|

市场调查报告书

商品编码

1642007

环境照明:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Ambient Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

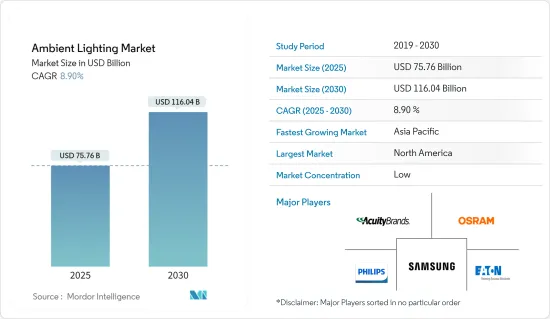

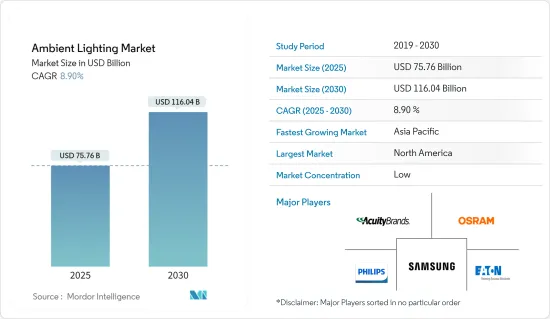

预计 2025 年环境照明市场规模为 757.6 亿美元,到 2030 年将达到 1,160.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.9%。

对舒适和创新照明解决方案的不断增长的需求以及对节能解决方案的需求可能会为环境照明市场创造机会。与白炽灯、卤素灯和紧凑型萤光(CFL) 等传统照明解决方案相比,LED 等节能灯泡的耗电量通常可减少约 25-80%,使用寿命更长,约 3-8 年。长25倍。

关键亮点

- 持续的技术进步,例如商业建筑和住宅的智慧照明系统、全球基础设施开发计划的增加以及消费者对更好的室内照明设计的偏好,正在推动市场成长。

- 此外,人们对全球气候变迁的日益关注导致了各种有关能源效率的规则和法规的实施。由于白炽灯泡因产生过多热量而效率降低,这些解决方案正成为更受欢迎的选择,有助于推动环境照明市场的成长。

- 然而,以环境照明取代传统系统会导致高昂的更换成本,这是预测期内阻碍市场成长的因素之一。全球对 LED 照明解决方案的需求正在迅速增长。智慧LED解决方案的出现预计将进一步提高LED的采用率,从而推动环境照明的需求。

- 能源部预计,到 2025 年,LED A 型灯将占安装量的 56%。因此,随着 LED 成本不断降低、功能不断增强,我们可以期待看到住宅要求的更多便利性、舒适性、美观性和控制选项。

- 自新冠肺炎疫情爆发以来,许多企业的供应链面临挑战。环境照明市场也不例外。由于LED原料大部分产自亚洲国家,该地区在3月和4月受到了疫情的严重影响。然而,由于各国对使用基于 LED 的解决方案来提高能源效率的严格监管,全球对 LED 的需求预计会下降。

环境照明市场趋势

LED 将占据主要市场占有率

- LED 照明系统与冷阴极萤光(CCFL) 或紧凑型萤光(CFL) 相比,消耗的能量最多可减少 50%,但可产生相同的光强度。降低能源消费量将直接意味着每年减少二氧化碳排放7亿多吨。因此,预计预测期内 LED 将会完全取代 CFL 和 CCFL。预计这一因素将很快推动环境照明市场的发展。

- 此外,LED不发射紫外线,且属于中性光,适合室内照明。此外,它对于患有光反应性疾病的患者来说是理想的选择。发光二极体发出的光是安全的。

- 此外,LED照明市场的主要推动因素是LED照明所提供的优势特性,例如更高的能源效率、更长的使用寿命、更好的物理强度、更小的尺寸、设计灵活性和环境友善性。据 MeitY(印度)称,21财年印度全国的LED产值约为1630亿印度卢比(约21.9亿美元)。这项数据较上一财年的 1,625 亿印度卢比(约 21.8 亿美元)有所增加。

- 此外,LED 照明解决方案还提供调光控制,这项功能在住宅和商业建筑中越来越被采用。根据美国电气工业协会 (NEMA) 的子公司照明控制协会的数据,可调光 LED 的价格已降至与标准开/关开关相当的水平。

