|

市场调查报告书

商品编码

1641977

AI 晶片组:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)AI Chipsets - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

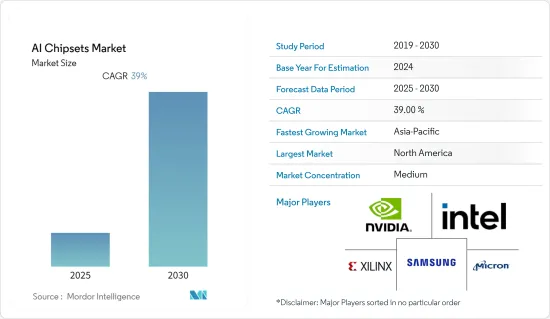

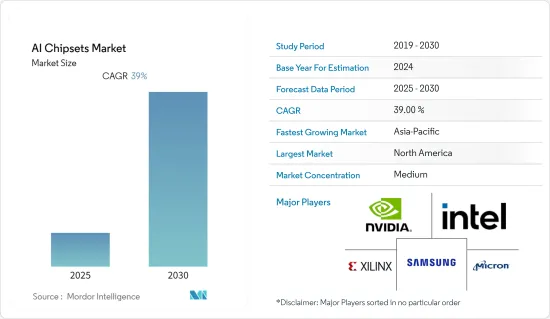

预计预测期内AI晶片组市场复合年增长率为39%。

主要亮点

- 汽车、金融和零售等多个领域对机器学习的需求正在迅速增长,推动了人工智慧技术的采用。 AI晶片在汽车产业最突出的应用包括生产无人驾驶汽车,以实现L5等级的自动驾驶技术。

- 人工智慧(AI)渗透到了消费性电子产品的几乎每个方面。它的用途不仅限于行动电话,而且还扩展到汽车产业。这种成长为半导体产业带来了许多新的视角。处理不断增加的资料量的需求是影响AI晶片组市场成长的主要因素。

- 此外,人工智慧有望在未来开闢许多商机,因为它使机器能够执行各种类似人类的活动。此外,人们对以人为本的人工智慧系统发展的日益关注也在推动市场成长。然而,技术纯熟劳工的短缺以及标准和通讯协定的缺乏阻碍了市场的成长。

- 随着人工智慧逐渐成为全球技术,对大量 ASIC 的需求预计会增加。亚马逊和谷歌等公司已开始努力增强其伺服器硅片。

- 公司正在利用人工智慧等新技术来设计新的人工智慧晶片。例如,根据2021年6月发表在《自然》杂誌上的一篇论文,Google正在其下一代AI晶片的设计中使用AI和机器学习。据该公司称,人工智慧将能够在不到六小时内完成人类需要数月才能完成的任务。

- 此外,神经型态研究的增加是人工智慧硬体领域的一个新兴领域,预计将推动对人工智慧晶片的需求。这里的直觉是开发受大脑实际神经功能启发的技术,因此得名神经形态。神经元的低能量和高品质输出激发了研究人员开发脉衝神经网路 (SNN) 的兴趣。然而,这些 SNN 需要自己的硬体。

- COVID-19疫情对AI晶片组市场的供应链和生产产生了不利影响。这对半导体製造商的影响是严重的。接受人工智慧来改善消费者服务并降低营运成本、人工智慧应用数量的不断增长、处理能力的不断提高以及深度学习和神经网路的日益普及是主要的市场驱动力。全球半导体供应链中的许多公司由于劳动力限製而限製或停止了运营,为依赖半导体的最终产品公司带来了瓶颈。

人工智慧晶片市场趋势

消费性电子产品可望强劲成长

- 由于新冠疫情,半导体晶片短缺导致全球消费性电子产品生产陷入停滞。然而,疫情导致对笔记型电脑、桌上型电脑和游戏机等家用电子电器的需求庞大,给产品公司、製造商和最终消费者带来了混乱。设备製造商加大力度满足动盪的消费科技市场的需求。预计晶片短缺和高需求的局面将在未来2-3年持续,推动消费性电子产品对AI晶片的需求。

