|

市场调查报告书

商品编码

1642005

威胁情报:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Threat Intelligence - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

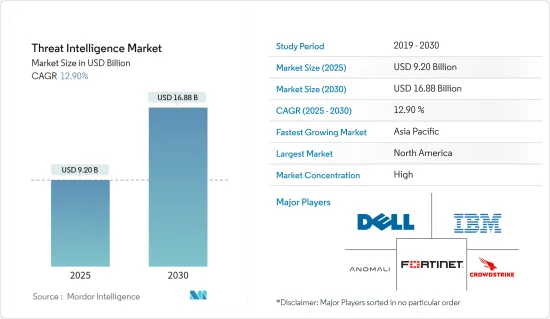

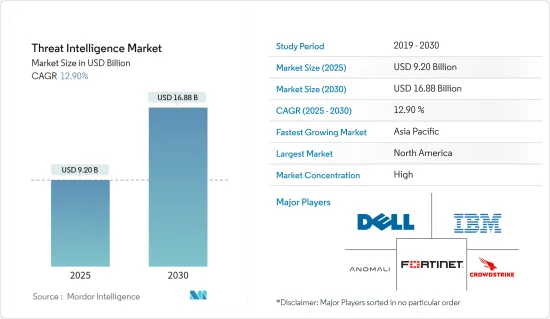

威胁情报市场在 2025 年的价值预估为 92 亿美元,预计到 2030 年将达到 168.8 亿美元,在市场估计和预测期(2025-2030 年)内以 12.9% 的复合年增长率增长。

在过去的几年中,攻击源、目标、攻击概况和不同类型的技术之间发生了模式转移。攻击的来源仍然是一个问题,因为虽然可以识别攻击的类型和目标,但很难确定谁实施了攻击。

主要亮点

- 随着攻击和资料外洩的增加,企业将重点转向各种网路安全解决方案。随着攻击者和防御者之间的网路军备竞赛愈演愈烈,越来越多的组织开始转向网路情报。威胁情报使防御者能够采取更快、更明智的安全行动,以便在发生攻击时从被动行为转变为主动行为。

- 大多数组织将情报工作重点放在基于现有案例研究和攻击的更基本的使用案例上,例如将情报来源整合到现有的IPS、防火墙和SIEM 中,而情报资讯对结果影响不大。并未充分体现利用了。

- 威胁情报市场的主要驱动力是攻击技术日益独特以及资料的弱化。推动这一市场的主要因素是各类企业产生的资料量不断增加。

- 透过整合云端和威胁情报,公司可以利用全球威胁社群主动侦测未知威胁,并透过缩小关注范围来防止攻击变得明显,从而保护自己免受网路威胁。这导致威胁情报解决方案的采用显着增加。

- 近年来,网路犯罪数量不断增加,且没有减缓的迹象。由于疫情的影响,在家工作增加。网路攻击的数量正在增加。随着企业采用远距工作模式,威胁情报市场对企业安全的担忧日益加剧。

- COVID-19 疫情对市场发展产生了积极影响,世界各国政府正在製定新策略来支持组织对网路安全的担忧。日益增多的网路漏洞正在推动威胁情报市场的成长。

威胁情报市场趋势

BFSI 部门预计将占据主要份额

- BFSI 产业是关键基础设施产业之一,由于其基本客群规模和金融资讯的敏感性,该产业持续面临大量资料外洩和网路攻击。

- 网路犯罪分子正在优化一系列灾难性的网路攻击,以破坏金融部门。这是因为网路攻击是一种利润丰厚的经营模式,可以产生巨额回报,同时还具有风险相对较低、易于侦测的优势。这些攻击的威胁包括 ATM 恶意软体、木马、恶意软体、勒索软体、行动银行恶意软体、资料外洩、组织入侵、资料窃取和逃税。

- 作为保护 IT 流程和系统的策略的一部分,公共和私人银行都专注于采用未授权存取技术来防止网路攻击,同时遵守政府法规并保护敏感的客户资料。此外,不断增长的客户期望、技术进步和监管要求迫使银行机构采取积极主动的安全措施。

- 随着网路银行、行动电话银行等科技和数位管道的日益普及,网路银行正成为客户使用银行服务的首选。银行必须使用高阶身份验证和存取控制流程,例如威胁情报策略。

北美占有最大市场占有率

- 美国金融服务业储存的资料超过Exabyte 。这些资料来自各种来源,包括信用卡和签帐金融卡历史记录、客户银行存取历史记录、银行交易量、通话记录、帐户交易和网路互动。

