|

市场调查报告书

商品编码

1642013

资料中心转型:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Data Center Transformation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

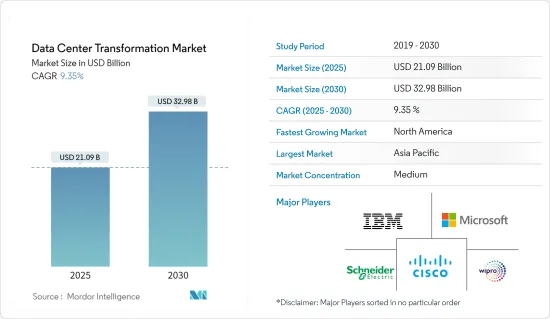

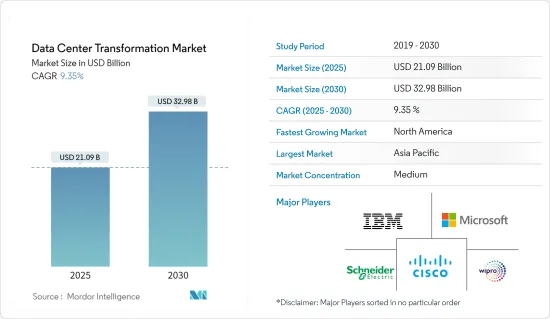

资料中心转型市场在 2025 年的估值为 210.9 亿美元,预计到 2030 年将达到 329.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.35%。

全球各地的资料中心供应商正在逐步转型其资料中心,以降低营运成本并提高整体效率。随着企业迅速采用云端运算、物联网(IoT)和巨量资料分析作为其数位转型策略的一部分,资料中心的负担也不断增加,从而推动了全球资料中心的成长。

主要亮点

- 此外,思科预测,鑑于通讯设备的兴起,以及越来越多的公司转向基于软体即服务 (SaaS) 的应用程序,全球资料中心的流量也将不断增长,从而引领市场。

- 随着可靠性的提高和全球资料中心数量的增加,资料中心供应商保持一致性和营运效率变得更具挑战性。

- 许多依赖数位基础设施的产业对资料中心服务的需求正在增加,这反过来又推动了对资料中心网路服务的需求。随着全球越来越多的企业和教育机构使用网路来提供必要的程式可用性和资料安全性,对资料中心的需求也日益增长。

- 此外,能源效率正在成为资料中心的一个重要考虑因素,能源成本占总成本的近 40%(根据网路策略和技术公司 Ciena 的数据)。作为资料中心转型的一部分,基础设施管理预计将在未来几年获得发展动力,因为人们越来越追求更高的能源效率以节省成本。

- 资料中心转型市场受到了新冠疫情的正面影响。资料中心的成长也受到人们日益意识到云端运算带来的好处(云端运算提供了高度安全和可靠的IT基础设施)以及建立本地资料中心的需求不断增长的推动。

资料中心转型市场趋势

电子商务资料库变得越来越重要,预计将显着成长

- 对于电子商务企业来说,资料中心提供了许多显着的好处。您需要利用收集的资料来产生非常有用的客户洞察并优化业务流程。

- 电子商务资料库日益增长的重要性是推动全球资料中心扩张的主要驱动力。资料中心被在网路上销售的公司用来储存和传输这些资料集,以用于各种组织任务,例如品牌推广和促销。

- 捕获电子商务资料可以让线上零售商监控电子商务的各个方面,包括分析和客户资讯。此外,新兴国家日益增强的数位转型预计将推动资料中心市场的成长。

- 因此,资料中心市场受到中国和印度等新兴经济体的强烈推动。在数位转型的这一阶段,技术进步正在推动更有效率的资料中心和相关解决方案的发展。

北美占有最大市场占有率

- 根据中国互联网络资讯中心(CNNIC)的数据,北美地区占据全球云端和互联网资料中心最大的市场占有率。如此高的比例也因为许多大公司都将总部设在该地区。

- 北美也对 IT、BFSI、零售和医疗保健等各个终端用户产业的全球资料中心需求做出了重大贡献。

- 联邦政府的资料中心最佳化倡议(DCOI) 是一项主要针对资料中心营运商的计划,旨在整合低效率的基础设施、优化现有设施、实现成本节约并开发更有效率的基础设施。在鼓励向

- 对可靠性和永续性的日益关注迫使资料中心所有者和营运商研究燃料能源储存等最尖端科技。一个相对较新的需求来源:加密货币挖掘,为可能不适合现代主机託管的旧资产提供了新的机会。

