|

市场调查报告书

商品编码

1851778

中国包装:市场份额分析、行业趋势、统计数据和成长预测(2025-2030)China Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

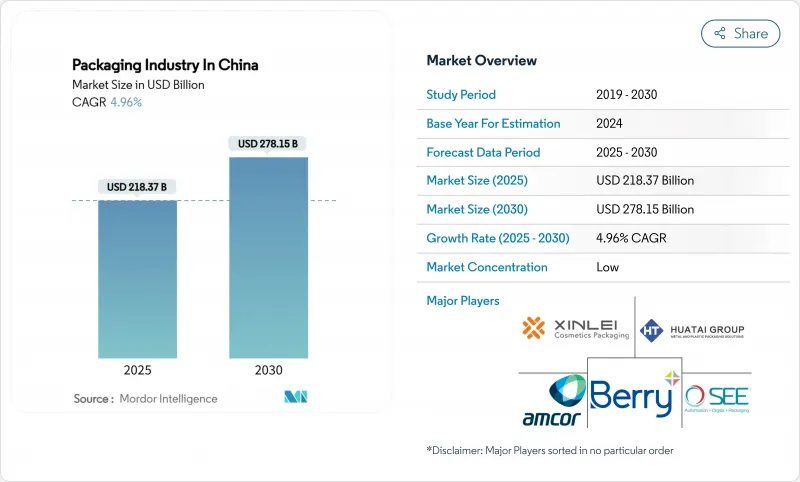

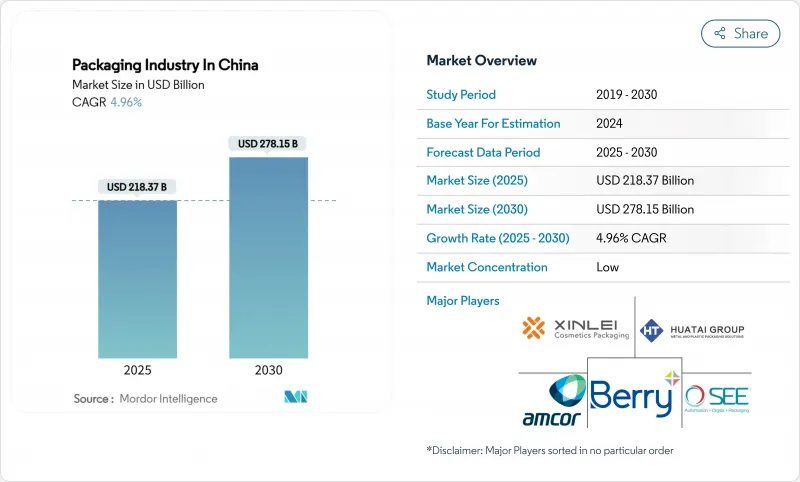

预计到 2025 年,中国包装市场规模将达到 2,183.7 亿美元,到 2030 年将达到 2,781.5 亿美元,在预测期内复合年增长率为 4.96%。

在全球最大的电子商务生态系统的推动下,中国包装市场持续扩张。预计到2024年,小包裹量将达到1750亿件,这将推动对耐用、易于自动化处理的包装的需求。此外,快递包装标准(GB 43352-2023)的强制实施,正促使中国包装市场朝向低毒基材和标准化尺寸方向发展。同时,九龙纸业等国内领先製造商和安姆科等全球製造商正利用其规模优势、智慧工厂投资和生物开发平臺来增强自身竞争力。针对一次性塑胶的监管压力,以及预计2025年PET饮料回收率将达到96.48%,正在加速再生和纤维性包装的转型。

中国包装市场趋势与洞察

电子商务小包裹量爆炸性成长

中国包装市场与小包裹吞吐量密切相关,预计到2024年,包裹吞吐量将达到1750亿件,这将给缓衝材料、防篡改封条和自动化分类带来前所未有的压力。一线城市的履约中心目前依赖人工智慧路线规划系统,可将从仓库到客户家门口的前置作业时间缩短35%,迫使加工商在不影响结构完整性的前提下缩短生产週期。瓦楞纸加工商正在投资高速数位印刷生产线,将条码和QR码与物流平台对接,并支援最后一公里追溯。采用模组化纸箱设计的市场参与企业报告称,纸箱内部空隙率降低了两位数。这些市场发展趋势将保持中国包装市场的成长势头,同时将使那些能够将资料载体功能直接整合到包装基材中的加工商受益。

