|

市场调查报告书

商品编码

1642046

虚拟路由器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Virtual Router - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

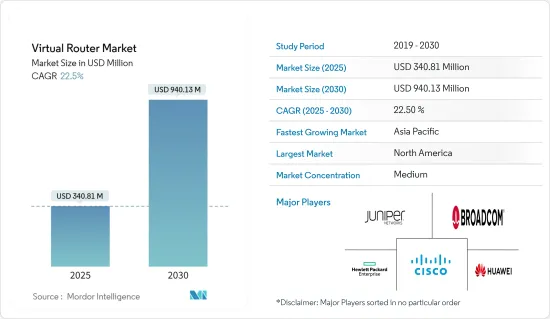

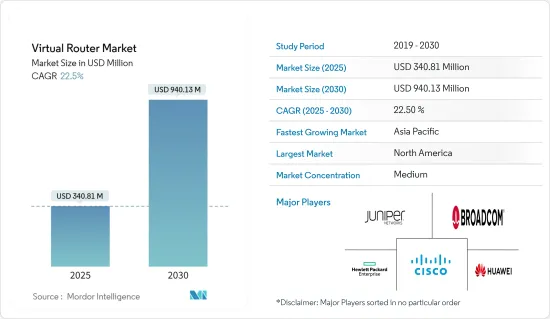

虚拟路由器市场规模预计在 2025 年为 3.4081 亿美元,预计到 2030 年将达到 9.4013 亿美元,在市场估计和预测期(2025-2030 年)内以 22.5% 的复合年增长率增长。

随着服务供应商从昂贵的专用硬体设备转向提供更低总拥有成本 (TCO)、灵活性和扩充性的虚拟解决方案,通讯和企业领域日益增长的需求正在推动虚拟路由器市场的发展。

主要亮点

- 人们对软体定义网路 (SDN) 的日益关注导致了几种领先的虚拟路由器软体解决方案的开发。此外,通讯和企业网路领域对私有云端和虚拟路由器应用的需求不断增长,预计将为市场提供巨大的成长机会。

- 此外,近年来,企业业务越来越丰富,越来越多的企业在公共云端云或私有云端上引入虚拟私有云端(VPC),将企业网路和IT基础设施云化、虚拟,从而降低网路成本、更快部署业务。这些因素推动了最终用户群体对具有可扩展且经济高效的虚拟路由器等经济高效的解决方案的需求。

- 此外,随着云端基础服务的发展,应用程式和流量将会猛增。传统企业广域网路正面临企业基础设施和服务云端化需求的挑战。虚拟路由器满足了云端运算和网路设备虚拟的趋势。虚拟路由器还降低了硬体成本,因为它们不需要专用的硬体平台。由于这些发展,虚拟路由器近年来获得了显着的支持,虚拟路由器市场正在扩大。

- 此外,企业对私有云端的需求不断增长,加上云端服务的日益普及,为预测期内的市场成长创造了机会。这些云端服务透过采用虚拟路由器来增强其运营,从而推动市场成长。由于虚拟路由器具有更快的资料检索、更快的网路速度、以及为云端服务提供安全的储存网路等优异的功能,网路环境中对虚拟路由器的需求大大增加。

- 大多数行业都因新冠肺炎疫情而面临困难。世界各国政府被迫无限期关闭企业,导致供应链中断。随着企业寻求降低其网路环境的维护成本,对虚拟路由器的需求也随之增加,以降低整体拥有成本。此外,由于数位化、云端服务的高度普及以及虚拟路由器环境的创新,预计市场在疫情后将出现巨大的需求。

虚拟路由器市场趋势

服务供应商预计将占据主要市场占有率

- 由于 SDN 和 VNF 的部署日益增多,资料中心、电信和云端等服务供应商预计将占据主要份额。通讯服务供应商面临的挑战是转变其营运商网路基础设施,以建立新的业务网路服务、创造新的收入来源并提高营运效率。虚拟路由器透过提供成本节省以及高度的灵活性和扩充性,正成为服务供应商克服这些挑战的首选。

- 在全球范围内,这些提供者认识到需要数位化其网路基础设施并创建更加以消费者为中心的经营模式。采用软体定义网路 (SDN)外形规格并以虚拟创新部署网路功能是营运商投资未来技术的关键先决条件。这推动了服务供应商对虚拟路由器的需求。

- 此外,世界各地的服务供应商正在其网路的各个部分迅速利用虚拟路由,包括资料中心、网路边缘和用户端设备 (CPE)。此外,随着光纤和 5G 的快速发展,资料需求将持续成长,从而增加对虚拟路由器等以软体为中心的模型的需求。虚拟路由器对于服务供应商来说是理想的,因为它们允许您轻鬆快速地扩展频宽。

- 在服务供应商领域,电信业者和云端服务供应商对虚拟路由器的采用预计将通讯业者成长。虚拟路由器透过使路由功能变得灵活且扩充性,有助于提高整体潜在网路容量。此外,随着公共云端、私有云端、混合云端等云端服务需求大幅成长,云端服务供应商对虚拟路由器的需求也预计将增加。例如,根据 Flexera 2023 年云端状况报告,混合云端和公共云端的使用率将分别达到 72% 和 24%,其次是私有云端,占 4%。

