|

市场调查报告书

商品编码

1641975

农业人工智慧 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)AI In Agriculture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

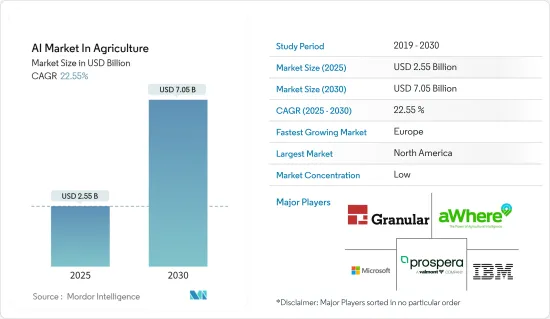

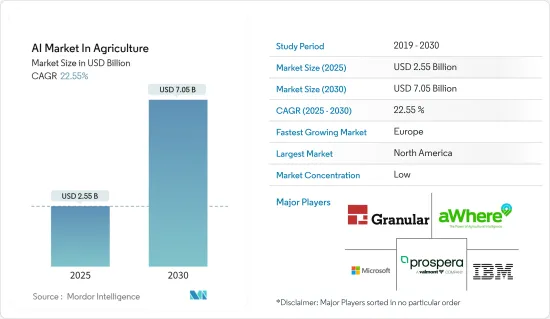

农业人工智慧市场预计将从 2025 年的 25.5 亿美元成长到 2030 年的 70.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 22.55%。

这些拖拉机使用基于 GPS 的技术来实现自动驾驶、将农具抬离地面、了解农场边界,并可使用平板电脑进行远端控制。一批小型自动驾驶拖拉机可以使农民的收益提高10%以上,并降低农场的人事费用。

关键亮点

- 利用机器学习技术最大限度地提高作物产量正在推动市场的发展。品种选择是一个艰苦的过程,需要寻找决定水和养分利用、气候变迁适应性、抗病性、营养价值和更好口感的特定基因。机器学习,特别是深度学习演算法,需要数十年的现场资料来分析不同气候条件下作物的表现。基于这些资料,我们可以建立机率模型来预测哪些基因最有可能赋予植物有益特性。

- 脸部辨识技术在牛的应用日益广泛,推动着市场的发展。透过应用先进的指标,例如牛脸部辨识程序和影像分类,结合身体状况评分和餵食模式,酪农现在可以单独监控牛群行为的各个方面。

- 无人机在农业中的应用有望扩大农业作业的范围,因为它们可用于使用小型频谱成像感测器扫描作物,使用机载摄影机创建 GPS 地图,运输重型有效载荷,并使用配备热感成像摄影机。人机(UAV)的使用正在增加,从而推动了对无人机的需求。

- 然而,资料收集和资料共用对标准化的需求很高,这限制了市场的成长。虽然机器学习、人工智慧和先进的演算法设计正在迅速发展,但有意义的、标记良好的农业资料的收集却落后了。

农业人工智慧 (AI) 市场趋势

无人机分析应用领域预计将占据相当大的市场占有率

- 无人机分析和人工智慧在农业领域的融合为优化农场运营、降低成本和提高永续性提供了巨大的潜力。透过利用人工智慧的力量分析无人机资料,农民可以做出资料驱动的决策,改善资源配置,并实现更高的生产力。因此,无人机分析有望成为农业市场人工智慧的关键驱动力。

- 无人机配备高解析度摄影机和感测器,可以捕获有关作物、土壤条件和田地特征的大量资料。结合人工智慧分析,这些资料可以为农民提供作物健康、营养水平、虫害和其他影响农业生产力的因素的宝贵见解。

- 人工智慧无人机分析透过提供有关田地内特定区域的详细信息,实现精密农业实践。透过使用人工智慧演算法分析无人机资料,农民可以识别作物生长、土壤湿度水平和害虫数量的波动。这允许进行有针对性的干预,例如精确施用肥料、农药和灌溉,从而优化资源利用并提高作物产量。