- 有了合适的基础设施,许多全球金融机构正在增加对物联网设备的使用,北美威胁情报解决方案的成长将由网路使用者推动。

- 该地区的公共和私营部门组织正在投资研发先进的威胁情报解决方案。美国国防安全保障部(DHS)网路安全和基础设施安全局(CISA)报告称,其正在监控使用COVID-19 主题诱饵的网路钓鱼和恶意软体传播,以及包含冠状病毒和COVID-19 相关语言的新型恶意软体。

- 投资威胁情报解决方案对于加强一个国家的安全态势至关重要。为了确保整个北美的无缝和安全运营,各组织将受益于威胁情报解决方案的实施。

威胁情报业概况

威胁情报市场正在整合并由少数几家大公司主导,导致更多安全的软体解决方案被推出。 Dell Inc.、IBM Corporation、Anomali Inc.、Fortinet Inc. 和 CrowdStrike Inc. 是市场上提供专用威胁情报解决方案的主要企业。

- 2023 年 12 月-Fortinet 宣布发布最新版整合操作技术(OT) 安全解决方案与服务。这些新增功能使 Fortinet 的 OT 安全平台与市场其他产品的差距进一步拉大。

- 2023 年10 月- IBM 公司宣布其託管检测和响应服务将采用新的AI 技术进行下一次演进,包括能够自动升级或关闭高达85% 的警报,1 有助于缩短客户的安全响应时间。助于缩短生产线。全新威胁侦测和回应服务 (TDR) 可全天候查看客户混合云端环境中所有相关技术的安全警报,包括现有安全工具和投资以及云端、本地和营运技术 (OT)。补救。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 安全漏洞和网路犯罪不断增加

- 下一代安全解决方案的演变

- 市场挑战/限制

- 资料安全预算低,解决方案实施成本高

第六章 市场细分

- 按类型

- 解决方案

- 按服务

- 按部署

- 本地

- 云

- 按最终用户产业

- BFSI

- 资讯科技/通讯

- 零售

- 製造业

- 卫生保健

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲国家

- 中东和非洲

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 北美洲

第七章 竞争格局

- 公司简介

- Juniper Networks Inc.

- AlienVault Inc.

- Farsight Security Inc.

- Trend Micro Incorporated

- LogRhythm Inc.

- F-Secure Corporation

- Check Point Software Technologies Ltd

- Dell Inc.

- IBM Corporation

- Webroot Inc.

- Fortinet Inc.

- Broadcom Inc.(Symantec Corporation)

- McAfee LLC

- LookingGlass Cyber Solutions Inc.

- FireEye Inc.

第八章投资分析

第九章:市场的未来

The Threat Intelligence Market size is estimated at USD 9.20 billion in 2025, and is expected to reach USD 16.88 billion by 2030, at a CAGR of 12.9% during the forecast period (2025-2030).

A paradigm shift has taken place in the last few years between attack sources, targets, destination attacks profiles and different types of technology. While it is possible to identify attack types and targets, the source of those attacks remains a problem due to difficulties in determining who was responsible for them.

Key Highlights

- Organizations are shifting their focus to different cyber security solutions in view of the increasing number of attacks and data breaches. Due to the increasing cyber arms race among attackers and defenders, a growing number of organisations are focusing their attention on cyber intelligence. Thanks to threat intelligence, defenders have been able to make quicker and more informed security decisions with a view to moving their behaviour from reactive to proactive in the event of an attack.

- Most organizations focus their intelligence efforts on more basic use cases, which are based on existing case studies and attacks, such as integrating intelligence feeds with existing IPS, firewalls and SIEMs, and do not take full advantage of the intelligence information they have to offer.

- The market for threat intelligence is primarily driven by the increasing uniqueness of the attack techniques, which makes the data vulnerable. The key factor driving this market is the increasing volumes of data generated by different enterprises.

- By integrating cloud and threat intelligence, organisations can protect themselves against cyber threats by using the Global Threat Community to detect unknown threats before they become known in order to prevent them from emerging so as to target an attack's surface. This has led to a significant increase in the adoption of threat intelligence solutions.

- The number of cyber crimes has increased in recent years, but there is no sign they are slowing down. telecommuting has increased as a result of the pandemic. The number of cyberattacks is increasing. The market for threat intelligence is further driven by the adoption of a remote working model by enterprises, which raises concerns about corporate security.

- The COVID 19 pandemic has had a positive impact on market growth, and new strategies are being developed by governments around the world to support organisations' concerns about cyber security. An increase in cyber vulnerabilities is driving the growth of threat intelligence markets.

