|

市场调查报告书

商品编码

1642044

商业生产力软体:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Business Productivity Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

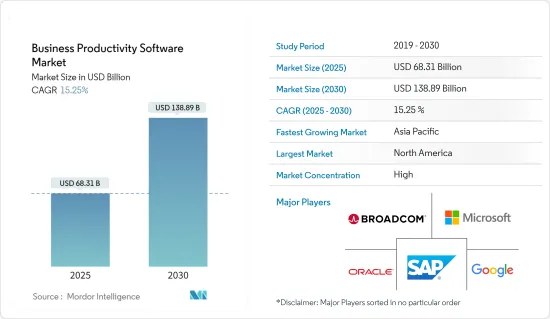

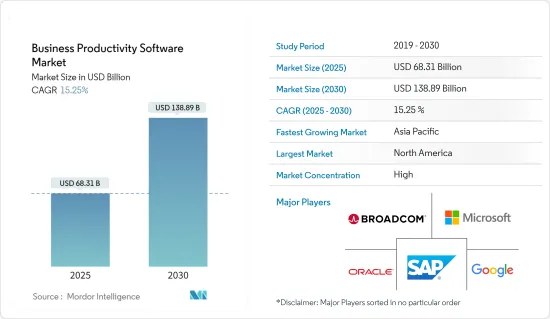

预计 2025 年商业生产力软体市场规模为 683.1 亿美元,到 2030 年将达到 1,388.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 15.25%。

可以在世界任何地方即时开展业务。协作工具具有经济和环境效益,包括降低差旅成本和提高生产力。

主要亮点

- 虽然人工智慧和物联网正在推动技术进步浪潮,但商业生产力是目前正在兴起的商业领域之一。业务生产力可以追溯到组织成功执行其整体策略的能力。此外,企业的生产力与员工的生产力成正比。企业正在广泛采用各种工具来帮助员工提高工作效率。

- 由于智慧型手机和自带设备(BYOD)的广泛使用,行动工作人员的扩大是市场发展的强大推动力。

- 云端运算和人工智慧引入业务流程将刺激市场。此外,企业产生的资料推动着采用更好的资料管理技术的需求,从而推动市场成长。

- 商业生产力软体支援并整合您业务各个方面的资料和流程。它还优化了云端处理,帮助您更好地与客户、供应商、供应商、员工和客户合作。

- 在疫情期间,各组织都采取了在家工作政策来保障员工的安全。这导致对商业生产力软体的需求增加,包括调度软体、协作工具和其他解决方案。

商业生产力软体市场趋势

内容管理和协作的采用率最高

- 传统上,企业内容管理 (ECM) 仍然局限于后勤部门且是非结构化的。然而,近年来,ECM 已转向在业务中扮演更具互动性的角色。机器学习、云端技术和行动功能为企业开闢了新的机会。视讯、音讯和社交等新类型的内容正在模糊传统 ECM 的界限。

- Microsoft SharePoint 提供了许多工具来建立具有强大文件管理和其他 SharePoint 功能的 ECMS。客户正在寻求与系统和文件管理的强大的内部集成,各种参与者都表示 SharePoint 提供了用于自订 ECMS 的强大套件。

- 云端基础的服务已显示出透过网路提供经济高效、灵活、易于管理且权威的资源设施的潜力。云端基础的ECM 服务透过最佳共用利用来提高硬体资源的能力。这些特点正在鼓励组织和个人用户将其服务和应用程式迁移到云端。

- 云端对于文件协作工具至关重要,Office 365 等工具提供云端协作等功能。现代职场的员工不再只满足于优厚的薪资和社会福利。他们希望拥有职场。根据银行控股公司 Capital One 的调查,超过四分之三的员工表示,他们在协作的职场环境中表现较好。随着自动化趋势的发展,它的普及度也日益提高,对于寻求解决方案来提供服务的企业来说,它变得更加重要。

- 此外,合规办公室是针对公共和私人组织提供的易于使用且合规的服务,在提供高安全标准的同时也提供数位创新的机会。在整个欧盟,政界人士、公共部门和行业协会都直言不讳地表示需要云端服务。关于使用云端服务的合法性已经有很多讨论和争论。一些公共当局已经进行了风险评估,并主动决定不遵守现行立法。

