|

市场调查报告书

商品编码

1642027

能源区块链 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Blockchain in the Energy Sector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

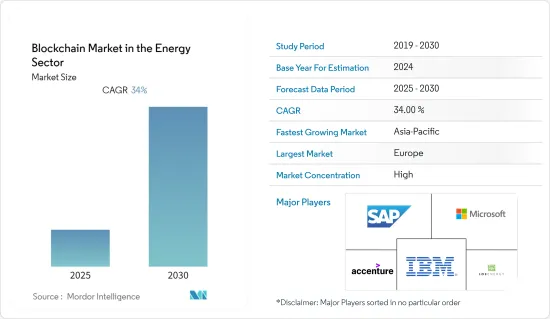

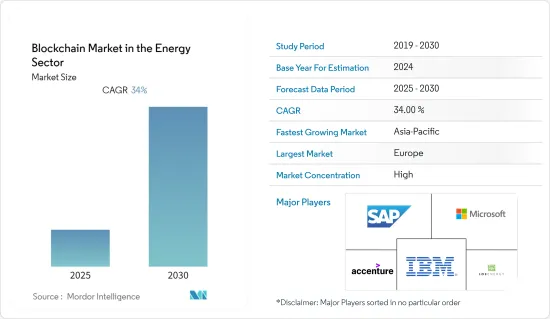

预测期内能源领域区块链市场预计复合年增长率达 34%

关键亮点

- 区块链技术可以帮助社区实现可再生能源目标,使电网更加可靠和高效,并减轻公用事业支付清洁能源发电的负担。因此,预计在预测期内其采用率将会增加。

- 市场上的供应商预计将利用微电网日益增长的使用,因为它们允许在特定区域内进行电力交易,并且在主电网发生紧急情况时也能提供优势(例如,充当备用解决方案)。其中一个例子是德国能源区块链销售商 OLI Systems 在欧洲微电网上进行的先导计画。

- 区块链在能源领域的最大好处是降低成本、减少环境破坏、在不牺牲隐私的情况下实现相关人员之间的更加开放。

- 像以太坊解决方案这样的企业软体解决方案也可以使石油和天然气等传统能源产业受益。这些私有区块链网路允许石油和天然气公司保护隐私和商业机密,方法是仅允许预先核准的相关人员存取资料并加入选定的联盟。

- 在主要应用中,「付款」类别显示出区块链在能源领域的最高相关性和实施。分散式帐本技术有潜力透过追踪电网材料的监管链来提高公共产业提供者的效率。除了来源追踪之外,区块链还为可再生能源的分配提供了独特的解决方案。

新冠疫情危机凸显了利用数位和能源技术对人民、企业和经济的重要性。该公司知道人们在多大程度上依赖数位和能源解决方案来实现在家工作、家庭供暖、医院运营和商业活动。

能源领域区块链的市场趋势

付款占市场最大份额

- 区块链帐本被应用于各个领域,包括降低交易成本、提高交易效率和识别能源来源。例如,IBM 的 Blockchain World Wire 网路彻底改变了跨境(外汇)付款。这使得近乎即时的贸易清算和最终付款成为可能。该方法充当双方共用的约定的价值存储,以整合付款指示讯息并利用数位资产来付款交易。此类产品功能可增强各领域的付款,可能促进市场竞争。

- 区块链技术的使用也使得将付款系统连接到智慧电网成为可能。这使得企业希望在金融服务和智慧电网技术的整合上投入更多。

- 区块链技术使得传统的付款方式失效。他们也正在努力克服骇客攻击和资料外洩问题。例如,电力公司 RWE 已经测试了区块链技术,以管理德国和加州数百个自动电动车充电站的身份验证和计费流程。

- 在能源领域使用区块链还可以最大限度地减少公用事业公司的管理费用。透过促进公用事业公司和消费者之间的计费和计量流程,无需中介零售商或仲介,消费者可以节省成本。

预计美国将占很大份额

- 当区块链应用于能源产业时,能源交易等交易几乎可以即时记录和付款。由于相关人员都使用同一平台,因此不需要中介,也几乎不需要调解。北美是区块链技术的早期采用者,已在能源领域大量应用区块链。

- 根据美国能源资讯署的数据,2021 年美国公用事业规模发电设施生产了约 4.12 兆千瓦时(kWh)的能源,约 41.16 亿千瓦时。煤炭、天然气、石油和其他气体约占发电燃料的61%。核能约占19%,可再生能源约占20%。小型太阳能光电系统额外发电490亿度。如此大规模的能源生产使得在能源领域引入区块链解决方案成为可能,以促进付款交易、风险和合规管理以及许多其他问题。

