|

市场调查报告书

商品编码

1642078

电脑辅助製造:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Computer Aided Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

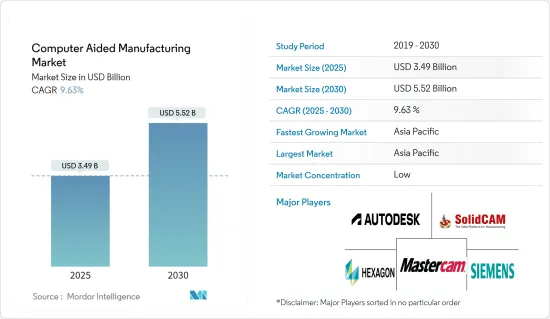

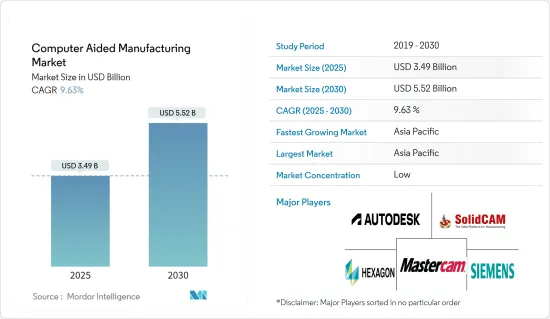

电脑辅助製造市场规模预计在 2025 年为 34.9 亿美元,预计到 2030 年将达到 55.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.63%。

关键亮点

- 电脑辅助製造 (CAM) 正在发展以与工业 4.0 技术无缝集成,包括物联网 (IoT)、人工智慧 (AI) 和巨量资料分析。这种整合促进了机器、系统和人员之间的即时资料交换和通讯,从而实现了更智慧的製造过程。

- 此外,CAM 系统现在支援增材製造技术,使得设计和製造使用传统方法无法实现的复杂形状成为可能。此外,混合製造(融合了积层和减材製程)在 CAM 应用中越来越受欢迎,为复杂零件的製造提供了更大的灵活性和准确性。

- CAM 软体为各种 CNC 工具机开发程序,包括铣削、车削、边缘加工和积层製造工具机。由于积层製造具有成本效益、减少材料浪费和简化製造流程等优势,其需求正在上升。积层製造有助于快速原型製作,从而实现快速设计迭代并缩短产品上市时间。

- 汽车製造商使用 CAM 来生产车身零件、引擎零件和其他复杂元件。 CAM 可以缩短前置作业时间、提高准确性并为您的车辆提供卓越的精度和品质。电动和联网汽车产量的不断增加进一步推动了该市场的成长。

- 开放原始码电脑辅助製造(CAM)软体的兴起对CAM市场的成长构成了重大挑战。这一趋势主要由开放原始码解决方案的成本效益和可访问性推动,它吸引了多样化的用户群,尤其是中小型企业 (SME)。由于预算紧张,这些小型企业发现开放原始码选项是经济上可行的选择。

- 随着工业4.0的到来,工业领域正在迅速采用创新技术和增强的网路架构,显示出良好的市场扩展前景。石油和天然气、汽车、製药和航太等主要行业正在整合 CAM 软体以减少生产延迟并提高业务效率。然而,地缘政治紧张局势,尤其是美国衝突、以色列与哈马斯局势以及俄罗斯与乌克兰战争,对这些地区的市场成长构成潜在威胁。

电脑辅助製造市场趋势

汽车产业将强劲成长

- CAM 在汽车产业的主要应用之一是设计和原型製作阶段。先进的软体工具使工程师和设计师能够创建汽车零件和系统的复杂 3D 模型。此功能大大减少了与传统原型製作方法相关的时间和成本。

- CAM 让製造商在实际生产开始之前模拟效能、评估可製造性并识别潜在的设计缺陷。 3D 列印等快速原型製作技术进一步增强了这一过程,实现了设计的快速迭代。

- CAM 系统透过分析生产能力、前置作业时间和资源分配来促进有效的生产计画和调度。透过将 CAM 与企业资源规划 (ERP) 系统结合,汽车製造商可以优化生产计划以满足需求波动,同时最大限度地减少停机时间。这种程度的优化对于以准时生产(JIT)为特征的行业来说至关重要,因为及时交货对于保持竞争力至关重要。

- 此外,汽车产业对引擎零件、传动系统和底盘等零件的製造要求很高的精度。 CAM 软体可以精确控制 CNC(电脑数值控制)机器,这对于加工过程至关重要。这些机器能够精确加工复杂的几何形状,确保零件符合严格的品质标准。此外,CAM 可以实现加工过程的自动化,减少人为错误的可能性并提高整体生产力。

