|

市场调查报告书

商品编码

1642016

AIaaS(人工智慧即服务):市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)AI-as-a-Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

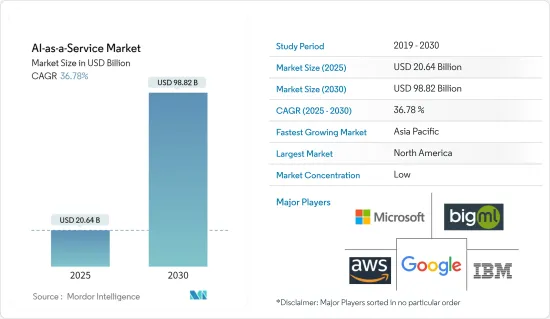

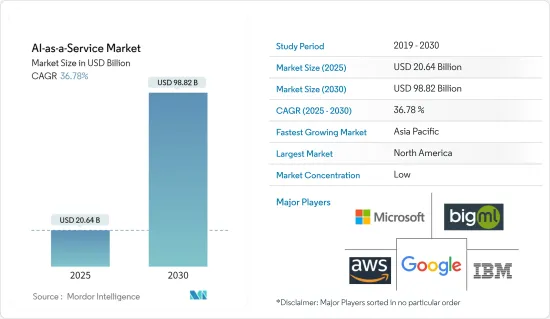

2025 年 AIaaS(人工智慧即服务)市场规模预估为 206.4 亿美元,预计到 2030 年将达到 988.2 亿美元,预测期内(2025-2030 年)复合年增长率为 36.78% 预计将达到。

随着企业数量的增加和竞争的加剧,企业正试图将人工智慧(AI)技术严格融入其应用程式、业务、分析和服务中。此外,企业希望降低营运成本以提高利润率,这就是为什么人工智慧即服务(AIaaS)比云端更受关注的原因。作为参考点,企业正在转向云端基础的机器学习,这有助于他们试验产品。

关键亮点

- 多重云端功能的趋势和对云端基础的智慧服务的日益增长的需求也在推动对人工智慧即服务 (AIaaS) 的需求。 IBM 称,98% 的组织计划在 2021 年采用多重云端架构,但只有 41% 的组织制定了多重云端管理策略,也没有操作多重云端环境的程式或工具。这为AI服务创造了巨大的机会。

- 此外,IBM 的 2022 年人工智慧采用指数显示,我们正处于人工智慧 (AI) 使用及其对商业和社会影响的转折点。全球范围内,人工智慧的采用率大幅提升,比前一年成长了4个百分点,达到35%。在某些领域和国家,人工智慧的使用已变得非常普遍。

- 由于新的自动化功能、更强的易用性和可访问性以及更具包容性的试验的使用案例,世界各地的组织正在迅速从人工智慧中获得新的优势和效率。虚拟助理和 IT 等现成的企业解决方案正在将 AI 纳入业务中。 44%的企业正在努力将人工智慧融入其当前的应用程式和流程,这一事实支持了「可访问性是关键」的说法。

- 许多政府机构,尤其是新兴经济体的政府机构也了解人工智慧的好处和力量,因此正在推动广泛的人工智慧基础设施建设。例如,印度国家提倡委员会增加了对「数位印度」的预算拨款,并推出了包括研发在内的国家人工智慧计划,以推动人工智慧、机器学习、3D列印等技术的发展。

人工智慧即服务 (AIaaS) 市场趋势

对预测和分析解决方案的需求不断增长预计将推动市场成长

- 对预测和分析解决方案的需求不断增长预计将推动 AIaaS(人工智慧即服务)市场的发展。 AIaaS是指将人工智慧(AI)的运算和分析能力外包给透过互联网提供AI解决方案和工具的第三方服务供应商。

- 随着人工智慧技术的进步,各行各业的公司都意识到将人工智慧融入其业务中的潜在好处。人工智慧有助于提高效率、增强客户体验并做出资料主导的决策。然而,引入人工智慧基础设施和内部开发人工智慧模型需要时间和精力。 AIaaS 透过提供预先建置的 AI 解决方案和平台,提供了经济高效且便利的替代方案。

