|

市场调查报告书

商品编码

1642076

IaaS(基础设施即服务):市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Infrastructure As A Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

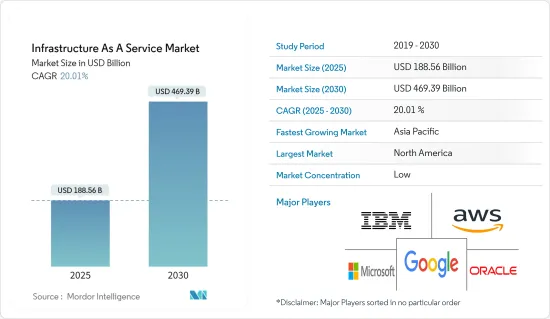

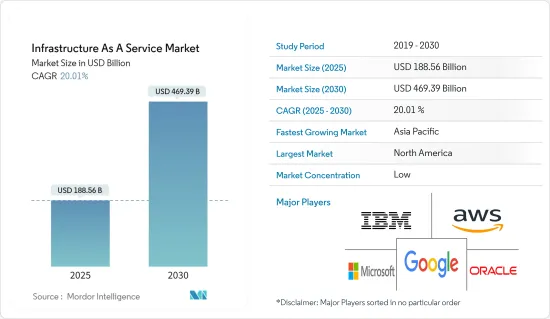

基础设施即服务 (IaaS) 市场规模预计在 2025 年为 1885.6 亿美元,预计到 2030 年将达到 4693.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 20.01%。

基础设施即服务 (IaaS) 是一种云端运算模式,它使公司能够租用伺服器用于远端运算和储存应用程序,同时透过互联网向用户分配虚拟运算资源。

主要亮点

- 随着跨各个 IT 学科的财务、业务和其他关键资料的增加,我们预计会看到更多企业采用 IaaS。对快速资料存取、即时查询处理和高速网路通讯的不断增长的需求可能会推动 IaaS 市场的发展。

- 无伺服器运算日益普及、云端服务带来混合云需求不断增长以及使用网路的人数增加。随着主要云端服务供应商转向混合环境,整合的 IaaS 服务有望推动下一波云端基础设施的采用。

- 最终用户认为 IaaS 是一种虚拟的节省成本的服务,因为他们只需为他们使用的内容付费,因为丛集云端伺服器具有最快的可扩展性。它还可以帮助最终用户节省与其网路中添加单一伺服器相关的安装成本。

- 然而,对私有云端部署的安全性担忧以及新兴市场缺乏IT基础设施预计也会在一定程度上抑制市场成长。

- COVID-19 疫情影响了当时显着成长的基础设施即服务 (IaaS) 市场。这是因为社会隔离、远距工作和商业关闭等限制性遏制措施为业务带来了营运挑战并促进了云端服务的发展。

IaaS(基础设施即服务)市场的趋势

IT 和电讯预计将保持强劲成长

- 随着云端基础服务获得各行各业的认可,IT 和通讯领域的 IaaS 市场预计将见证强劲成长。该行业是产生大量资料的最重要行业之一,包括金融、医疗保健和个人资料。许多通讯公司希望提供云端基础设施即服务。

- 资讯科技和通讯业产生大量的资料。因此,託管主机、DRaaS 和 STaaS 解决方案为企业提供了经济实惠的运算和储存资源。云端技术使通讯转移到了线上,使企业无需昂贵的设备即可与世界保持联繫。

- IaaS 预计将拥有巨大的潜力,因为单一云端应用程式可以处理多种业务需求,包括文件储存、网路安全和虚拟资料中心。

- 由于对低成本IT基础设施和快速资料存取的需求不断增长,全球基础设施即服务 (IaaS) 结构市场正在扩大。此外,云端运算在IT和通讯领域的日益广泛应用也推动了IaaS产业的扩张。

- 然而,5G等高速网路连线的普及、人口成长、通讯和IT服务供应商之间竞争加剧以及全球GDP的成长是造成此现象的因素。

- 许多国家的政府正在推动资讯和通讯技术的发展,从而增加了云端系统的使用,从而刺激了市场的扩张。数位化正在为主要企业创造商机,各类IT企业对资料中心的需求也日益增加。

亚太地区可望实现强劲成长

- 预计预测期内亚太地区将出现显着成长并引领 IaaS 市场。该地区的高成长得益于中国、印度和韩国等多个经济体的网路使用率不断提高和技术进步。

- 经济实力增强正在推动日本、中国和印度等新兴经济体的市场发展,这可能会促进该区域市场的扩张。此外,该地区的快速工业化是IaaS市场发展的主要驱动力。该地区的政府正在加大对 IT 的投资,创造更多的市场机会。

