|

市场调查报告书

商品编码

1642056

3D 重建:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)3D Reconstruction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

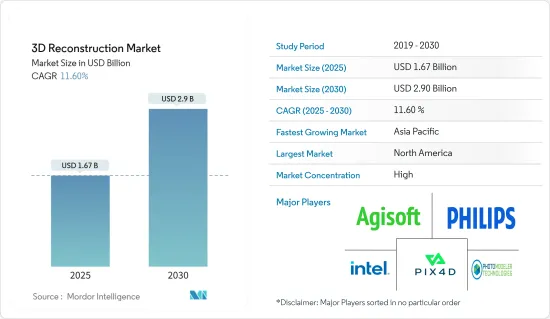

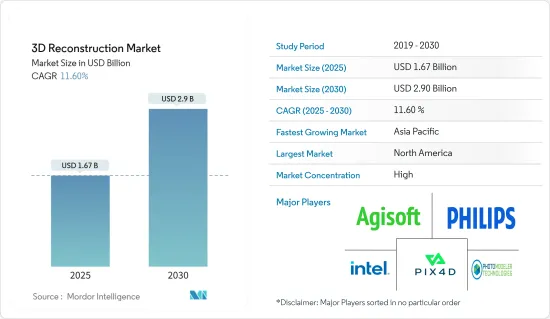

3D 重建市场在 2025 年的估值为 16.7 亿美元,预计到 2030 年将达到 29 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.6%。

3D 重建具有广泛的应用,包括艺术品分析和修復、表型分析、电影和游戏图形以及设计。终端用户和商业应用是推动供应商投资技术开发的主要驱动力之一。

主要亮点

- 由于医疗保健、製造业以及媒体和娱乐产业的应用不断扩大,3D 重建市场在过去几年中获得了显着的发展。此外,扩增实境(AR) 和虚拟实境 (VR) 产业对为用户提供沉浸式虚拟体验的需求不断增长,也可能在预测期内推动 3D 重建市场的需求。

- 过去几年来,建筑物三维重建一直是电脑视觉和数位摄影测量领域的活跃的研究主题。 3D 建筑模型在城市规划和旅游等领域越来越受欢迎。由于这些进步,预计市场在预测期内将实现可观的成长。

- 深度学习技术的出现,以及最重要的大型训练资料集的日益普及,导致了新一代方法的出现,这些方法能够在没有复杂的相机校准过程的情况下恢復物体的 3D 几何形状和结构。近年来先进相机的出现进一步推动了 3D 重建市场的发展。

- 元宇宙的出现也为3D重建创造了应用机会,因为元宇宙很大程度上依赖场景的3D重建。各公司正在开发利用3D重建等最尖端科技的计划,以使元宇宙更加强大,并为使用者提供身临其境的视觉体验。

- 3D 重建可以透过捕捉文化资产、建筑、生物和生态事实以及文化景观的形状和外观来帮助保存。例如,去年3月,澳门文化局宣布将利用3D技术重建澳门标誌性建筑大三巴牌坊,提供游客虚拟导览。经过一段时间的测试和调整,这次的3D重建将为游客和市民提供英语、葡萄牙语、粤语和普通话的导览服务。

- 由于製造业、媒体和娱乐业等潜在终端用户产业的关闭,COVID-19 疫情严重影响了 3D 重建市场的成长。然而,医疗保健领域对 3D 重建解决方案的需求激增,用于诊断和管理 COVID-19 患者。

3D重建技术的市场趋势

3D 重建软体领域预计将占据最大份额

- 随着技术不断进步和产品不断创新,3D列印技术已应用到许多领域,并带动了许多多视角影像重建软体解决方案的采用。我们的软体解决方案广泛应用于 GIS 应用、媒体和娱乐、文化遗产、製造业和医疗保健。

- 3D 重建软体在医疗保健领域的需求很高。 3D 重建技术有助于从萤光聚焦影像中可视化代表神经元形态的 3D 模型,从而有助于提供准确和完整的表征。该技术可以重建具有亚微米分辨率的单一神经元以及具有毫米特征尺寸的大规模神经元系统。

