|

市场调查报告书

商品编码

1642024

东南亚国协仓储与配送物流:市场占有率分析、产业趋势与成长预测(2025-2030 年)ASEAN Warehousing And Distribution Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

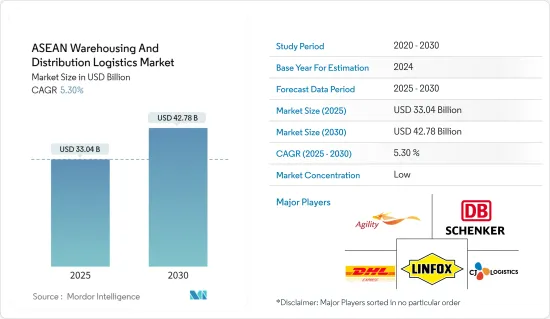

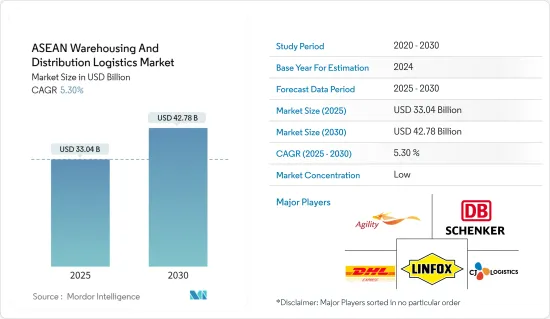

东南亚国协仓储和配送物流市场规模预计在2025年为330.4亿美元,预计到2030年将达到427.8亿美元,预测期内(2025-2030年)复合年增长率为5.3%。

作为全球成长最快的经济体之一,东南亚受惠于由全球贸易、外来投资以及区域和全球价值链一体化所推动的广泛经济成长模式。然而,为了维持这一成长势头,需要进行多项改革来增强该地区的经济和社会復原力。这些改革包括降低竞争和市场准入的监管壁垒,以促进创新、生产力和效率。

由于电子商务领域的快速成长,东协的仓储和配送物流预计将快速成长。最后一哩物流的高需求和快速发展的交通基础设施正在促进东协仓储和配送物流市场的发展。除了物流业的成长之外,外国公司在该地区的存在以及政府的倡议(例如 Adapt 和 Grow &Go Digital)也推动了该地区仓储和配送市场的成长。新加坡是东协主要国家之一。其地理位置和强大的货运及物流业务使其成为该地区发展最快的国家之一。该地区的大型公司正在大力投资仓储基础设施。

一些地区对仓库的需求正在增加,这主要是由于电子商务的成长。去年,专门开发仓库和工厂的BW(越南第一大工厂开发商)收到的请求比以往任何时候都多。 BW的长期发展策略是有效利用这些短期机会,透过建造轻型、现代化的工业仓库来满足製造业日益增长的需求和电子商务的爆炸性增长。

冷藏需求的不断成长迫使企业调整其供应链策略。据行业报告称,外国投资者对在越南建造冷藏仓库的兴趣日益浓厚,因为他们受益于都市化进程和零售现代化,从而改变了越南大城市获取生鲜食品的方式。随着重大基础设施的投资和发展,例如期待已久的隆城国际机场的建设,预计未来的供应链将变得更加高效。

东南亚国协仓储配送物流市场趋势

增加泰国的仓库空间

仓库不只是一个仓库。进行即时包装、组装和产品客製化等增值业务。过去五年来,泰国的电子商务经历了巨大的成长。该电子商务仓库群位于曼谷 Bangna-Trat 路沿线 15 公里至 23 公里处。

近年来,泰国的零售市场大幅成长。在全国范围内,有组织的零售和现代购物稳步增长。随着泰国民众可支配收入的不断增加、年轻人口的庞大以及旅游业的蓬勃发展,许多外国品牌正在进入泰国。这导致仓储服务的增加。

在泰国,由于经济逐渐復苏,仓库租赁业者预计将在预测期内继续扩大业务,这主要得益于出口产业的改善和国内零售业的復苏。未来三年对新供应的投资可能会增加。大型营运商将处于最前线,造成部分局部市场供应过剩,加剧价格竞争,限制营运商提高租金的能力。

大多数营运商目前正在对其设施进行现代化改造,以提供现代化的仓储解决方案,从而扩大基本客群并透过附加服务增加收益。参与企业还将升级仓库建筑,以满足行业标准(例如LEED 计划),投资于能源效率和环境保护,并安装设施,使其更能抵御洪水和地震等自然灾害。进行现代化改造手段,例如:仓库扩大了占地面积和天花板空间,以提高货物运输的速度和便利性。

电子商务成长推动东南亚国协市场

东南亚电子商务的现阶段不仅仅是增值。该地区的消费者越来越多地透过各种管道在网路上购买各种各样的产品。该地区的供应链可能需要新的物流能力来满足日益增长的履约需求。已经具备这些能力的公司和新进者都可能从这些变化中受益最多。

