|

市场调查报告书

商品编码

1851738

脸部辨识:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Facial Recognition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

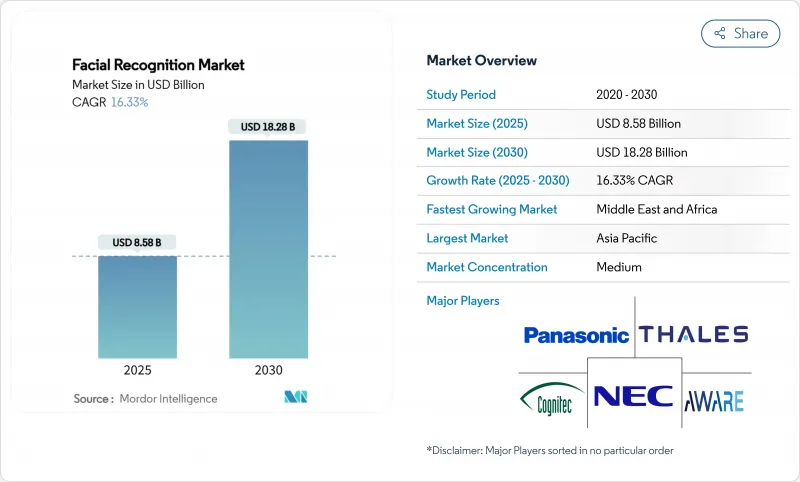

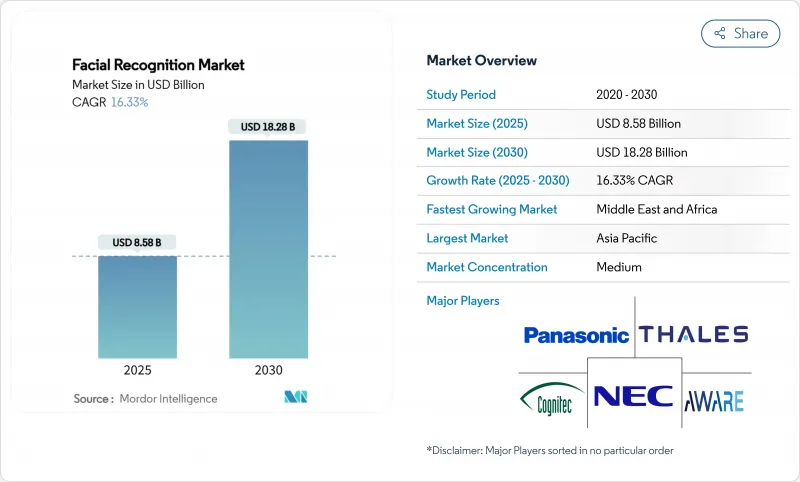

预计到 2025 年,人脸部辨识市场规模将达到 85.8 亿美元,到 2030 年将达到 182.8 亿美元,预测期(2025-2030 年)的复合年增长率为 16.33%。

如今,成长依赖于边缘运算架构,这种架构能够在亚秒级推理的同时,将生物识别资料保留在设备端。欧盟人工智慧法律中较严格的使用者授权规则,正促使欧洲买家转向隐私保护型设计,并推动供应商预设整合差分隐私、同态加密和联邦学习等技术。硬体小型化和低功耗人工智慧加速器正将智慧型手机、执法记录器和自助服务终端转变为登记点,将目标用户群扩展到固定闭路电视CCTV之外。最后,支付、乘客资讯和零售分析正在补充传统的安全应用场景,以实现收入来源多元化,并平滑不同地区的需求週期。

全球脸部辨识市场趋势与洞察

加速新兴亚洲国家国民身分证和电子护照的推广

越南计画在2025年在所有边境口岸实施生物辨识认证,新加坡的目标是到2026年将樟宜机场免护照通道的等待时间缩短40%,并实现95%的自动化。马来西亚和巴布亚纽几内亚正计划在全国部署生物辨识系统,这将使亚太地区的累积註册用户超过8亿,使其成为全球最大的设备端脸部认证系统测试基地。供应商不仅获得了授权收入,还获得了参考架构,这些架构将影响从非洲到拉丁美洲的公共部门竞标。这些计划中开发的互通性标准将降低金融服务提供者重复使用相同身分钱包的整合风险。最终,这将从根本上加强脸部辨识市场的软体、边缘硬体和合规管理服务。