- 政府机构正在提供资金,采用区块链来确保电网的安全。例如,美国能源局(DOE) 已向 TFA 实验室提供约 20 万美元的资金,以帮助保护国家电网的安全。提案的策略包括检验和保护电网上的设备免受恶意软体的侵害,开发技术以提高常用家用电子电器产品的安全性,并使用区块链技术来保护任何物品免受恶意软体的侵害。一种价格合理的方法来保护任何物品免受盒子。

- Invenergy 是非上市公司,该公司和通用电气可再生能源宣布,998 兆瓦的特拉弗斯风电中心将于 2022 年 3 月开始商业运营。这是北美第一个分阶段建造的风电场。预计这些因素将在预测期内促进市场成长。

2022 年 1 月,BMW与 Energy Web 合作展示了使用可再生能源为电动车充电的区块链解决方案。充电费用透过 Energy Web 的区块链解决方案支付。

能源领域的区块链产业概况

有许多大公司进入能源领域的区块链市场,竞争非常激烈。就市场占有率而言,SAP SE(SAP)、微软公司、埃森哲公司和 IBM 公司是目前市场上最大的三大参与企业。这些大公司占据了很大的市场份额,因此专注于在其他国家赢得更多的客户。这些公司正在利用战略合作计划来增加市场占有率和盈利。为了增强产品能力,在市场上营运的公司也在收购致力于能源技术区块链的新兴企业。

2022年7月,INFINITY与区块链公司Yesports合作。此次合作旨在利用非同质化代币(NFT)推出粉丝参与计画。这笔交易凸显了越来越多的电竞组织希望藉助区块链和 Web3 来建立粉丝参与策略。

2022年4月,英特尔宣布了英特尔的区块链ASIC(专用积体电路)。据称,该晶片可以使工作量证明共识网路中的哈希计算更加节能。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 产业价值链分析

- COVID-19 市场影响评估

- 市场驱动因素

- 可变电费的出现和P2P交易的必要性

- 创业投资积极投入

- 市场限制

- 可扩展性约束

- 能源领域的区块链-按地区分類的使用案例场景

第五章 市场区隔

- 按应用

- 支付

- 智能合约

- 数位身份验证

- 管治,风险与合规管理

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 荷兰

- 欧洲其他地区

- 亚太地区

- 日本

- 澳洲

- 纽西兰

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲国家

- 中东和非洲

- 阿拉伯聯合大公国

- 以色列

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 公司简介

- SAP SE(SAP)

- Electron(Chaddenwych Services Limited)

- Accenture PLC

- IBM Corporation

- LO3 Energy Inc.

- GREENEUM

- Drift Marketplace Inc.

- IOTA Foundation

- Btl Group Ltd.

- Power Ledger Pty Ltd.

- ImpactPPA

第七章投资分析

第 8 章:未来机会

The Blockchain Market in the Energy is expected to register a CAGR of 34% during the forecast period.

Key Highlights

- Blockchain technology helps regions meet their goals for renewable energy, makes grids more reliable and efficient, and cuts down on the amount of money utilities have to spend on clean energy generation. Thus, its adoption is expected to increase over the forecast period.

- Since microgrids allow electricity to be traded within a certain area and have other benefits during emergencies with the main grid (like acting as backup solutions), vendors on the market could take advantage of the growing use of microgrids. One illustration is the pilot project that German company OLI Systems, which sells energy blockchains, set up in Europe's microgrid.

- The biggest benefits of blockchain in the energy sector are lower costs, less damage to the environment, and more openness among stakeholders without sacrificing privacy.

- Software solutions, such as enterprise Ethereum solutions, can also help traditional energy sectors like oil and gas. With these private blockchain networks, oil and gas companies can protect their privacy and trade secrets by giving only pre-approved parties access to their data and letting them join select consortiums.

- Among significant applications, the 'payments' category exhibited the highest association and implementation of blockchain in the energy sector. By tracking the chain of custody for grid materials, distributed ledger technology can potentially improve utility providers' efficiencies. Beyond provenance tracking, blockchain offers unique solutions for renewable energy distribution.

The COVID-19 pandemic crisis made it more important for people, businesses, and the economy to use digital and energy technologies. The company knew how much it depended on digital and energy solutions to help people work from home, heat their homes, run hospitals, and run their businesses.

Blockchain in Energy Sector Market Trends

Payments Hold the Largest Share in the Market

- The blockchain ledger is used in many different fields to lower transaction costs, make exchanges more efficient, and find out where energy comes from. For instance, IBM's Blockchain World Wire network revolutionized cross-border (Forex) payments. It enabled nearly real-time transaction clearing and settlement with finality. By acting as an agreed-upon store of value shared between parties, the method integrated payment instruction messages and leveraged digital assets to settle transactions. Such product features that enhance payments in different sectors will create a competitive edge in the market.