东南亚是一个由处于不同发展阶段的经济体组成的大杂烩,因此各国的电子商务普及率有差异也是自然而然的。印尼和新加坡占该地区电子商务渗透率的 30% 左右,紧随其后的是菲律宾、泰国和越南,各占 15% 左右。印尼作为东南亚最大的经济体,凭藉其庞大的消费市场,占该地区GMV成长的51%。

随着东南亚电子商务市场进入下一个成长阶段,消费者在付款产品类别和通路上进行更多的数位购买,提出了更高的要求,并创造了新的、先进的物流解决方案。 。另一方面,随着供应链的转变,分销商可能会减少对中国进口的依赖,并将采购路线扩展到更多东南亚国家。因此,他们将寻求扩大上游能力,以获得更广泛的价值组合,为物流供应商开闢更多的管道。

东南亚国协仓储配送物流产业概况

东南亚国协仓储配送物流市场细分化,许多参与企业争夺新兴市场的关键地位。东协地区的一些国家,例如印尼和菲律宾,成长缓慢,既有许多本土参与企业,也有一些国际参与企业。然而,新加坡、越南和泰国是竞争激烈的市场,拥有许多国际参与企业。 CEVA、Yusen Logistics、Kerry Logistics 和 DHL 是该地区的主要参与者。电子商务和国际贸易的压力越来越大,促使参与企业在该地区建立许多仓库。长期在国内的存在使得本地参与企业和经销商能够与国际参与企业竞争。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

- 分析方法

- 研究阶段

第三章执行摘要

第四章 市场动态与洞察

- 当前市场状况

- 市场动态

- 驱动程式

- 在黄金位置策略性地放置仓库起着关键作用

- 电子商务的兴起导致仓库空间增加

- 限制因素

- 物流仓储市场竞争激烈,既有国内的竞争对手,也有国外的参与企业。

- 复杂的法律规范,包括税收、许可证和许可要求,可能成为进入障碍

- 机会

- 自动化在建造未来仓库中发挥关键作用

- 驱动程式

- 产业吸引力-波特五力分析

- 价值链/供应链分析

- 东南亚国协政府法规

- 仓库技术开发

- 仓库租金洞察

- 一般仓储业见解

- 危险品仓库洞察

- 深入了解冷藏

- 洞察电子商务成长的影响

- 深入了解自由区和工业

- COVID-19 对市场的影响

第五章 市场区隔

- 按地区

- 新加坡

- 泰国

- 马来西亚

- 越南

- 印尼

- 菲律宾

- 其他东南亚国协

第六章 竞争格局

- 公司简介

- DHL Supply Chain

- Ceva Logistics

- CJ Century Logistics

- DB Schenker

- Agility

- Linfox

- Kuehne+Nagel

- Yusen Logistics

- Kerry Logistics

- CWT Ltd

- Gemadept

- Tiong Nam Logistics

- Ych Group

- Singapore Post

- WHA Corporation

- Keppel Logistics*

- 其他公司(关键资讯/概况)

第七章:未来趋势与机会

第 8 章 附录

The ASEAN Warehousing And Distribution Logistics Market size is estimated at USD 33.04 billion in 2025, and is expected to reach USD 42.78 billion by 2030, at a CAGR of 5.3% during the forecast period (2025-2030).

As one of the world's fastest-growing economies, Southeast Asia has benefitted from a broad-based economic growth model based on global trade, inward investment, and regional and global integration into value chains. However, sustaining this growth momentum will necessitate several reforms to strengthen the region's economic and social resilience. These reforms will include lowering regulatory barriers to competition and market entry to promote innovation, productivity, and efficiency.

Warehousing and distribution logistics in ASEAN are expected to experience rapid growth due to the rapid growth of the e-commerce sector. The high demand for last-mile logistics and the fast-developing transportation infrastructure contribute to the development of ASEAN's warehousing and distribution logistics market. The presence of foreign firms in the region, as well as government initiatives like Adapt and Grow & Go Digital, in addition to the growing logistics industry, is driving the growth of the warehousing and distribution market in the region. Singapore is one of the major countries in ASEAN. With its geographical location and strong freight and logistics business, it is one of the fastest-growing countries in the region. Major players in the region have significantly funded the warehouse infrastructure.

Warehousing demand has been on the rise in some regions, mainly due to the growth of e-commerce. The previous year, BW (Vietnam's #1 Industrial For-Rent Developer), specializing in developing warehouses and factories to rent, received unprecedented requests. BW's long-term development strategy allowed it to take advantage of these short-term opportunities effectively by constructing light and contemporary industrial warehouses to cater to the growing manufacturing demand and the explosion of e-commerce growth.

The demand for cold storage is rising, forcing companies to adjust their supply chain strategies. According to the industry report, foreign investors are increasingly interested in building cold storage facilities in Vietnam to benefit from the urbanization process and retail modernization, changing how Vietnam's big cities get fresh food. The supply chains are expected to become more efficient in the future due to significant infrastructure investment and development, including the construction of the long-awaited Long Thanh International Airport.

ASEAN Warehousing And Distribution Logistics Market Trends

Increase in Warehousing Space in Thailand

Warehouses are not just storage rooms. They house value-added operations such as just-in-time packing, assembly, product customization, etc. Over the past five years, Thailand has seen incredible growth in e-commerce. The e-commerce warehousing cluster is between 15 and 23 km along Bang Na-trat Road in Bangkok.

