|

市场调查报告书

商品编码

1642020

雷射直接成型 (LDS) 天线 -市场占有率分析、行业趋势和成长预测(2025-2030 年)Laser Direct Structuring (LDS) Antenna - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

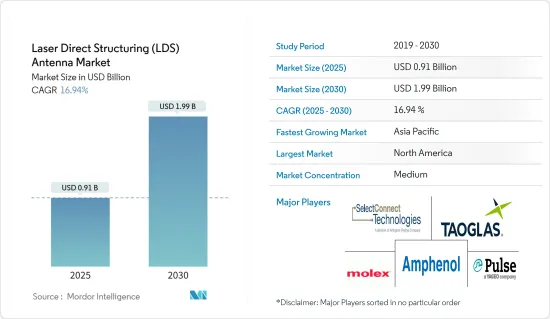

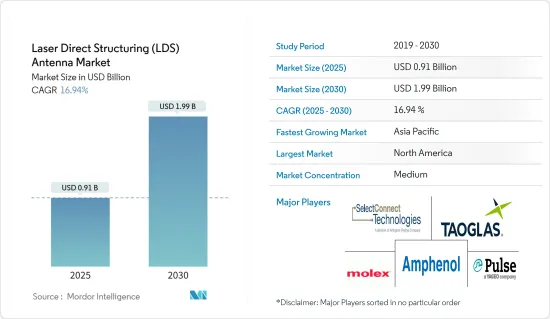

雷射直接成型 (LDS) 天线市场规模预计在 2025 年达到 9.1 亿美元,预计到 2030 年将达到 19.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 16.94%。

关键亮点

- 随着各行业小型化趋势愈发明显,LDS市场日益受到青睐。 LDS 技术可实现具有整合功能的紧凑型设计。现代电子产品给製造商带来了一些挑战。然而,采用 LDS 天线技术透过提供金属化形态的高度自由度,为克服这些挑战提供了一种有效的方法。

- 数位音讯、视讯和资讯科技的融合正在重塑消费性电子产业,创造出一个能够吸引消费者註意力的全新电子产品世界。消费者支出趋势是家用电子电器产业的领先经济指标,与经济成长密切相关。

- 技术进步促进了电脑、通讯和家用电子电器的融合,小型化为产品创新提供了许多新机会,这对产业有利。消费性电子产业的小型化趋势已将封装元件尺寸缩小至早期技术设计规则的水平。

- 这项技术得到了迅速应用,尤其是在智慧型手机领域,过去十年产量大约翻了一番。除此之外,智慧型装置、穿戴式装置和连网医疗设备的日益普及以及现代医疗保健领域的创新,为全球医疗保健服务带来了重大进步。

- 此外,由于无人机(UAV)、全球定位系统/全球导航卫星系统 (GPS/GNSS) 导航和共形通讯天线的兴起,军事和国防电子领域也看到了 LDS 天线市场的潜在成长。了令人兴奋的商机。

- 据蒂尔集团称,2013年至2027年间预计将研发28912架无人机,其中约95%将用于军事目的。无人机作战正在世界各地的军队中逐渐确立,对全球安全产生影响。推动这一趋势的是,TE Connectivity 等公司正致力于提供能够在航太和国防部门恶劣环境下生存的轻型小型天线。

- 然而,高昂的设备成本、对耐高温材料的需求、冗长的电镀製程、由于金属化层薄而产生的程序复杂性以及雷射结构化过程中的珠子预计会阻碍市场的成长。

- COVID-19 对 LDS 技术广泛应用天线的许多行业的製造业务产生了不利影响。智慧型手机、垫片电脑、笔记型电脑、车辆追踪系统、游戏机、库存追踪系统、无线印表机、路由器、无人机等的销售和生产都受到物流和劳动力可用性限制的影响。

雷射直接成型 (LDS) 市场趋势

汽车产业预计将大幅成长

- 3D 模製连接装置 (3D MID) 的雷射直接成型 (LDS) 广泛应用于汽车应用,以减轻重量并提高可靠性。下一代(未来)汽车的生产将在很大程度上取决于增强汽车无线连接各种服务的能力。连网汽车的愿景旨在有效利用无线通讯资源来提供有效的交通管理、资讯娱乐和驾驶员安全等先进功能。

- 为了满足多样化广播和远端资讯处理应用的需求,车载设备正在整合越来越多的无线服务。一般以车用天线为主,涵盖所有无线通讯标准,例如车顶整合天线、玻璃天线、拉桿天线等。

