|

市场调查报告书

商品编码

1641990

球阀:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Ball Valve - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

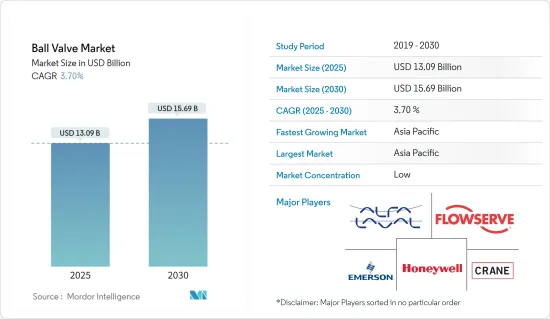

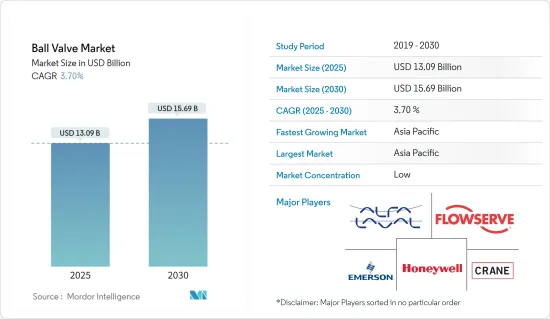

球阀市场规模预计在 2025 年为 130.9 亿美元,预计到 2030 年将达到 156.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.7%。

预计石油和天然气需求的大幅增加将成为推动球阀市场成长的关键因素之一。此外,快速工业化和都市化也是支撑新兴市场发展的关键因素。

关键亮点

- 球阀本质上是四分之一转驱动阀,其提供正向关闭的能力使其适用于工业应用中的清洁气体、压缩空气和液体服务。然而,如果用于泥浆服务,应采取措施防止碎片堆积。此外,这些阀门非常坚固,非常适合需要简单开/关动作的应用。它还非常耐用,无论使用多少次都能保持稳定的性能。

- 球阀是石油和天然气生产设备中应用最广泛的流体截止阀。这些阀门也用于供给熔炉的燃气系统。此类应用使得产油区和精製能力强大的地区成为产品供应商眼中颇具吸引力的目标。此外,由于此类工厂将透过浮动竞标进行开发,因此与此类解决方案提供者合作的市场供应商有望享有竞争优势。

- 在所有类型的材料中,不銹钢因其高耐腐蚀性而变得越来越重要,并且预计未来这种趋势仍将持续。由于阀门频繁开启和关闭,腐蚀会造成严重的问题。这些阀门能够更好地抵御恶劣的水质,这对食品加工厂来说是有益的。不銹钢阀门的压力等级高于黄铜等其他材料,这一事实进一步促进了其应用。

- 此外,根据阀口和阀座的数量,提供不同类型的球阀,如单向、双向和多通,补充了其工业应用。这些阀门是按照高压和低压管道分类製造的,进一步扩大了使用案例。多家供应商不断投资创新新产品,这是推动市场发展的主要因素之一。

- 阀门技术的进步,包括智慧阀门的出现以及自动化和控制系统的加入,为市场带来了新的视角。日益增长的环境问题和监管要求推动了对环保和节能阀门的需求。提供排放最小、洩漏率低且能源效率更高的球阀的製造商可以利用对永续解决方案日益增长的需求。

- 球阀的直径通常较大,而蝶阀等替代类型的阀门阀桿往往较小且较弱。在空间限制和结构负荷至关重要的情况下,例如在海上钻探平臺和浮式生产储油卸油设备)上,使用者会选择球阀的替代品。此外,流量控制的精度有限对研究市场的成长提出了挑战。

球阀市场趋势

食品加工产业可望成为重要应用

- 食品加工产业是球阀具有重要应用的一个显着领域。产品填充过程需要维持受控的流量,因此球阀是不可或缺的零件。本行业使用的阀门有两种类型:直接与材料接触的阀门和用于水和蒸气等公共产业服务的阀门。无论哪种情况,阀门都必须符合多项工业法规,特别是与食品材料接触的法规。这对製造商获得监管部门批准和设计符合严格工业标准的阀门提出了重大挑战。

