|

市场调查报告书

商品编码

1642041

边缘运算:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Edge Computing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

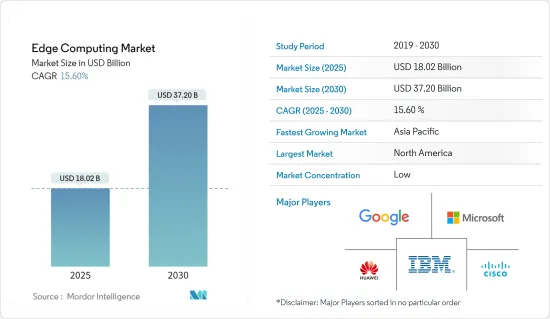

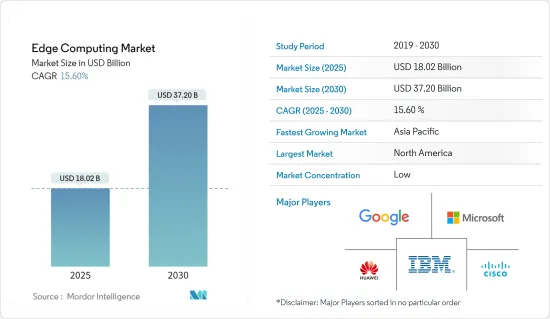

边缘运算市场规模在 2025 年估计为 180.2 亿美元,预计到 2030 年将达到 372 亿美元,预测期内(2025-2030 年)的复合年增长率为 15.6%。

物联网的不断普及以及 5G 营运的增强是推动受调查市场成长的主要动力。相当一部分工业IoT服务供应商和聚合商正在提供支援 5G 的网路产品,并可能在未来几年采用边缘运算来处理大量资料。

主要亮点

- 在所调查的市场中取得重大进展的主要企业包括思科、HPE、戴尔和华为。这些公司正在开发适合工业现场恶劣工况和运作环境的边缘运算产品,包括防电磁干扰、防尘、防爆、防振、防电流电压波动等。这些公司正在努力透过伙伴关係和频繁的产品开发来创造边缘运算市场的下一个大事件。

- 边缘运算由思科、英特尔、微软和戴尔 EMC 等供应商以及由普林斯顿大学和普渡大学等学术机构主导的 OpenFog 联盟等组织主导。该联盟旨在为雾和边缘运算部署开发参考架构。

- 2022 年 1 月,Verizon 与 AWS 合作,将行动边缘运算扩展到美国 30% 的大都会区,新增夏洛特、底特律、洛杉矶和明尼阿波利斯。这种组合最大限度地减少了从平台上託管的应用程式连接到最终用户设备所需的延迟和网路跳数。

- 边缘运算市场由大型供应商主导,他们占据了调查市场的很大份额,并且在各个地理市场激烈竞争以站稳脚跟。出于此原因,供应商正在建立多种联盟和伙伴关係关係,以增加其市场占有率和技术力。

- 例如,2022年4月,Ball与AWS续约了合约。此次合作旨在利用 AWS Wavelength 在加拿大启动首个公共多接取边缘运算(MEC) 部署。 5G网路可望为边缘运算市场带来新的成长机会。

- 随着企业以服务速度和低延迟作为差异化策略,COVID-19 疫情将对 5G 和多重存取边缘运算 (MEC) 的部署产生正面影响。更深层的网路和运算融合以支援次世代应用程式是未来的发展方向。

边缘运算市场趋势

预计通讯业将以显着的复合年增长率成长

- 通讯是全球市场上成长最快的产业之一。该产业目前正在升级其基础设施,为 5G 转型做准备,再加上全球 5G 应用的快速成长,推动通讯业对边缘运算资源的投资。

- 在5G和物联网的推动下,边缘运算将彻底重塑通讯网路。此外,对云端的依赖、对网路连接的依赖以及物联网的巨大成长和潜力是推动通讯业者走向边缘的一些关键因素。通讯业者不仅可以利用边缘来增强其核心连接业务、减少客户延迟,还可以引入边缘资料管理等新服务。

- 此外,随着 5G 技术受到更多监管并成为主流,预计符合 5G 标准的设备数量将会增加,从而带来一些容量挑战。虽然毫米波频段有望与 3G 和 4G 频段有很大差异,但不断增长的用户数量可能会对边缘的额外运算资源产生需求。例如,根据GSMA Intelligence的资料,全球5G市场渗透率预计将从2020年的3%增加到2030年的64%。

