|

市场调查报告书

商品编码

1642048

SD-WAN(软体定义广域网路):市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Software-Defined Wide Area Network - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

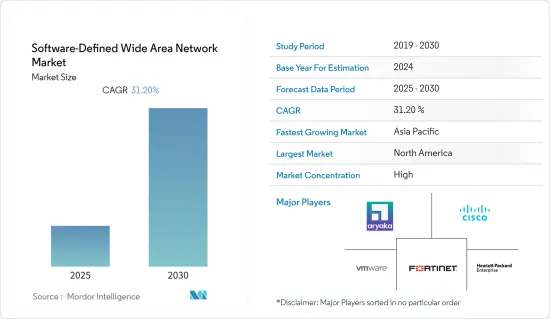

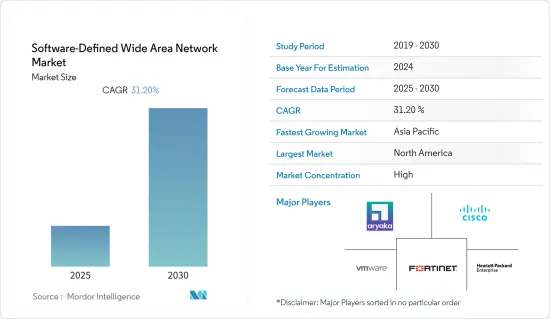

预计预测期内软体定义广域网路 (SD-WAN) 市场复合年增长率将达到 31.2%。

主要亮点

- 智慧型手机普及率的不断提高,推动了行动资料流量的增加。这使得服务供应商在简化流程方面面临重大挑战。

- 此外,网路宽频连线的需求正在激增,简化的网路解决方案取代了更昂贵的解决方案。

- 公司现在将重点转向降低营运费用。由于製造商之间竞争激烈,增加利润的唯一方法就是尽量降低营运成本。

- 对 SD-WAN 网路安全的某些担忧限制了其成长和采用率。

SD-WAN(软体定义广域网路)市场趋势

企业部门推动 SD-WAN 市场成长

随着世界加速走向数位化,无论企业规模大小,都需要安全、无缝的连接来管理其业务运作。这就是企业选择 SD-WAN 架构的原因。 SD-WAN 也有助于维持企业内部内容消费的高品质流。

- Edgecore Networks 宣布其 SD-WAN 产品组合推出两个新系列。这有助于改善远端工作人员的网路并解决远端使用者的应用程式效能问题。它专为连锁店和中小型企业设计,按需提供强大、安全、适应性强的网路服务。 Edgecore Networks 是一家开放网路解决方案供应商,为企业、资料中心和通讯服务供应商提供 NOS 和 SDN 软体。

- Aryaka 是全託管 SD-WAN 和 SASE 解决方案的领导者,已在法国巴黎开设了一个存取点 (PoP)。 Aryaka 的新工厂意味着无论未来工作环境存在何种不确定性,其业务都可以受到保护。

北美预计将占据主要市场占有率

SD-WAN 解决方案在北美的企业和服务供应商中越来越受欢迎。多个成功的先导计画和公司的全面实施已成为世界各地的头条新闻。随着 SD-WAN 解决方案的知名度不断提高及其优势得到证实,北美主要市场预计将出现显着的成长。

SD-WAN市场的长期趋势表明,北美市场为SD-WAN供应商贡献了最高的商机。美国零售业的成长带来了日益增加的组织复杂性,而 SD-WAN 解决方案可以简化这一过程。

北美地区的大多数国家经济实力雄厚。这一优势使该地区相对于其他地区更具优势,并利用它投资于 5G、RAN、网路安全和其他物联网服务等最新技术。

SD-WAN(软体定义广域网路)产业概况

SD-WAN(软体定义广域网路)市场竞争激烈,由多家大型参与者组成。从市场占有率来看,目前市场主要被少数几家大公司占据。服务提供者正在透过併购来获取竞争优势并推动市场扩张。