- AIaaS平台具有可扩展性和灵活性,可让企业根据其需求存取AI资源。随着对预测和分析解决方案的需求不断增长,企业可以透过利用 AIaaS 服务轻鬆扩展其 AI 能力。这种灵活性使公司能够适应不断变化的业务需求,而无需在基础设施和专业知识方面进行大量的前期投资。

- AIaaS 消除了企业投资昂贵的硬体、软体和专业 AI 专业知识的需求。 AIaaS 解决方案可让企业以订阅或付费使用制存取 AI 功能,从而降低前期成本并让更广泛的组织能够使用 AI。这种成本效益特别有利。

- 在医疗保健领域实施预测分析需要强大的人工智慧能力、运算能力和专业知识。 AIaaS 平台为医疗保健机构提供了 AI 和预测分析工具的便利性和可近性,无需大量的前期投资。随着医疗保健提供者和付款人意识到预测分析的价值,医疗保健领域对 AIaaS 解决方案的需求预计将成长,从而推动整个 AIaaS 市场的发展。

- 据飞利浦称,截至去年第二个月,在新加坡接受调查的医疗保健领导者中,92%表示他们已经在其医疗保健组织中实施或正在实施预测分析,这一比例在所有受访者中是最大的。排名第二的是中国,占79%,排名第三的是巴西和美国,占66%。

预计北美将占据较大的市场占有率

- 北美AIaaS(AI即服务)市场是AIaaS解决方案最大的市场之一。北美拥有硅谷等主要技术中心,这些中心致力于促进创新并推动技术进步。该地区拥有强大的基础设施和先进的技术劳动力,有利于人工智慧技术的开发和部署。这样的技术生态系统为AIaaS供应商提供解决方案和服务创造了良好的环境。

- 美国拥有强大的创新生态系统,这得益于联邦政府对先进技术的战略投资,以及来自世界各地富有远见的科学家、企业家和知名研究机构的存在。

- 根据国家安全委员会人工智慧最终报告,国会应该每年将联邦人工智慧提案预算增加一倍,到2026财年达到320亿美元。在拜登政府提出的2023财年预算中,联邦研发预算预计将超过2,040亿美元,较2021财年授权水准成长28%。国家人工智慧研究机构,包括新的和现有的,都将获得部分资金。该实验室将汇集商业部门、组织、学术界以及联邦、州和地方当局,共同应对人工智慧研究和劳动力发展的挑战。预计政府的这些人工智慧发展措施将推动市场发展。

- 北美是人工智慧产业蓬勃发展的地区,拥有许多专注于人工智慧技术开发的新兴企业、科技巨头和研究机构。这个生态系统正在促进创新并推动对 AIaaS 解决方案的需求。医疗、金融、零售和製造等领域的公司正积极采用AI技术来增强其竞争地位,进一步推动北美AIaaS市场的成长。

- 北美的许多组织正在进行数位转型,希望利用人工智慧技术来加强业务、优化流程并从资料中获取洞察。 AIaaS 在这些努力中发挥关键作用,为企业提供一种可扩展、经济高效的方式来存取 AI 功能,而无需在基础设施和专业知识方面进行大量的前期投资。

AIaaS(人工智慧即服务)产业概览

人工智慧即服务 (AIaaS) 市场高度细分,主要参与者包括微软公司、Google有限责任公司、亚马逊网路服务公司、IBM 公司和 BigML 公司。市场参与企业正在采取联盟和收购等策略来增强其产品供应并获得可持续的竞争优势。

2022年7月,IBM宣布收购领先的资料可观察性软体供应商Databand.ai。 Databand.ai 协助组织解决资料问题,例如错误、管线故障和品质不佳,以免影响收益。今天的公告扩展了 IBM 在资料、人工智慧和自动化领域的软体产品组合,以涵盖完整的可观察性范围。我们帮助组织在正确的时间将可信赖的资料交到正确的个人手中。

2022 年 6 月,亚马逊推出了一项名为 Code Whisperer 的新服务,该服务利用机器学习为软体开发人员产生程式码提案。这是亚马逊首次附加服务云端服务。该工具目前处于预览阶段,旨在帮助程式设计师更快地编写程式码并为人工智慧计划建立训练资料。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 产业价值链分析

- COVID-19 工业影响评估

第五章 市场动态

- 市场驱动因素

- 对预测和分析解决方案的需求不断增加

- 改善消费者体验的需求不断增加

- 市场问题

- 资料外洩和骇客攻击的风险

第六章 市场细分

- 按部署

- 民众

- 私人的

- 杂交种

- 按组织规模

- 中小企业

- 大型企业

- 按最终用户产业

- BFSI

- 零售

- 医疗

- 资讯科技/通讯

- 製造业

- 活力

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Microsoft Corporation

- Google LLC

- Amazon Web Services, Inc.