- 5G、物联网和边缘运算的结合将为通讯服务提供者及其客户带来变革。边缘运算技术已成为通讯业的主要投资领域,这得益于通讯服务供应商 (CSP) 改善用户体验以及启用和支援新经营模式的需求。 CSP 正在投资边缘运算技术以满足不断增长的需求。

- 为了满足全球市场的这一潜在需求,多种开放原始码架构已相继出现。开放网路基金会和 Akraino Edge Stack计划等措施预计将加速该领域对边缘运算的需求。

预计亚太地区将以最高复合年增长率成长

- 中国在5G和边缘运算方面已经取得了良好的开端。监视文化可能会影响技术的发展。 Meta、苹果、Netflix 和谷歌等西方公司透过制定使用个人资料投放广告的标准塑造了全球数位经济。阿里巴巴、百度、华为和中兴等中国公司正在塑造边缘运算支援的监控技术的未来方向。中国的这些努力满足了需求,因此占据了该地区的最高份额。

- 根据GSMA的调查,近90%的中国行动生态系统参与者将边缘运算视为5G时代的关键商机。该国的边缘运算部署旨在满足智慧港口、校园和工厂的需求。随着未来几年 5G 网路的扩展,体育赛事、游戏和自动驾驶等边缘运算使用案例将成为可能。

- IIJ 已在其 Shirai资料中心园区(Shirai DCC)内部署了 MDC。 MDC 由澳洲製造商 Zella DC 生产,并首次在日本推出。它配备了资料中心的所有基本功能,包括冷却、不断电系统(UPS)、环境感测器、监视录影机和实体安全(包括远端启动电子锁)。

- 作为「数位印度」计画的一部分,印度政府计划在该国推广物联网。政府已拨款 7,000 亿印度卢比用于建设 100 个由物联网设备驱动的智慧城市。政府打算控制交通、有效利用水和电,并使用物联网感测器收集资料以用于医疗保健和其他服务。

- 2022 年 2 月,Reliance Jio 在印度 50 多处物业的云端原生 5G 网路上启用了边缘运算。通讯业者已经完成了针对印度「前 1,000 个城市」的 5G 计划,并组建了专门的团队,专注于在该国提供「专门的 5G 推出解决方案」。 Jio、Airtel 和 Vodafone Idea 目前正在使用实验性 5G 频谱与设备和企业合作伙伴一起试行创新的 5G 用例。

- 此外,2022 年 3 月,塔塔咨询服务公司宣布使用 Microsoft Azure 私有行动边缘运算(Private MEC)为企业推出一套 5G 边缘解决方案。由于这些发展,预计预测期内亚太地区对边缘运算的需求将会成长。

边缘运算产业概览

边缘运算市场分散且竞争激烈。目前,市场由戴尔、微软、亚马逊和谷歌等云端基础的物联网供应商主导。此外,通用电气等公司凭藉其为航太和製造业等各行业提供边缘运算解决方案的专业知识,在市场上也占有重要地位。收购、与产业参与者的合作以及新产品/服务的推出是供应商的主要竞争策略。

- 2022 年 4 月 - 戴尔科技扩展其边缘解决方案,帮助零售商从零售店产生的资料中更快地获取更多价值并提供增强的客户体验。

- 2022年3月,华为与Du签署了关于多接入边缘运算(MEC)联合创新的谅解备忘录。两家公司将在中东研究、检验和复製MEC应用。两家公司还旨在支持全球数位经济的发展并加速中东地区的数位转型。

- 2022 年 3 月 - Foghorn 与 IBM 合作,提供安全、开放的下一代混合云平台,该平台具有先进的闭合迴路系统控制和边缘驱动的人工智慧 (AI)。透过整合边缘和云端功能,Foghorn 和 IBM 计画帮助客户快速处理、部署、分析、储存和训练从边缘到云端的关键资料,以支援业务流程。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 法律行业对自动化的需求不断增加,诉讼案件数量不断增加

- 律师事务所越来越多地使用人工智慧来完成法律事务

- 市场限制

- 敏感或合法资料的隐私问题

第六章 市场细分

- 按组件

- 硬体

- 软体

- 服务

- 按最终用户

- 金融与银行

- 零售

- 医疗保健和生命科学

- 产业

- 能源与公共产业

- 通讯业

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 澳洲

- 其他亚太地区

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲国家

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲地区

- 北美洲

第七章 竞争格局

- 公司简介

- Microsoft Corporation

- Google LLC(Alphabet Inc.)