2022 年 2 月,思科与 Microsoft Teams 和 Office 365 合作解决软体即服务 (SaaS) 效能不一致的问题。思科发布了其 SD-WAN 软体的更新版本,以支援透过 SD-WAN 对 Microsoft SaaS 应用程式(包括 Microsoft SharePoint、OneDrive 和 Teams)进行最佳路由。 Cisco SD-WAN 客户可以利用 Cisco 的 Cloud OnRamp 智慧地路由 Microsoft 365 流量,以提供最快、最安全、最可靠的最终使用者体验。

2022 年 3 月,Verizon 将与 VMware 合作,协助 Verizon 将该软体巨头的 VeloCloud SD-WAN 平台部署到其託管服务组合中。该服务包括一个集中式 SD-WAN 编排器、一个全球分布的 SD-WAN 网关网络,以及一系列用于分店连接的边缘设备。

2022 年 11 月,技术服务经销商 TVI 与 Aryaka 签署协议,允许 TBI 的代理商销售这家安全网路服务供应商的产品。它还提供整合的安全存取服务边缘 (SASE)。 Aryaka 的先进技术在同一云端基础的平台上完全整合了先进的网路和安全功能,而不是在单独的孤岛中运行它们。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

第 2 章 简介

- 研究假设和市场定义

- 研究范围

第三章调查方法

第四章执行摘要

第五章 市场动态

- 市场概况

- 市场驱动因素

- 云端基础的解决方案的兴起

- 简化您的网路解决方案

- 出行服务需求不断成长

- 市场限制

- 资料安全

- 缺乏合格的培训师

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第六章 市场细分

- 依部署方式

- 前提

- 云

- 杂交种

- 依组件类型

- 解决方案

- 服务

- 按组织规模

- 大型企业

- 中小企业

- 按最终用户产业

- 卫生保健

- 银行和金融服务

- 零售和消费者服务

- 製造业

- 运输和物流

- 资讯科技/电讯

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 英国

- 法国

- 德国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲和纽西兰

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲国家

- 北美洲

第七章 竞争格局

- 供应商市场占有率

- 合併和收购

- 公司简介

- Aryaka

- Cisco

- vmware

- Nokia

- Hewlett Packard Enterprise

- Huawei

- Tata Communications

- MCM Telecom

- Fortinet

- Ericsson

第八章投资分析

第九章 市场机会与未来趋势

The Software-Defined Wide Area Network Market is expected to register a CAGR of 31.2% during the forecast period.

Key Highlights

- The increase in smartphone penetration rates has led to an increase in mobile data traffic. This has exposed the service providers to huge problems related to the streamlining of the processes.

- There is also an upsurge in the demand for internet broadband connections to replace more expensive solutions with simplified network solutions.

- The enterprises have now shifted their focus to the reduction of operational expenditure. Due to huge competition among the manufacturers, the only way to increase profits is to minimize operational expenditure.

- Certain concerns over the security of the SD-WAN network have come into the picture, which is restricting its growth and adoption rates.

Software-Defined Wide Area Network Market Trends

Enterprise Sector will Add to the SD-WAN Market Growth

As the world accelerates towards digitization, enterprises, either small or large, want to have secure and seamless connectivity to manage business operations. This directs them to opt for SD-WAN architecture. SD-WAN also helps in maintaining high-quality streams for content consumption within businesses.

- Edgecore Networks launched two new series in the SD-WAN portfolio. This will help in better networking for remote workers and will address application performance issues for remote users. Specifically designed for chain stores and small to medium-sized enterprises, it will provide robust, secure, and adaptive network services on demand. Edgecore Networks is a provider of open networking solutions which offers NOS and SDN software for enterprises, data centers, and telecommunication service providers.

- Aryaka, the leader in fully managed SD-WAN and SASE solutions, launched a service Point of Presence (PoP) in Paris, France. Aryaka's new facilities mean it can protect its businesses, regardless of any future uncertainty concerning the working environments.

North America is Expected to Hold the Major Market Share

SD-WAN solutions have gained popularity amongst enterprise and service providers in the North American region. Multiple successful pilot projects and full-fledged deployments performed by enterprises are creating a significant market buzz across the world. Driven by growing awareness and proven benefits of SD-WAN solutions, critical markets of North America are expecting a massive boost in growth.