- 量子计算技术在解决复杂问题和执行分析计算方面的应用日益广泛,市场可能会受益。例如,Google LLC 的量子计算机 Sycamore 是目前最快的计算机,能够在大约 200 秒内完成任务。人工智慧、机器学习、电脑视觉、巨量资料、AR/VR等技术正在实现量子运算。对量子运算的广泛了解将增加对人工智慧晶片组的需求,从而有助于推动产业成长。

- 人工智慧技术正在应用于汽车和製造业等各个行业,以简化流程。疫情期间,製造商专注于增强基于人工智慧的解决方案,这可能会使整个产业受益。例如,2020 年 5 月,Nvidia 公司更新了其 EGX Edge AI 平台,推出了新设备 EGX Jetson Xavier NX 和 EGX A100。

- 预计预测期内,家用电器类别将占据 AI 晶片组市场的很大一部分。平板电脑、智慧型手机等各类电子设备规格高端,市场需求强劲。众多製造商不断推出新型 AI 晶片组以满足日益增长的需求。例如,台湾晶片製造商联发科于 2022 年 5 月发布了用于物联网人工智慧 (AIoT) 装置的 Genio 架构及其 Genio 1200 晶片。联发科表示,基于 Genio 1200 晶片的高阶 AIoT 解决方案将于 2022 年下半年广泛普及。

- 人工智慧晶片组市场的发展受到对更快电脑处理器日益增长的需求以及对改善客户服务和降低营运成本日益增长的需求的推动。由于缺乏经验丰富的劳动力以及缺乏标准和通讯协定,该行业的发展受到阻碍。

亚太地区可望实现强劲成长

- 预计亚太市场将在韩国、印度和中国等新兴经济体的推动下实现显着成长。预计基于人工智慧的解决方案的日益接受将支持该地区市场的健康扩张。人工智慧晶片组在智慧型手机、平板电脑和笔记型电脑等家用电子电器的应用日益增多,其中包括整合语音命令等,这导致该地区对人工智慧晶片组的采用率很高。

- 日本是最早制定国家人工智慧政策的国家之一。日本的做法着重于利用人工智慧造福社会和经济,旨在扩大人工智慧研发技能,建立工业人工智慧系统,并为不断变化的劳动力市场做好工人的准备。 2019 年 6 月,首相安倍晋三宣布计画在 2025 年每年培训 25 万人接受人工智慧技能培训。

- 人工智慧晶片组在智慧型手机、平板电脑和笔记型电脑等消费性电子产品中的应用,包括整合语音命令、增强摄影体验以及根据过去的搜寻收集和分类相关资料,正在推动人工智慧晶片组的广泛采用。它带来了。

- 该地区是世界上最大的智慧型手机製造商和半导体公司的所在地。中国、日本、台湾和韩国约占全球智慧型手机製造商的80%。由于人口数量最多,智慧型手机的使用量正在上升,这很可能成为市场成长的驱动力。

- 该地区的多家市场参与者处于人工智慧晶片开发和製造的前沿。例如,2021年8月,中国科技巨头百度开始量产第二代昆崙AI晶片,旨在成为晶片产业的主要企业。根据百度介绍,新一代昆崙AI晶片采用7nm製程製程生产,算力较上一代提升2至3倍。

AI晶片产业概况

- 儘管一些大型和小型全球公司正在影响市场,但AI晶片组市场预计将逐步整合。该市场仍处于发展初期。目前业界知名的参与者包括英特尔公司、三星电子、NVIDIA 公司、赛灵思公司和美光科技。为了在AI晶片组市场占据主导地位,这些参与者正在进行合作、新产品创新和市场扩张等竞争策略进步。

- 2021 年 8 月-IBM 宣布推出一款新晶片 Telum,预计将使 IBM 客户能够大规模利用深度学习推理。该晶片采用集中式设计,使客户能够充分利用AI处理器的全部功能来处理AI专用工作负载,包括贷款处理,贸易清算和付款,诈骗检测和反洗钱,以及金融服务工作负载,例如风险分析。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 对 AI 晶片组市场的影响评估

第五章 市场动态

- 市场驱动因素

- 自动驾驶技术需求不断成长

- 物联网应用边缘分析的成长

- 市场限制

- 设计和人工智慧介面的复杂性

第六章 市场细分

- 按组件

- 中央处理器 (CPU)

- 图形处理单元 (GPU)

- 神经网路处理器(NNP)

- 其他组件

- 按应用

- 消费性电子产品

- 车

- 卫生保健

- 自动化和机器人

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东

第七章 竞争格局

- 公司简介

- Advanced Micro Devices Inc.(AMD)

- Xilinx Inc.