- 例如,飞利浦的 XperCT 是一款用于介入系统的 3D 重建软体(类似 CT 的成像) ,允许使用者存取软组织、骨骼结构、支架部署和肿瘤供血者。它还有助于在操作过程中避开结构。

- 数位化和投资的增加,以及医疗保健领域对人工智慧和 3D 重建等先进技术的日益广泛的使用,可能会为未来几年 3D 重建软体的采用创造机会。例如,根据 StartUp Health 的数据,数位健康产业的资金筹措从 2017 年的 118 亿美元成长到 2021 年的 440 亿美元。

- 3D 重建使用不同的方法,例如 123D Catch、PhotoScan、PhotoTourism、VideoTrace、KinectFusion 和 ProFORMA,以及多种输入,例如影像集合、单一影像和影片影像。目前,3D 重建存在诸如光滑表面、无纹理表面和有遮蔽的表面等问题。然而,功能增强的先进 3D 重建软体的推出预计将在未来几年推动软体产业的发展。

预计北美将占据最大的市场份额

- 预计预测期内北美将主导整体 3D 重建技术市场。一些地方政府正在采用 3D 重建技术进行犯罪现场评估和调查、犯罪现场的 3D 电脑重建和情境察觉。

- 此外,美国媒体和娱乐产业是采用 3D 结构的主要推动力,这可能会在预测期内极大地推动市场发展。该地区各种领先供应商的存在以及先进技术的早期采用者可能会为预测期内该地区 3D 重建市场的成长铺平道路。

- 该地区修復历史遗蹟的运动日益兴起,政府、各种教育机构和私人组织都参与了此类修復工作。预计这些倡议将在预测期内推动该地区的 3D 重建市场的发展。

- 该地区的市场供应商正专注于透过整合先进技术进行产品创新,这有望为市场创造成长机会。例如,自动光学检测 (AOI)、自动 X 射线检测 (AXI) 和焊膏检测 (SPI) 领域的全球领导者欧姆龙自动化美国公司 (OMRON Automation Americas) 于去年 12 月在圣地亚哥举行的 IPC Apex 2023 上宣布推出两款新型 AOI 系统 VT-Z600 和 VT-S10040。 VT-S1040 也支援回流焊接前/后检查。 VT-S1040 配备 MDMC 照明和 AI 辅助微相移 (MPS) 3D 重建,进一步提高了缺陷检测和首次通过产量比率,减少了误报。

3D重建技术产业概况

3D 重建市场正在整合,少数领先公司占据相当大的市场占有率。 3D 重建市场的供应商专注于持续的产品创新以及合併、合作和收购活动。这些公司在该领域不断创新,从而获得了相对于竞争对手的竞争优势。

- 2022 年 10 月 - RSIP Vision 是透过电脑视觉解决方案和先进的 AI 推动医学成像创新的领导者之一,宣布推出一种用于输尿管 3D 重建的新工具。该工具将输尿管的二维透视影像转换为医学级三维模型。医生使用重建的模型进行手术规划、诊断和手术过程中的即时导航。

- 2022 年 7 月 - Skyline Software Systems, Inc. 宣布,日本领先的工程和测量公司兼其全球经销商网路的重要合作伙伴 Pasco Corporation 已开始在日本市场销售 TerraExplorer。 TerraExplorer 是最先进的 3D GIS 桌面检视器,提供高解析度 3D 环境和强大的工具,用于显示、查询、分析和呈现地理空间资料。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 技术简介

- 主动重组

- 被动重组

- COVID-19 的市场评估

第五章 市场动态

- 市场驱动因素

- 3D 技术在维修领域的应用日益广泛

- 相机领域的技术进步

- 市场限制

- 专业技能人才短缺

第六章 市场细分

- 依施工解决方案类型

- 软体

- 服务

- 按最终用户产业

- 媒体与娱乐

- 航太和国防

- 製造业

- 卫生保健

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Pix4D SA

- Koninklijke Philips NV

- Agisoft LLC

- PhotoModeler Technologies

- Intel Corporation

- Matterport Inc.