零售连锁店对边缘智慧摄影机的需求激增

预计到2024年,美国有组织零售犯罪造成的损失将超过1,000亿美元,这将加速边缘人工智慧摄影机的普及应用。这些摄影机无需将资料传输到云端伺服器即可分析人脸和行为。 Asda与FaceTech合作的试点计画实现了99.992%的准确率。在美国排名前50名的杂货商中,已有15家使用脸部辨识来标记惯犯,并侦测员工和顾客的「甜言蜜语」式诈骗行为。由Nvidia Jetson或EdgeCortix SAKURA-II开发板提供的即时分析功能可以减少损耗,并产生客流量数据,为行销系统提供资讯。由于损失预防和个人化体验的双重优势,零售业已成为人脸部辨识市场中成长最快的私部门。

严格的GDPR生物辨识同意要求(欧盟27国)

欧盟人工智慧法将远端生物识别认证列为「高风险」技术,除少数例外情况外,禁止执法部门即时使用,并禁止在职场情绪辨识。采用者必须进行资料保护影响评估,证明其合法权益,并在存在权力不对等的情况下获得明确同意。随着整合商添加遮罩、设备端处理和审核日誌等功能,合规成本将增加20%至30%。建造符合欧盟标准的版本的供应商通常会将其隐私保护技术堆迭重复用于其他市场,而规模较小的公司则会撤出或推迟其在欧洲的业务,从而减缓脸部辨识市场近期的普及速度。

细分市场分析

改进的演算法已将误报率降低至 0.1% 以下,从而能够在标准 CPU 上部署,预计到 2024 年,软体收入将占全球总收入的 58%。边缘硬体继续以 19.4% 的复合年增长率快速增长,因为金融和医疗保健合规团队要求生物识别模板不得离开办公室。 SAKURA-II 晶片可在 10W 的功耗预算内运行复杂的模型,从而支援便利商店和交通枢纽的自助服务终端。

基于 API 的授权模式使开发者能够在数小时内将脸部认证嵌入行动应用,从而避免了以往承包计划通常需要数年才能完成的週期。同时,硬体供应商将安全元件储存和专用加速器与其电脑视觉 SDK 捆绑销售,每次新的分析模组作为韧体下载发布时,都会锁定一笔可观的收入。这种双边模式既提高了软体的黏性,也增加了脸部辨识市场的转换成本。

2D演算法仍将依赖现有的CCTV基础设施,预计2024年将占总营收的43.5%。然而,能够辨识微表情、注意力、困倦程度等的「情绪AI」引擎将以18.8%的复合年增长率成长,从而重塑客户体验和道路安全应用。随着零售商、保险公司和汽车製造商将行为洞察货币化,预计到2030年,基于分析主导的脸部辨识模组市场规模将成长3.5倍。

此混合技术堆迭融合了3D深度资讯和 2D RGB 帧,可有效防止欺骗攻击,并实现符合 ISO/IEC 30107-3 标准的活体侦测。 Suprema 的 Q-Vision Pro 可对每台设备最多 50,000 个用户进行身份验证,并对所有交易进行端对端加密,从而使 ATM 运营商能够取消 PIN 码垫片。这种安全性和分析能力的整合丰富了开发平臺,并使收入来源多元化,涵盖授权、硬体和服务等多个层面。

区域分析

由于各国将脸部认证融入其数位公共基础设施,亚洲将在2024年占38.7%的销售额。中国的安全管理措施要求所有储存超过10万个范本的公司向当地网路安全机构註册,并设有严格的审核机制,优先考虑拥有安全供应链的成熟供应商。日本2025年大阪关西世界博览会将采用NEC人脸支付系统,预计将吸引120万游客。