- 球阀在控制和维持大容量、温度和压力方面非常有效。在食品饮料领域,卫生级球阀用于连接和调节输送管道,采用不銹钢材质,确保了输送流体的纯度、稳定性和品质。卫生阀门也更容易消毒和清洗,促进卫生。随着各供应商不断推出产品,市场预计将会成长。

- 例如,2022 年 11 月,驱动阀和设备控制装置製造商 Valworx 最近推出了一系列适合部署在食品和饮料製造领域的新型卫生球阀。这些球阀具有可见的位置指示器,并与 Namur 和 ISO 支架相容。阀门有二通阀和三通阀,尺寸从 0.5 英吋到 4 英吋不等。新系列阀门符合 FDA、USDA 和 3-A 标准。

- 不銹钢因其广泛的耐腐蚀性能而日益被视为一种重要材料,而耐腐蚀是食品加工领域关注的主要问题。这些阀门在暴露于更具腐蚀性的水成分时也表现出优异的耐用性,为食品加工厂提供了显着的优势。此外,与黄铜等替代材料相比,不銹钢阀门的压力等级更高。例如,典型的 1 英吋黄铜球阀的压力额定值为 600 PSI,而相同尺寸的标准不銹钢球阀的压力额定值为 1,000 PSI。此特性使其特别适合食品加工产业的高压应用。

- 世界各地都市化的上升导致对包装食品的需求大幅增加。此外,生活方式的改变(尤其是都市区的生活方式)也导致包装和加工食品的需求不断增加。为确保粮食安全、实现自给自足的目标,各国正透过监管改革、建立经济特区等努力发展食品加工产业。

- 根据人口实验室预测,2023年全球都市化将达57%。北美、拉丁美洲和加勒比海地区处于领先地位,城市人口超过80%。

- 在其他国家也观察到了所研究市场成长的良好前景。印度工业和国内贸易促进部报告称,预计2022年印度食品加工行业的投资将达到1,203.7亿印度卢比(14.7亿美元)。食品加工部 (MPF) 正在努力鼓励整个价值链上的投资,包括透过实施 PLI 计划,到 2026-27 年将食品加工能力扩大近 3000 亿印度卢比(36 亿美元)。直接和间接就业机会。这些倡议预计将为球阀提供重大机会。

预计北美将占据较大的市场占有率

- 北美是球阀的主要市场,石油和天然气、电力、食品包装和化学品等多个行业的需求强劲。美国和加拿大表现出巨大的需求,这进一步刺激了工业自动化的快速融合。预计这一趋势将刺激该地区球阀市场的需求。

- 北美对智慧球阀的需求日益增长。该地区的重点产业正在转向具有嵌入式处理器和网路功能的球阀,以补充透过中央控制站协调的先进监控技术。製程工业中自动化的日益应用将进一步加强这一需求趋势。

- 与加拿大相反,美国在成长区域需求方面发挥关键作用。在美国,几乎所有终端用户领域的需求都在成长,其中石油和天然气、精製和发电领域的需求最大。能源消费量的上升是这些产业需求增加的主要驱动力。例如,根据美国能源资讯署的数据,2022 年美国即时能源消耗总量约为102.92 千万亿英热单位,其中石油消费量约占 31%。

- 此外,对石油、天然气和其他石油产品的需求不断增长也促使石油生产商增加产量和开发新油田,预计将进一步推动市场成长。例如,2022年11月,加拿大石油和天然气承包商协会(CAOEC)宣布,预计2023年加拿大将钻探约6,409口油井,比2022年增加约15%。

- 由于该地区人口预计会增加,各领域的消费量也会增加,预计该地区可能会建立新的水处理厂,以满足对球阀的需求。一个值得注意的例子是纽约州官员于 2022 年 9 月宣布为七个城市的供水和用水和污水基础设施计划拨款超过 2.32 亿美元。纽约州环境设施公司提供资金和低成本贷款计划推进水利基础设施计划,累积支出超过 7.63 亿美元。建立处理厂的投资不可避免地增加了对球阀的需求。