- 快速的都市化、全球数位化以及数位商务的日益普及都是可能为该地区带来巨大市场潜力的因素。

- 此外,预测期内该地区基础设施即服务 (IaaS) 市场的扩张受到数位趋势接受度不断提高、智慧型装置普及率不断提高以及中小企业数量不断增加的推动。此外,中国占据亚太基础设施即服务市场的最大份额,而印度则是成长最快的国家。

IaaS(基础设施即服务)产业概况

由于参与者众多且对 IaaS 软体模型的需求不断增长,基础设施即服务 (IaaS) 市场变得分散且竞争激烈。预计持续的研究和技术进步将成为全球市场的主要趋势。市场的主要企业包括Google公司、甲骨文公司、微软公司、IBM 公司、亚马逊网路服务公司等。

- Oracle Database@Azure 让使用者直接存取託管在 Microsoft Azure资料并由 Oracle 云端基础架构 (OCI) 管理的Oracle资料库服务。 Oracle Database@Azure 将 Oracle Database on OCI 的效能、规模和工作负载可用性优势与 Microsoft Azure 的安全性、灵活性和效率产品(包括 Azure OpenAI 等竞争 AI 服务)结合。

- 2023 年 2 月-Oracle Oracle与 Uber Technologies 建立策略云端伙伴关係关係,以加速 Uber 的创新,协助将新产品推向市场,并盈利。将一些最关键的工作负载迁移到 Oracle 云端基础架构 (OCI) 将使 Uber 能够实现基础架构现代化,同时加速其收益之路。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链/供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场动态

- 市场驱动因素

- 对混合云端平台的需求不断增加

- 各种网路之间高速互动的需求日益增加

- 市场限制

- 严格的政府法规

第六章 市场细分

- 依部署方式

- 公共云端

- 私有云端

- 混合云端

- 按服务

- 託管

- Disaster Recovery as a Service(DRaaS)

- Communication as a Service(CaaS)

- Database as a Service(DBaaS)

- Storage as a Service(SaaS)

- 按最终用户产业

- BFSI

- 资讯科技和电信

- 卫生保健

- 媒体与娱乐

- 零售

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Amazon Web Services Inc.

- Google Inc.

- Microsoft Corporation

- Oracle Corporation

- IBM Corporation

- Rackspace Hosting Inc.

- EMC Corporation

- VMWare Inc.

- RedHat Inc.

- RedCentric PLC

第八章投资分析

第九章 市场机会与未来趋势

The Infrastructure As A Service Market size is estimated at USD 188.56 billion in 2025, and is expected to reach USD 469.39 billion by 2030, at a CAGR of 20.01% during the forecast period (2025-2030).

IaaS, or Infrastructure as a service, is a cloud computing paradigm that allows businesses to rent servers for remote computing and storage applications while allocating virtualized computing resources to users over the Internet.

Key Highlights

- More enterprises are expected to embrace IaaS due to the growth in financial, business, and other vital data across various IT sectors. The IaaS market may expand due to the rising demand for quick data access, real-time query processing, and high-speed network communication.

- Serverless computing's expanding popularity, cloud services' growing demand for hybrid clouds, and more people using the Internet. As the leading cloud service providers transition to hybrid environments, integrated IaaS services are anticipated to drive the next wave of cloud infrastructure adoption.

- End users consider IaaS a substantial cost-saving service where clients pay only for what they use because cluster cloud servers have the fastest scalability. Also, the end user saves on the installation costs of adding individual servers to the network.

- However, security worries regarding the deployment of private clouds and a lack of IT infrastructure in developing nations are also anticipated to restrain market expansion somewhat.

- The COVID-19 pandemic impacted the Infrastructure as a Service (IaaS) market, which showed significant growth then. This was because of the restrictive containment measures, such as social isolation, remote work, and the suspension of commercial activities, which created operational difficulties for businesses and encouraged cloud services.

Infrastructure as a Service Market Trends

IT & Telecom Expected to Hold Significant Growth

- Due to the industry's increased acceptance of cloud-based services, the IT and telecommunications sector is predicted to experience a strong growth rate for the IaaS market. This sector is one of the most important verticals, producing a vast amount of financial, healthcare, and personal data. Numerous telecom companies want to offer cloud infrastructure as a service.