在中东,阿联酋的生物辨识辨识技术将以17.4%的复合年增长率快速发展,逐步取代银行、医疗保健和公共网站中的塑胶卡。杜拜机场的无护照计划将乘客的脸部资讯与其登机证和钱包资讯关联起来,使该地区成为无摩擦旅行的试验场。海湾国家政府正在资助概念验证,并迅速将其转化为全国性政策,从而缩短了推广週期,并加速了脸部辨识市场供应商的收入成长。

北美地区在航空公司部署和执法预算方面仍然至关重要,但也面临最严峻的诉讼风险。国会对美国运输安全管理局(TSA)扩张的审查凸显了公民自由方面的担忧,儘管此举无疑提高了旅客处理能力。联邦法律的分散化导致了各州法律的拼凑,例如伊利诺伊州的《生物辨识资讯隐私法案》(BIPA)和加州的《公民隐私权法案》(CPRA),这使得跨境部署更加复杂。欧洲严格的监管制度虽然减缓了即时城市监控的发展,但也推动了对能够进行设备端录音和用户许可管理的边缘设备的需求,从而使隐私技术供应商在脸部辨识行业站稳了脚跟。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 目录

第二章 引言

- 研究假设和市场定义

- 调查范围

第三章调查方法

第四章执行摘要

第五章 市场情势

- 市场驱动因素

- 加速新兴亚洲国家国民身分证和电子护照的推广

- 零售连锁店对边缘智慧摄影机的需求激增

- 北美航空公司将强制使用生物识别登机

- 海湾合作委员会金融科技领域快速普及 FacePay 和 KYC 简化钱包

- 市场限制

- 严格的GDPR生物辨识同意要求(欧盟27国)

- 美国演算法偏见诉讼风险

- 中国网路安全2.0硬体认证瓶颈

- 市民反对全市扩大摄影机

- 监理展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第六章 市场规模与成长预测

- 按组件

- 硬体

- 网路摄影机和感测器

- 边缘人工智慧晶片

- 软体

- 脸部侦测和对齐

- 特征提取与匹配

- 活体检测

- 服务

- 託管服务

- 专业服务

- 硬体

- 透过技术

- 二维人脸部辨识

- 3D脸部辨识

- 热感/红外线脸部认证

- 脸部分析和情感人工智慧

- 混合和多模态演算法

- 透过部署

- 本地部署

- 云端基础的

- 边缘/设备端

- 依设备类型

- 固定监视录影机

- 行动装置和穿戴式装置

- 智慧型手机

- 执法记录仪

- 自助服务终端和存取终端

- 透过使用

- 安全与监控

- 边境管制/电子门

- 公共区域CCTV分析

- 存取控制

- 企业/校园招聘

- 智慧锁(住宅)

- 身份验证/电子KYC

- 数位银行註册

- SIM卡註册

- 支付和交易

- Face Pay(零售POS)

- 客户分析与个人化

- 商店定向广告

- 安全与监控

- 最终用户

- 政府和执法部门

- BFSI

- 零售与电子商务

- 卫生保健

- 汽车与运输

- 电信和资讯技术

- 饭店和娱乐

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- ASEAN

- 澳洲和纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- GCC

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第七章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- NEC Corporation

- Thales Group

- IDEMIA

- Panasonic Corp.

- Aware, Inc.

- Cognitec Systems GmbH

- Face++, Megvii Technology

- SenseTime Holdings

- Clearview AI

- Daon, Inc.

- FacePhi Biometria SA

- AnyVision(now Oosto)

- SAFR(RealNetworks Inc.)

- CyberLink Corp.

- Innovatrics

- Suprema Inc.

- Herta Security

- iProov Ltd.

- Corsight AI

- VisionLabs

第八章:市场机会与未来展望

- 閒置频段与未满足需求评估

The Facial Recognition Market size is estimated at USD 8.58 billion in 2025, and is expected to reach USD 18.28 billion by 2030, at a CAGR of 16.33% during the forecast period (2025-2030).