- LDS 主要用于方向盘毂,因为大多数汽车通常都配备了方向盘控制装置。此外,LDS在前进控制开关、定位感知器以及煞车感知器等方面也有广泛的应用。 LDS 广泛应用于自动驾驶汽车的 ADAS(进阶驾驶辅助系统)。此外,自动驾驶汽车预计将在交通运输领域迅速普及。总部位于布鲁塞尔的非营利倡导组织欧洲道路安全委员会 (ETSC) 估计,自动煞车可以将道路交通事故死亡率降低 20%。

- 例如,2022年6月,特斯拉在中国和美国推出了增强型自动驾驶仪。增强型自动驾驶仪在美国的售价为 6,000 美元。而在中国,它的售价为 4,779 美元。增强型自动驾驶仪包含的功能包括自动驾驶导航、自动变换车道、自动停车、召唤和智慧召唤。特斯拉也在纽西兰和澳洲发布了增强型自动驾驶仪。在新西兰,增强型自动驾驶仪的售价为 3,615 美元,在澳大利亚,其售价为 3,579 美元。增强型自动驾驶仪在这四个国家都列出了相同的功能。

- 据纳斯达克称,到 2030 年,自动驾驶汽车将占据市场主导地位。此外,世界各地的多个政府都在推广使用 ADAS 功能。例如,美国运输部国家公路交通安全管理局(NHTSA)针对高度自动化汽车(HAV)制定了联邦自动驾驶汽车政策(FAVP)。

预计北美将占据主要份额

- 北美几乎每个终端用户领域都对 LDS 天线解决方案有着强烈的需求。然而,该地区对 LDS 天线的主要需求来源可能是家用电子电器、网路和汽车产业。

- 该地区汽车行业的强劲成长促进了市场的成长和扩张。为了提高乘客的舒适度和安全性,现代车辆必须结合各种感测器和电子辅助装置。然而,随着这些感测器和组件的部署,减少组件数量的需求也日益增加。

- 采用 LDS 技术并结合适当的连接和组装技术有望促进小型化并减少元件数量。 LDS 技术也有助于使製造过程更具成本效益,并开启更多的设计选择。

- 美国在主要家用电子电器市场占有较大的份额。据美国消费技术协会(CTA)称,过去五年来,智慧型手机是美国消费性电子产品和技术销售中最大的收益来源。预计2022年美国智慧型手机销售额将从前一年的747亿美元增加17亿美元,达到754亿美元。

雷射直接成型 (LDS) 天线产业概览

雷射直接成型 (LDS) 天线市场竞争激烈。主要参与者包括 Taoglas Limited、Molex LLC、SelectConnect Technologies、TE Connectivity Ltd 和 Pulse Electronics Corporation(Yageo Corporation)。从市场占有率来看,目前市场主要被几家主要企业所占据。这些在市场上占有较大份额的大公司高度专注于扩大海外基本客群。这些公司正在利用各种策略合作措施来最大限度地提高市场占有率并提高盈利。

2022 年 7 月,全球感测器供应商 TE Connection 收购了物联网 (IoT) 市场射频 (RF) 组件供应商 Linx Technologies。此次策略性收购进一步增强了TE的产品系列和物联网竞争力。随着 TE 持续增加对物联网市场的投资,此次收购将有助于扩大 TE 的供应链,特别是用于物联网的天线和射频连接器。这也是 TE 继 2021 年收购 Laird Connectivity 天线业务之后迈出的具有重要战略意义的一步。

此外,2022 年 7 月,透过物联网实现数位转型的领先公司 Taoglas 和领先的 4G/5G蜂窝物联网电子元件分销商和解决方案供应商Novotech 将收购Taoglas 的4G/5G蜂巢式物联网联网电子元件,包括工业合资企业,生产领先的天线。 我们签署了一项新的加拿大伙伴关係协议,该协议结合了先进组件的销售以及蜂巢式物联网连接解决方案的销售和技术支援。新的伙伴关係关係扩大了 Novotech 的产品组合,使其合作伙伴和客户能够使用 Taoglass 创新的 4G/5G 蜂窝产品组合,支援公共、交通、电子充电、固定无线和5G 行动网路解决方案。这样做。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 家用电子电器产业对小型化的需求日益增加

- 物联网和高天线距离设备的成长

- 市场问题

- 缺乏对模製互连设备的认识与製造复杂性

第六章 市场细分

- 最终用户产业

- 医疗

- 消费性电子产品

- 车

- 联网

- 其他的

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Taoglas Limited

- Molex LLC

- Multiple Dimensions AG

- SelectConnect Technologies

- TE Connectivity Ltd

- Pulse Electronics Corporation(Yageo Corporation)

- Amphenol Corporation

- Tongda Group Holdings Limited

- Shenzhen Sunway Communication Co. Ltd

- Luxshare Precision Industry Co. Ltd

- HARTING KGaA

- Huizhou Speed Wireless Technology Co. Ltd

- LPKF Laser & Electronics AG

第八章投资分析

第九章 市场机会与未来趋势

The Laser Direct Structuring Antenna Market size is estimated at USD 0.91 billion in 2025, and is expected to reach USD 1.99 billion by 2030, at a CAGR of 16.94% during the forecast period (2025-2030).

