|

市场调查报告书

商品编码

1642006

5G 晶片组:全球市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Global 5G Chipset - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

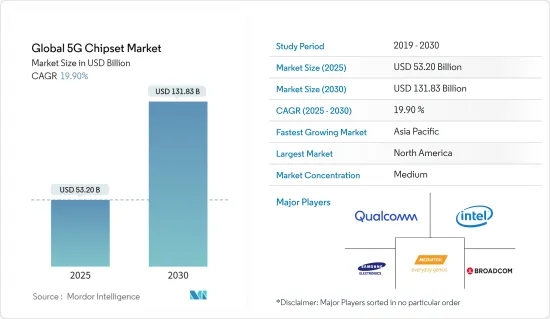

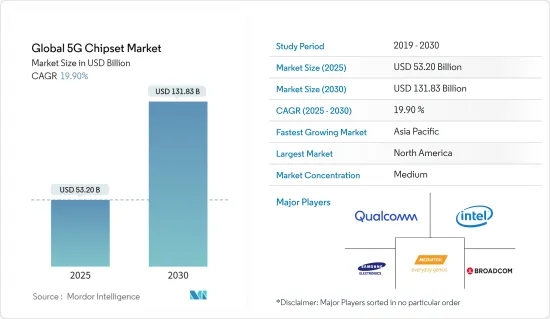

2025年全球5G晶片组市场规模预估为532亿美元,预计到2030年将达到1318.3亿美元,在市场预估和预测期内(2025-2030年)的复合年增长率为19.9%。

5G调变解调器晶片组将与服务供应商结合,显着贡献和增强三大关键应用:增强行动宽频、超可靠和低延迟通讯、以及大规模基于机器的通讯。预计该技术的应用将在预测期内推动对 5G 晶片组的需求。

主要亮点

- 5G晶片组有望成为5G网路的关键组成部分,并将很快为智慧型手机OEM和通讯业者大规模部署。为了提供超快的网路速度和资料速率,世界各地的主要通讯服务供应商都在将其网路升级到 5G。

- 5G的出现有望促进已迈向第四次工业革命(工业4.0)的产业使用连网设备。工业 4.0 正在促进跨行业的蜂窝连接,而物联网和机器对机器连接的兴起也有助于推动市场的发展。全球各地正在进行多个智慧城市计划和倡议,预计到 2025 年,全球整体将建立约 30 个智慧城市,其中一半将位置北美和欧洲。根据经合组织预测,2010年至2030年间,城市基础建设计划预计将达1.8兆美元。这主要是因为它用于智慧城市连接应用,这是推动5G晶片组需求的主要因素之一。

- 多家通讯业者正在获取频谱以扩大 5G 连接的覆盖范围。例如,在 2022 年 8 月印度首次 5G 频谱竞标中,Airtel 以 43,084 千万卢比的价格购买了 19,800 MHz 的频谱。在过去的20年里,900 MHz、2100 MHz、1800 MHz、3300 MHz 和 26 GHz 的频谱都是透过竞标获得的。该公司已在3.5GHz和26GHz频段取得了全印度业务覆盖。该公司表示,这是提供最佳5G体验的理想频谱库,可以以最低的成本策略性地实现100倍的容量扩展。

- Global Workplace Analytics 在 2020 年进行的一项调查发现,超过 80% 的受访者俱备居家办公所需的技术技能和知识,并且可以轻鬆存取公司网路(可能包括固网和行动网路)。 100% 的受访者表示他们信任这项服务。

- 3GPP规定5G应提供基于IMS的语音或视讯通讯服务。 ii 要求在 3GPP Release 16 中部署用于 5G-to-3G SRVCC 的 IMS,或在 3GPP Release 15 中部署 VoNR、EPS FB、VoeLTE 和 RAT FB。因此,预计此类升级将增加基础设施成本并使市场成长变得困难。每种架构都有其自身的挑战,但它们都要求在通讯业者网路内为 IP 多媒体子系统 (IMS) 做好网路准备。

5G晶片组市场趋势

工业自动化占很大份额

- 根据凯捷顾问公司调查,过去 18 到 24 个月内,每 10 家汽车工厂中就有 3 家已经变得更聪明。此外,80% 的汽车製造商认为 5G 对未来五年的数位转型至关重要。例如,爱立信和奥迪正在合作,在位于德国盖默斯海姆的奥迪生产实验室中演示无线连接的生产机器人如何製造车身,采用与该公司位于英戈尔施塔特的总部相同的模拟流程。我们正在进行一场考试。