Growth now relies on edge-based architectures that deliver sub-second inference while allowing biometric data to remain on-device, a requirement embedded in new laws such as China's Security Management Measures for Facial Recognition Technology. Stricter consent rules under the EU AI Act steer European buyers toward privacy-preserving designs, pushing vendors to integrate differential privacy, homomorphic encryption, and federated learning by default. Hardware miniaturization and low-power AI accelerators have turned smartphones, body cameras, and kiosks into enrolment points, broadening the addressable base well beyond fixed CCTV. Finally, payments, passenger facilitation, and retail analytics now complement traditional security use cases, diversifying revenue streams and smoothing demand cycles across regions.

Global Facial Recognition Market Trends and Insights

Accelerating National ID and e-Passport Roll-outs in Emerging Asia

By 2025 Vietnam requires biometric authentication at every border, while Singapore's passport-free lanes at Changi have cut wait times by 40% and target 95% automated use by 2026. Malaysia and Papua New Guinea have scheduled nationwide deployments that push cumulative APAC enrolments above 800 million citizens, creating the world's largest testing ground for on-device facial verification systems. Vendors gain not only licence revenue but also reference architectures that influence public-sector bids from Africa to Latin America. Interoperability standards drafted in these projects reduce integration risk for financial-service players that later reuse the same ID wallets. The result is a structural pull-through for software, edge hardware, and managed compliance services across the facial recognition market.

Soaring Adoption of Edge-Based Smart Cameras in Retail Chains

Organized retail crime exceeded USD 100 billion in the United States in 2024, accelerating deployment of edge AI cameras that analyse faces and behaviours without streaming to cloud servers. Asda's pilot with FaiceTech achieves 99.992% accuracy and deletes non-matches instantly to satisfy GDPR mandates. Fifteen of the top 50 US grocers now use facial recognition to flag repeat offenders and detect employee-customer "sweethearting" fraud. Real-time analytics delivered on Nvidia Jetson or EdgeCortix SAKURA-II boards reduce shrinkage and generate footfall intelligence that feeds marketing systems, giving retailers a hard ROI within months. This twin benefit of loss prevention and experience personalisation keeps retail the fastest-growing private-sector adopter in the facial recognition market.

Strict GDPR Biometric Consent Requirements (EU-27)

The EU AI Act classifies remote biometric identification as "high-risk," banning real-time use for law enforcement except under narrow exemptions and prohibiting emotion recognition at work. Deployers must run Data Protection Impact Assessments, justify legitimate interest, and obtain explicit consent where power imbalances exist. Compliance costs rise 20-30% as integrators add masking, on-device processing, and audit logs. Vendors building EU-ready versions often re-use the privacy-by-design stack for other markets, but smaller firms exit or defer Europe, slowing short-term diffusion of the facial recognition market.

Other drivers and restraints analyzed in the detailed report include:

- Mandated Biometric Boarding by North-American Airlines

- Rapid Uptake of Face Pay and KYC-Lite Wallets in GCC Fintech

- Algorithmic Bias Litigation Risk in the United States

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software accounted for 58% of global revenue in 2024 as algorithmic improvements lowered false accept rates to below 0.1% and enabled deployment on standard CPUs. Edge hardware remains the fastest-growing slice at 19.4% CAGR because compliance teams in finance and healthcare insist that biometric templates never leave the premises. SAKURA-II chips run complex models within 10 W power budgets, making autonomous kiosks viable inside convenience stores and transit hubs.

API-based licensing lets developers embed facial verification into mobile apps in hours, eliminating the multi-year cycles typical of earlier turnkey projects. At the same time, hardware vendors bundle computer-vision SDKs with secure-element storage and dedicated accelerators, locking in annuity streams as every new analytics module becomes a firmware download. This two-sided model keeps software sticky while raising switching costs for the entire facial recognition market.

2-D algorithms still ride on existing CCTV infrastructure and therefore generated 43.5% of 2024 revenue. Yet "emotion AI" engines that map micro-expressions, attention span, or drowsiness will grow at 18.8% CAGR, reshaping customer-experience and road-safety applications. The facial recognition market size for analytics-driven modules is forecast to rise 3.5 X by 2030 as retailers, insurers, and automakers monetise behavioural insights.

Hybrid stacks blend 3-D depth cues with 2-D RGB frames to thwart spoofing and deliver liveness checks that comply with ISO/IEC 30107-3. Suprema's Q-Vision Pro validates up to 50,000 users per device and encrypts every transaction end-to-end, allowing ATM operators to eliminate PIN pads. Such crossover of security and analytics keeps R&D pipelines full and diversifies revenue across licence, hardware, and service layers.

Facial Recognition Market Report is Segmented by Component (Hardware, Software, Services), Technology (2-D, 3-D, Thermal, Facial Analytics, Hybrid), Deployment (On-Premise, Cloud, Edge), Device (Fixed Cameras, Mobile, Smartphones, Kiosks), Application (Security, Identity Verification, Payments), End-User (Government, BFSI, Retail, Healthcare and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD)

Geography Analysis

Asia held 38.7% of 2024 revenue thanks to states that embed facial recognition into digital public infrastructure. China's Security Management Measures force any entity that stores templates for more than 100,000 persons to register with provincial cyber authorities, establishing a vetting hurdle that favours established vendors with secure supply chains. Japan's 2025 Osaka-Kansai Expo will run NEC face-payments for an anticipated 1.2 million visitors, a live showcase that can seed exports across Southeast Asia.

The Middle East will expand at a 17.4% CAGR as UAE's biometric ID replaces plastic cards across banking, healthcare, and public portals. Dubai Airport plans passport-free travel that links passengers' faces to boarding and retail wallets in one corridor, positioning the region as a laboratory for frictionless mobility. Gulf governments bankroll proof-of-concepts and rapidly convert them to nationwide policies, compressing adoption cycles and accelerating revenue capture for suppliers within the facial recognition market.

North America remains pivotal through airline rollouts and law-enforcement budgets but faces the strongest litigation risk. Congressional scrutiny over TSA's expansion highlights civil-liberty concerns even as passenger throughput gains are undeniable. Federal fragmentation spawns a patchwork of state laws Illinois' BIPA, California's CPRA making cross-border deployments complex. Europe's strict regime slows real-time city surveillance but ramps demand for edge devices running on-device redaction and consent management, giving privacy-tech vendors a foothold in the facial recognition industry.

- NEC Corporation

- Thales Group

- IDEMIA

- Panasonic Corp.

- Aware, Inc.

- Cognitec Systems GmbH

- Face++, Megvii Technology

- SenseTime Holdings

- Clearview AI

- Daon, Inc.

- FacePhi Biometria SA

- AnyVision (now Oosto)

- SAFR (RealNetworks Inc.)

- CyberLink Corp.

- Innovatrics

- Suprema Inc.

- Herta Security

- iProov Ltd.

- Corsight AI

- VisionLabs

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Table of Contents

2 INTRODUCTION

- 2.1 Study Assumptions and Market Definition

- 2.2 Scope of the Study

3 RESEARCH METHODOLOGY

4 EXECUTIVE SUMMARY

5 MARKET LANDSCAPE

- 5.1 Market Drivers

- 5.1.1 Accelerating National ID and e-Passport Roll-outs in Emerging Asia

- 5.1.2 Soaring Adoption of Edge-based Smart Cameras in Retail Chains

- 5.1.3 Mandated Biometric Boarding by North-American Airlines

- 5.1.4 Rapid Uptake of Face Pay and KYC-lite Wallets in GCC Fintech

- 5.2 Market Restraints

- 5.2.1 Strict GDPR Biometric Consent Requirements (EU-27)

- 5.2.2 Algorithmic Bias Litigation Risk in the U.S.

- 5.2.3 China Cyber-Security Classified Protection 2.0 Hardware Certification Bottlenecks

- 5.2.4 Public Push-back on City-wide Camera Expansion

- 5.3 Regulatory Outlook

- 5.4 Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.1.1 Cameras and Sensors

- 6.1.1.2 Edge AI Chips

- 6.1.2 Software

- 6.1.2.1 Face Detection and Alignment

- 6.1.2.2 Feature Extraction and Matching

- 6.1.2.3 Liveness Detection

- 6.1.3 Services

- 6.1.3.1 Managed Services

- 6.1.3.2 Professional Services

- 6.1.1 Hardware

- 6.2 By Technology

- 6.2.1 2-D Facial Recognition

- 6.2.2 3-D Facial Recognition

- 6.2.3 Thermal/Infra-red Facial Recognition

- 6.2.4 Facial Analytics and Emotion AI

- 6.2.5 Hybrid and Multimodal Algorithms

- 6.3 By Deployment

- 6.3.1 On-premise

- 6.3.2 Cloud-based

- 6.3.3 Edge / On-device

- 6.4 By Device Form-factor

- 6.4.1 Fixed Surveillance Cameras

- 6.4.2 Mobile and Wearables

- 6.4.2.1 Smartphones

- 6.4.2.2 Body-worn Cameras

- 6.4.3 Kiosks and Access Terminals

- 6.5 By Application

- 6.5.1 Security and Surveillance

- 6.5.1.1 Border Control / e-Gates

- 6.5.1.2 Public Area CCTV Analytics

- 6.5.2 Access Control

- 6.5.2.1 Corporate and Campus Entry

- 6.5.2.2 Smart Locks (Residential)

- 6.5.3 Identity Verification / e-KYC

- 6.5.3.1 Digital Banking On-boarding

- 6.5.3.2 SIM Registration

- 6.5.4 Payments and Transactions

- 6.5.4.1 Face Pay (Retail POS)

- 6.5.5 Customer Analytics and Personalisation

- 6.5.5.1 In-store Targeted Advertising

- 6.5.1 Security and Surveillance

- 6.6 By End-user

- 6.6.1 Government and Law-Enforcement

- 6.6.2 BFSI

- 6.6.3 Retail and E-commerce

- 6.6.4 Healthcare

- 6.6.5 Automotive and Transportation

- 6.6.6 Telecom and IT

- 6.6.7 Hospitality and Entertainment

- 6.7 By Geography

- 6.7.1 North America

- 6.7.1.1 United States

- 6.7.1.2 Canada

- 6.7.1.3 Mexico

- 6.7.2 South America

- 6.7.2.1 Brazil

- 6.7.2.2 Argentina

- 6.7.2.3 Chile

- 6.7.2.4 Rest of South America

- 6.7.3 Europe

- 6.7.3.1 Germany

- 6.7.3.2 United Kingdom

- 6.7.3.3 France

- 6.7.3.4 Italy

- 6.7.3.5 Spain

- 6.7.3.6 Nordics

- 6.7.3.7 Rest of Europe

- 6.7.4 Asia Pacific

- 6.7.4.1 China

- 6.7.4.2 Japan

- 6.7.4.3 South Korea

- 6.7.4.4 India

- 6.7.4.5 ASEAN

- 6.7.4.6 Australia and New Zealand

- 6.7.4.7 Rest of Asia Pacific

- 6.7.5 Middle East and Africa

- 6.7.5.1 Middle East

- 6.7.5.1.1 GCC

- 6.7.5.1.2 Turkey

- 6.7.5.1.3 Rest of Middle East

- 6.7.5.2 Africa

- 6.7.5.2.1 South Africa

- 6.7.5.2.2 Nigeria

- 6.7.5.2.3 Rest of Africa

- 6.7.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 7.4.1 NEC Corporation

- 7.4.2 Thales Group

- 7.4.3 IDEMIA

- 7.4.4 Panasonic Corp.

- 7.4.5 Aware, Inc.

- 7.4.6 Cognitec Systems GmbH

- 7.4.7 Face++, Megvii Technology

- 7.4.8 SenseTime Holdings

- 7.4.9 Clearview AI

- 7.4.10 Daon, Inc.

- 7.4.11 FacePhi Biometria SA

- 7.4.12 AnyVision (now Oosto)

- 7.4.13 SAFR (RealNetworks Inc.)

- 7.4.14 CyberLink Corp.

- 7.4.15 Innovatrics

- 7.4.16 Suprema Inc.

- 7.4.17 Herta Security

- 7.4.18 iProov Ltd.

- 7.4.19 Corsight AI

- 7.4.20 VisionLabs

8 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 8.1 White-space and Unmet-Need Assessment