Threat Intelligence Market Trends

BFSI Segment is Expected to Occupy a Significant Share

- Due to its large customer base, which the BFSI sector serves and due to the Financial Information at stake, it is one of the critical infrastructure segments facing a number of data breaches and cyber attacks on an ongoing basis.

- Cyber criminals optimize many calamitous cyberattacks to immobilize the financial sector because they are a highly lucrative business model with spectacular returns and an added upside of relatively low risk and detection. The threat landscape of these attacks ranges from ATM malware, Trojans, malware, ransomware, and mobile banking malware to data breaches, institutional intrusions, data thefts, tax evasion, etc.

- Public and privately owned banks are focusing on the implementation of new technology to prevent cyber attacks, as part of a strategy for safeguarding IT processes and systems, ensuring critical customer data is protected against unauthorised access while respecting government rules. Moreover, a proactive approach to security is required by banking institutions in view of increasing customer expectations, technical advances and legislative requirements.

- Online banking is becoming a favourite choice for customers of banking services due to the growing penetration of technology and digital channels, e.g. internet banking and cellphone banking. Advanced authentication and access control processes, such as threat intelligence strategies, must be used by the banks.

North America to Hold the Largest Market Share

- There are more than 1 exabyte of stored data in the financial services industry in the United States. These data are collected from different sources, such as credit and debit card history, customer bank visits, banking volumes, call logs, account transactions or web interactions.

- A number of global financial institutions have increased their use of Internet of Things devices due to the availability of adequate infrastructure, and the growth of threat intelligence solutions in North America is expected to be driven by Internet users.

- In order to develop advanced threat intelligence solutions, public authorities and private players in different regions are investing in research and development. The US Department of Homeland Security (DHS) Cybersecurity and the Infrastructure Security Agency (CISA) mentioned that they experienced a massive rise in phishing and malware distribution using COVID-19-themed lures, registration of new domain names containing wording related to coronavirus or COVID-19, and attacks against newly and rapidly deployed remote access and teleworking infrastructure.

- In order to strengthen the security posture of a country, investments in threat intelligence solutions are essential. In order to ensure a seamless and secure operation throughout North America, organizations will benefit from the deployment of threat intelligence solutions.

Threat Intelligence Industry Overview

The threat intelligence market is consolidated and dominated by a few major players, with more secure software solutions being launched. Dell Inc., IBM Corporation, Anomali Inc., Fortinet Inc., and CrowdStrike Inc. are key players in the market that offer dedicated solutions for threat intelligence.

- December 2023 - Fortinet, Inc has announced the latest release of new, integrated operational technology (OT) security solutions and services. These additions further distance Fortinet's OT Security Platform from the rest of the market.

- October 2023 - IBM Corporation has launched the next evolution of its managed detection and response service offerings with new AI technologies, including the ability to automatically escalate or close up to 85% of alerts,1 helping to accelerate security response timelines for clients., Wher the new Threat Detection and Response Services (TDR) provide 24x7 monitoring, investigation, and automated remediation of security alerts from all relevant technologies across client's hybrid cloud environments - including existing security tools and investments, as well as cloud, on-premise, and operational technologies (OT).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Incidences of Security Breaches and Cyber Crime

- 5.1.2 Evolution of Next-generation Security Solutions

- 5.2 Market Challenges/restraints

- 5.2.1 Low Data Security Budget and High Installation Cost of Solution

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 By Deployment

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By End-user Industry

- 6.3.1 BFSI

- 6.3.2 IT and Telecommunications

- 6.3.3 Retail

- 6.3.4 Manufacturing

- 6.3.5 Healthcare

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Australia

- 6.4.3.5 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Mexico

- 6.4.4.2 Brazil

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 South Africa

- 6.4.5.3 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Juniper Networks Inc.

- 7.1.2 AlienVault Inc.

- 7.1.3 Farsight Security Inc.

- 7.1.4 Trend Micro Incorporated

- 7.1.5 LogRhythm Inc.

- 7.1.6 F-Secure Corporation

- 7.1.7 Check Point Software Technologies Ltd

- 7.1.8 Dell Inc.

- 7.1.9 IBM Corporation

- 7.1.10 Webroot Inc.

- 7.1.11 Fortinet Inc.

- 7.1.12 Broadcom Inc. (Symantec Corporation)

- 7.1.13 McAfee LLC

- 7.1.14 LookingGlass Cyber Solutions Inc.

- 7.1.15 FireEye Inc.