- 对智慧製造方法的重视是影响市场的关键趋势。根据IBEF的资料,印度政府有一个雄心勃勃的目标,即到2025年将製造业产出对GDP的贡献从16%提高到25%。智慧先进製造和快速转型中心 (SAMARTH) Udyog Bharat 4.0倡议旨在提高印度製造业对工业 4.0 的认识,并帮助相关人员应对智慧製造的挑战。

- 工业 4.0 革命,即工业物联网 (IIOT),正在透过即时分析智慧机器和哑机器产生的资料,朝向汽车、製造、仓储和物流领域迈进。然而,自动化在这些领域带来了一些挑战。由于与必要硬体的整合不佳,预期的业务改善很难实现。例如,自动化仅占印度製造业GDP的1%,而已开发国家则约为5%。这是由于缺乏适合实施的技术。此外,根据 GSMA 预测,到 2025 年,北美消费者和工业物联网 (IoT) 连接总数将成长到 54 亿。

- 5G 在工业环境中被期望带来许多好处,因此引起了广泛的兴趣。自 3GPP Release 16 以来,5G 为企业提供的关键特性(如 99.999% 的网路可用性和可靠性、低于 10 毫秒的延迟以及对时间敏感网路的网路支援)已被定义为产业在以下背景下的数位化。

- 例如,ABB 和爱立信联手实现泰国的工业 4.0 目标,并透过自动化系统和无线通讯促进未来的弹性生产。重点领域包括 ABB 的机器人和离散式自动化、工业自动化和运动业务领域以及 ABB Ability™ 平台服务。此次合作将透过爱立信的通讯服务供应商合作伙伴和物联网加速器平台推出用于製造环境中远端试运行的支援 5G 和扩增实境的镜头,以及支援 5G 和全球 NB-IoT 连接的马达和驱动器。我们已经为你做好准备了。

北美占最大份额

北美是最重要的市场成长地区之一。美国占据该地区大部分市场占有率。这一成长是由物联网、M2M通讯、行动宽频和其他新兴应用的需求所推动的。

根据GSMA Intelligence的《2020年北美行动经济》报告,5G连线将占北美所有行动连线的一半以上。到2025年,该地区4.26亿个行动连线中,51%将使用5G网路。报告称,到2025年该地区将拥有3.4亿个行动用户。

此外,根据思科年度网路报告,美国智慧型手机的平均连线速度将从 2018 年的 19.2 Mbps 成长 4.2 倍(33% 复合年增长率)至 2023 年的 81.1 Mbps。随着5G的推出,通讯业者也正在推行雄心勃勃的网路转型策略。此外,全球18家通讯和消费性设备製造商已与美国公司合作开发5G晶片组。

5G 增强的吞吐量、可靠性、可用性和降低的延迟将实现新的安全敏感型应用,统称为 V2X 或车对万物 (Vehicle-to-Everything)。 5G 蜂窝 V2X(C-V2X)提供通用无线网络,促进都市区、郊区和高速公路驾驶情况下各种应用的整合。

5G晶片组产业概况

5G晶片组市场是半静态的,有许多区域和全球参与者。创新正在推动产品市场的发展,供应商也正在对创新进行投资。

- 2023 年 11 月-联发科推出具有 genAI 功能的 Dimensity 8300 5G 晶片组。该晶片组基于台积电第二代 4nm 工艺,配备八核心CPU,由四个 Arm Cortex-A715 核心和四个 Cortex-A510 核心组成,基于 Arm 的 v9 CPU 架构建构。 GPU是Mali-G615 MC6。 Dimensity 8300 为高阶智慧型手机领域带来了新的可能性,为用户提供掌上 AI、超现实的娱乐机会和无缝连接。

- 2023 年 11 月-Viettel High Tech 开发自己的 5G 晶片组。 5G DFE(数位前端)晶片每秒能够执行1兆次计算。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 技术简介

- 宏观经济趋势对产业的影响

第五章 市场动态

- 市场驱动因素

- 对高速互联网和广泛网路覆盖、降低延迟和功耗的需求不断增加

- 增加机器对机器/物联网连接

- 行动资料服务需求不断成长

- 市场限制

- 频谱分配分散

第六章 市场细分

- 按晶片组类型

- 专用积体电路 (ASIC)

- 无线电频率积体电路(RFIC)

- 毫米波技术晶片

- FPGA(现场可程式化闸阵列)

- 按运作频率

- 低于 6GHz

- 26~39 GHz

- 39 GHz 或更快

- 按最终用户

- 消费性电子产品

- 工业自动化

- 汽车和运输

- 能源和公共产业

- 卫生保健

- 零售

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- MediaTek Inc.

- Intel Corporation

- Samsung Electronics Co. Ltd

- Xilinx Inc.

- Nokia Corporation

- Broadcom Inc.