人们越来越偏好选择永续的纸质形式

随着中国政策议程优先考虑可回收的原材料,品牌所有者越来越倾向于在饮料、个人护理用品、电商包装等领域采用纤维基解决方案。国务院的绿色运输法规要求零售商提供店内回收设施并公布包装减量指标。瓦楞纸板厂正在转向生产性能更高、重量更轻的纸板,这得益于涂布技术的创新,这些创新技术可以有效防止水分渗入。维美德为安徽临平公司设计的OptiConcept M纸板生产线(价值4,000万至6,000万欧元,约合4,300万至6,400万美元)计画于2025年底投入运作。消费者意识的提高也促进了纤维基包装的普及。一项全国性调查发现,在表现相当的情况下,68%的消费者更喜欢纸质包装的网路生鲜配送产品。

塑胶禁令和生产者延伸责任规则

中国正在扩大零售商店和宅配通路一次性塑胶製品的禁令范围,这增加了合规成本,并加速了材料替代品。根据生产者责任延伸制度(EPR),生产商必须为回收系统提供资金,但由于各地执法力度不统一,成本转嫁策略变得复杂。品牌商面临PET和PP食品接触包装再生材料含量基准值即将提高的不确定性。大型加工商正透过建造闭合迴路造纸系统来规避风险,而其他企业则与废弃物处理公司成立合资企业以确保原料供应。在标准稳定之前,中国包装市场的资金配置将倾向维修,而非新建聚合物计划。

细分市场分析

到2024年,纸和纸板将占中国包装市场份额的43%,这主要得益于瓦楞纸箱在电子商务物流履约中发挥的重要作用,以及消费者对纤维可回收性的信心依然强劲。中国高达96.48%的PET饮料回收率以及消费者对纤维素基循环利用的兴趣日益浓厚,都为该领域带来了正面影响。造纸厂的维修旨在生产高强度、轻量纸板,以满足快递标准GB 43352-2023的尺寸和堆迭测试要求。同时,预计到2030年,中国纸和纸板包装市场规模将随着出口导向瓦楞纸需求的成长而维持中等个位数的成长速度。

其他材料——生物基聚合物、黄麻混纺织物和木质素复合材料——儘管基数较低,但其复合年增长率仍高达7.21%,增速最快。杂合反应可将纤维产量比率提高24.42%,进而加速防潮淀粉-黄麻内衬材料的规模化生产。木质素-生物奈米复合材料具有抗氧化性能,适用于糖果甜点包装,满足了不含合成添加剂的活性包装的需求。儘管投资仍面临挑战,且成本与生物聚合物持平仍有一段路要走,但在生产者责任延伸(EPR)费用返还的推动下,领先的快速消费品公司正在试点应用这些材料。

初级包装形式(纸盒、瓶装、泡壳包装)占中国包装市场规模的70%,仍是产品保护和提升货架吸引力的关键。食品安全要求和QR码溯源法规促使企业持续投资高速填充线和装饰技术。此外,法规环境还要求膳食补充剂使用防篡改密封,从而推动了对多层复合材料的需求。

随着履约中心实现托盘化自动化,跨境电商载重的要求也成长了两倍,三级包装市场将以6.03%的复合年增长率成长。出口宅配业者透过指定使用抗压、具备RFID功能的托盘,并将即时资料传输至仓库管理系统,获得了可观的利润。市场参与企业提供由再生纤维和生物树脂製成的复合托盘,缩短了线上零售商的前置作业时间,并进一步推动了中国包装市场的成长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电子商务小包裹量爆炸性成长

- 人们越来越偏好选择永续的纸质形式

- 对方便/即饮食品包装的需求

- 扩大药品低温运输

- 智慧物流(物联网)赋能的追踪包裹

- 超低温生物製药包装衝击

- 市场限制

- 塑胶禁令及生产者延伸责任规则

- 不稳定的纸浆和聚合物原料成本

- 当地的回收基础设施

- 可重复使用购物袋试点计画削弱了都市区纸板需求

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 评估市场宏观经济趋势

第五章 市场规模与成长预测

- 透过包装材料

- 塑胶

- 纸张和纸板

- 玻璃

- 金属

- 其他材料

- 按包装类型

- 初级包装

- 二级包装

- 三级包装

- 按包装类型

- 硬包装

- 软包装

- 按最终用户行业划分

- 饮食

- 医疗保健和製药

- 美容及个人护理

- 工业的

- 其他终端用户产业

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Nine Dragons Paper(Holdings)Ltd.

- Lee and Man Paper Manufacturing Ltd.

- Shanying International Holdings Co., Ltd.

- Hexing Packaging Co., Ltd.

- Greatview Aseptic Packaging Co., Ltd.

- Wuxi Huatai Co.,Ltd

- Shanghai Zijiang Enterprise Group Co., Ltd.

- YUTO Packaging Technology Co., Ltd.

- Zhejiang Xinlei Packaging Co., Ltd.

- Guangdong Champ New Material Co., Ltd.

- Crown Holdings, Inc.