- 所有上述因素预计都将加速 LED 照明市场的发展,并可能在预测期内产生对环境照明的需求。

亚太地区成长强劲

- 由于中国和印度等新兴经济体基础建设活动的活性化,亚太地区呈现最快的成长。

- 此外,该地区各政府也正在努力实施严格的能源效率法规和法律。这进一步推动了该地区环境照明市场的成长。例如,印度政府的「Deen Dayal Upadhyay Gram Jyoti Yojana」(DDUGJY)和「综合电力发展计画」(IPDS)等倡议已分别在农村和都市区实施。

- 印度也将成为世界上第一个全年使用 LED 照明的国家。如此大规模的采用预计将推动环境照明市场的成长。亿盏LED灯,每年可节省67亿元,并避免1,119.40兆瓦的尖峰电力需求。 EESL 计划到 2024 年投资 800 亿印度卢比(约 10.7 亿美元),在未来四到五年内覆盖印度农村地区。预计 EESL 将维修/安装超过 3000 万盏 LED 灯。在斯里兰卡民族党的领导下,安得拉邦率先安装 LED 灯,其次是拉贾斯坦邦和北方邦。

- 此外,这些灯也用于汽车照明系统。印度、中国、日本和韩国是占汽车产量大部分的主要国家,为汽车照明市场创造了成长机会。

- 由于都市化的快速发展和人们生活方式的改变,LED照明在建筑业越来越受欢迎。其相容的尺寸和精美的外观吸引了高标准人士的关注,大大增加了氛围照明的采用。

环境照明产业概况

环境照明市场竞争激烈且分散。参与该市场的一些公司包括 GE Lighting、三星电子、Koninklijke Philips NV、OSRAM Licht AG、The Zumtobel Group、Wipro Consumer Care &Lighting Ltd、Hafele America Co. 和 Acuity Brands Inc.在环境照明市场,领先公司之间提供技术先进解决方案的竞争日益激烈,导致研发投资增加。

2022 年 10 月,欧司朗和 TacoTek 宣布将合作透过提供薄型、无缝整合的3D照明结构来帮助改变汽车内装市场。两家公司开发了一款采用 ams-Osram 全新 RGB 侧视 OSIRE E5515 LED 的示范器。结合 TactoTek 的 IMSE 技术,LED 可以以新颖、节省空间的设计整合到汽车内部。这些 LED 在 20mA 时的亮度性能为红光 1,100mcd、绿光 2,600mcd 和蓝光 500mcd。它还有深蓝色可供选择。

同样,2022 年 8 月,海福乐新加坡与 SIXiDES Asia 建立了合作伙伴关係。对于海福乐新加坡公司来说,这是一个推出新照明和储存解决方案的机会。 60多位室内设计师齐聚一堂,首次独家展示并接受海福乐最新照明和收纳系列LOOX LED和Kosmo的培训。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 对环境照明市场的影响

第五章 市场动态

- 市场驱动因素

- 对节能照明解决方案的需求日益增加

- 智慧照明的普及率不断提高

- 基础设施现代化

- 市场问题

- 使用环境照明取代传统照明的高成本

第六章 市场细分

- 按产品

- 灯具和照明设备

- 白炽灯

- 卤素灯

- 萤光

- 发光二极体(LED)

- 照明控制

- 灯具和照明设备

- 按类型

- 表面贴装灯

- 轨道灯

- 灯带

- 吊挂

- 嵌入式灯具

- 其他的

- 按最终用户

- 住宅

- 车

- 饭店业

- 医疗

- 其他最终用户(工业)

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 其他的

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Acuity Brands Inc.

- OSRAM Licht AG

- Koninklijke Philips NV

- Samsung Electronics Co. Ltd

- Eaton Corporation Inc.

- The Zumtobel Group

- Wipro Consumer Care & Lighting Ltd

- Hafele America Co.

- Cree Inc.

- Bridgelux Inc.

- Hubbell Incorporated

- GE Lighting

- Decon Lighting Pvt Ltd

- Louis Poulsen

- Nulite Lighting

- SPI Lighting

- v2 Lighting Group

- Amerlux

第八章投资分析

第九章:市场的未来

The Ambient Lighting Market size is estimated at USD 75.76 billion in 2025, and is expected to reach USD 116.04 billion by 2030, at a CAGR of 8.9% during the forecast period (2025-2030).