- 球阀用于调节压力和流量。它的防洩漏特性是一个显着的特点,使其极具优势,特别是在处理液体的化学工业中。 2022年7月,BASF宣布对一项价值7.8亿美元的计划做出最终投资决定,该项目旨在将其位于路易斯安那州阿森松县的化学製造综合体的生产能力提高一倍。扩建计划历时七年,总资本投资超过 10 亿美元,使该公司能够满足北美建筑、家用电子电器、道路运输和汽车等各个领域对其产品日益增长的需求。

球阀产业概况

球阀市场比较分散,由多个参与企业组成,但目前没有哪个集团占据较大的份额。公司正在进行併购以提高其产品专业化程度。由于拥有广泛的消费者群体,该市场被视为一个有利可图的投资机会。主要市场参与企业包括 Flowserve Corporation、Alfa Laval、Crane Co. 和 Honeywell International Inc.

- 2023 年 11 月 - 阿法拉伐 (Alfa Laval) 推出两款新阀门,扩大其阀门产品组合。新型阀门、独特的防混製程和独特的防混 CIP 可随时保持介质分离,从而提高产品安全性。此外,完全平衡的设计允许在高压下进行无风险处理。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 各国工业化进程

- 对製程安全的需求不断增加

- 市场问题

- 因阀门维修而停机

第六章 市场细分

- 按材料(定性分析)

- 铸铁

- 钢

- 合金底座

- 其他的

- 按最终用户产业

- 石油和天然气

- 化学

- 水和污水

- 力量

- 饮食

- 药品

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- ALFA LAVAL

- CIRCOR International Inc.

- Crane Co.

- Castel SRL

- Sanhua USA

- Curtiss-Wright Corporation

- Danfoss A/S

- Emerson Electric Co

- Georg Fischer Ltd

- Flowserve Corporation

- Hitachi Ltd

- Honeywell International Inc.

- KITZ Corporation

- Mueller Water Products Inc

第八章投资分析

第九章:未来市场展望

The Ball Valve Market size is estimated at USD 13.09 billion in 2025, and is expected to reach USD 15.69 billion by 2030, at a CAGR of 3.7% during the forecast period (2025-2030).

A significant rise in the demand for oil and gas is expected to be one of the significant factors contributing to the ball valve market growth. Additionally, rapid industrialization and urbanization are other essential factors supporting the development of the studied market.

Key Highlights

- The ball valve is essentially a valve that requires a quarter-turn to operate and is well-suited for clean gas-compressed air and liquid service in industrial applications, owing to its ability to provide a secure shutoff. However, when used for slurry service, measures must be taken to prevent the accumulation of debris. Furthermore, these valves are incredibly robust and highly suitable for applications requiring a simple on/off action. They're also highly durable and maintain consistent performance even after many use cycles.

- Ball valves are the most widely adopted fluid shutoff valves among oil and gas production facilities. These valves are also used in fuel gas systems feeding furnaces. Such applications make the oil-producing regions and regions with huge oil refining capacities attractive targets for the product vendors. Furthermore, as such plants are developed on tender floatation, the market vendors with partnerships and collaborations with such solution providers are expected to have a competitive advantage.

- Among all the types of materials, stainless steel is gaining and is expected to witness importance since they are more corrosion-resistant. Because valves open and close frequently, corrosion can cause significant issues. These valves hold up much better to harsher water types, which can benefit food processing plants. The fact that stainless steel valves also have a higher pressure rating than other materials, such as brass, further drives their adoption.

- Furthermore, the availability of ball valves in different variants, such as unidirectional, bidirectional, or multi-directional, depending on valve ports and the valve seat number, also complements their industrial adoption. These valves are also manufactured based on the classification for high-pressure or low-pressure pipelines, further expanding their use cases. Several vendors are constantly investing in innovative new products, which is acting as one of the major factors driving the market.