预计北美将占据主要市场占有率

- 由于研发(R&D)的成长和网路技术的进步,北美地区预计将占据主要份额。该地区的国家(例如美国和加拿大)也正在经历网路基础设施日益复杂化、服务供应商越来越多地采用虚拟路由器解决方案来优化其网路以及在所有主要垂直行业中提供增强客户体验的需求日益增长。

- 此外,该地区的虚拟路由器市场正在获得Juniper Networks、思科网路和 IBM 公司等几家知名主要企业的大量投资和新产品的推出,从而推动服务供应商采用虚拟路由器,从而推动市场成长。包括 IT 和通讯、BFSI、医疗保健、政府机构等在内的各行业都在采用虚拟路由器解决方案,促进这些产业的发展。

- 此外,该地区对 SDN 和 NFV 的高度采用也导緻美国和加拿大等国家的虚拟路由器显着扩张。此外,采用虚拟路由器可大幅降低 OPEX 和 CAPEX,并提供可扩展性和灵活性,从而为虚拟路由器市场的成长创造潜力,预计未来几年将在该地区的各个终端用户行业中广泛采用。

- 此外,由于北美互联网基础设施高度发达、5G等各种先进网路技术的引入、互联网服务供应商采用虚拟路由器解决方案进行网路优化的趋势日益增加、以及该地区所有主要垂直行业改善虚拟体验的趋势日益增加,对虚拟路由器的需求预计也将增长。

虚拟路由器产业概览

虚拟路由器市场近年来竞争日益激烈,竞争程度适中。市场参与者正在进行策略创新、合作和扩张,以提供创新的虚拟路由器解决方案。

2022 年 1 月,Juniper Networks Inc.) 宣布推出新的软体功能和硬件,使路由器更易于企业管理,成为企业网路的关键建构模组。 2021 年,瞻博网路以 4.5 亿美元收购了新兴企业,扩大了其在企业路由器市场的影响力。该公司将此次收购中获得的虚拟路由器软体重新打包成其会话智慧路由器(SSR)产品。企业可以使用 SSR 在资料中心、分店和云端部署之间建立网路连线。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 购买者/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 服务供应商越来越要求更高的网路灵活性和高效的扩展能力

- 对 SDN 和 NFV 的需求不断增加

- 降低总拥有成本 (TCO) 的需求

- 市场限制

- 虚拟环境中的安全问题

第六章 市场细分

- 按组件

- 解决方案

- 服务

- 按最终用户

- 服务供应商

- 企业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 世界其他地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Broadcom Inc.

- Cisco Systems Inc.

- Juniper Networks, Inc.

- Huawei Technologies Co., Ltd.

- Hewlett Packard Enterprise

- IBM Corporation

- Telefonaktiebolaget LM Ericsson

- Nokia Corporation

- Netronome Systems, Inc.

- ZTE Corporation

- netElastic Systems

第八章投资分析

第九章 市场机会与未来趋势

The Virtual Router Market size is estimated at USD 340.81 million in 2025, and is expected to reach USD 940.13 million by 2030, at a CAGR of 22.5% during the forecast period (2025-2030).

The virtual router market is driven by the increasing demand from the telecommunication and enterprise sector as service providers are increasingly moving from expensive, dedicated hardware devices to virtualized solutions that reduce the total cost of ownership (TCO), flexibility, and scalability.

Key Highlights

- The increasing focus on software-defined networking (SDN) has led to the development of several advanced virtual router software solutions. Moreover, the growing demand for private cloud and virtual router applications across network segments in the telecommunication and enterprise sector is expected to provide significant growth opportunities in the market.

- Further, in the past few years, enterprise services have been becoming more diversified; more and more enterprises have deployed virtual private clouds (VPCs) on public or private clouds to cloudification and virtualize enterprise networks and IT infrastructure, thereby reducing network costs and implementing fast service rollout. Such factors increase the demand for cost-effective solutions such as Virtual routers in end-user segments owing to their scalability and cost-effective features.

- Additionally, as cloud-based services develop, applications and traffic surge rapidly. Traditional enterprise WANs face challenges in enterprise infrastructure and service cloudification requirements. Virtual routers cope with trends of network device cloudification and virtualization. In addition, virtual routers save hardware costs because no dedicated hardware platform is required. Such developments resulted in virtual routers gaining significant traction in the past few years, expanding the virtual router market.

- Moreover, the rising need for private clouds in enterprises coupled with expanding popularity of cloud services is creating growth opportunities for the market over the forecast period. These cloud services are strengthening their operations via the deployment of virtual routers, consequently fostering market growth. The need for virtual routers has significantly increased in the network environment due to their favorable features, which include faster data acquisition, faster network speed increases, and safer storage networks, among others, for cloud services.