预计北美将占据大部分市场份额

- 预计北美将主导商业生产力软体市场。技术进步的快速采用是该市场成长的主要动力。北美是采用云端运算服务以及采用人工智慧和物联网方面最成熟的市场,这归功于多种因素,包括存在许多拥有先进IT基础设施和技术专长的公司。

- 竞争非常激烈,主要生产力软体供应商如亚马逊网路服务公司(美国)、微软(Office 365)和Google都位于该地区。此外,北美的财政实力使其能够大量投资先进的解决方案和技术。这些优势使该地区的组织在市场上具有竞争优势。

- 由于云端基础技术的使用日益增多,生产力管理软体的市场发展预计将加速。透过连接的设备,云端基础的技术可以存取储存的文件。透过减少员工停工时间并提高生产力,云端基础的技术有助于生产力管理。

- 例如,根据美国生产力管理软体公司Flexera的预测,到2021年,94%的公司将使用云端基础的技术进行生产力管理。因此,生产力管理软体市场将受到云端基础的技术日益广泛的使用的推动。

业务生产力软体产业概况

商业生产力软体市场竞争激烈,由几家大公司组成。目前,只有少数主要参与者占据市场占有率。凭藉着压倒性的市场占有率,这些大公司正致力于扩大海外基本客群。这些公司正在利用策略合作措施来增加市场占有率和盈利。

2022年2月,美国软体新兴企业Pendo宣布了其生产力管理计画Pendo Adopt。该计划将帮助组织提高员工绩效并提高生产力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 智慧型手机普及率和 BYOD 采用率不断提高

- 对云端运算、商业智慧和人工智慧的需求不断增长

- 资料管理需求日益增加

- 市场限制

- 实施和培训成本高

- 产业吸引力-波特五力模型

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场区隔

- 按部署

- 本地

- 在云端

- 按组织规模

- 中小企业

- 大型企业

- 按最终用户产业

- BFSI

- 通讯业

- 製造业

- 媒体与娱乐

- 运输

- 零售

- 其他最终用户产业

- 按解决方案

- 内容管理与协作

- 资产管理

- 人工智慧和预测分析

- 工作管理结构

- 其他解决方案

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第六章 竞争格局

- 公司简介

- Microsoft Corporation

- Google LLC

- Oracle Corporation

- Broadcom Inc.(Symantec Corporation)

- SAP SE

- Salesforce.com Inc.

- VMware Inc.

- IBM Corporation

- Amazon.com Inc.

- AppScale Systems Inc.

第七章投资分析

第八章 市场机会与未来趋势

The Business Productivity Software Market size is estimated at USD 68.31 billion in 2025, and is expected to reach USD 138.89 billion by 2030, at a CAGR of 15.25% during the forecast period (2025-2030).

Business can be conducted from anywhere, across the world, in real-time. Collaboration tools are economically and environmentally helpful, as their benefits include reduced travel costs and increased productivity.

Key Highlights

- While AI and IoT propagate the wave of incoming technology advances, business productivity is one area of business that is currently emerging. Business productivity can be traced to an organization's ability to execute an overall strategy successfully. Moreover, business productivity is directly proportional to employee productivity. Businesses are widely adopting various tools to aid employees in enhancing their productivity.

- The increased adoption of smartphones and bring-your-own devices (BYOD), which have expanded the mobile workforce, are strong drivers in the market.

- Implementing cloud computing or AI in business processes stimulates the market. Moreover, vast data being generated across businesses propels the need for adopting better data management techniques, driving the market's growth.

- Business Productivity Software supports and integrates data and processes in every aspect of the business. It also aids in optimizing cloud computing and helps in better collaboration with clients, vendors, suppliers, employees, and customers.

- Organizations adopted the work-from-home policy during the pandemic to ensure their employees' safety. Thus, the demand for business productivity software, such as scheduling software, collaboration tools, and other solutions, increased.

Business Productivity Software Market Trends

Content Management and Collaboration to have the Highest Adoption Rate

- Traditionally, enterprise content management (ECM) was confined to the back office and remained unstructured. However, over the past few years, ECM shifted toward a more interactive role in businesses. Machine learning, cloud technology, and mobile capability presented new opportunities for businesses. New types of content, including video, audio, and social, blur the lines of a traditional ECM.