- 电动车需求的成长预计也将为新兴市场的发展提供重大推动力。例如,根据国际能源总署 (IEA) 的数据,2023 年全球将註册约 1,400 万辆新电动车,使道路上的电动车总数达到 4,000 万辆。

- 2023年电动车销量将比2022年增加350万辆,与前一年同期比较增长35%。到 2023 年,电动车将占所有汽车销量的 18% 左右,高于 2022 年的 14%。此外,国际能源总署(IEA)预测,在净零情境下,到2030年电动车(EV)销量将占汽车销量的约65%。为实现这一目标,2023 年至 2030 年间,电动车销量每年需要成长约 25%。

亚太地区将经历大幅成长

- 中国在全球製造业供应链中的关键作用,加上数位转型的浪潮,成为中国电脑辅助製造业快速成长的主要催化剂。过去一年来,地缘政治对全球供应链的影响日益加深。在已开发国家纷纷製造地註资的同时,墨西哥和东南亚等地区正逐渐成为人们关注的焦点。这种动态加剧了各国之间在生产线方面的竞争。

- 从历史上看,日本製造业一直是全球创新、效率和弹性的象征。日本企业,包括丰田这样的汽车巨头和索尼这样的电子巨头,不仅获得了竞争优势,而且享有相当长的寿命。

- 然而,当今日本製造业正处于一个关键的十字路口。过去三年来,该领域的供应链遭遇了显着中断,主要原因是新冠疫情以及美国关係恶化。面对这些挑战,公司正在扩大其供应商网路以提高可靠性。日本公司以其可靠性和最尖端科技而闻名,它们已做好战略准备来利用这些行业变化。

- 韩国充满活力的市场特征是,众多的应用推动着各个领域的成长。韩国利用最尖端科技框架和创新精神,在多个行业中占据领先地位。在製造业方面,ICT 和电子领域表现出色,由三星电子和 LG 电子公司等工业巨头引领。这些企业集团也巧妙地将製造范围拓展到韩国以外,三星在越南的两家主要工厂目前占其全球产量的三分之一。

- 随着对高科技自动化机器的需求激增,製造业正经历强劲的市场成长。人们对电动车和家用电子电器产品的需求日益增长,进一步增强了这一势头,凸显了各个领域对精密工具机的需求日益增长。随着全球製造业的扩张,最终产品的生产越来越依赖瑞士型自动车床等工具机。

- 此外,随着製造方法的进步,对于具有卓越精度和准确度的高端工具机的需求也日益强烈。这种发展推动了对 CAM 软体的需求,以便熟练地操作这些先进的工具。

电脑辅助製造业概况

CAM 软体市场竞争激烈,参与企业。儘管进入门槛较高,但一些新参与企业正在增强实力。此市场的特点是产品差异化程度中/高,产品渗透率高,竞争激烈。

创新带来可持续的竞争优势。人工智慧、机器学习和云端运算等新兴技术正在重塑安全格局。

领先的供应商正在增强其现有软体并推出先进的解决方案,以满足技术进步推动的不断变化的消费者需求。其中包括 Autodesk Inc.、SolidCAM Ltd.、Siemens AG、CNC Software, LLC.(Mastercam)和 Hexagon AB。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 新冠肺炎疫情及其他宏观经济因素对市场的影响

- 技术简介

- 2D 设计

- 3D 设计

- 5D 设计

第五章 市场动态

- 市场驱动因素

- 工业 4.0 的采用率不断提高

- 包装器材领域 CAM 软体的使用日益增多

- 市场限制

- 开放原始码CAM 软体的兴起

第六章 市场细分

- 按部署模型

- 本地

- 云端基础

- 按最终用户产业

- 航太和国防

- 车

- 医疗

- 能源与公共产业

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 瑞士

- 西班牙

- 奥地利

- 比利时

- 荷兰

- 英国

- 法国

- 义大利

- 瑞典

- 波兰

- 亚洲

- 中国

- 日本

- 韩国

- 印度

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 北美洲

第七章 竞争格局

- 公司简介

- Autodesk, Inc.

- Siemens AG

- SolidCAM Ltd.

- CNC Software, LLC.(Mastercam)

- Hexagon AB

- Cimatron Ltd.

- HCL Technologies Limited

- NTT Data Engineering Systems Corporation(NTT DATA Corporation)

- OPEN MIND Technologies AG

- BobCAD-CAM Inc.

- MecSoft Corporation

- Dassault Systmes

- PTC Inc.

- ZWSOFT CO., LTD.(Guangzhou)

- SmartCAMcnc, Inc.

