerbated the semiconductor and energy supply chain issues and the chip shortage that have affected the industry for some time. The disruption may result in volatile pricing for necessary raw materials, resulting in material shortages. Furthermore, the US-China trade dispute is also anticipated to influence the studied market's growth as China is among the leading suppliers of LED chips.

LED Chips Market Trends

Automotive is Expected to Hold Major Market Share

- Vehicle manufacturing is on the rise around the world, which has a positive impact on the automotive lighting industry. The increasing production of electric automobiles heavily influences the automotive lighting market's revenue due to lower fuel costs and less harmful environmental emissions. As ambulances and police cars increasingly rely on lighting systems for signaling purposes, the demand for quality vehicle lighting solutions has increased. Furthermore, government regulations pertaining to road safety also encourage automobile manufacturers to adopt quality lighting solutions such as LEDs.

- According to the central government of China, by 2025, the country's automobile production is anticipated to reach 35 million units. With the growth in automobile production, the need for LED chips is expected to increase, which in turn is anticipated to impact the studied market's growth positively.

- Similarly, increasing global automotive production drives the demand for automotive LED chips. For instance, according to OICA, in 2023, some 94million motor vehicles were produced worldwide. This figure translates into an expansion of around 6 percent compared with the previous year.

- Considering the growing demand, vendors are launching innovative solutions. For instance, in May 2024, Daktronics launchedits latest Flip-Chip COB (Chip On Board) LED display technology. This new addition to Daktronics' Narrow Pixel Pitch (NPP) product range features pixel spacings as tight as 0.9 millimeters, offering enhanced durability, reliability, and reduced power consumption. These advancements are designed to elevate the customer experience.. Such developments will further drive the studied market's growth.

- LED lamps mainly consume only one-tenth of the electricity an incandescent lamp consumes. In this context, the European Union has officially recognized LED headlamps as energy-efficient. Hence, companies like OSRAM offer a broad range of LEDs for the automotive industry; for example, Audi is using OSRAM LEDs in the headlights of a new model of the Audi A8. For general lighting, OSRAM has almost all SMD LEDs from 0.1W to 5W in all dimension packages, i.e., 3030, 5050, 5630, 2835, and others.

Asia-Pacific is Expected to Witness the Highest Growth Rate

- The Asia-Pacific region has a good demand for consumer electronics and automobiles, where rapid technological changes result in high performance. As a result, the need for increased and medium-power LEDs is expected to rise. Given rising disposable income, rapid urbanization, and a shift in spending habits, the region has been the largest market for consumer electronics and is among the leading adopters of LED chips. For instance, according to IBEF, the Indian consumer electronics industry was valued at USD 9.84 billion in the previous year and is expected to more than double to INR 1.48 lakh crore (USD 21.18 billion) by 2025.

- Furthermore, the Indian government is actively introducing initiatives to move the country further along the path of transforming illumination and energy efficiency. For Instance, EESL intends to attract investments totaling INR 8,000 crores (USD 1.09 billion) under the Street Lighting National Programme (SLNP) by 2024, covering rural India. The company plans to install and retrofit approximately 30 million LED streetlights. Such investment will further drive the market's growth.

- Similarly, in November 2022, Pune Municipal Corporation (PMC) announced its plan to invest approximately INR 20 crore (USD 2.420 million) in replacing about 27,500 old public light fixtures. Such initiatives by various governments of different regions and countries across the region are expected to promote the adoption of LED lighting solutions, creating a favorable outlook for the growth of the studied market.

- Although the adoption of LED lighting solutions is on the rise, the recent US-China trade dispute has hampered the LED chip manufacturing industry in China. For instance, in January 2023, countries like the Netherlands and Japan also joined the United States in restricting the exports of semiconductor manufacturing equipment to China. However, in recent years, some of the Chinese chip manufacturing companies have been able to make positive progress in developing their chip manufacturing capabilities, which is anticipated to positively impact the studied market's growth in China during the forecast period.

LED Chips Industry Overview

The LED chips market is moderately competitive and consists of several leading players. Regarding market share, only some significant players hold a significant market presence. The manufacturers focus on product differentiation to gain a competitive advantage. The manufacturers also try to show their products superior quality to achieve higher sales. Some key market players include OSRAM Opto Semiconductors GmbH, Nichia Corporation, Lumileds Holding B.V., etc.

In July 2023, Nichia, a leading high-brightness blue and white LED producer, launched the E11A (1.1mmX1.1mm) Red, brilliant red, and green to expand its Direct Mountable Chip portfolio of high luminous flux density solutions. The company expects this expansion of the color portfolio to provide flexibility for the fixture designs and expand the application area.

In July 2023, ROHM, a leading semiconductor company, developed an RGB chip LED, SMLVN6RGBFU, ideal for automotive interiors, such as accent lighting for footwells and door handles, and function and status indicators in instrument clusters.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Backlighting Application of Devices Boosting the LED Chips Market

- 5.1.2 R&D Investments and Government Initiatives

- 5.1.3 Power Efficiency of LED Chips

- 5.2 Market Challenges

- 5.2.1 Growing Adoption of OLEDs in Consumer Electronics

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Backlighting

- 6.1.2 Illumination

- 6.1.3 Automotive

- 6.1.4 Signs and Signals

- 6.1.5 Other Applications

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 OSRAM Opto Semiconductors GmbH

- 7.1.2 Nichia Corporation

- 7.1.3 Lumileds Holding B.V.

- 7.1.4 Epistar Corporation

- 7.1.5 SemiLEDS

- 7.1.6 Bridgelux Inc.

- 7.1.7 TOYODA GOSEI Co.

- 7.1.8 Seoul Viosys Co. Ltd

- 7.1.9 Samsung Electronics. Co. Ltd

- 7.1.10 Cree Inc.

- 7.1.11 Formosa Epitaxy