- Amcor Plc

- Berry Global Group, Inc.

- International Paper Company

- WestRock Company

- Sealed Air Corporation

- Tetra Pak(China)Ltd.

- Beijing Hualian Printing Co., Ltd.

- Zhejiang Jiashan Dingxin Packaging Co., Ltd.

- Shenzhen Yutong Packaging Technology Co., Ltd.

第七章 市场机会与未来展望

The China packaging market is valued at USD 218.37 billion in 2025 and is forecast to reach USD 278.15 billion in 2030, reflecting a 4.96% CAGR across the review period.

The China packaging market continues to expand on the back of the world's largest e-commerce ecosystem; parcel volumes touched 175 billion units in 2024, intensifying demand for durable, automation-ready pack formats. Mandatory express packaging standards (GB 43352-2023) are also steering the China packaging market toward low-toxicity substrates and standardised dimensions. Concurrently, large domestic producers such as Nine Dragons Paper and global majors like Amcor are leveraging scale, smart-factory investments and bio-based R&D pipelines to strengthen competitive positions. Regulatory pressure on single-use plastics, coupled with a 96.48% PET beverage recovery rate in 2025, is accelerating the shift to recycled and fibre-based formats.

China Packaging Market Trends and Insights

Explosive Growth of E-commerce Parcel Volume

The China packaging market is tightly linked to parcel throughput, which reached 175 billion units in 2024, driving unprecedented pressure on cushioning, tamper-evident seals and automated sorting compatibility. Fulfilment centres in Tier 1 cities now rely on AI routing systems that reduce dock-to-door lead-times by 35%, obliging converters to shorten run lengths without compromising structural integrity. Corrugated converters are investing in high-speed digital print lines that align barcodes and QR codes with logistics platforms, supporting last-mile traceability. Market participants adopting modular carton designs report double-digit reductions in void space, a priority as courier firms pivot toward volumetric pricing. These developments sustain the momentum of the China packaging market while rewarding converters able to integrate data carrier features directly into pack substrates.

Rising Preference for Sustainable Paper-Based Formats

China's policy agenda prioritises recyclable inputs, prompting brand owners to favour fibre-based solutions across beverages, personal care and e-commerce mailers. The State Council's eco-friendly delivery rules oblige retailers to offer in-store take-back facilities and publicly disclose packaging reduction metrics. Containerboard mills are shifting to higher-performance lightweight grades, helped by coating innovations that mitigate moisture ingress. Capacity expansions include Valmet's OptiConcept M board line for Anhui Linping, scheduled online by end-2025 (EUR 40-60 million; USD 43-64 million). Fibre-based adoption also benefits from consumer recognition: nationwide surveys show 68% of shoppers prefer paper wrappers for online grocery deliveries when performance is comparable.

Plastic-Ban and Extended-Producer-Responsibility Rules

China prohibits a widening list of single-use plastics in retail and courier channels, increasing compliance costs and accelerating material substitutions. Producers must finance recycling systems under EPR, and the absence of uniform provincial enforcement complicates cost pass-through strategies. Brands face uncertainty over forthcoming recycled-content thresholds for PET and PP food-contact packs. Leading converters are hedging by building closed-loop paper systems; others form joint ventures with waste-management firms to secure feedstock. Until standards stabilise, capital allocation in the China packaging market skews toward retrofits rather than green-field polymer projects.

Other drivers and restraints analyzed in the detailed report include:

- Demand for Convenience/RTD Food Packs

- Pharmaceutical Cold-Chain Expansion

- Volatile Pulp and Polymer Feedstock Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Paper and Paperboard captured 43% of China packaging market share in 2024 as corrugated boxes underpinned e-commerce fulfilment and consumer confidence in fibre recyclability remained high. The segment benefits from China's 96.48% PET beverage recycling milestone that shifts public attention to cellulose-based loops. Mill revamps are oriented toward high-strength light-weight grades, enabling shippers to meet express standard GB 43352-2023 dimensional and stacking tests. Concurrently, the China packaging market size for Paper and Paperboard is expected to rise in tandem with export-oriented corrugated demand growing at a mid-single-digit pace to 2030.

Other Materials-bio-based polymers, jute-blend films and lignin composites-record the fastest 7.21% CAGR, albeit from a low base. Academic breakthroughs reveal jute hybridisation delivering 24.42% fibre-yield gains, accelerating scale-up of moisture-resistant starch-jute liners. Lignin-bionanocomposites imbue antioxidant properties suitable for confectionery wraps, meeting demand for active packaging without synthetic additives. Investment hurdles linger-biopolymer cost parity remains elusive-but leading FMCG firms are piloting such materials, incentivised by EPR fee rebates.