Key Highlights

- With the miniaturization trend gaining prominence across various industries, the LDS market is gaining popularity. LDS technology allows smaller designs with integrated functionalities. Modern electronics have brought several difficulties for manufacturers. However, the introduction of the LDS antenna technology offers an effective way to overcome these challenges by offering a high degree of freedom in terms of metallization shape, thus, allowing improved radiation performance.

- The convergence of digital-based audio, video, and information technology is changing the shape of the consumer electronics industry, creating a whole new world of electronic gadgets that can grab consumers' attention. The consumer-spending trend is a leading economic indicator in the consumer electronics industry, strongly correlated with economic growth.

- Technological advancements are bringing convergence of computer, communication, and consumer electronics, auguring well for the industry, with many new opportunities for product innovations, with miniaturization. The trend towards miniaturization in the consumer electronics industry has driven package component sizes down to the design-rule level of early technologies.

- Specifically, smartphones have observed a robust uptake of this technology, nearly doubling production volumes over the past decade. Apart from this, the rising adoption of smart devices, wearables, and connected medical equipment, innovations in the modern medical sciences across the world has bought a massive advancement into the global healthcare offerings as most consumers are now leveraging the advantages offered by smart medical devices to address critical health needs.

- Furthermore, the electronics segment in the military and defense industry also presents potential opportunities for the LDS antenna market, buoyed by the rising number of unmanned aerial vehicles (UAVs), global positioning system/global navigation satellite system (GPS/GNSS) navigation, and conformal communication antennas, among others.

- According to Teal Group, approximately 95% of the 28,912 UAVs projected to be developed between 2013 and 2027 will be employed for military purposes. UAV operations are becoming well-embedded in the armed forces worldwide, affecting global security. Aiding this trend, players, such as TE Connectivity, are focused on delivering lighter, smaller antennas that can sustain in harsh environments in the aerospace and defense sector.

- However, the market growth is expected to be hindered by the high equipment costs, need for high temperature-resistant materials, long plating process, and complexity in procedure due to thin metallization layers and beads of the laser structuring process.

- COVID-19 adversely affected manufacturing operations in numerous industries where LDS technology has a wide range of antenna uses. The sales, as well as production of smartphone and pad devices, laptop and notebook computers, vehicle tracking systems, gaming consoles, inventory tracking systems, wireless printers, and routers, UAVs, etc., were all affected by restrictions on logistics and the availability of the workforce.

Laser Direct Structuring (LDS) Market Trends

Automotive is expected to register a Significant Growth

- Laser direct structuring of 3D molded connecting devices (3D MIDs) is widely used in automotive applications to reduce weight and boost reliability. The production of next-generation (future) vehicles depends mostly on enhancing vehicles' abilities to connect wirelessly to a wide variety of services. The vision for connected vehicles aims to effectively use wireless communication resources to deliver advanced functionalities for effective traffic management, infotainment, and ensuring the driver's safety.

- To fulfill the requirements for a wide variety of applications in broadcasting and telematics, onboard automobile equipment is integrated into an increasing number of wireless services. Typically, automotive onboard antennas, like integrated rooftop antennas, on-glass antennas, and rod antennas, are mostly used to cover all wireless communication standards.

- LDS is majorly used in steering wheel hubs, as most automobiles generally come equipped with steering-mounted controls. In addition, LDS is widely used in forwarding control switches, positioning sensors, and brake sensors. LDS finds its applications vastly in advanced driver-assistance systems (ADAS) for self-driving cars. Moreover, self-driving cars are anticipated to see rapid adoption in the transportation sector. The European Transport Safety Council (ETSC), a not-for-profit advocacy group in Brussels, projected that automatic braking could minimize traffic death rates by as much as 20%.