- Most industries faced difficulties as a result of the COVID-19 pandemic. Governments across the world forced indefinite shutdowns and disrupted supply chains. Businesses attempted to reduce maintenance costs across network environments, thus increasing the demand for virtual routers to reduce the total cost of ownership. Moreover, the market is expected to witness significant demand post-pandemic owing to the high penetration of digitization and cloud services and innovations in the virtual router environment.

Virtual Router Market Trends

Service Providers are Anticipated to Hold Significant Market Share

- The service providers such as data centers, telecom, and cloud are expected to hold a significant share due to the growing deployment of SDN and VNF. Telecommunication service providers are challenged to transform their carrier network infrastructure to build new business network services, generate new revenue streams, and improve operational efficiency. Virtual routers are becoming the preferred choice to overcome these challenges for service providers by offering a cost reduction coupled with high flexibility and scalability.

- These providers globally recognized the need to digitally transform their network infrastructure and build more consumer-centric business models. Embracing software-defined networking (SDN) principles and the innovative deployment of network functions in virtualized form factors are key necessities for carriers investing in their future technologies. This necessitated the demand for virtual routers for the service providers.

- In addition, service providers worldwide are rapidly leveraging virtual routing in various parts of their networks, including the data centers, the network edge, and customer premises equipment (CPE). Moreover, data demands continue to increase as fiber and 5G are witnessing significant growth; the need for software-centric models, such as Virtual routers, is expected to grow. The ability of virtual routers to easily and rapidly scale up bandwidth makes them ideal for service providers.

- The service provider segment is expected to witness significant adoption of virtual routers among telecom and cloud service providers, as it helps them to increase the overall network capacity latent by providing flexibility and scalability in routing functionalities. Further, as the demand for cloud services such as public, private, and hybrid cloud gains significant momentum, the need for virtual routers for cloud service providers is expected to grow. For instance, according to Flexera 2023 State of the Cloud Report, hybrid cloud and public cloud usage are 72% and 24%, followed by Private cloud with 4%.

North America Region is Expected to Hold Major Market Share

- The North American region is anticipated to hold a major share owing to the growth in Research and Development (R&D) and advancements in networking technology. Countries in the region, such as the United States and Canada, are also witnessing increasing complexities in network infrastructure, growing adoption of virtual router solutions by service providers to optimize their networks, and a growing demand to deliver an enhanced customer experience across all the major industry verticals.

- Further, the virtual router market in the region is receiving significant investment and new product launches from several well-known key companies, including Juniper Networks, Cisco Networks, IBM Corporation, and others, and the adoption of virtual routers by service providers is boosting the market growth. Various industries, including IT and telecommunication, BFSI, healthcare, and government agencies, contribute to the industry's growth by adopting virtual router solutions.

- Further, the high penetration of SDN and NFV in the region also resulted in the significant expansion of virtual routers in countries like the United States and Canada. In addition, considerable reduction offered in OPEX and CAPEX coupled with scalability and flexibility by deploying the virtual router will create growth potential for the virtual router market and high adoption in the region's various end-user industries in the coming years.

- Additionally, the demand for virtual routers in North America is also expected to grow owing to the region's highly developed internet infrastructure coupled with the introduction of various advanced network technologies such as 5G, as well as the growing adoption of virtual router solutions by internet service providers to optimize their networking and an increasing preference to improve the customer experience across in all major industry verticals in this region.

Virtual Router Industry Overview

The virtual router market has been gaining a competitive edge in recent years and is moderately competitive. The companies in the market are strategically innovating, partnering, and expanding to provide innovative virtual router solutions.

In January 2022, Juniper Networks Inc. introduced new software features and hardware to make it easier for companies to manage their routers, forming a crucial corporate network building block. Juniper expanded its presence in the enterprise router market in 2021 by acquiring a startup called 128 Technology Inc. for USD 450 million. The company repackaged the virtual router software obtained through the acquisition into the Session Smart Router (SSR) product. Businesses can use SSR to establish network connectivity between data centers, branch offices, and cloud deployments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of the COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Need to Improve Network Agility and Efficient Scale Out by Service Providers

- 5.1.2 Increase in the Demand for SDN and NFV

- 5.1.3 Demand of Reduction in Total Cost of Ownership (TCO)

- 5.2 Market Restraints

- 5.2.1 Security Concerns Associated with the Virtualized Environment

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solution

- 6.1.2 Service

- 6.2 By End-User

- 6.2.1 Service Provider

- 6.2.2 Enterprise

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Rest of the World

- 6.3.4.1 Latin America

- 6.3.4.2 Middle-East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Broadcom Inc.

- 7.1.2 Cisco Systems Inc.

- 7.1.3 Juniper Networks, Inc.

- 7.1.4 Huawei Technologies Co., Ltd.

- 7.1.5 Hewlett Packard Enterprise

- 7.1.6 IBM Corporation

- 7.1.7 Telefonaktiebolaget LM Ericsson

- 7.1.8 Nokia Corporation

- 7.1.9 Netronome Systems, Inc.

- 7.1.10 ZTE Corporation

- 7.1.11 netElastic Systems