- The advancements in valve technology, including the emergence of smart valves and the incorporation of automation and control systems, present fresh prospects in the market. The rising environmental concerns and regulatory mandates fuel the need for eco-friendly and energy-efficient valves. Manufacturers who provide ball valves with minimized emissions, low leakage rates, and enhanced energy efficiency can seize the expanding demand for sustainable solutions.

- Ball valves are commonly employed in larger bore sizes, as alternative valve types like butterfly valves tend to have smaller and weaker stems. In situations where space constraints and structural load are paramount, such as offshore drilling platforms and floating production storage and offloading (FPSOs), users opt for alternatives to ball valves. Furthermore, the limited precision in flow rate control poses a challenge to the growth of the examined market.

Ball Valve Market Trends

Food Processing Industry Expected to Have Significant Applications

- The food processing industry is a notable sector where ball valves find significant application. The process of product fillings necessitates the maintenance of a regulated flow, making ball valves an essential component. The valves employed in the industry are of two types: those that come in direct contact with the material and those used in utility services such as water and steam. In both cases, the valves must comply with several industry regulations, particularly those that come in contact with food material. This presents a considerable challenge for manufacturers to obtain regulatory approvals, requiring them to design valves that meet stringent industry standards.

- Ball valves are highly efficient in controlling and maintaining high volume, temperature, and pressure. In the food and beverage sector, sanitary ball valves are utilized to connect and regulate conveyance pipes, ensuring the purity, stability, and quality of fluids during transport due to their stainless steel construction. Sanitary valves are also easy to disinfect and clean, promoting hygiene. The market is expected to grow due to continuous product launches by various vendors.

- For instance, in November 2022, Valworx, a producer of actuated valves and equipment controls, recently introduced a novel range of hygienic ball valves suitable for deployment in the food and beverage manufacturing sector. These ball valves are equipped with a conspicuous position indicator and are compatible with Namur and ISO mountings. The valves are obtainable in two- and three-way configurations and available in various sizes ranging from 0.5 to 4 inches. The new line of valves conforms to the FDA, USDA, and 3-A standards.

- Stainless steel is increasingly recognized as a crucial material due to its extensive resistance to corrosion, a significant concern in the food processing sector. These valves have also demonstrated exceptional durability when exposed to more aggressive water compositions, offering notable advantages to food processing plants. Moreover, stainless steel valves possess a higher pressure rating compared to alternative materials like brass. For instance, a typical 1-inch brass ball valve may have a pressure rating of 600 PSI, whereas a standard stainless steel ball valve of the same size would likely have a pressure rating of 1000 PSI. This characteristic renders them particularly suitable for high-pressure applications within the food processing industry.

- The growing urbanization rate across various parts of the world significantly enhances the demand for packaged food. Changing lifestyles, especially in urban areas, also contribute to the ever-increasing demand for packaged and processed foods. To ensure food security and achieve self-sufficiency goals, various countries are making efforts such as making regulatory changes and developing special economic zones to develop food processing industries.

- According to Population Reference Bureau, as of 2023, global urbanization stood at 57 percent. North America, Latin America, and the Caribbean led the pack, boasting urban populations exceeding 80 percent.

- A favorable scenario for the growth of the studied market has also been observed in other countries. The Department for Promotion of Industry and Internal Trade reported that the proposed investment in the food processing sector in India was valued at INR 120.37 billion (USD 1.47 billion) in 2022. Efforts are being taken to encourage investments across the entire value chain by the Indian Ministry of Food Processing Industries, including the implementation of the PLI scheme, which is expected to expand food processing capacity by nearly INR 30,000 crore (USD 3.6 billion) and create additional direct and indirect employment by the year 2026-27. Such initiatives are expected to offer significant opportunities for the ball valves.

North America is Expected to hold a Significant Market Share

- North America stands as a prominent market for ball valves, boasting substantial demand across diverse industries such as oil and gas, electricity, food and packaging, and chemicals. Both the United States and Canada exhibit immense demand, further fueled by the swift integration of industrial automation. The projected trend is expected to stimulate the market demand for ball valves in the region.