- The use of blockchain technology also made it possible to connect payment systems to smart grids. This made the companies want to put even more money into combining financial services with smart grid technology.

- Blockchain technology has made traditional payment methods less effective. It is also advancing to overcome the issues of hacking and data breaches. For instance, RWE's power utility has tested blockchain technology to authenticate and manage the billing process for hundreds of autonomous electric vehicle charging stations in Germany and California.

- Using blockchain in the energy sector would also minimize the overhead for utilities. By facilitating the billing and metering process between the utility and the consumer instead of involving intermediary retailers and brokers, consumers benefit from lower costs.

United States is Expected to Hold Major Share

- When blockchain is used in the energy industry, transactions, like trading energy, can be recorded and settled almost immediately. Since all parties use the same platform, there is no need for an intermediary and little need for reconciliation. As early adopters of technology, North Americans are seeing a lot of blockchain being used in the energy sector.

- According to the US Energy Information Administration, utility-scale electricity-producing facilities in the US generated nearly 4.12 trillion kilowatt-hours (kWh), or about 4.116 billion kWh, of energy in 2021. Coal, natural gas, petroleum, and other gases made up about 61% of the fuel used to generate this power. Nuclear energy roughly accounted for 19% of the total, while renewable energy sources comprised about 20%. Small-scale solar photovoltaic systems generated an additional 49 billion kWh of electricity. Such massive energy production will enable the energy sector to adopt blockchain solutions to ease payment transactions, risk and compliance management, and many other issues.

- Government bodies are granting funds to incorporate blockchain to secure energy grids. For example, to assist in safeguarding the national power system, the US Department of Energy (DOE) is awarding TFA Labs almost USD 200,000 in funding. The suggested strategy calls for verifying and securing devices on the grid that are free of malware, creating technology to increase the security of commonly used consumer electronics, and offering a reasonably priced way to secure any item right out of the box using blockchain technology.

- Invenergy, a privately held company that builds, owns, and runs clean energy solutions around the world, and GE Renewable Energy announced that the 998-megawatt Traverse Wind Energy Center will begin commercial operations in March 2022. This was the first wind farm in North America to be built in a single phase. Such factors are expected to augment the market's growth during the forecast period.

In January 2022, BMW partnered with Energy Web to demonstrate a blockchain solution for recharging electric vehicles with renewable energy. The charging cost was routed through Energy Web's blockchain solution.

Blockchain in Energy Sector Industry Overview

There are a lot of big players in the energy blockchain market, which is very competitive. As far as market share goes, SAP SE (SAP), Microsoft Corp., Accenture PLC, and IBM Corp. are the three biggest players on the market right now. These big players have a big share of the market, so they are focusing on getting more customers in other countries. These companies leverage strategic collaborative initiatives to increase their market shares and profitability. To strengthen their product capabilities, the companies operating in the market are also acquiring start-ups working on blockchain in energy technologies.

In July 2022, INFINITY partnered with the blockchain company Yesports. This partnership aimed to launch a fan engagement program based on non-fungible tokens (NFTs). The deal highlighted an increasing number of esports organizations looking to rely on blockchain and Web3 to establish fan engagement strategies.

Intel announced in April 2022 that their new Intel Blockchain ASIC (application-specific integrated circuit) was coming out. This chip is supposed to make hashing for proof-of-work consensus networks more energy-efficient.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions And Market Definition

- 1.2 Scope Of The Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment Of The Impact Of COVID-19 On The Market

- 4.5 Market Drivers

- 4.5.1 Emergence of Variable Electricity Rates and Need for Peer-to-peer Trading

- 4.5.2 Aggressive Spending by Venture Capitalists

- 4.6 Market Restraints

- 4.6.1 Scalability Constraints

- 4.7 Blockchain In Energy Sector - Use Case Scenario Across The Region

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Payments

- 5.1.2 Smart Contracts

- 5.1.3 Digital Identities

- 5.1.4 Governance, Risk, and Compliance Management

- 5.1.5 Other Applications

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 Netherlands

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 Japan

- 5.2.3.2 Australia

- 5.2.3.3 New Zealand

- 5.2.3.4 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.4.1 Brazil

- 5.2.4.2 Mexico

- 5.2.4.3 Rest of Latin America

- 5.2.5 Middle East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Israel

- 5.2.5.3 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 SAP SE (SAP)

- 6.1.2 Electron (Chaddenwych Services Limited)

- 6.1.3 Accenture PLC

- 6.1.4 IBM Corporation

- 6.1.5 LO3 Energy Inc.

- 6.1.6 GREENEUM

- 6.1.7 Drift Marketplace Inc.

- 6.1.8 IOTA Foundation

- 6.1.9 Btl Group Ltd.

- 6.1.10 Power Ledger Pty Ltd.

- 6.1.11 ImpactPPA