The rising demand for comfortable and innovative lighting solutions and the need for energy-efficient solutions may create an opportunity for the ambient lighting market. Compared to traditional lighting solutions, such as incandescent, halogen, compact fluorescent lamps (CFLs), etc., energy-efficient lightbulbs such as LEDs typically use about 25%-80% less energy and last about 3-25 times longer.

Key Highlights

- The ongoing technological evolutions, such as smart lighting systems in commercial or residential buildings, increasing infrastructural projects worldwide, and consumer preferences for better interior lighting design, favor the market's growth.

- Moreover, the rising concerns over global climate change have led to the implementation of various rules and regulations about energy efficiency. The increasing inefficiency of incandescent bulbs, owing to excess heat generation, is making these solutions a more preferred option, thus aiding the ambient lighting market growth.

- However, replacing traditional systems with ambient light leads to high replacement costs and is one of the hindering factors for the market growth during the forecast period. The global demand for LED lighting solutions is growing fast. With the advent of smart LED solutions, the adoption rate of LED is expected to increase further, driving the demand for ambient lighting.

- The Department of Energy estimates that LED A-type lamps will achieve a 56% penetration by 2025 in the installed stock. Thus, as LEDs continue to reduce cost-wise and grow functionality-wise, they are expected to deliver greater convenience, comfort, aesthetics, and control options that homeowners require.

- Since the outbreak of COVID-19, various businesses have faced challenges in the supply chain. The ambient lighting market is no exception. Since a prominent share of the raw materials for producing LEDs originated from Asian countries, the industry was significantly influenced during March and April, as the region was under the severe clutches of the pandemic. However, the global LED demand is expected to see lower scale impacts due to the stringent regulations in countries related to the usage of LED-based solutions for energy efficiency; yet, the market may see sluggish growth in connected solutions.

Ambient Lighting Market Trends

LEDs to Hold Significant Market Share

- LED lighting systems use up to 50% less energy to generate an equivalent light intensity emitted by cold cathode fluorescent lamps (CCFL) and compact fluorescent lamps (CFL). The reduced energy consumption directly converts into a reduction of over 700 million metric tons of carbon dioxide emissions annually. Thus, LEDs are expected to completely replace CFLs and CCFLs during the forecast period. This factor is expected to drive the ambient lighting market shortly.

- Moreover, LEDs are UV radiation-free and neutral, which makes them more suitable for indoor lighting. Additionally, they are ideal for people with photoreactive sickness. The rays emitted from the light-emitting diodes are safe.

- Additionally, the LED lighting market is mainly driven by advantageous features offered by LED lights, such as increased energy efficiency, longer lifetime, enhanced physical strength, smaller size, design flexibility, and environmental friendliness. According to MeitY (India), LED production across India was valued at about INR 163 Billion (~USD 2.19 billion) in the financial year 2021. The statistics indicated an increase from the previous financial year, which was INR 162.5 Billion (~USD 2.18 Billion).

- Moreover, LED lighting solutions offer dimmable controls, and this feature is increasingly adopted in the residential sector and commercial buildings. As per the Lighting Controls Association, a part of the National Electrical Manufacturers Association (NEMA), prices of dimmable LEDs are dropping to levels comparable with standard on/off switches.

- All the factors mentioned above are expected to accelerate the LED lighting market, which may create a demand for ambient lighting during the forecast period.

Asia-Pacific to Witness Significant Growth

- The Asia-Pacific region is witnessing the fastest growth due to rampant infrastructure-building activities in emerging economies, such as China and India.

- Additionally, the various regional governments are also focusing on implementing stringent regulations and legislation on energy efficiency. Thus, this is further supporting the growth of the ambient lighting market in this region. For instance, initiatives from the Indian government, such as Deen Dayal Upadhyay Gram Jyoti Yojana (DDUGJY) and Integrated Power Development Scheme (IPDS), have already been implemented for rural and urban areas, respectively.

