|

市场调查报告书

商品编码

1642040

木地板:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Wood Flooring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

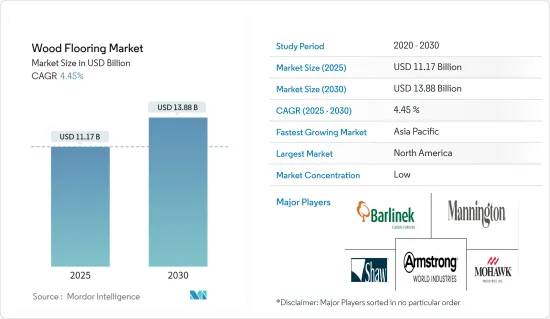

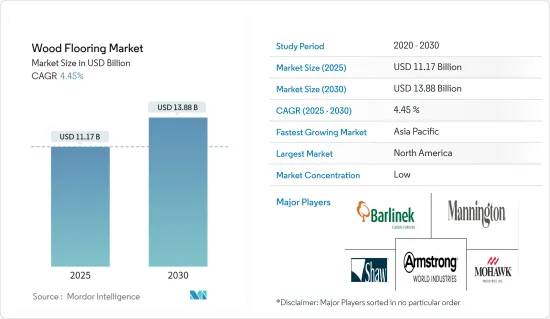

预计 2025 年木地板市场规模为 111.7 亿美元,到 2030 年将达到 138.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.45%。

多年来,随着都市化进程加快、可支配收入增加、对永续建筑材料认识的不断提高以及消费者对美观耐用地板选择的偏好发生变化,木地板市场经历了显着的增长和演变。

木地板市场成长的主要驱动力之一是永续性和环保意识的增强。由于对气候变迁和森林砍伐的担忧,人们越来越倾向于环保建筑材料。特别是,来自森林的木地板引起了有环保意识的消费者的共鸣,因为它得到了永续管理,并获得了森林管理委员会 (FSC) 等组织的认证。为了满足这种需求,製造商提供各种永续木地板解决方案,包括再生木材和竹地板。

室内设计客製化和个性化的趋势日益增长,推动了对具有独特纹理、饰面和颜色的木地板产品的需求。透过使用数位印刷和染色技术,製造商正在创造出模仿稀有树种或具有复杂图案的木地板设计,使消费者能够实现他们想要的美感,而无需承担与稀有或异国风材料相关的高成本和环境影响。

木地板市场趋势

复合木地板推动市场成长

相对于实木地板,复合地板的市场占有率较大。工程木材比硬木尺寸更稳定,并且不太可能因温度或湿度的变化而膨胀或收缩。这种稳定性使得工程木材可以安装在不适合使用实木的环境中,例如地下室或有加热地板的房间。此外,工程木材的价格通常比实心硬木低,但外观却相似。

复合木地板通常使用实木作为顶层,增强硬木的自然美感、温暖感和耐用性。与强化地板相比,工程木材具有更真实的外观和感觉,因为它使用的是真正的木质饰面而不是印刷图像。工程木材的多功能性、耐用性和美观性使其成为寻求高品质地板的住宅的热门选择。

北美引领木地板市场

受建设活动增加、改造和装修计划增加以及对环保和永续建筑材料的偏好日益增加等因素影响,北美木地板市场正在稳步增长。在美国和加拿大,实木地板历来是一种受欢迎的选择,因其永恆的吸引力和耐用性而受到重视。然而,近年来,复合木地板由于其增强的稳定性、多功能性和防潮性而获得了广泛支持,使其适用于各种应用,包括潮湿地区和辐射供暖系统。

此外,对经森林管理委员会 (FSC) 认证机构认证的木地板产品的需求不断增长,反映出消费者对环境永续性的意识不断增强。更宽的木板宽度、纹理饰面和再生木材的使用等趋势正在促进北美木地板市场的多样性。製造技术的进步带来了创新的木地板产品,满足了不断变化的消费者需求和兴趣。总体而言,北美木地板市场充满活力且竞争激烈,都市化、设计趋势和永续实践的进步等因素提供了成长机会。

木地板产业概况

木地板市场竞争激烈,几个主要企业占据市场主导地位。 Mohawk Industries、Armstrong World Industries、Mannington Mills Inc.、Barlinek SA 和 Shaw Industries Group 等公司都是知名参与者,提供各种各样的木地板产品。此外,还存在着来自专注于细分市场或特定区域的地区性和本地性的公司的竞争。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态与洞察

- 市场概况

- 市场驱动因素

- 建筑和装修活动增加

- 更重视永续和环保产品

- 市场限制

- 来自替代地板市场的竞争

- 原物料价格上涨

- 市场机会

- 木地板技术的进步,包括改进的表面处理和安装技术

- 客製化和设计趋势日益兴起

- 价值链分析

- 产业吸引力:波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 洞察产业技术进步

- COVID-19 市场影响

第五章 市场区隔

- 按产品

- 实木

- 工程木材

- 按分销管道

- 家装中心

- 旗舰店

- 专卖店

- 网路商店

- 按最终用户

- 住宅

- 商业的

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 英国

- 德国

- 法国

- 俄罗斯

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 市场集中度概览

- 公司简介

- Mohawk Industries

- Armstrong World Industries

- Mannington Mills Inc.