8.供应商市场占有率分析

第九章投资分析

第十章:投资分析市场的未来

The Computer Aided Manufacturing Market size is estimated at USD 3.49 billion in 2025, and is expected to reach USD 5.52 billion by 2030, at a CAGR of 9.63% during the forecast period (2025-2030).

Key Highlights

- Computer-Aided Manufacturing (CAM) is evolving to seamlessly integrate with Industry 4.0 technologies, including the Internet of Things (IoT), artificial intelligence (AI), and big data analytics. This integration facilitates real-time data exchange and communication among machines, systems, and humans, resulting in more intelligent manufacturing processes.

- Furthermore, CAM systems increasingly support additive manufacturing techniques, enabling the design and production of intricate geometries that traditional methods couldn't achieve. Additionally, hybrid manufacturing, which merges both additive and subtractive processes, is gaining traction in CAM applications, providing enhanced flexibility and precision in crafting complex parts.

- CAM software develops programs for a range of CNC machines, including milling, turning, edge machining, and additive manufacturing machines. The demand for additive manufacturing is on the rise, driven by its benefits like cost efficiency, reduced material waste, and fewer production steps. It facilitates rapid prototyping, allowing for swift design iterations and a faster time-to-market.

- Manufacturers in the automotive industry utilize CAM to produce body parts, engine components, and other intricate elements. With CAM, they can shorten lead times, enhance accuracy, and achieve superior precision and quality in vehicles. The rising production of electric and connected vehicles further propels this market growth.

- The rise of open-source computer-aided manufacturing (CAM) software poses a significant challenge to the growth of the CAM market. This trend is primarily fueled by the cost-effectiveness and accessibility of open-source solutions, drawing in a diverse user base, especially small and medium-sized enterprises (SMEs). Operating on tighter budgets, these SMEs find open-source options to be a financially viable choice.

- With the dawn of Industry 4.0, the industrial sector is rapidly adopting innovative techniques and enhanced networking architectures, signaling promising prospects for market expansion. Key industries, including oil and gas, automotive, pharmaceutical, and aerospace, are integrating CAM software to mitigate production delays and boost operational efficiency. However, geopolitical tensions, notably the U.S.-China conflict, the Israel-Hamas situation, and the Russia-Ukraine war, loom as potential threats to market growth in these regions.

Computer Aided Manufacturing Market Trends

Automotive Segment to Witness Major Growth

- One of the primary applications of CAM in the automotive industry is in the design and prototyping phase. Advanced software tools enable engineers and designers to create intricate 3D models of automotive components and systems. This capability significantly reduces the time and cost associated with traditional prototyping methods.

- By utilizing CAM, manufacturers can simulate performance, assess manufacturability, and identify potential design flaws before physical production begins. Rapid prototyping technologies, such as 3D printing, further enhance this process, allowing for the quick iteration of designs.

- CAM systems facilitate effective production planning and scheduling by analyzing production capacities, lead times, and resource allocation. By integrating CAM with Enterprise Resource Planning (ERP) systems, automotive manufacturers can optimize their production schedules to meet demand fluctuations while minimizing downtime. This level of optimization is critical in a sector characterized by just-in-time (JIT) manufacturing practices, where timely delivery is essential to maintaining competitiveness.

- Further, the automotive sector demands high precision in manufacturing components, such as engine parts, transmission systems, and chassis. CAM software enables the precise control of CNC (Computer Numerical Control) machines, which are integral to the machining process. These machines can execute complex geometries accurately, ensuring that components adhere to stringent quality standards. Additionally, CAM allows for the automation of machining processes, reducing the likelihood of human error and enhancing overall productivity.

- The growth in the demand for electric vehicles is also likely to aid the development of the studied market significantly. For instance, according to the International Energy Agency (IEA), almost 14 million new electric cars were registered globally in 2023, bringing their total number on the roads to 40 million.

- Electric car sales in 2023 were 3.5 million higher than in 2022, a 35% year-on-year increase. Electric cars accounted for around 18% of all cars sold in 2023, up from 14% in 2022. Further, the International Energy Agency (IEA) projected that electric vehicle (EV) sales will make up approximately 65% of total car sales by 2030 in the Net Zero Scenario. To achieve this, there should be an annual growth rate of around 25% in EV sales from 2023 to 2030.

Asia Pacific to Witness Major Growth

- China's pivotal role in the global manufacturing supply chain, coupled with a wave of digital transformation, has been the primary catalyst for the country's burgeoning computer-aided manufacturing sector. Over the past year, geopolitics have increasingly influenced global supply chains. While developed nations are reshoring their manufacturing bases, regions such as Mexico and Southeast Asia are gaining prominence. This dynamic has heightened competition among nations vying for manufacturing lines.