- Infineon Technologies AG

- Huawei Technologies Co. Ltd

- Renesas Electronics Corporation

- Anokiwave Inc.

- Qorvo Inc.

- NXP Semiconductors NV

- Cavium Inc.

- Analog Devices Inc.

- Texas Instruments Inc.

第八章投资分析

第九章:市场的未来

The Global 5G Chipset Market size is estimated at USD 53.20 billion in 2025, and is expected to reach USD 131.83 billion by 2030, at a CAGR of 19.9% during the forecast period (2025-2030).

The 5G modem chipsets, in combination with service providers, largely serve and enhance the capabilities of three major applications - enhanced mobile broadband, ultra-reliable and low latency communications, and massive machine-type communications. The applications of this technology are expected to drive the demand for 5G chipsets during the forecast period.

Key Highlights

- The 5G chipsets are expected to be a critical component of 5G networks, which will soon be rolled out at a massive scale for smartphone OEMs and telecom players. In order to provide ultra-high network speeds and data rates, major telecom service providers across the globe are upgrading their networks to 5G.

- The emergence of 5G is expected to expedite the use of connected devices in industries that are already pushing toward the fourth industrial revolution (Industry 4.0). Industry 4.0 is aiding cellular connectivity throughout the industry; the rise of IoT and machine-to-machine connections is also instrumental in driving market traction. Several smart city projects and initiatives are underway around the world, and it is expected that by 2025, there will be around 30 global smart cities, with half of these located in North America and Europe. These steps are supported by global investments, which, according to the OECD, are expected to total USD 1.8 trillion in urban infrastructure projects between 2010 and 2030. This is one of the major factors driving demand for 5G chipsets, owing primarily to their use in smart city connectivity applications.

- Multiple telecom operators are acquiring spectrums to increase their 5G connection coverage. For instance, in August 2022, In India's first 5G spectrum auction, Airtel paid Rs 43,084 crore for 19,800 MHz spectrum. In the past 20 years, spectrum bands 900 MHz, 2100 MHz, 1800 MHz, 3300 MHz, and 26 GHz have been acquired through auctions. It obtained a pan-India footprint in the 3.5 GHz and 26 GHz bands. According to the company, this is the ideal spectrum bank for the best 5G experience, with 100x capacity enhancement done strategically at the lowest cost.

- During the pandemic, the WFH setting was prepared for the extra technological benefits of 5G: in the Global Workplace Analytics (2020) survey, more than 80% of respondents stated that they had the technical skills and knowledge required for WFH, as well as easy and reliable access to company networks (presumably by both fixed-line and mobile means).

- 3GPP has specified that 5G should offer voice or video communication services based on the IMS, i.e., the IMS must be deployed for 5G-to-3G SRVCC in 3GPP Release 16 or VoNR, EPS FB, VoeLTE, and RAT FB in 3GPP Release 15. Hence such upgrades are expected to increase the infrastructure cost, thereby challenging the market's growth. While every architecture has specific challenges, all of them need network readiness of the IP Multimedia Subsystem (IMS) within the carrier's network.

5G Chipset Market Trends

Industrial Automation to Account for a Significant Share

- According to Capgemini, three out of every ten automotive plants have become smart in the last 18-24 months. Furthermore, 80% of automakers believe 5G will be critical to their digital transformation over the next five years. For instance, Ericsson and Audi are conducting field trials, such as wirelessly connected production robots building a car body at the latter company's production lab in Gaimersheim, Germany, using simulated processes similar to those used at its headquarters in Ingolstadt.

- The emphasis on smart manufacturing practices is a significant trend influencing the market. According to IBEF data, the Government of India has set an ambitious target of increasing manufacturing output contribution to GDP to 25% by 2025, up from 16%. The Smart Advanced Manufacturing and Rapid Transformation Hub (SAMARTH) Udyog Bharat 4.0 initiative aims to raise awareness of Industry 4.0 in the Indian manufacturing industry and assist stakeholders in addressing smart manufacturing challenges.

- The Industry 4.0 revolution, or industrial internet of things (IIOT) is making a dent in the automotive, manufacturing, warehousing, and logistics sectors by leveraging smart machines and real-time analytics on data produced by dumb machines. However, automation created several challenges in these sectors. Expected operational improvements proved hard to match due to a lack of integration with the required hardware. For instance, automation contributes to just 1% of manufacturing GDP in India, compared to around 5% in developed countries. This stems from a gap in suitable technology available for adoption. Further, According to GSMA By 2025 the total number of consumer and industrial Internet of Things (IoT) connections in North America is forecast to grow to 5.4 billion

- 5G has garnered significant interest considering the promised benefits within industrial environments. Since 3GPP's Release 16, key capabilities for enterprise 5G (such as 99.999% network availability and reliability, sub-10 milliseconds latencies, and Internet support for time-sensitive networking) has attracted ,industrial players for digitization in the context of Industry 4.0.