- Faro Technologies Inc.

- Autodesk Inc.

- General Electric Company

- Vi3Dim Technologies

- Quorum Technologies Inc.

第八章投资分析

第九章:市场的未来

The 3D Reconstruction Market size is estimated at USD 1.67 billion in 2025, and is expected to reach USD 2.90 billion by 2030, at a CAGR of 11.6% during the forecast period (2025-2030).

3D reconstruction can be used across a wide range of applications, including art analysis and restoration, phenotype analysis, film and game graphics, and design, among others. The applications in the end-user and commercial sector have been among the prominent factors prompting vendors to invest in technological developments.

Key Highlights

- The 3D reconstruction market has been gaining significant traction over the past few years due to its increasing applications in the healthcare, manufacturing, and media and entertainment industries. The growing demand from the augmented reality (AR) and virtual reality (VR) industries to provide users with immersive virtual experiences may also drive the demand for the 3D reconstruction market over the forecast period.

- 3D reconstruction of buildings has been an active research topic in computer vision and digital photogrammetry during the past years. 3D building models are gaining increasing popularity in the areas of urban planning, tourism, etc. Owing to these advancements, the market is expected to register promising growth during the forecast period.

- The advent of deep learning techniques and, most importantly, the increased availability of large training data sets led to a new generation of methods that can recover objects' 3D geometry and structure without using any complex camera calibration process. The advent of advanced cameras in the past few years further propelled the 3D reconstruction market.

- The emergence of the Metaverse also creates opportunities for the application of 3D reconstruction, as the Metaverse heavily depends on the 3D recreation of scenes. Businesses are developing their projects to use cutting-edge technology, such as 3D reconstruction, to make the Metaverse more powerful and provide users with an immersive visual experience.

- 3D reconstruction can help preserve cultural artifacts, architecture, biofacts or ecofacts, and cultural landscapes by capturing their shape and appearance. For instance, in March last year, the Cultural Affairs Bureau of Macau announced using 3D technology to reconstruct the city's iconic Ruins of St. Paul's for guided virtual tours for visitors. Following the 3D reconstruction, tourists and residents can enjoy guided tours in the English, Portuguese, Cantonese, and Mandarin after a period of testing and adjustment.

- The COVID-19 pandemic significantly impacted the growth of the 3D reconstruction market due to the closure of the potential end-user industries such as manufacturing, media, and entertainment. However, the demand for 3D reconstruction solutions surged in the healthcare sector to diagnose and manage COVID-19 patients.

3D Reconstruction Technology Market Trends

3D Reconstruction Software Segment is Expected to Gain the Largest Share

- With continuous technological advancements and product innovations, 3D printing technology is being applied in many areas, leading to the adoption of many reconstruction software solutions for multi-view images. The software solutions used in various applications are GIS applications, media and entertainment, cultural heritage, manufacturing, healthcare, etc.

- The 3D reconstruction software segment is witnessing significant demand in the healthcare sector. 3D reconstruction technology helps visualize 3D models representing neuron morphology for fluorescent confocal images, which help provide accurate and complete characterizations. This technology makes it possible to reconstruct a single neuron with sub-micron resolution or a large neuron system with a feature size of millimeters.

- For instance, Philips' XperCT, a 3D reconstruction software CT-like imaging to interventional systems, allows the user to access soft tissue, bone structure, stent deployment, and tumor feeders. It also helps in avoiding structures during procedures.

- The growing digitalization and investments, coupled with the increasing use of advanced technologies such as AI and 3D reconstruction in the healthcare sector, may create opportunities for the adoption of 3D reconstruction software in the coming years. For instance, according to StartUp Health, digital health industry funding increased from USD 11.8 billion in 2017 to USD 44 billion in 2021.