- Japan's manufacturing landscape has historically epitomized global innovation, efficiency, and resilience. With automotive giants like Toyota and electronic powerhouses such as Sony, Japanese companies have not only secured a competitive advantage but have also demonstrated remarkable longevity.

- Yet, today, Japanese manufacturing stands at a crucial juncture. The sector has grappled with notable supply chain disruptions over the last three years, primarily due to the COVID-19 pandemic and evolving US-China relations. In light of these challenges, companies are broadening their supplier networks to bolster reliability. With their renowned dependability and state-of-the-art technology, Japanese firms are strategically poised to leverage these industry shifts.

- South Korea's dynamic market is marked by a multitude of applications driving growth across its diverse sectors. Harnessing its cutting-edge technological framework and innovative spirit, South Korea has positioned itself as a leader in several industries. At the forefront of the nation's manufacturing landscape, the ICT and electronics sectors shine brightly, spearheaded by industry titans like Samsung Electronics Co., Ltd. and LG Electronics Inc. These conglomerates have adeptly broadened their manufacturing horizons beyond South Korea, with Samsung's two pivotal plants in Vietnam now constituting a third of its global production.

- As the demand for advanced, tech-driven automated machines surges, the manufacturing industry is witnessing a robust market upswing. This momentum is further amplified by the escalating appetite for electric vehicles and consumer electronics, underscoring the heightened need for sophisticated machine tools across diverse sectors. With the global manufacturing landscape expanding, the dependence on machine tools, such as Swiss-type automatic lathe machines, for final product production is deepening.

- Furthermore, as manufacturing methodologies advance, there's a pronounced demand for high-end machine tools that promise superior accuracy and precision. This evolution, in turn, amplifies the need for CAM software to adeptly operate these advanced tools.

Computer Aided Manufacturing Industry Overview

The CAM software market comprises global and regional players in a competitive space. Although the market poses high barriers to entry for new players, several new entrants have gained traction. This market is characterized by moderate/high product differentiation, growing levels of product penetration, and high levels of competition.

Innovation can bring about a sustainable competitive advantage. New technologies such as AI, machine learning, cloud computing, and others are reshaping security trends.

Leading vendors are responding to evolving consumer demands driven by technological advancements by enhancing their existing software and introducing advanced solutions. Some of the players include Autodesk Inc., SolidCAM Ltd, Siemens AG, and CNC Software, LLC. (Mastercam), Hexagon AB.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and other Macroeconomic Factors on the Market

- 4.4 TECHNOLOGY SNAPSHOT

- 4.4.1 2D Design

- 4.4.2 3D Design

- 4.4.3 5D Design

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Industry 4.0

- 5.1.2 Growing Utilization of CAM Software in the Packaging Machinery Sector

- 5.2 Market Restraints

- 5.2.1 Wide Availability of Open Source CAM Software

6 MARKET SEGMENTATION

- 6.1 By Deployment Model

- 6.1.1 On-Premises

- 6.1.2 Cloud-Based

- 6.2 By End-User Industry

- 6.2.1 Aerospace & Defense

- 6.2.2 Automotive

- 6.2.3 Medical

- 6.2.4 Energy & Utilities

- 6.2.5 Other End-User Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 Switzerland

- 6.3.2.3 Spain

- 6.3.2.4 Austria

- 6.3.2.5 Belgium

- 6.3.2.6 Netherlands

- 6.3.2.7 United Kingdom

- 6.3.2.8 France

- 6.3.2.9 Italy

- 6.3.2.10 Sweden

- 6.3.2.11 Poland

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 South Korea

- 6.3.3.4 India

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.5.1 Brazil

- 6.3.5.2 Mexico

- 6.3.6 Middle East and Africa

- 6.3.6.1 United Arab Emirates

- 6.3.6.2 Saudi Arabia

- 6.3.6.3 South Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Autodesk, Inc.

- 7.1.2 Siemens AG

- 7.1.3 SolidCAM Ltd.

- 7.1.4 CNC Software, LLC. (Mastercam)

- 7.1.5 Hexagon AB

- 7.1.6 Cimatron Ltd.

- 7.1.7 HCL Technologies Limited

- 7.1.8 NTT Data Engineering Systems Corporation (NTT DATA Corporation)

- 7.1.9 OPEN MIND Technologies AG

- 7.1.10 BobCAD-CAM Inc.

- 7.1.11 MecSoft Corporation

- 7.1.12 Dassault Systmes

- 7.1.13 PTC Inc.

- 7.1.14 ZWSOFT CO., LTD. (Guangzhou)

- 7.1.15 SmartCAMcnc, Inc.