- Microsoft SharePoint offers many tools to build an ECMS with solid document management and other SharePoint facilities. Customers look for strong internal integration with systems and document management, and as per various players, SharePoint offers a strong toolkit for customizing an ECMS.

- The cloud-based services exhibit the potential to provide cost-effective, flexible, easy-to-manage, and authoritative resource facilities over the internet. Cloud-based ECM services upsurge the capabilities of hardware resources through optimal and shared utilization. These features encourage organizations and individual users to shift their services and applications to the cloud.

- Cloud is essential for document collaboration tools, and tools like Office 365 provide features such as cloud collaboration. Employees in the modern workplace no longer accept adequate pay and perks as sufficient. They seek out working places where they may advance their careers and learn. Over 3/4 of workers, according to a study by Capital One, a bank holding company, perform better in collaborative work environments. The penetration rate is also increasing with automation trends, which has become increasingly important for enterprises looking for solutions offering services.

- Further, Compliant Office is an easy-to-use and regulatory-compliant service for both public and private sector organizations, which features high-security standards while still providing opportunities for digital innovation. Across the EU, politicians, the public sector, and industry organizations have been very vocal about their need for cloud services. There has been much debate and discussion about the legality of their usage. Some public organizations even conducted their risk assessments and actively decided not to comply with current legislation.

North America is Expected to Hold a Majority Share

- North America is expected to dominate the business productivity software market. The early adoption of technological advancements has majorly driven the growth in this market. North America is the most mature market in terms of cloud computing services adoption or AI and IoT adoption due to several factors, such as the presence of many enterprises with advanced IT infrastructure and the availability of technical expertise.

- The major productivity software vendors, like Amazon Web Services Inc. (US), Microsoft (Office 365), Google, etc., are based in this region, so there is strong competition. Also, North America's strong financial position enables it to invest heavily in advanced solutions and technologies. These advantages have provided regional organizations with a competitive edge in the market.

- The market for productivity management software is anticipated to develop due to the rise in cloud-based technology use. Through connected devices, cloud-based technology offers access to stored files. By decreasing employee downtime and increasing productivity, cloud-based technology aids in the management of productivity.

- For instance, 94% of businesses will use cloud-based technology for productivity management in 2021, according to Flexera, a US-based company that makes productivity management software. As a result, the market for productivity management software is driven by the growth in the usage of cloud-based technologies.

Business Productivity Software Industry Overview

The business productivity software market is highly competitive and consists of several major players. Few of the major players currently dominate the market share. These major players with a prominent market share focus on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability.

In February 2022, a US-based software startup called Pendo introduced Pendo Adopt, a productivity management program. This program aids an organization's staff to improve their performance, which raises productivity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in Smartphone Penetration and Increased Adoption of BYOD

- 4.2.2 Growing Demand for Cloud Computing, Business Intelligence, and AI

- 4.2.3 Growing Need for Data Management

- 4.3 Market Restraints

- 4.3.1 High Installation and Training Costs

- 4.4 Industry Attractiveness - Porter Five Forces

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Deployment

- 5.1.1 On-premise

- 5.1.2 On-cloud

- 5.2 Organization Size

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 End User Industry

- 5.3.1 BFSI

- 5.3.2 Telecommunication

- 5.3.3 Manufacturing

- 5.3.4 Media and Entertainment

- 5.3.5 Transportation

- 5.3.6 Retail

- 5.3.7 Other End User Industries

- 5.4 Solutions

- 5.4.1 Content Management and Collaboration

- 5.4.2 Asset Creation

- 5.4.3 AI and Predictive Analytics

- 5.4.4 Structured Work Management

- 5.4.5 Other Solutions

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia Pacific

- 5.5.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Microsoft Corporation

- 6.1.2 Google LLC

- 6.1.3 Oracle Corporation

- 6.1.4 Broadcom Inc. (Symantec Corporation)

- 6.1.5 SAP SE

- 6.1.6 Salesforce.com Inc.

- 6.1.7 VMware Inc.

- 6.1.8 IBM Corporation

- 6.1.9 Amazon.com Inc.

- 6.1.10 AppScale Systems Inc.