Thailand has seen massive growth in the retail market in recent years. There has been a steady rise in organized retail or contemporary shopping nationwide. The increasing disposable income of the people in Thailand, the large youth population, and the booming tourism industry have attracted a lot of foreign brands. This has led to an increase in warehousing services.

During the forecast period in Thailand, operators of leased warehouse space will continue to experience business growth in line with a gradual economic upturn, driven mainly by an upturn in the export industry and a recovery in domestic retail. Investment in new supply tends to increase over the next three years. Large players will be at the forefront of this, leading to oversupply in some local markets, increasing competition on pricing, and limiting operators' ability to increase rents.

Currently, the majority of operations are modernizing their facilities to provide modern warehousing solutions, which, in turn, allows them to expand their client base and generate revenue through additional services. Players are also modernizing their facilities through other means, such as upgrading their warehouse buildings to meet industry standards (for example, the LEED scheme), investing in energy efficiency and environmental protection, and installing facilities that enhance resilience to natural disasters, such as flooding and earthquakes. Warehouses have expanded their floor and ceiling space, increasing the speed and ease of goods movement.

E-commerce Growth in the ASEAN Region is Driving the Market

The current phase of e-commerce in Southeast Asia is about more than just increasing value. Consumers in the region increasingly purchase a wider range of products online through various channels. The region's supply chains will likely require new logistics capabilities to meet this growing demand for fulfillment. Those who already possess these capabilities and those new to the market will benefit the most from these changes.

Southeast Asia is a patchwork quilt of economies at various stages of development; it is only natural that e-commerce penetration rates vary from country to country. Indonesia and Singapore account for approximately 30% of the region's e-commerce penetration, with the Philippines, Thailand, and Vietnam trailing at around 15% each. The largest Southeast Asian economy, Indonesia, accounts for 51 of the region's GMV growth due to its large consumer market.

As Southeast Asia's e-commerce market moves into the next phase of growth, customers will make more digital purchases across all product categories and channels, and they will also demand and pay more for new and advanced logistics solutions. On the other hand, merchants will be less reliant on Chinese imports and expand their sourcing channels to more Southeast Asian countries as they migrate their supply chains. As a result, they will look to extend their upstream capabilities to access a wider value mix, which will open up more channels for logistics providers.

ASEAN Warehousing And Distribution Logistics Industry Overview

The warehousing and distribution market in the ASEAN region is fragmented, with many players trying to grab a significant chunk of the developing market. Some of the countries in the ASEAN region, like Indonesia and the Philippines, are moderately growing, with many local players and some international players. However, Singapore, Vietnam, and Thailand are highly competitive markets, with the presence of a large number of international players. CEVA, Yusen Logistics, Kerry Logistics, and DHL are among the major players present in the region. Increasing pressure from e-commerce and international trade has allowed the players to develop many warehouses in the region. Due to the long-term domestic presence, local players and distributors have been able to compete with international players.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMERY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 The strategic placement of warehouses in key locations plays a crucial role

- 4.2.1.2 Warehousing Spaces are Increasing in the region due to the rise in e-commerce

- 4.2.2 Restraints

- 4.2.2.1 The logistics and warehouse distribution market is highly competitive, with both domestic and international players

- 4.2.2.2 Complex regulatory frameworks, including taxes, permits, and licensing requirements, can create barriers to entry

- 4.2.3 Opportunities

- 4.2.3.1 Automation plays a significant role in building the warehouse of the future

- 4.2.1 Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Government Regulations in ASEAN Countries

- 4.6 Technological Developments in Warehousing

- 4.7 Insights into Warehousing Rents

- 4.8 Insights into General Warehousing

- 4.9 Insights into Dangerous Goods Warehousing

- 4.10 Insights into Refrigerated Warehousing

- 4.11 Insights into the Effects of E-commerce Growth

- 4.12 Insights into Free Zones and Industrial Parks

- 4.13 Impact of COVID-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Geography

- 5.1.1 Singapore

- 5.1.2 Thailand

- 5.1.3 Malaysia

- 5.1.4 Vietnam

- 5.1.5 Indonesia

- 5.1.6 Philippines

- 5.1.7 Rest of ASEAN

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration and Major Players)

- 6.2 Company Profiles

- 6.2.1 DHL Supply Chain

- 6.2.2 Ceva Logistics

- 6.2.3 CJ Century Logistics

- 6.2.4 DB Schenker

- 6.2.5 Agility

- 6.2.6 Linfox

- 6.2.7 Kuehne + Nagel

- 6.2.8 Yusen Logistics

- 6.2.9 Kerry Logistics

- 6.2.10 CWT Ltd

- 6.2.11 Gemadept

- 6.2.12 Tiong Nam Logistics

- 6.2.13 Ych Group

- 6.2.14 Singapore Post

- 6.2.15 WHA Corporation

- 6.2.16 Keppel Logistics*

- 6.3 Other Companies (Key Information/Overview)