- 3D reconstruction uses various approaches, such as 123D Catch, PhotoScan, photo tourism, VideoTrace, KinectFusion, and ProFORMA, with multiple inputs, like image collections, single images, and video footage. Currently, 3D reconstructions have issues with shiny, textureless, or occluded surfaces. However, introducing advanced 3D reconstruction software with enhanced features is expected to drive the software segment in the coming years.

North America is Expected to Hold the Largest Share in the Market

- North America is expected to dominate the overall 3D reconstruction technology market during the forecast period. Several regional governments have adopted 3D reconstruction technology for site assessments and investigations, crime scene reconstruction using 3D computers, and situational awareness.

- In addition, the US media and entertainment industry is gaining significant traction in terms of 3D construction adoption, which may significantly drive the market over the forecast. The presence of various prominent vendors and the early adoption of advanced technologies in the region would pave the way for the growth of the 3D reconstruction market in the region over the forecast period.

- With the increasing drive in the region to restore historical sites, governments, including various educational institutions and private organizations, are taking part in such restoration initiatives. Initiatives like these are expected to boost the 3D reconstruction market in the region during the forecast period.

- The market vendors in the region are focusing on product innovations with the integration of advanced technology, which is expected to create growth opportunities for the market. For instance, in December last year, Omron Automation Americas, one of the global leaders in automated optical inspection (AOI), automated x-ray inspection (AXI), and solder paste inspection (SPI), announced the launch of two new AOI systems at IPC Apex 2023 in San Diego: the VT-Z600 and VT-S1040. The VT-S1040 is also intended for pre/post-reflow inspection. It also features MDMC illumination and includes AI-assisted microphase shift (MPS) 3D reconstruction, further improving defect detection and first-pass yields while reducing false calls.

3D Reconstruction Technology Industry Overview

The 3D reconstruction market is consolidated due to a few major players holding significant market shares. Vendors in the 3D reconstruction market focus on continuous product innovation, coupled with involving in mergers, partnerships, and acquisition activities. The ability of these firms to constantly innovate in this field has allowed them to gain a competitive advantage over their competitors.

- October 2022 - RSIP Vision, one of the leaders in driving innovation for medical imaging through computer vision solutions and advanced AI, announced the launch of a new tool for 3D reconstruction of the ureter. The tool transforms 2D fluoroscopic images of the ureter into a medical-grade 3D model. The physician will use the reconstructed model for procedural planning, diagnosis, and real-time navigation during a procedure.

- July 2022 - Skyline Software Systems Inc. announced that Pasco Corporation, a leading engineering and survey company in Japan and a key partner in its Global Reseller Network, launched TerraExplorer in the Japanese market. TerraExplorer is a cutting-edge 3D GIS desktop viewer and creator that provides powerful tools and a high-resolution 3D environment to view, query, analyze, and present geospatial data.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Technology Snapshot

- 4.3.1 Active Method of Reconstruction

- 4.3.2 Passive Method of Reconstruction

- 4.4 Assessment of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Adoption of 3D Technology in Maintenance

- 5.1.2 Technological Advancements in the Field of Cameras

- 5.2 Market Restraints

- 5.2.1 Lack of Skilled Professionals

6 MARKET SEGMENTATION

- 6.1 By Type of Construction Solution

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By End-user Industry

- 6.2.1 Media and Entertainment

- 6.2.2 Aerospace and Defense

- 6.2.3 Manufacturing

- 6.2.4 Healthcare

- 6.2.5 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Pix4D SA

- 7.1.2 Koninklijke Philips NV

- 7.1.3 Agisoft LLC

- 7.1.4 PhotoModeler Technologies

- 7.1.5 Intel Corporation

- 7.1.6 Matterport Inc.

- 7.1.7 Faro Technologies Inc.

- 7.1.8 Autodesk Inc.

- 7.1.9 General Electric Company

- 7.1.10 Vi3Dim Technologies

- 7.1.11 Quorum Technologies Inc.