- The IT and telecom industries produce a lot of data. Consequently, managed hosting, DRaaS, and STaaS solutions give companies access to affordable compute and storage resources. Cloud technology has allowed telecoms to go online, where organizations can now stay linked to the rest of the world without the need for expensive gear.

- One cloud application may handle numerous operational demands, including document storage, network security, virtual data centers, and many others, so it is anticipated that IaaS will have global potential.

- The global market for infrastructure as a service is expanding as a result of rising demand for low-cost IT infrastructure and quicker data accessibility. Moreover, increased cloud use in the IT and telecommunications sectors is helping the IaaS industry expand.

- However, due to an increase in the use of high-speed internet connections, such as 5G connections, a sizable population, increased competition among telecom and IT service providers, and an increase in global GDP.

- Governments in many countries are pushing information and communication technologies that increase the use of cloud systems, which in turn is fueling market expansion. Digitilazation, along with increasing data center demand from various IT companies, is creating opportunities for major players.

Asia-Pacific Expected to Hold Significant Growth

- Over the projection period, Asia-Pacific will likely have considerable expansion and take the lead in the IaaS market. High growth in this region can be due to rising internet usage and improving technology in several economies, including China, India, and South Korea.

- Due to the strengthening economy, nations like Japan, China, and India are developing, which will foster the expansion of the regional market. Also, the region's rapid industrialization is a crucial factor in developing the IaaS market there. The government in this area is spending more money on IT, creating more market opportunities.

- Rapid urbanization, global digitization, and the increasing use of digital commerce in the region will all drive to contribute to the market's enormous potential.

- The expansion of the Infrastructure as a Service market in this area throughout the projection period is also aided by the rising acceptance of digital trends, the increasing penetration of smart devices, and the rising number of SMEs. Moreover, the highest market share in the Asia-Pacific area for Infrastructure as a service was held by China, and the fastest-growing market was India.

Infrastructure as a Service Industry Overview

The infrastructure-as-a-service market is fragmented and highly competitive due to the presence of various players and increasing demand for IaaS software models. Ongoing research and technological advancements are expected to be the key trends in the global market. Key players in the market include Google Inc., Oracle Corporation, Microsoft Corporation, IBM Corporation, and Amazon Web Services Inc.

- September 2023 - The extended partnership of Oracle Corp and Microsoft Corp was announced to deliver Oracle Database@Azure, allowing users to access Oracle database services directly, hosted in Microsoft Azure datacenters and managed by Oracle Cloud Infrastructure (OCI). Oracle Database@Azure combines the security, flexibility, and effective offerings of Microsoft Azure, including competitive AI services like Azure OpenAI, with Oracle Database's performance, scale, and workload availability benefits on OCI.

- February 2023 - Oracle Corporation and Uber Technologies have collaborated strategic cloud partnership to accelerate Uber's innovation, help deliver new products to market, and drive increased profitability, where migrating some of the company's most critical workloads to Oracle Cloud Infrastructure (OCI), Uber will be in a position to modernize its infrastructure while also accelerating its path to profitability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Driver

- 5.1.1 Increased Demand For Hybrid Cloud Platform

- 5.1.2 Growing Need For High Speed Interaction Between Various Networks

- 5.2 Market Restraints

- 5.2.1 Stringent Government Regulations

6 MARKET SEGMENTATION

- 6.1 By Deployment Mode

- 6.1.1 Public Cloud

- 6.1.2 Private Cloud

- 6.1.3 Hybrid Cloud

- 6.2 By Service

- 6.2.1 Managed Hosting

- 6.2.2 Disaster Recovery as a Service ( DRaaS)

- 6.2.3 Communication as a Service (CaaS)

- 6.2.4 Database as a Service (DBaaS)

- 6.2.5 Storage as a Service (SaaS)

- 6.3 By End-user Industry

- 6.3.1 BFSI

- 6.3.2 IT & Telecom

- 6.3.3 Healthcare

- 6.3.4 Media & Entertainment

- 6.3.5 Retail

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon Web Services Inc.

- 7.1.2 Google Inc.

- 7.1.3 Microsoft Corporation

- 7.1.4 Oracle Corporation

- 7.1.5 IBM Corporation

- 7.1.6 Rackspace Hosting Inc.

- 7.1.7 EMC Corporation

- 7.1.8 VMWare Inc.

- 7.1.9 RedHat Inc.

- 7.1.10 RedCentric PLC