- For example, ABB and Ericsson collaborated to realize Thailand's Industry 4.0 ambition and facilitate future flexible production with automation systems and wireless communications. The focus areas include ABB's Robotics & Discrete Automation, Industrial Automation, and Motion business areas and ABB Ability TM Platform Services. The collaboration would cover 5 G-enabled andAugmented Reality Lenses for remote commissioning in manufacturing environments G-enabledand global NB-IoT connected motors and drives through Ericsson Communication Service Provider partners and its IoT-Accelerator platform.

North America to Account for the Largest Share

North America is one of the most important market growth regions. The United States has contributed the majority of the region's market share. The demand for IoT, M2M communications, mobile broadband, and other emerging applications is driving the increase.

In North America, 5G connections will represent more than half of all mobile connections, according to GSMA Intelligence's 'Mobile Economy North America 2020' report. By 2025, 51% of the region's 426 million mobile connections will be on 5G networks. According to the report, the region will have 340 million mobile subscribers by 2025.

Furthermore, according to Cisco Annual Internet Report, the average smartphone connection speed in the United States will be 81.1 Mbps by 2023, up from 19.2 Mbps in 2018, 4.2-fold growth (33% CAGR). Alongside 5G rollouts, operators are also pursuing ambitious network transformation strategies. Moreover, 18 global telecom and consumer device makers partnered with US-based Qualcomm for their 5G chipset.

New safety-sensitive applications, collectively known as V2X or Vehicle-to-Everything, will be made possible by 5G's enhanced throughput, dependability, availability, and decreased latency. To facilitate the convergence of various apps for urban, suburban, and highway driving circumstances, 5G Cellular V2X (C-V2X) offers a common wireless network.

5G Chipset Industry Overview

The 5G chipset market is semi-consolidated, with many regional and global players. Innovation drives the market in product offerings, and each vendor invests in innovation.

- Nov 2023 - MediaTek launched Dimensity 8300 5G chipset with genAI capabilities. The chipset is based on TSMC's second-generation 4nm process and has an octa-core CPU comprising four Arm Cortex-A715 cores and four Cortex-A510 cores built on Arm's v9 CPU architecture. It is paired with the Mali-G615 MC6 GPU. The Dimensity 8300 unlocks new possibilities for the premium smartphone segment, offering users in-hand AI, hyper-realistic entertainment opportunities, and seamless connectivity.

- November 2023 - Viettel High Tech developed its own 5G chipset. The 5G DFE (digital front end) chip can perform 1 quadrillion calculations per second.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.5 Impact of Macro Economic trends on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for High-speed Internet and Broad Network Coverage with Reduced Latency and Power Consumption

- 5.1.2 Growing Machine-to-machine/IoT Connections

- 5.1.3 Increase in Demand for Mobile Data Services

- 5.2 Market Restraints

- 5.2.1 Fragmented Spectrum Allocation

6 MARKET SEGMENTATION

- 6.1 By Chipset Type

- 6.1.1 Application-specific Integrated Circuits (ASIC)

- 6.1.2 Radio Frequency Integrated Circuit (RFIC)

- 6.1.3 Millimeter Wave Technology Chips

- 6.1.4 Field-programmable Gate Array (FPGA)

- 6.2 By Operational Frequency

- 6.2.1 Sub-6 GHz

- 6.2.2 Between 26 and 39 GHz

- 6.2.3 Above 39 GHz

- 6.3 By End User

- 6.3.1 Consumer Electronics

- 6.3.2 Industrial Automation

- 6.3.3 Automotive and Transportation

- 6.3.4 Energy and Utilities

- 6.3.5 Healthcare

- 6.3.6 Retail

- 6.3.7 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 MediaTek Inc.

- 7.1.2 Intel Corporation

- 7.1.3 Samsung Electronics Co. Ltd

- 7.1.4 Xilinx Inc.

- 7.1.5 Nokia Corporation

- 7.1.6 Broadcom Inc.

- 7.1.7 Infineon Technologies AG

- 7.1.8 Huawei Technologies Co. Ltd

- 7.1.9 Renesas Electronics Corporation

- 7.1.10 Anokiwave Inc.

- 7.1.11 Qorvo Inc.

- 7.1.12 NXP Semiconductors NV

- 7.1.13 Cavium Inc.

- 7.1.14 Analog Devices Inc.

- 7.1.15 Texas Instruments Inc.