- Graphcore Ltd

- Huawei Technologies Co. Ltd

- IBM Corporation

- Intel Corporation

- NVIDIA Corporation

- Micron Technology Inc.

- Samsung Semiconductor(Samsung Electronics Co. Ltd)

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 64258

The AI Chipsets Market is expected to register a CAGR of 39% during the forecast period.

Key Highlights

- The rapidly growing demand for machine learning in multiple sectors, such as automotive, finance, and retail, boosts the adoption of AI technology. The most famous application of AI chipsets in the automotive industry includes manufacturing a driverless car to achieve the L5 level of autonomous technology.

- Artificial intelligence (AI) is entering nearly every aspect of consumer electronics. Its uses are growing beyond cell phones to include the automotive industry. This growth is bringing a slew of new prospects to the semiconductor industry. The requirement to process a constantly rising volume of data is a major element influencing the AI chipset market's growth.

- Moreover, as AI enables machines to perform various activities like those operated by human beings, numerous opportunities are expected to open in the future. Additionally, the growing focus on developing human-aware AI systems is boosting the growth of the market. However, the lack of a skilled workforce and the absence of standards and protocols are restraining the market growth.

- The need for a large number of ASICs is anticipated to rise as artificial intelligence gains more ground in global technology. Companies, such as Amazon and Google, are already in the process of fortifying their server silicon endeavors.

- Companies are using new technologies, such as artificial intelligence, to design new AI chips. For instance, as per a paper published in the journal Nature in June 2021, Google is using AI and machine learning to help design its next generation of AI chips. According to the company, work that takes months for humans can be completed by AI in under six hours.

- Furthermore, the increasing neuromorphic research is an emerging field within the areas of AI hardware anticipated to boost the demand for AI chips. The intuition here is to develop techniques inspired by the real neurons in the brain function; hence, the name neuromorphic was used. The low energy and high-quality output of neurons have enthused researchers to develop Spiking Neural Networks (SNNs). However, these SNNs require hardware of their own.

- The outbreak of COVID-19 has negatively impacted the AI chipsets market's supply chain and production. The impact on semiconductor producers was severe. The acceptance of AI for improving consumer services and reducing operational costs, the expanding number of AI applications, improving processing power, and the growing adoption of deep learning and neural networks are major market drivers. Many companies in the semiconductor supply chain worldwide restricted or even stopped operations due to workforce constraints, causing a bottleneck for semiconductor-dependent end-product companies.

AI Chipsets Market Trends

Consumer Electronics Is Expected to Witness Significant Growth

- Semiconductor chip shortage halted the production of consumer electronics worldwide due to the COVID-19 pandemic. However, the pandemic created a huge demand for consumer electronics, such as laptops, desktops, and gaming consoles, causing chaos for product companies, manufacturers, and end consumers. Equipment manufacturers focused on meeting this demand from the volatile consumer technology market. The chip shortage and high demand scenario are expected to continue until the next 2 to 3 years, driving the demand for AI chips for consumer electronics.

- The market will benefit from the increased use of quantum computing technologies to tackle complicated issues and perform analytical computations. For example, Google LLC's Sycamore quantum computer is the fastest computer, capable of completing work in roughly 200 seconds. Artificial intelligence, machine learning, computer vision, Big Data, AR/VR, and other technologies enable quantum computers. The expanding understanding of quantum computing will boost the demand for AI chipsets, thus boosting the industry's growth.

- AI technologies have been deployed in various industries, including automotive and manufacturing, to streamline processes. The industry may benefit from manufacturers' focus on enhanced AI-based solutions during the pandemic. For example, in May 2020, Nvidia Corporation updated its EGX Edge AI platform by launching new devices, namely, the EGX Jetson Xavier NX and EGX A100.