- IBM Corporation

- Huawei Technologies Co. Limited

- Cisco Systems Inc.

- Hewlett Packard Enterprise Company

- Juniper Networks Inc.

- Dell Technologies Inc.

- Capgemini Engineering(Capgemini)

- EdgeIQ(MachineShop Inc.)

- ADLINK Technology Inc.

- General Electric Company

- Amazon Web Services Inc.

第八章投资分析

第九章:市场的未来

The Edge Computing Market size is estimated at USD 18.02 billion in 2025, and is expected to reach USD 37.20 billion by 2030, at a CAGR of 15.6% during the forecast period (2025-2030).

The increasing adoption of IoT is augmented by 5G operations, primarily driving the growth of the market studied. A significant share of industrial IoT service providers and aggregators are offering 5G capable network offerings that are expected to adopt edge computing over the coming years for handling the sheer amount of data.

Key Highlights

- The key players that are significantly active in the market studied include cisco, HPE, Dell, and Huawei. They have been developing edge computing products that adapt to harsh working conditions and operating environments at industrial sites, such as anti-electromagnetic interference, anti-dust, anti-explosion, anti-vibration, and anti-current/voltage fluctuations. These companies are making significant efforts in the edge computing market to create the next big thing by engaging in partnerships and making frequent product developments.

- Edge computing is being led by initiatives like OpenFog Consortium, an organization headed by vendors in the market studied, including Cisco, Intel, Microsoft, and Dell EMC, as well as academic institutions like Princeton University and Purdue University. The consortium aims at developing reference architectures for fog and edge computing deployments.

- In January 2022, Verizon and AWS partnered to expand to 30% more metro area locations in the United States with mobile edge computing with the addition of Charlotte, Detroit, Los Angeles, and Minneapolis. The combination minimizes the latency and network hops required to connect from an application hosted on the platform to the end user's device.

- The edge computing market is dominated by major vendors that cover a significant share of the market studied, and they are intensely competing to gain a foothold in different regional markets. Owing to this, vendors are involved in several partnerships and alliances to gain market presence and technological capabilities.

- For instance, In April 2022, Ball extended its agreement with AWS. This collaboration aims to launch the first public multi-access edge computing (MEC) with AWS Wavelength in Canada. 5G network is expected to bring new growth opportunities to the edge computing market.

- The COVID-19 pandemic positively affects the 5G and multi-access edge computing (MEC) deployments as businesses strategize service speed and low latency as key differentiators. The tight integration of network and compute to support next-generation apps is the way forward.

Edge Computing Market Trends

Telecommunication Sector is Expected to Grow at A significant CAGR

- Telecommunications is one of the fastest evolving industries in the global market. The industry is currently in the process of upgrading its infrastructure to prepare for the 5G transition coupled with the booming 5G penetration across the world, is driving the telecom sector to invest in edge computing resources.

- Edge computing is poised to significantly reshape telecom networks, driven by 5G and the IoT. Additionally, the dependence on the cloud, the reliance on internet connectivity, and the enormous growth and potential of the IoT are some of the critical factors driving telecoms toward the edge. Telecom operators can use edge both to boost their core connectivity business and reduce latency for their own customers, as well as to introduce new services such as data management at the edge.

- Further, as 5G technologies become more regulated and go mainstream, 5G-compliant devices are expected to grow, leading to several capacity issues. Although the mm-wave bands ensure that they are highly differentiated from the 3G or 4G bands, the increased number of subscriptions is likely to create demand for additional computing resources at the edge.For instance, according to the data from GSMA Intelligence, the 5G market penetration worldwide is expected to increase from 3% in 2020 to 64% in 2030.

- The combination of 5G, IoT, and edge computing would be transformational for both communication service providers and their customers. Edge computing technology has become the major area of investment in the telecom industry, driven by CSPs' need to enhance user experiences and enable and support new business models. CSPs are investing in edge computing technology to meet the growing demand.

- Owing to such potential demand in the global market, several open-source architectures are emerging. Initiatives by The Open Networking Foundation, Akraino Edge Stack project, and others, are expected to accelerate the demand for edge computing in the sector.

Asia Pacific is Expected to Grow at a Highest CAGR

- China has made a good start in terms of 5G and the edge; a surveillance culture could set the course for the evolution of technology. Western companies such as Meta, Apple, Netflix, and Google have shaped the global digital economy by establishing standards for using personal data to target ads. Chinese companies such as Alibaba, Baidu, Huawei, and ZTE are shaping the future direction of edge computing-backed surveillance technology. Such initiatives in China cater to the demand; thus, the country has the highest share in the region.

- According to a survey by GSMA, approximately 90% of mobile ecosystem players in China recognized edge computing as a significant revenue opportunity in the 5G era. The country's edge computing deployments are designed to meet smart ports, campuses, and factories' requirements. As the 5G networks scale over the next few years, edge computing use cases, such as sporting events, gaming, and autonomous driving, will be possible.

- IIJ deployed MDC on the premises of Shiroi Data Center Campus (Shiroi DCC). The MDC, from Australian manufacturer Zella DC, was the first to be installed in Japan. It is equipped with the functions a data center needs, including a cooling unit, an uninterruptible power supply (UPS), environmental sensors, security cameras, and physical security, including a remote-controlled electronic lock.

- As part of the Digital India initiative, the Government of India planned to give IoT a push in the country. The government has allocated INR 7,000-crore funds to develop 100 smart cities powered by IoT devices. The government intends to control traffic, efficiently use water and power, and collect data using IoT sensors for healthcare and other services.

- In February 2022, Reliance Jio enabled edge computing on its cloud-native 5G network at more than 50 facilities across India. The telco has completed 5G planning for the "top 1,000 cities" across India, and dedicated teams have been formed to focus on "dedicated solutions for 5G deployment" in the country. Jio, Airtel, and Vodafone Idea are currently piloting innovative 5G use cases with their equipment and enterprise partners using the trial 5G spectrum.

- Moreover, in March 2022, Tata Consultancy Services announced the launch of an enterprise 5G edge solution suite with Microsoft Azure Private Mobile Edge Computing (Private MEC). Such developments are poised to grow the demand for edge computing in the Asia Pacific region over the forecast period.

Edge Computing Industry Overview

The edge computing market is fragmented and competitive in nature. Currently, the market is dominated by cloud-based IoT vendors, such as Dell, Microsoft, Amazon, and Google. Companies like GE, which have the expertise of delivering edge computing solutions across different industries, including aerospace or manufacturing, also have significant market positions. Acquisitions, partnerships with industry participants, and new product/service rollouts have been the vendors' key competitive strategies. Some of the recent developments in the market are:

- April 2022 - Dell Technologies expanded its edge solutions to help retailers quickly generate more value and deliver enhanced customer experiences from data generated in retail locations.

- March 2022 - Huawei and Du signed a memorandum of understanding (MoU) for joint innovation on multiaccess edge computing (MEC). The two companies would research, verify, and replicate MEC-oriented applications in the Middle East. The companies also aim to accelerate digital transformation in the Middle East, along with supporting the development of the global digital economy.

- March 2022 - FogHorn collaborated with IBM to provide a secure and open next-generation hybrid cloud platform with advanced, closed-loop system control capabilities and edge-powered artificial intelligence (AI). By bringing together edge and cloud capabilities, FogHorn and IBM plan to help customers rapidly process, deploy, analyze, store, and train critical data from the edge to the cloud and enhance their business processes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand For Automation And Increasing Number Of Litigations In The Legal Industry

- 5.1.2 Growth In The Utilization Of Ai By Legal Companies To Complete Legal Cases

- 5.2 Market Restraints

- 5.2.1 Data Privacy Concerns Of The Confidential And Legal Data

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By End-user

- 6.2.1 Financial and Banking Industry

- 6.2.2 Retail

- 6.2.3 Healthcare and Life Sciences

- 6.2.4 Industrial

- 6.2.5 Energy and Utilities

- 6.2.6 Telecommunications

- 6.2.7 Other End-users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 Australia

- 6.3.3.4 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.4.1 Mexico

- 6.3.4.2 Brazil

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microsoft Corporation

- 7.1.2 Google LLC (Alphabet Inc.)

- 7.1.3 IBM Corporation

- 7.1.4 Huawei Technologies Co. Limited

- 7.1.5 Cisco Systems Inc.

- 7.1.6 Hewlett Packard Enterprise Company

- 7.1.7 Juniper Networks Inc.

- 7.1.8 Dell Technologies Inc.

- 7.1.9 Capgemini Engineering (Capgemini)

- 7.1.10 EdgeIQ (MachineShop Inc.)

- 7.1.11 ADLINK Technology Inc.

- 7.1.12 General Electric Company

- 7.1.13 Amazon Web Services Inc.