- Also, India is expected to become the world's first country to use LEDs for all lighting needs annually. Such a colossal implementation will aid the growth of the ambient lighting market. The hundred million LED lights resulted in an annual saving of 6.7 billion units and avoided 1,119.40 MW of peak power demand. The EESL plans to bring INR 80 billion (~USD 1.07 billion) in investment by 2024 to cover rural India in the next 4-5 years. It is anticipated that more than 30 million LED lights will be retrofitted/installed by EESL. Under SLNP, Andhra Pradesh leads the way in installing LED lights, followed by Rajasthan and UP.

- Moreover, these lights are used in automotive lighting systems as well. India, China, Japan, and South Korea are some of the major countries which hold the majority of vehicle production, thus, offering growth opportunities for the automotive lighting market.

- The rapid urbanization and changing lifestyles of people in the country have also increased the penetration of LED lighting in the building and construction industries. The compatible size and aesthetic look have drawn the attention of people with high standards, which resulted in significant growth in the adoption of ambient lighting.

Ambient Lighting Industry Overview

The Ambient Lighting Market is highly competitive and fragmented. Some of the players in this market include GE Lighting, Samsung Electronics Co. Ltd, Koninklijke Philips NV, OSRAM Licht AG, The Zumtobel Group, Wipro Consumer Care & Lighting Ltd, Hafele America Co., Acuity Brands Inc., and many more. The rising competition among major players to offer advanced technology-based solutions in the ambient lighting market is making them invest increasingly in R&D.

In October 2022, Osram and TacoTek announced that they cooperated to help revolutionize the car interior market by delivering thin, seamlessly integrated, three-dimensional illuminated structures. The companies have developed a demonstrator with the new RGB side-looker OSIRE E5515 LED from ams Osram, which with TactoTek's IMSE technology, can be integrated into automotive interiors in new types of space-saving design. The LED offers a brightness performance of 1100 mcd for red, 2600 mcd for green, and 500 mcd for blue color at 20 mA. Also, deep blue colors are available.

Similarly, in August 2022, Hafele Singapore partnered with SIXiDES Asia. It was an opportunity for Hafele Singapore to announce its new lighting and storage solutions. Over 60 interior designers got an exclusive first look and training at the gathering using Hafele's most recent lighting selection, LOOX LED and storage range, Kosmo.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Ambient Lighting Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Need for Energy-efficient Lighting Solutions

- 5.1.2 Increasing Adoption of Smart Lighting

- 5.1.3 Modernization of Infrastructure

- 5.2 Market Challenges

- 5.2.1 High Costs Involved in Replacing Traditional Lighting with Ambient Lighting

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Lamps and Luminaires

- 6.1.1.1 Incandescent Lamps

- 6.1.1.2 Halogen Lamps

- 6.1.1.3 Fluorescent Lamps

- 6.1.1.4 Light Emitting Diode (LED)

- 6.1.2 Lighting Controls

- 6.1.1 Lamps and Luminaires

- 6.2 By Type

- 6.2.1 Surface-mounted Light

- 6.2.2 Track Light

- 6.2.3 Strip Light

- 6.2.4 Suspended Light

- 6.2.5 Recessed Light

- 6.2.6 Other Types

- 6.3 By End User

- 6.3.1 Residential

- 6.3.2 Automotive

- 6.3.3 Hospitality and Retail

- 6.3.4 Healthcare

- 6.3.5 Other End Users (Industrial)

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of Asia Pacific

- 6.4.4 Rest of the World

- 6.4.4.1 Latin America

- 6.4.4.2 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Acuity Brands Inc.

- 7.1.2 OSRAM Licht AG

- 7.1.3 Koninklijke Philips NV

- 7.1.4 Samsung Electronics Co. Ltd

- 7.1.5 Eaton Corporation Inc.

- 7.1.6 The Zumtobel Group

- 7.1.7 Wipro Consumer Care & Lighting Ltd

- 7.1.8 Hafele America Co.

- 7.1.9 Cree Inc.

- 7.1.10 Bridgelux Inc.

- 7.1.11 Hubbell Incorporated

- 7.1.12 GE Lighting

- 7.1.13 Decon Lighting Pvt Ltd

- 7.1.14 Louis Poulsen

- 7.1.15 Nulite Lighting

- 7.1.16 SPI Lighting

- 7.1.17 v2 Lighting Group

- 7.1.18 Amerlux