- 配备人工智慧分析功能的无人机可以监测作物的整个生长阶段。透过分析无人机影像和感测器资料,人工智慧演算法可以检测出植物压力、疾病爆发和营养缺乏的早期征兆。然后,农民可以采取主动措施,例如调整灌溉、采取适当的治疗措施和实施预防措施,以降低风险并优化作物健康。

- 人工智慧无人机分析使农民能够有效地监控大面积土地。无需进行耗时的人工检查,人工智慧演算法可以自动分析无人机资料并识别需要注意的区域。这使得操作更加高效,降低了人事费用,并使农民能够根据准确、及时的资讯做出决策。根据NASSCOM预测,到2025年,资料和人工智慧技术将为印度农业部门带来约900亿美元的收入。在所有领域,到 2025 年人工智慧预计将为印度的 GDP 增加约 5,000 亿美元。

预计北美将占据较大的市场占有率

- 北美农业人工智慧(AI)市场是农业技术产业的重要组成部分。北美农业人工智慧市场正在经历显着成长。随着人工智慧技术在农业领域的应用越来越广泛,预计未来几年市场将大幅扩张。提高生产力的需求、对精密农业技术的需求不断增长以及先进基础设施的可用性等因素促进了市场成长。

- 北美农民和农业企业正在采用人工智慧技术来提高效率、优化资源配置和增强决策流程。人工智慧在该地区农业产业的应用包括精密农业、遥感探测、作物监测、预测分析和自动化农业系统。这些技术帮助农民做出资料驱动的决策,以提高产量、降低成本并降低风险。

- 技术供应商、农业相关企业、研究机构和新兴企业之间的合作是北美农业人工智慧市场的特征。这些合作将促进创新并开发适合该地区农业部门特定需求的主导解决方案。对人工智慧新兴企业的合作和投资进一步促进了市场成长和技术进步。

- 北美各国政府认识到人工智慧在农业领域的潜力,并正在实施支持性政策和措施。这包括资助计画、研究津贴和法律规范,以促进农业领域人工智慧的采用和创新。这些努力将为人工智慧市场的成长提供有利环境,促进永续和有弹性农业的市场发展。

- 2023 年 1 月,美国和欧盟建立合作关係,利用人工智慧 (AI) 改善农业、气候预报、紧急应变和电网。目前,该合作是在欧盟委员会和欧盟 27 个成员国的执行机构白宫之间进行的。

农业人工智慧 (AI) 产业概览

- 农业人工智慧 (AI) 市场由微软公司、IBM 公司、Granular Inc.、aWhere Inc. 和 Prospera Technologies Ltd. 等主要企业细分。该市场的参与企业正在采用合作、协作和收购等策略来增强其产品供应并获得可持续的竞争优势。

- 2023 年 4 月,IBM 与 Texas A&M AgriLife 联手,为农民提供消费量洞察,以提高农业生产力并降低经济和环境成本。德州 A&M AgriLife 和 IBM 正在部署和推广 Liquid Prep,这是一项技术解决方案,可帮助农民决定何时在美国干旱地区浇水。

- 2022年5月,AGRA与微软扩大合作,支持农业数位转型。 AGRA和微软在达沃斯签署了一份谅解备忘录,就透过非洲转型办公室开展未来合作展开讨论。这两个组织将利用 2019 年建立的先前伙伴关係的成功经验来推动 AgriBot 的开发。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 购买者/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 对农业人工智慧 (AI) 市场的影响分析

第五章 市场动态

- 市场驱动因素

- 利用机器学习技术最大限度提高作物产量

- 牛脸部辨识技术的采用率不断提高

- 无人机在农业领域的应用日益广泛

- 市场限制

- 资料收集缺乏标准化

第六章 市场细分

- 按应用

- 天气追踪

- 精密农业

- 无人机分析

- 按部署

- 云

- 本地

- 杂交种

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

第七章 竞争格局

- 公司简介

- Microsoft Corporation

- IBM Corporation

- Granular Inc.