Primary formats-cartons, bottles, blister packs-represent 70% of the China packaging market size and remain critical to product protection and shelf appeal. Food-safety expectations and QR-code traceability rules ensure persistent capital expenditure in high-speed filling lines and decoration technologies. The regulatory environment also requires tamper-proof seals for nutraceuticals, sustaining demand for multi-layer laminates.

Tertiary packaging grows at 6.03% CAGR as fulfilment centres automate palletising and cross-border e-commerce triples load-bearing requirements. Export couriers specify crush-proof, RFID-enabled pallets that feed real-time data to warehouse-management systems, creating an attractive profit pool. Market entrants offering composite pallet blocks made with recycled fibre and bio-resins shorten lead times for online retailers and reinforce the growth curve of the China packaging market.

The China Packaging Market Report is Segmented by Packaging Material (Plastic, Paper and Paperboard, Glass, and More), Types of Packaging (Primary Packaging, Secondary Packaging, and Tertiary Packaging), Packaging Format (Rigid Packaging, and Flexible Packaging), End-User Industry (Food and Beverage, Healthcare and Pharmaceutical, Beauty and Personal Care, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Nine Dragons Paper (Holdings) Ltd.

- Lee and Man Paper Manufacturing Ltd.

- Shanying International Holdings Co., Ltd.

- Hexing Packaging Co., Ltd.

- Greatview Aseptic Packaging Co., Ltd.

- Wuxi Huatai Co.,Ltd

- Shanghai Zijiang Enterprise Group Co., Ltd.

- YUTO Packaging Technology Co., Ltd.

- Zhejiang Xinlei Packaging Co., Ltd.

- Guangdong Champ New Material Co., Ltd.

- Crown Holdings, Inc.

- Amcor Plc

- Berry Global Group, Inc.

- International Paper Company

- WestRock Company

- Sealed Air Corporation

- Tetra Pak (China) Ltd.

- Beijing Hualian Printing Co., Ltd.

- Zhejiang Jiashan Dingxin Packaging Co., Ltd.

- Shenzhen Yutong Packaging Technology Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosive growth of e-commerce parcel volume

- 4.2.2 Rising preference for sustainable paper-based formats

- 4.2.3 Demand for convenience/RTD food packs

- 4.2.4 Pharmaceutical cold-chain expansion

- 4.2.5 Smart-logistics (IoT) enabled track-and-trace packs

- 4.2.6 Ultra-low-temperature bio-pharma packaging surge

- 4.3 Market Restraints

- 4.3.1 Plastic-ban and extended-producer-responsibility rules

- 4.3.2 Volatile pulp and polymer feedstock costs

- 4.3.3 Patchy provincial recycling infrastructure

- 4.3.4 Reusable tote pilots eroding urban corrugated demand

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Assessment of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Packaging Material

- 5.1.1 Plastic

- 5.1.2 Paper and Paperboard

- 5.1.3 Glass

- 5.1.4 Metal

- 5.1.5 Other Materials

- 5.2 By Types of Packaging

- 5.2.1 Primary Packaging

- 5.2.2 Secondary Packaging

- 5.2.3 Tertiary Packaging

- 5.3 By Packaging Format

- 5.3.1 Rigid Packaging

- 5.3.2 Flexible Packaging

- 5.4 By End-user Industry

- 5.4.1 Food and Beverages

- 5.4.2 Healthcare and Pharmaceutical

- 5.4.3 Beauty and Personal Care

- 5.4.4 Industrial

- 5.4.5 Other End-user Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Nine Dragons Paper (Holdings) Ltd.

- 6.4.2 Lee and Man Paper Manufacturing Ltd.

- 6.4.3 Shanying International Holdings Co., Ltd.

- 6.4.4 Hexing Packaging Co., Ltd.

- 6.4.5 Greatview Aseptic Packaging Co., Ltd.

- 6.4.6 Wuxi Huatai Co.,Ltd

- 6.4.7 Shanghai Zijiang Enterprise Group Co., Ltd.

- 6.4.8 YUTO Packaging Technology Co., Ltd.

- 6.4.9 Zhejiang Xinlei Packaging Co., Ltd.

- 6.4.10 Guangdong Champ New Material Co., Ltd.

- 6.4.11 Crown Holdings, Inc.

- 6.4.12 Amcor Plc

- 6.4.13 Berry Global Group, Inc.

- 6.4.14 International Paper Company

- 6.4.15 WestRock Company

- 6.4.16 Sealed Air Corporation

- 6.4.17 Tetra Pak (China) Ltd.

- 6.4.18 Beijing Hualian Printing Co., Ltd.

- 6.4.19 Zhejiang Jiashan Dingxin Packaging Co., Ltd.

- 6.4.20 Shenzhen Yutong Packaging Technology Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment