|

市场调查报告书

商品编码

1642003

光度计:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Light Meter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

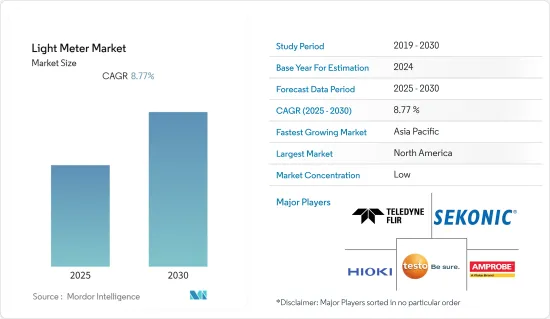

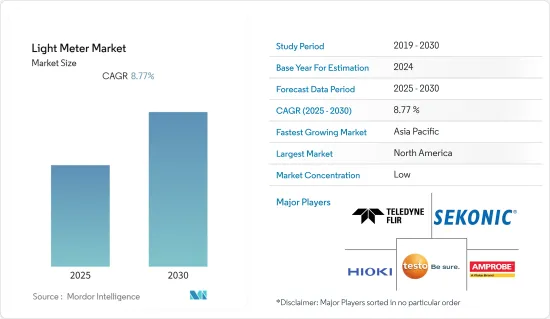

预测期内,光度计市场预期的复合年增长率为 8.77%。

在全球范围内,政府对部署节能照明(例如 LED 照明)的监管力度不断加强,这推动了光度计市场的发展。

主要亮点

- 包括 LED 照明在内的照明技术的进步正在对照明仪表市场产生重大影响。由于 LED 照明节能、持久且可控,因此准确测量和最佳化光输出至关重要。

- 照明计市场也受到全球对照明计的需求以及电影摄影和摄影领域的先进技术进步等因素的推动。测光錶在摄影和电影摄影中发挥着至关重要的作用,它可以帮助专业人士实现拍摄所需的曝光水平和照明条件。

- 此外,政府加强对照明通讯协定标准化的倡议,可能会导致光度计市场成长率的激增。此外,政府加强职场照明的规定也将对测光錶市场的成长产生重大影响。

- 然而,智慧型手机应用和取代测光仪的光学测量仪器的进步可能会抑制市场成长率。正在开发一款智慧型手机应用程序,利用 iPhone 和其他智慧型手机的内藏相机作为光感应器,发挥照度仪的作用。

测光錶市场趋势

LED 型测光錶预计将占据较大的市场占有率

- LED 测光錶用于製造 LED 灯时的品管和测试过程。製造商使用这些仪表来确保每个 LED 二极体和灯具符合色温、显色指数 (CRI)、光通量和其他参数的特定标准。

- LED光照度计是采用特定的演算法计算来测量LED的频谱,从而克服错误结果的问题。测光錶可以帮助确保 LED 灯在所需范围内,最大限度地减少对您生活的干扰。

- 测光錶对于测量 LED 照明的色温至关重要。这种测量有助于确保 LED 照明系统发出具有所需色彩特性的光,例如暖色、冷色或日光色。色温在营造所需的照明氛围方面起着至关重要的作用。

- 此外,LED 光照度计还可以透过测量 LED 照明的潜在危害(例如蓝光照射)来评估光生物安全性。确保 LED 照明对人体健康安全至关重要,尤其是在医疗保健和製造工厂等环境中。

- LED照明安装数量的增加是市场成长的主要驱动力。 LED照度度计是测量和评估与 LED 照明相关的各种参数的重要工具。根据美国能源局的数据,预计2017年至2035年,美国LED照明安装量将成长,从2017年的约14亿台增加到2035年的约79亿台。然而,到 2025 年,住宅领域的 LED 照明安装量将出现最大成长。户外领域应是 LED 照明渗透率最高的领域。

预计北美将占据较大的市场占有率

- 北美照明市场正在经历向更节能的照明技术的重大转变。测光錶对于确保这些照明系统以最佳水平运作、有助于实现节能和永续性目标至关重要。

- 智慧城市的兴起和物联网技术与城市基础设施的融合正在推动测光錶的需求。根据《经济学人》报道,2022年,全球领先的数位城市华盛顿特区的指数排名得分为71.2。优化智慧城市的户外照明对于提高能源效率和安全性至关重要。

- 北美是摄影和电影製作行业的发源地,这些领域的专业人士依靠测光錶来实现准确的照明条件和曝光设置。

- 联邦和州政府为提高能源效率和永续性所做的努力正在鼓励采用 LED 照明,进而使用测光錶来检验照明性能。

- 随着测光技术的发展,数位无线测光仪也应运而生,使得使用者的测量更加方便、有效率。工业数位化正在推动人们对可远端监控和控制的连网照明系统的兴趣。

照度计行业概况

光度计市场高度分散,主要参与者包括 FLIR Systems、SekonicA Corporation、Testo SE、Hioki EECorporation 和 Amprobe Instrument Corporation(丹纳赫公司)。市场参与者正在采取联盟和收购等策略来加强其产品供应并获得永续的竞争优势。

- 2023 年 6 月-瑞典公司 LIT Systems 推出 LIT DUO 1。 LIT DUO 1 将色彩、照度、曝光、频谱和闪烁计整合到一个仪器中,并装在一个耐用的铝製机身中。 LIT DUO 1 的概念是打造一个电影製作人可以使用的一体化设备。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 全球摄影和电影产业对测光錶的需求不断增加

- 改善职场照明的规定

- 市场限制

- 开发智慧型手机应用程式和替代测光仪的光测量仪器

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 按类型

- 通用测光錶

- LED 照度计

- 紫外线照度计

- 按应用

- 照片拍摄

- 生产工厂

- 诊所和医院

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 亚洲

- 中国

- 日本

- 印度

- 拉丁美洲

- 中东和非洲

- 北美洲

第六章 竞争格局

- 公司简介

- FLIR Systems

- Sekonic Corporation

- Testo SE

- Hioki EE Corporation

- Amprobe Instrument Corporation(Danaher Corporation)

- KERN & SOHN GmbH

- B&K Precision Corporation

- Line Seiki Co., Ltd

- TENMARS ELECTRONICS CO., LTD.

- Martindale Electric Co. Ltd.

- LIT SYSTEMS AB

第七章投资分析

第八章 市场机会与未来趋势

The Light Meter Market is expected to register a CAGR of 8.77% during the forecast period.

The Light Meter Market has been driven by the increasing government regulations across the globe for deploying energy-efficient lighting such as LED lighting.

Key Highlights

- The ongoing advancements in lighting technology, including LED lighting, have significantly impacted the lighting meter market. LED lighting is energy efficient, long-lasting, and controllable, making it essential to measure and optimize light levels accurately.

- The light meter market is also driven by factors such as global demand for light meters and advanced technological advancement in the cinematography and photography sector. Light meters play a crucial role in photography and cinematography by assisting professionals in achieving the desired exposure level and lighting conditions for their shoots.

- Furthermore, the increase in government initiatives toward the standardization of lighting protocols would result in the proliferation of the growth rate of the light meter market. Also, government regulations for enhancing workplace lighting will significantly influence the growth of the light meter market.

- However, advancing smartphone applications and light measuring devices to substitute light meters would restrain the market's growth rate. Smartphone applications have been developed to enable iPhones and other smartphones to work as a light meter using its built-in camera as a light sensor.

Light Meter Market Trends

LED Type Light Meters Segment is Expected to Hold Significant Market Share

- LED light meters are used in quality control and testing processes while manufacturing LED lights. Manufacturers use these meters to verify that each LED diode and lighting fixture meets the specific criteria for color temperature, color rendering index (CRI), luminous flux, and other parameters.

- The LED light meters are designed to overcome the problem of erroneous results by using specific algorithmic calculations to measure the LED light spectrum, which may not necessarily fall within the CIE Photopic curve. A light meter can check LED lights to ensure they fall into the desired range for minimal disruption to life.

- These Light meters are essential for measuring the color temperature of LED lights. This measurement helps ensure that LED lighting systems emit light with desired color characteristics, whether it's warm, cool, or daylight-like. Color temperature plays an important role in creating the required light ambiance.

- Moreover, The LED light meters can assess photobiological safety by measuring the potential hazards of LED lighting, such as blue light exposure. Ensuring LED lighting is safe for human health is crucial, especially in settings like healthcare and manufacturing plants.

- The increase in the number of LED lights installed has been significant drives the market growth. LED light meters are essential tools for measuring and assessing various parameters associated with LED lighting. According to the US Department of Energy, The number of LED light installations in the United States is forecast to grow between 2017 and 2035, increasing from about 1.4 billion units installed in 2017 to about 7.9 billion units in 2035. However, the residential sector would grow the most LED light installations in 2025. The outdoor sector should have the highest penetration rate of LED lights.

North America is Expected to Hold Significant Market Share

- The North American light market is witnessing a significant shift towards energy-efficient light technologies. Light meters are crucial in ensuring that these lighting systems operate at their optimal levels, contributing to energy savings and sustainability goals.

- The increasing number of smart cities and the integration of IoT technology in urban infrastructure have driven the demand for light meters. According to The Economist, In 2022, the leading global digital city on the index ranking score of Washington, DC is 71.2. They are crucial in optimizing outdoor lighting in smart cities to improve energy efficiency and safety.

- North America region has a thriving photography and film production industry, and light meters are essential for professionals in these fields to achieve precise lighting conditions and exposure settings for their work.

- Federal and state-level government initiatives promoting energy efficiency and sustainability have encouraged the adoption of LED lighting and, consequently, the use of light meters to verify lighting performance.

- Advancements in light meter technology have led to the development of digital and wireless light meters, making measurements more convenient and efficient for users. The digital transformation of industries has led to increased interest in connected lighting systems that can be monitored and controlled remotely.

Light Meter Industry Overview

The light meter market is fragmented with the presence of major players like FLIR Systems, SekonicA Corporation, Testo SE, Hioki E.E. Corporation, and Amprobe Instrument Corporation ( Danaher Corporation). Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- June 2023 - LIT Systems, founded in Sweden has introduced the LIT DUO 1. The LIT DUO 1 combines color, illuminance, exposure, spectrum, and a flicker meter all into one device inside a durable aluminum body. The concept behind LIT DUO 1 was to make an all-in-one device that filmmakers could use.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Light Meters in the Photography and Cinematography Industry Worldwide

- 4.2.2 Regulations to Improve Workplace Lighting

- 4.3 Market Restraints

- 4.3.1 Development of Smartphone Applications and Light Measuring Devices to Substitute Light Meters

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 General Purpose Light Meters

- 5.1.2 LED Light Meters

- 5.1.3 UV Light Meters

- 5.2 By Application

- 5.2.1 Photography and Cinematography

- 5.2.2 Manufacturing Plants

- 5.2.3 Clinics and Hospitals

- 5.2.4 Others Application

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.3 Asia

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 FLIR Systems

- 6.1.2 Sekonic Corporation

- 6.1.3 Testo SE

- 6.1.4 Hioki E.E. Corporation

- 6.1.5 Amprobe Instrument Corporation ( Danaher Corporation)

- 6.1.6 KERN & SOHN GmbH

- 6.1.7 B&K Precision Corporation

- 6.1.8 Line Seiki Co., Ltd

- 6.1.9 TENMARS ELECTRONICS CO., LTD.

- 6.1.10 Martindale Electric Co. Ltd.

- 6.1.11 LIT SYSTEMS AB