- IBM Corporation

- BigML Inc

- DATAIKU SAS

- Salesforce.com Inc.

- SAS Institute Inc

- Oracle Corporation

- H2O.Ai Inc

- Craft.AI

第八章投资分析

第九章 市场机会与未来趋势

The AI-as-a-Service Market size is estimated at USD 20.64 billion in 2025, and is expected to reach USD 98.82 billion by 2030, at a CAGR of 36.78% during the forecast period (2025-2030).

With the increasing number of enterprises and competition, companies are rigorously trying to integrate artificial intelligence (AI) technology into their application, business, analytics, and services. Moreover, companies are trying to reduce their operational cost to increase profit margins, due to which Artificial Intelligence-as-a-Service (AIaaS) is gaining more prominence over the cloud. Notably, companies are more interested in cloud-based machine learning, which helps in experimenting with their offerings.

Key Highlights

- The rising trend of multi-cloud functioning and the growing need for cloud-based intelligence services are also increasing the demand for AI as a service. According to IBM, by 2021, 98% of the organization's plans will adopt multi-cloud architectures, with only 41% having a multi-cloud management strategy and just 38% having procedures and tools to operate a multi-cloud environment. This creates a massive opportunity for AI services.

- Furthermore, the IBM AI adoption index 2022 states, " A tipping point has been reached in using artificial intelligence (AI) and its effects on businesses and society. The adoption rate of AI globally increased significantly and is at 35%, up four points from the previous year. And the usage of AI is nearly universal in several sectors and nations.

- Organizations worldwide are quickly gaining new advantages and efficiencies from AI thanks to new automation capabilities, improved usability and accessibility, and a more comprehensive range of tried-and-true use cases. Virtual assistants and other ready-made corporate solutions like IT incorporate AI into their operations. The fact that 44% of firms are working to integrate AI into current apps and processes supports the argument that accessibility is important.

- Many government organizations, especially in emerging economies, also understand the benefits and power of AI; hence, they are extensively promoting AI-based infrastructure development. For instance, Niti Aayog in India launched a national program on AI, including R&D, with increased budget allocation for Digital India to promote AI, machine learning, 3D printing, and other technologies.

Artificial Intelligence as a Service (AIaaS) Market Trends

Increasing Demand for Predictive and Analytics Solutions is Expected to Drive Market Growth

- The increasing demand for predictive and analytics solutions would drive the artificial intelligence-as-a-service (AIaaS) market. AIaaS refers to outsourcing artificial intelligence (AI) computational and analytical capabilities to third-party service providers offering AI solutions and tools over the Internet.

- With advancements in AI technology, businesses across various industries recognize the potential benefits of integrating AI into their operations. AI can help improve efficiency, enhance customer experiences, and make data-driven decisions. However, implementing AI infrastructure and developing AI models in-house can take time and effort. AIaaS provides a cost-effective and convenient alternative by offering pre-built AI solutions and platforms.

- AIaaS platforms offer scalability and flexibility, allowing businesses to access AI resources according to their requirements. As the demand for predictive and analytics solutions grows, companies can easily scale up their AI capabilities by leveraging AIaaS services. This flexibility enables organizations to adapt to changing business needs without significant upfront investments in infrastructure and expertise.

- AIaaS eliminates the need for businesses to invest in expensive hardware, software, and specialized AI expertise. By leveraging AIaaS solutions, companies can access AI capabilities on a subscription or pay-per-use basis, reducing upfront costs and making AI more accessible to a broader range of organizations. This cost efficiency is particularly beneficial.

- Adopting predictive analytics in healthcare requires robust AI capabilities, computational power, and expertise. AIaaS platforms offer healthcare organizations the convenience and accessibility of accessing AI and predictive analytics tools without significant upfront investments. As healthcare providers and payers increasingly recognize the value of predictive analytics, the demand for AIaaS solutions in the healthcare sector is expected to grow, driving the overall AIaaS market.