- The consumer electronics category is likely to occupy a major proportion of the AI chipset market during the forecast period. Various electronic devices, such as tablets and smartphones, are in high demand in the market with high-end specifications. Numerous manufacturers are continuously introducing novel AI chipsets to cater to the rising demand. For instance, in May 2022, MediaTek, a Taiwanese chipmaker, announced the Genio architecture for artificial intelligence of things (AIoT) devices, as well as the Genio 1200 chip. Premium AIoT solutions based on the Genio 1200 chip will be widely accessible in the latter half of 2022, according to MediaTek.

- The AI chipsets market is being driven by the increasing need for high-speed computer processors and increasing demand for better customer services and lower operating costs. The industry is being restrained by a shortage of experienced labor and a lack of standards and protocols.

Asia-Pacific Is Anticipated to Witness Significant Growth

- The Asia-Pacific market is projected to grow significantly due to emerging economies like South Korea, India, and China. The increased acceptance of AI-based solutions will support the market's healthy expansion in the region. The growing application of AI chipsets in consumer electronics, such as smartphones, tablets, and laptops, involves integrating voice commands, among others, which has resulted in the high adoption of AI chipsets in the region.

- Japan was one of the first nations to adopt a national AI policy. Japan's approach, primarily focused on making AI helpful to both society and the economy, intends to expand AI R&D skills, build AI systems with industrial applications, and prepare workers for labor market transformations. In June 2019, Prime Minister Shinzo Abe unveiled a plan to train 250,000 people in AI skills annually by 2025.

- The integration of voice commands, enhancement of photography experience, gathering and sorting relevant data based on previous searches, and other applications of AI chipsets in consumer electronics, such as smartphones, tablets, and laptops, resulted in the high adoption of AI chipsets.

- The region is home to the world's largest smartphone manufacturers and semiconductor companies. China, Japan, Taiwan, and South Korea account for roughly 80% of smartphone manufacturers worldwide. The greatest population has led to increased smartphone usage, which is likely to drive market growth.

- Several market players in the region are at the forefront of developing and producing AI chips. For instance, in August 2021, Baidu, a Chinese tech giant, started mass-producing second-generation Kunlun AI chips to become a major player in the chip industry. According to Baidu, the new generation of Kunlun AI chips is produced using 7 nm process technology, with computational capability 2-3 times better than the previous generation.

AI Chipsets Industry Overview

- Though some small and large global companies have influenced the market, the AI chipsets market is expected to be moderately consolidated. The market is still in its early stages of development. Some of the prominent participants in the current industry include Intel Corporation, Samsung Electronics, NVIDIA Corp., Xilinx Inc., and Micron Technology. To obtain leading positions in the AI chipsets market, these players are engaged in competitive strategic advancements, such as collaborations, new product innovations, and market expansions.

- August 2021 - IBM announced a new chip, Telum, which is expected to allow IBM clients to leverage deep learning inference at scale. This chip features a centralized design enabling clients to leverage the full power of the AI processor for AI-specific workloads, making it suitable for financial services workloads, such as loan processing, clearing and settlement of trades, fraud detection, anti-money laundering, and risk analysis.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the AI Chipsets Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Demand for Autonomous Driving Technology

- 5.1.2 Growth in Edge Analytics for IoT Application

- 5.2 Market Restraints

- 5.2.1 Complexity in Design and AI Interface

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Central Processing Unit (CPU)

- 6.1.2 Graphics Processing Unit (GPU)

- 6.1.3 Neural Network Processor (NNP)

- 6.1.4 Other Components

- 6.2 By Application

- 6.2.1 Consumer Electronics

- 6.2.2 Automotive

- 6.2.3 Healthcare

- 6.2.4 Automation and Robotics

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Advanced Micro Devices Inc. (AMD)

- 7.1.2 Xilinx Inc.

- 7.1.3 Graphcore Ltd

- 7.1.4 Huawei Technologies Co. Ltd

- 7.1.5 IBM Corporation

- 7.1.6 Intel Corporation

- 7.1.7 NVIDIA Corporation

- 7.1.8 Micron Technology Inc.

- 7.1.9 Samsung Semiconductor (Samsung Electronics Co. Ltd)

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219