- aWhere Inc.

- Prospera Technologies Ltd.

- Gamaya SA

- ec2ce

- PrecisionHawk Inc.

- Cainthus Corp.

- Tule Technologies Inc.

第八章投资分析

第九章 市场机会与未来趋势

简介目录

Product Code: 64248

The AI Market In Agriculture Industry is expected to grow from USD 2.55 billion in 2025 to USD 7.05 billion by 2030, at a CAGR of 22.55% during the forecast period (2025-2030).

The driverless tractor is trending in the market, as these tractors can steer automatically using GPS-based technology, lift tools from the ground, recognize the boundaries of a farm, and be operated remotely using a tablet. A fleet of smaller automated tractors could raise farmer revenue by more than 10 percent and reduce farm labor costs.

Key Highlights

- Maximizing crop yield using machine learning techniques is driving the market. Species selection is a tedious process of searching for specific genes that determine water and nutrient use effectiveness, adaptation to climate change, disease resistance, nutrient content, or a better taste. Machine learning, in particular deep learning algorithms, takes decades of field data to analyze crop performance in various climates. Based on this data, one can build a probability model to predict which genes will most likely contribute a beneficial trait to a plant.

- An increase in the adoption of cattle face recognition technology is driving the market. By applying advanced metrics, including cattle facial recognition programs and image classification incorporated with body condition scores and feeding patterns, dairy farms can now individually monitor all behavioral aspects of a group of cattle.

- The increased use of unmanned aerial vehicles (UAVs) across agricultural farms is driving the market, as the use of drones in the agriculture industry can be used in crop field scanning with compact multispectral imaging sensors, GPS map creation through onboard cameras, heavy payload transportation, and livestock monitoring with thermal-imaging camera-equipped drones, which increases the demand for UAVs.

- However, the need for standardization is restraining market growth as the need for data collection and data sharing standards is high. Machine learning, artificial intelligence, and advanced algorithm design have moved quickly, but collecting well-tagged, meaningful agricultural data is way behind.

Artificial Intelligence (AI) in Agriculture Market Trends

Drone Analytics Application Segment is Expected to Hold Significant Market Share

- Integrating drone analytics and AI in agriculture offers tremendous potential for optimizing agricultural operations, reducing costs, and enhancing sustainability. By leveraging the power of AI to analyze drone-captured data, farmers can make data-driven decisions, improve resource allocation, and achieve higher productivity. Therefore, drone analytics is expected to be a significant driver of the AI market in agriculture.

- Drones with high-resolution cameras and sensors can capture vast amounts of data about crops, soil conditions, and field characteristics. Combined with AI-powered analytics, this data enables farmers to gain valuable insights into crop health, nutrient levels, pest infestations, and other factors influencing agricultural productivity.

- AI-powered drone analytics enable precision agriculture practices by providing detailed information about specific areas within a field. By using AI algorithms to analyze drone-captured data, farmers can identify variations in crop growth, soil moisture levels, or pest populations. This allows for targeted interventions, such as precise fertilizers, pesticides, or irrigation applications, leading to optimized resource utilization and increased crop yields.

- Drones equipped with AI-enabled analytics can monitor crops throughout their growth stages. By analyzing drone imagery and sensor data, AI algorithms can detect early signs of plant stress, disease outbreaks, or nutrient deficiencies. Farmers can then take proactive measures, such as adjusting irrigation, applying appropriate treatments, or implementing preventive measures, to mitigate risks and optimize crop health.