- 概括来说,政府打算透过这项倡议在财政年度结束前将实体资料中心成本降低至少 25%。该地区在市场上的主导地位,加上日益增长的降低营运成本的需求,为采用资料中心转型解决方案提供了空间,从而推动了市场的发展。

资料中心转型产业概览

资料中心转型市场是一个半独立市场,有许多参与者在国内和国际市场运作。市场集中度适中,主要企业采用产品设计创新策略。市场的主要企业包括 IBM 公司、思科系统公司和 Wipro。

2023 年 9 月,Schneider ElectricSE 宣布与 Compass Datacenters 达成价值 30 亿美元的多年期协议,并与投资者合作。该协议整合了两家公司的供应链,并扩大了他们现有的合作关係,以製造和交付预製模组化资料中心解决方案。

2022年10月,Kindrill宣布与戴尔科技集团和微软公司合作推出全面的混合云端解决方案。该解决方案使资料中心、远端和大型主机环境中的客户能够利用戴尔、Kyndryl 託管服务和 Microsoft Azure 提供的基础设施来加速他们的云端转型之旅。

2022 年 1 月,IBM推出了IBM Z 和云端现代化中心,以加速混合云端的采用。该中心将作为各种工具、资源、培训和生态系统合作伙伴的数位门户,帮助 IBM Z 客户加速混合云端环境中应用程式、流程和资料的数位化。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场动态

- 市场驱动因素

- 降低资料中心成本并提高效率的需求

- 采用云端基础的服务

- 电子商务资料库的重要性预计将大幅成长

- 市场限制

- 对未载入资料中心投资的投资报酬率的担忧

第六章 市场细分

- 按服务

- 整合服务

- 优化服务

- 自动化服务

- 基础设施管理

- 按资料中心级别

- 第 1层级

- 第 2层级

- 第 3层级

- 层级4 层

- 按最终用户

- 资料中心提供者

- 企业

- 资讯科技和电信

- BFSI

- 卫生保健

- 零售

- 製造业

- 航太、国防与情报

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- IBM Corporation

- Cisco Systems, Inc.

- NetApp, Inc.

- NTT Communications

- Dell EMC(Dell Inc.)

- Microsoft Corporation

- Schneider Electric SE

- HCL Technologies Limited

- Accenture plc

- Wipro Technologies

- Hitachi Vantara Federal, Corporation

- Emerson Network Power, Inc

第八章投资分析

第九章 市场机会与未来趋势

The Data Center Transformation Market size is estimated at USD 21.09 billion in 2025, and is expected to reach USD 32.98 billion by 2030, at a CAGR of 9.35% during the forecast period (2025-2030).

Data center providers across the globe are gradually moving towards data center transformation in order to increase overall efficiency whilst reducing operational costs. Owing to the rapidly rising adoption of cloud, Ineternet of Things (IoT), and big data analytics across various enterprises as a part of their digital transformation strategy, the burden on the data centers is also increasing, leading to the growth in the data centers globally.

Key Highlights

- Moreover, data center traffic across the world is also increasing, considering the number of increasing communicating devices and more enterprises switching to software-as-a-service (SaaS)-based applications, as forecasted by Cisco, which will also drive the market.

- With the increasing reliability and the increase in the number of data centers around the world, data center providers are finding it difficult to maintain consistency and operational efficiency

- Demand for data center services increased in many sectors which are dependent on digital infrastructures and this has resulted in an increase in the demand for Data Center Network Services. The need for data centres is increasing as a result of the rising number of enterprises and education institutions around the world who are Internet based, which means that they have to provide required program availability and data security.

- Energy efficiency considerations are also gaining importance among data centers since energy accounts for almost 40% of total costs (according to network strategy and technology company Ciena). Infrastructure management, as a part of the data center transformation, is expected to gain traction over the years, considering the attempt to increase energy efficiency as a cost-saving measure.

- The market for data center transformation was positively affected by the COVID 19 pandemic. Increasing awareness of the advantages provided by cloud computing to deliver a high security, reliable IT infrastructure and growing demand for building local data centres has also helped drive Data Centres growth.

Data Center Transformation Market Trends

Increasing Significance of E-commerce Databases are Expected to Grow at a Significant Rate

- For e commerce companies, data centres offer a number of significant advantages. In addition, they need to take advantage of the data that they collect and use it for extremely useful customer insights and business process optimisation.