- Barlinek SA

- Shaw Industries Group

- Beaulieu International Group

- Home Legend LLC

- Provenza Floors Inc.

- Boral Limited

- Tarkett SA*

第七章 未来市场趋势

第八章 免责声明和出版商

The Wood Flooring Market size is estimated at USD 11.17 billion in 2025, and is expected to reach USD 13.88 billion by 2030, at a CAGR of 4.45% during the forecast period (2025-2030).

The wood flooring market has witnessed significant growth and evolution over the years, driven by increasing urbanization, rising disposable income, growing awareness of sustainable construction materials, and changing consumer preferences for aesthetic and durable flooring options.

One of the key drivers behind the growth of the wood flooring market is the increasing emphasis on sustainability and environmental consciousness. With concerns about climate change and deforestation, there's a growing preference for eco-friendly building materials. Particularly, wood flooring that is sourced from forests is sustainably managed and has certification from groups like the Forest Stewardship Council (FSC), which resonates well with environmentally conscious consumers. In response to this demand, manufacturers are providing a variety of sustainable wood flooring solutions, including reclaimed wood and bamboo flooring, which are gaining popularity due to their eco-friendly attributes.

The growing trend of customization and personalization in interior design is fueling the demand for wood flooring products that offer unique textures, finishes, and colors. Manufacturers are leveraging digital printing and staining techniques to create wood flooring designs that mimic rare wood species or feature intricate patterns, allowing consumers to achieve their desired aesthetic without the high cost or environmental impact associated with rare or exotic woods.

Wood Flooring Market Trends

Engineered Wood Flooring is Boosting the Market's Growth

Engineered wood flooring holds a larger market share compared to solid wood flooring. Engineered wood is dimensionally more stable than solid hardwood, featuring less expansion and contraction with changes in temperature and humidity. This stability allows engineered wood to be installed in environments where solid hardwood may not be suitable, such as basements or rooms with underfloor heating systems. Additionally, engineered wood is often available at a lower price point than solid hardwood while still providing a similar aesthetic appeal.

Engineered wood flooring typically utilizes a top layer of real wood, offering the natural beauty and warmth of hardwood with enhanced durability. Compared to laminate flooring, engineered wood provides a more authentic look and feel, as it is constructed using genuine wood veneers rather than printed images. The versatility, durability, and aesthetic appeal of engineered wood make it a popular choice for homeowners seeking high-quality flooring solutions.

North America is Leading the Wood Flooring Market

The wood flooring market in North America is defined by steady growth, driven by factors such as increasing construction activities, rising renovation and remodeling projects, and a growing preference for eco-friendly and sustainable building materials. In the United States and Canada, solid hardwood flooring has historically been a popular choice, valued for its timeless appeal and durability. However, engineered wood flooring has gained significant traction in recent years due to its enhanced stability, versatility, and resistance to moisture, making it suitable for various applications, including areas with high humidity levels or radiant heating systems.

Additionally, the demand for wood flooring products approved by Forest Stewardship Council (FSC) certification bodies is increasing, reflecting consumers' growing awareness of environmental sustainability. Trends such as wider plank widths, textured finishes, and the use of reclaimed wood contribute to the diversity of offerings in the North American wood flooring market. Technological advancements in manufacturing techniques have led to the development of innovative wood flooring products, meeting consumers' changing needs and interests. Overall, the wood flooring market in North America is dynamic and competitive, with growth opportunities driven by factors such as urbanization, design trends, and advancements in sustainable practices.

Wood Flooring Industry Overview

The wood flooring market is highly competitive, with several key players dominating the market. Companies like Mohawk Industries, Armstrong World Industries, Mannington Mills Inc., Barlinek SA, and Shaw Industries Group are prominent players, offering a wide range of wood flooring products. Additionally, the market also sees competition from regional and local players, focusing on niche segments or specific geographical areas.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Construction and Renovation Activities

- 4.2.2 Increasing Focus on Sustainable and Eco-friendly Products

- 4.3 Market Restraints

- 4.3.1 Competition from Alternative Flooring Market

- 4.3.2 High Price of Raw Materials

- 4.4 Market Opportunities

- 4.4.1 Advancements in Wood Flooring Technology, Such as Enhanced Finishes and Installation Techniques

- 4.4.2 Rising Customization and Design Trends

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness: Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Technological Advancements in the Industry

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Solid Wood

- 5.1.2 Engineered Wood

- 5.2 By Distribution Channel

- 5.2.1 Home Centers

- 5.2.2 Flagship Stores

- 5.2.3 Specialty Stores

- 5.2.4 Online Stores

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Italy

- 5.4.2.6 Spain

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Mohawk Industries

- 6.2.2 Armstrong World Industries

- 6.2.3 Mannington Mills Inc.

- 6.2.4 Barlinek SA

- 6.2.5 Shaw Industries Group

- 6.2.6 Beaulieu International Group

- 6.2.7 Home Legend LLC

- 6.2.8 Provenza Floors Inc.

- 6.2.9 Boral Limited

- 6.2.10 Tarkett SA*