- According to Philips, as of the second month of the previous year, 92 percent of healthcare leaders surveyed in Singapore reported that they had either implemented or were implementing predictive analytics in their healthcare organization, the highest adoption rate among all countries examined. China stood second with a 79 percent adoption rate, followed by Brazil and the United States with 66 percent.

North America is Expected to Hold Significant Market Share

- The North American Artificial Intelligence-as-a-Service (AIaaS) market is one of the largest markets for AIaaS solutions. North America is home to major technology hubs, such as Silicon Valley, which foster innovation and drive technological advancements. The region has a robust infrastructure and a highly skilled workforce, enabling the development and deployment of AI technologies. This technological ecosystem creates a favorable environment for AIaaS providers to offer solutions and services.

- The United States has a robust innovation ecosystem fueled by strategic federal investments in advanced technology, complemented by the presence of visionary scientists and entrepreneurs coming together from across the world and renowned research institutions, which have propelled the development of AI in the North American region.

- According to the National Security Commission on Artificial Intelligence, its final report proposed that Congress increase federal R&D funding for AI by a factor of two annually, up to a total of USD 32 billion in fiscal 2026. The federal R&D budget was expected to be increased by 28% from FY 2021 authorized levels to more than USD 204 billion under the Biden administration's fiscal 2023 budget plan. The National AI Research Institutes, both new and established, would get some of those funds. To address the difficulties of AI research and workforce development, these institutes bring together the commercial sector, organizations, academics, and federal, state, and municipal authorities. Such government initiatives for the development of AI will drive the market.

- The North American region has a thriving AI industry with numerous startups, technology giants, and research institutions focused on advancing AI technologies. This ecosystem fosters innovation and drives demand for AIaaS solutions. Companies in sectors like healthcare, finance, retail, and manufacturing are actively adopting AI technologies to gain a competitive edge, further fueling the growth of the AIaaS market in North America.

- Many organizations in North America are undergoing digital transformation initiatives, aiming to leverage AI technologies to enhance their operations, optimize processes, and gain insights from their data. AIaaS plays a crucial role in these initiatives, providing businesses with a scalable and cost-effective way to access AI capabilities without significant upfront investments in infrastructure and expertise-the need for businesses to remain competitive drives the demand for AIaaS solutions.

Artificial Intelligence as a Service (AIaaS) Industry Overview

The artificial intelligence-as-a-service (AIaaS) market is highly fragmented, with the presence of major players like Microsoft Corporation, Google LLC, Amazon Web Services, Inc., IBM Corporation, and BigML Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain a sustainable competitive advantage.

In July 2022, IBM announced the acquisition of Databand.ai, a major provider of data observability software that assisted organizations in resolving data issues such as mistakes, pipeline failures, and low quality before they influenced their bottom line. The announcement expanded IBM's software portfolio across data, AI, and automation to cover the whole spectrum of observability. It assisted organizations in ensuring that trustworthy data was in the hands of the appropriate individuals at the right time.

In June 2022, Amazon launched "Code Whisperer,' a new service that used machine learning to generate code suggestions for software developers. It is the first addition to its cloud offering. This tool, currently in preview, is intended to help programmers write code faster and build training datasets for their artificial intelligence projects.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Predictive and Analytics Solutions

- 5.1.2 Rising Demand for Enhancing Consumer Experience

- 5.2 Market Challenges

- 5.2.1 Risks Associated with Data Breaches and Hacks

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 Public

- 6.1.2 Private

- 6.1.3 Hybrid

- 6.2 By Organization Size

- 6.2.1 Small and Medium Enterprise

- 6.2.2 Large Enterprise

- 6.3 By End-user Industry

- 6.3.1 BFSI

- 6.3.2 Retail

- 6.3.3 Healthcare

- 6.3.4 IT and Telecom

- 6.3.5 Manufacturing

- 6.3.6 Energy

- 6.3.7 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microsoft Corporation

- 7.1.2 Google LLC

- 7.1.3 Amazon Web Services, Inc.

- 7.1.4 IBM Corporation

- 7.1.5 BigML Inc

- 7.1.6 DATAIKU SAS

- 7.1.7 Salesforce.com Inc.

- 7.1.8 SAS Institute Inc

- 7.1.9 Oracle Corporation

- 7.1.10 H2O.Ai Inc

- 7.1.11 Craft.AI