- The growing importance of e commerce databases is the key driver for expanding data centres around the world. In order to store and transfer these data sets for a variety of organizational tasks, e.g. branding, promotion or anything like that, Data Centres are being used by businesses selling on the Internet.

- Through the acquisition of e-commerce data, online retailers monitor all the many components of their e-commerce, such as analytics or customer information. It is also expected that rising digital transformation in emerging nations fuels data centre market growth.

- Consequently, the market for data centres has been significantly stimulated by developing economies like China and India. At this phase of digital transformation, efficient data centers and related solutions are being developed due to the evolution of technology.

North America Occupies the Largest Market Share

- The North American region holds the largest market share of the global cloud and internet data centers, according to China Internet Network Information Center (CNNIC). This high share can also be because many major players are headquartered in this region.

- North America also contributes substantially to the global data center demand from various end-user industries such as IT, BFSI, retail, and healthcare.

- The Federal government's Data Center Optimization Initiative (DCOI) primarily aims to encourage data center players to consolidate the inefficient infrastructure, optimize existing facilities, achieve cost savings, and transition to a more efficient infrastructure.

- Due to the increased focus on dependability and sustainability, data center owners and operators must investigate cutting-edge technologies like fuel-cell energy storage. Older assets that might be deemed unsuitable for modern colocation are receiving new opportunities thanks to cryptocurrency mining, a comparatively recent source of demand.

- To generalize the statement, through this initiative, the government intends to reduce the costs of physical data centers by a minimum of 25% by the end of the fiscal year. The dominance of this region in the market, combined with the increasing need to reduce operational costs, provides scope for adopting data center transformation solutions, hence driving the market.

Data Center Transformation Industry Overview

The data center transformation market is semi-conslidated owing to the presence of many players in the market operating in the domestic as well as the international market. The market is moderately concentrated, with key players adopting product and design innovation strategies. Some of the major players in the market are IBM Corporation, Cisco Systems, Inc., and Wipro, among others.

In September 2023 - Schneider Electric SE announced at its Collobration with investors a USD 3 billion multi-year agreement with Compass Datacenters. The agreement extends the companies' existing relationship that integrates their respective supply chains to manufacture and deliver prefabricated modular data center solutions.

In October 2022, Kyndryl announced a comprehensive hybrid cloud solution in collaboration with Dell Technologies and Microsoft Corporation. This solution empowers clients in data center, remote, and mainframe environments to expedite their cloud transformation journey by leveraging the infrastructure offered by Dell, Kyndryl's managed services, and Microsoft Azure.

In January 2022, IBM launched the IBM Z and Cloud Modernization Center to facilitate the adoption of hybrid clouds. The center serves as a digital gateway to a wide range of tools, resources, training, and ecosystem partners, assisting IBM Z clients in accelerating the digitization of their applications, processes, and data in a hybrid cloud environment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Need to Reduce Costs and Increase Efficiency of Data Centers

- 5.1.2 Adoption of Cloud-based Services

- 5.1.3 Increasing Significance of E-commerce Databases are Expected to Grow at a Significant Rate

- 5.2 Market Restraints

- 5.2.1 ROI Concerns Over the Investment across Low Load Data Centers

6 MARKET SEGMENTATION

- 6.1 By Services

- 6.1.1 Consolidation Services

- 6.1.2 Optimization Services

- 6.1.3 Automation Services

- 6.1.4 Infrastructure Management

- 6.2 By Level of Data Center

- 6.2.1 Tier 1

- 6.2.2 Tier 2

- 6.2.3 Tier 3

- 6.2.4 Tier 4

- 6.3 By End User

- 6.3.1 Data Center Providers

- 6.3.2 Enterprises

- 6.3.2.1 IT and Telecom

- 6.3.2.2 BFSI

- 6.3.2.3 Healthcare

- 6.3.2.4 Retail

- 6.3.2.5 Manufacturing

- 6.3.2.6 Aerospace, Defense, and Intelligence

- 6.3.2.7 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Cisco Systems, Inc.

- 7.1.3 NetApp, Inc.

- 7.1.4 NTT Communications

- 7.1.5 Dell EMC (Dell Inc.)

- 7.1.6 Microsoft Corporation

- 7.1.7 Schneider Electric SE

- 7.1.8 HCL Technologies Limited

- 7.1.9 Accenture plc

- 7.1.10 Wipro Technologies

- 7.1.11 Hitachi Vantara Federal, Corporation

- 7.1.12 Emerson Network Power, Inc