- Drone analytics powered by AI enable farmers to efficiently monitor large agricultural areas. Instead of conducting time-consuming manual inspections, AI algorithms can automatically analyze drone-captured data and identify areas requiring attention. This streamlines operations saves labor costs, and allows farmers to make informed decisions based on accurate and timely information. According to NASSCOM, by 2025, approximately USD 90 billion of value will be added to the agriculture sector through data and AI technologies in India. With all the sectors combined, artificial intelligence is projected to add approximately USD 500 billion to India's GDP by 2025.

North America is Expected to Hold Significant Market Share

- The North American artificial intelligence (AI) market in agriculture is a significant segment within the larger agricultural technology industry. The North American AI market in agriculture has been experiencing substantial growth. With the increasing adoption of AI technologies in the agricultural sector, the market is expected to expand significantly in the coming years. Factors such as the need for increased productivity, rising demand for precision farming techniques, and the availability of advanced infrastructure contribute to market growth.

- North American farmers and agricultural businesses embrace AI technologies to improve efficiency, optimize resource allocation, and enhance decision-making processes. AI applications in the region's agriculture industry include precision agriculture, remote sensing, crop monitoring, predictive analytics, and automated farming systems. These technologies help farmers make data-driven decisions, increase yields, reduce costs, and mitigate risks.

- Collaborations between technology providers, agriculture companies, research institutions, and startups characterize the North American AI market in agriculture. These collaborations foster innovation and the development of AI-driven solutions tailored to the specific needs of the region's agricultural sector. Partnerships and investments in AI startups further contribute to market growth and technological advancements.

- Governments in North America recognize the potential of AI in agriculture and are implementing supportive policies and initiatives. These include funding programs, research grants, and regulatory frameworks to foster AI adoption and innovation in the agricultural sector. Such initiatives provide a conducive environment for AI market growth and facilitate the development of sustainable and resilient agricultural practices.

- In January 2023, the United States and the European Union established a collaboration to improve agriculture, climate forecasting, emergency response, and the electric grid through the use of artificial intelligence (AI). The cooperation is now between the European Commission and the White House, the executive arm of the 27-member European Union.

Artificial Intelligence (AI) in Agriculture Industry Overview

- The artificial intelligence (AI) market in the agriculture market is fragmented with major players like Microsoft Corporation, IBM Corporation, Granular Inc., aWhere Inc., and Prospera Technologies Ltd. Players in the market are adopting strategies such as partnerships, collaborations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In April 2023, IBM and Texas A&M AgriLife collaborated to provide farmers with water consumption insights, which can boost agricultural productivity while lowering economic and environmental expenses. Texas A&M AgriLife and IBM will deploy and grow Liquid Prep, a technology solution that helps farmers decide "when to water" in dry parts of the United States.

- In May 2022, AGRA and Microsoft expanded their collaboration to help with the digital agricultural transformation. AGRA and Microsoft signed an MoU in Davos for future collaboration through its Africa Transformation Office. The organizations will leverage their success from a previous partnership started in 2019, which led to the development of the AgriBot.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers/Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Analysis on the impact of COVID-19 on the Artificial Intelligence (AI) Market in Agriculture

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Maximize Crop Yield Using Machine Learning technique

- 5.1.2 Increase in the Adoption of Cattle Face Recognition Technology

- 5.1.3 Increase Use of Unmanned Aerial Vehicles (UAVs) Across Agricultural Farms

- 5.2 Market Restraints

- 5.2.1 Lack of Standardization in Data Collection

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Weather Tracking

- 6.1.2 Precision Farming

- 6.1.3 Drone Analytics

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-premise

- 6.2.3 Hybrid

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microsoft Corporation

- 7.1.2 IBM Corporation

- 7.1.3 Granular Inc.

- 7.1.4 aWhere Inc.

- 7.1.5 Prospera Technologies Ltd.

- 7.1.6 Gamaya SA

- 7.1.7 ec2ce

- 7.1.8 PrecisionHawk Inc.

- 7.1.9 Cainthus Corp.

- 7.1.10 Tule Technologies Inc.

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219