- North American area is witnessing a growing requirement for intelligent ball valves. Prominent regional industries are transitioning towards ball valves that incorporate processors and networking capabilities to complement advanced monitoring technology, which is coordinated through a central control station. The increased adoption of automation in process industries further reinforces this demand trend.

- The United States assumes a pivotal role in augmenting regional demand in contrast to Canada. The nation experiences a growing demand across nearly all end-user sectors, particularly in oil and gas, refining, and power generation. Higher energy consumption is the primary factor behind the higher demand across these sectors. For instance, according to EIA, total immediate energy consumption in the United States in 2022 was about 102.92 quadrillions Btu, of which petroleum consumption was about 31 percent.

- Furthermore, higher demand for oil & gas and other petroleum products also drives oil producers to increase their production and explore new oil extraction sites, which are expected to help the studied market grow further. For instance, in November 2022, the Canadian Association of Energy Contractors (CAOEC) announced that in 2023, it expects about 6,409 wells to be drilled in Canada, an approximately 15 percent increase from 2022.

- It is expected that new water treatment facilities will likely be set up in the region to feed the demand for ball valves as a result of an anticipated increase in regional population and increased water consumption across different sectors. A notable example is the recent announcement by New York State officials in September 2022, wherein they allocated over USD 232 million for water and sewer infrastructure projects in seven municipalities. The New York State Environmental Facilities Corporation granted funds and offered low-cost financing packages to facilitate water infrastructure initiatives with a cumulative expenditure exceeding USD 763 million. These investments in establishing treatment plants will inevitably augment the need for ball valves.

- Ball valves are utilized to regulate pressure and flow. Their leak-proof nature is a notable attribute that renders them highly advantageous, particularly in the chemical industry involving liquids. In July of 2022, BASF declared its final investment decision on a project worth USD 780 million, aimed at doubling the production capacity of its chemical manufacturing complex in Ascension Parish, Louisiana. The expansion project, which spans over seven years and represents a combined capital investment of over USD 1 billion, will enable the company In order to meet the growing demand for its products in a variety of sectors, such as construction, appliances, road haulage, and automobiles throughout North America.

Ball Valve Industry Overview

The ball valve market is fragmented and consists of several players, with no group currently holding a major share in the market. The companies are engaging in mergers and acquisitions to increase their expertise in the product. The market is viewed as a lucrative investment opportunity due to its wide consumer base. Some key market players include Flowserve Corporation, Alfa Laval, Crane Co., Honeywell International Inc., etc.

- November 2023 - Alfa Laval expands its valve portfolio with two new additions. The new valves, Unique Mixproof Process, and Unique Mixproof CIP enhance product safety by ensuring media is always separated. Their fully balanced design also enables risk-free handling at high pressures.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Industrialization in Various Countries

- 5.1.2 Growing Demand for ProcessSafety

- 5.2 Market Challenges

- 5.2.1 Downtime Due to Repairing of Valves

6 MARKET SEGMENTATION

- 6.1 By Material (Qualitative Analysis)

- 6.1.1 Cast Iron

- 6.1.2 Steel

- 6.1.3 Alloy Based

- 6.1.4 Other Materials

- 6.2 By End-User Industry

- 6.2.1 Oil and Gas

- 6.2.2 Chemicals

- 6.2.3 Water and Waste Water

- 6.2.4 Power

- 6.2.5 Food and Beverage

- 6.2.6 Pharmaceutical

- 6.2.7 Other End-User Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ALFA LAVAL

- 7.1.2 CIRCOR International Inc.

- 7.1.3 Crane Co.

- 7.1.4 Castel SRL

- 7.1.5 Sanhua USA

- 7.1.6 Curtiss-Wright Corporation

- 7.1.7 Danfoss A/S

- 7.1.8 Emerson Electric Co

- 7.1.9 Georg Fischer Ltd

- 7.1.10 Flowserve Corporation

- 7.1.11 Hitachi Ltd

- 7.1.12 Honeywell International Inc.

- 7.1.13 KITZ Corporation

- 7.1.14 Mueller Water Products Inc