- For example, in June 2022, Tesla built its Enhanced Autopilot in China and the United States. In the United States, Enhanced Autopilot costs USD 6,000. Meanwhile, in China, it costs USD 4,779. The features included in Enhanced Autopilot are navigate on autopilot, auto lane change, autopark, summon, and smart summon. Tesla also released Enhanced Autopilot in New Zealand and Australia. In New Zealand, Enhanced Autopilot costs USD 3,615, and in Australia, it costs USD 3,579. Enhanced Autopilot offers the same features in all four countries.

- By 2030, autonomous automobiles will probably rule the market, as per NASDAQ. In addition, several governments worldwide are promoting the use of ADAS features. For instance, the National Highway Traffic Safety Administration (NHTSA) of the United States Department of Transportation (USDT) established the Federal Automated Vehicles Policy (FAVP) in relation to highly automated vehicles (HAVs), which can range from cars with advanced driver-assistance features to autonomous vehicles.

North America is Expected to Hold Major Share

- Nearly all the end-user sectors in the North American region greatly demand LDS Antenna solutions. However, the region's main source of demand for LDS antennas is likely to come from the consumer electronics, networking, and automotive industries.

- The region's strong automobile industry growth helps the market grow and expand. For the enhancement of the comfort and safety of passengers, modern automobiles need to combine a variety of sensors and electronic assistants. However, the requirement to reduce the number of components is growing along with deploying these sensors and components.

- Incorporating LDS technology is anticipated to promote miniaturization and lower the number of components when used with appropriate connection and assembly technology. LDS technology also assists in terms of cost-effectiveness in the manufacturing process and aids in the extension of design alternatives.

- The United States has a significant share of the major consumer electronics markets. According to the Consumer Technology Association (CTA), smartphones generated the most revenue in consumer electronics/technology sales in the United States during the previous five years. The sales value of smartphones sold in the United States increased by 1.7 billion USD in 2022 to USD 75.4 billion compared to USD 74.7 billion in the previous year.

Laser Direct Structuring (LDS) Industry Overview

The market for laser direct structuring (LDS) antenna is hugely competitive. It contains several leading players such as Taoglas Limited, Molex LLC, SelectConnect Technologies, TE Connectivity Ltd, Pulse Electronics Corporation (Yageo Corporation), etc. In terms of market share, few significant players currently dominate the market. These major players with a substantial stake in the market are highly focused on expanding their customer base across foreign countries. These companies leverage various strategic collaborative initiatives to maximize their market share and increase their profitability.

In July 2022, TE Connection, a global provider of sensors, bought Linx Technologies, a supplier of radio frequency (RF) components in the Internet of Things (IoT) markets. The strategic acquisition will further strengthen Te's product portfolio and competitiveness in the IoT. As TE continues to strengthen its investment in the IoT market, the acquisition will help expand TE's supply chain, particularly in antennas and RF connectors for the IoT. It is also an important strategy for TE following the acquisition of Laird Connectivity's antenna business in 2021.

Moreover, in July 2022, Taoglas, a leading enabler of digital transformation through IoT, and Novotech, a leading 4G/5G cellular IoT electronics components distributor and solutions provider, entered into a new Canadian partnership agreement combining the distribution of Taoglas' advanced components, including industry-leading antennas, sales and technical support for cellular IoT connectivity solutions. This new partnership will expand Novotech's portfolio, providing the company's partners and customers access to Taoglas' innovative 4G/5G cellular portfolio for supporting public safety, transportation, e-charging, fixed wireless, and 5G mobile networking solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand For Miniaturization In Consumer Electronics Industry

- 5.1.2 Growth of IoT and Devices With Higher Antenna Ranges

- 5.2 Market Challenges

- 5.2.1 Lack of Awareness and Manufacturing Complexities Associated With Molded Interconnect Devices

6 MARKET SEGMENTATION

- 6.1 End-user Industry

- 6.1.1 Healthcare

- 6.1.2 Consumer Electronics

- 6.1.3 Automotive

- 6.1.4 Networking

- 6.1.5 Other End-user Industries

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Taoglas Limited

- 7.1.2 Molex LLC

- 7.1.3 Multiple Dimensions AG

- 7.1.4 SelectConnect Technologies

- 7.1.5 TE Connectivity Ltd

- 7.1.6 Pulse Electronics Corporation (Yageo Corporation)

- 7.1.7 Amphenol Corporation

- 7.1.8 Tongda Group Holdings Limited

- 7.1.9 Shenzhen Sunway Communication Co. Ltd

- 7.1.10 Luxshare Precision Industry Co. Ltd

- 7.1.11 HARTING KGaA

- 7.1.12 Huizhou Speed Wireless Technology Co. Ltd

- 7.1.13 LPKF Laser & Electronics AG