The long-term trend for the SD-WAN market indicates that the North American market has contributed the highest business opportunities for SD-WAN vendors. The growing retail business in the United States has led to more organizational complexities, which can be simplified with SD-WAN solutions.

Most of the countries in the North American region are economically robust. This advantage keeps the region ahead of other geographies and leverages them to invest in the latest technologies like 5G, RAN, cyber security, and other IoT services.

Software-Defined Wide Area Network Industry Overview

The Software-defined Wide Area Network Market is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. The service providers are engaging themselves in mergers and acquisitions in order to gain a competitive advantage and trigger expansion.

In February 2022, Cisco joined hands with Microsoft Teams and Office 365 to address inconsistent software-as-a-service (SaaS) performance. Cisco released an updated version of their SD-WAN software which supports the optimal routing of Microsoft SaaS apps, including Microsoft SharePoint, OneDrive, and Teams on their SD-WAN. Cisco SD-WAN customers can leverage Cisco's Cloud OnRamp to intelligently route Microsoft 365 traffic to provide the fastest, most secure, and most reliable end-user experience.

In March 2022, Verizon collaborated with VMware, which will help Verizon roll the software giant's VeloCloud SD-WAN platform into its managed services portfolio. The service includes a centralized SD-WAN orchestrator, a network of globally distributed SD-WAN gateways, and a bevy of edge appliances for branch connectivity.

In November 2022, TVI, the technology services distributor, signed a deal with Aryaka that will allow TBI agents to sell the secure network services provider's offering. It will also offer a unified, secure access service edge (SASE). With its advanced technology, Aryaka fully converges advanced networking and cybersecurity features onto the same cloud-based platform rather than running them in separate silos.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 TOC

2 INTRODUCTION

- 2.1 Study Assumption and Market Definition

- 2.2 Scope of the Study

3 RESEARCH METHODOLOGY

4 EXECUTIVE SUMMARY

5 MARKET DYNAMICS

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Increased Number of Cloud-based Solution

- 5.2.2 Simplified Network Solution

- 5.2.3 Growing Demand for Mobility Services

- 5.3 Market Restraints

- 5.3.1 Data Security

- 5.3.2 Lack of Qualified Trainers

- 5.4 Industry Value Chain Analysis

- 5.5 Porter's Five Forces Analysis

- 5.5.1 Threat of New Entrants

- 5.5.2 Bargaining Power of Buyers/Consumers

- 5.5.3 Bargaining Power of Suppliers

- 5.5.4 Threat of Substitute Products

- 5.5.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Deployment Mode

- 6.1.1 Premise

- 6.1.2 Cloud

- 6.1.3 Hybrid

- 6.2 By Component Type

- 6.2.1 Solutions

- 6.2.2 Services

- 6.3 By Organisation Size

- 6.3.1 Large Enterprises

- 6.3.2 Small-Medium Enterprises

- 6.4 By End-user Industry

- 6.4.1 Healthcare

- 6.4.2 Banking and Financial Services

- 6.4.3 Retail and Consumer Services

- 6.4.4 Manufacturing

- 6.4.5 Transport and Logistics

- 6.4.6 IT and Telecom

- 6.4.7 Other End-user Industries

- 6.5 Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.1.3 Mexico

- 6.5.1.4 Rest of North America

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 France

- 6.5.2.3 Germany

- 6.5.2.4 Rest of Europe

- 6.5.3 Asia-Pacific

- 6.5.3.1 China

- 6.5.3.2 India

- 6.5.3.3 Japan

- 6.5.3.4 Australia & New Zealand

- 6.5.3.5 Rest of Asia-Pacific

- 6.5.4 Latin America

- 6.5.4.1 Brazil

- 6.5.4.2 Mexico

- 6.5.4.3 Rest of Latin America

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Market Share

- 7.2 Mergers and Acquisitions

- 7.3 Company Profiles

- 7.3.1 Aryaka

- 7.3.2 Cisco

- 7.3.3 vmware

- 7.3.4 Nokia

- 7.3.5 Hewlett Packard Enterprise

- 7.3.6 Huawei

- 7.3.7 Tata Communications

- 7.3.8 MCM Telecom

- 7.3.9 Fortinet

- 7.3.10 Ericsson