|

市场调查报告书

商品编码

1642091

室内无线:市场占有率分析、行业趋势和成长预测(2025-2030 年)In-Building Wireless - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

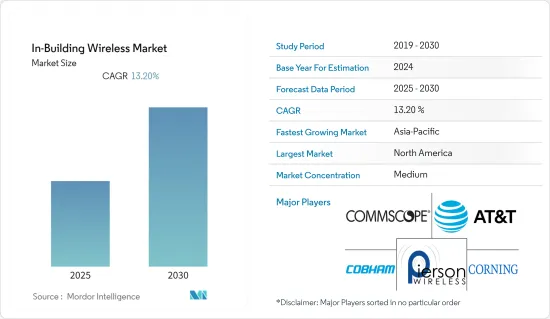

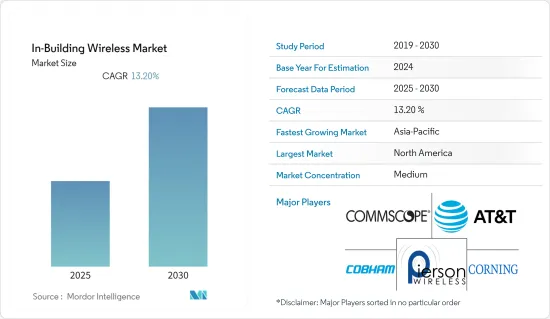

预测期内,室内无线市场预计将以 13.2% 的复合年增长率成长

关键亮点

- 预计预测期内全球室内无线市场将会出现需求。这主要是因为对清晰、明确的网路覆盖范围的需求日益增长,以及全球实施的公共措施越来越多。快速的数位化变化意味着最终用户现在正在积极寻求智慧技术和设备来节省时间和金钱。此外,为市场扩张创造新机会的第二个因素是智慧化和智慧建筑趋势的发展。

- 除了智慧建筑的趋势外,任务关键型应用的业务保证不断增长,对高效和强大的室内连接的需求将影响医疗保健领域室内无线解决方案的采用,以及日益增长的农村地区对蜂窝连接的需求提高连结性和其他因素是加速市场成长的重要因素。此外,CBRS 和 MulteFire 频段的研究和开发以及未经授权频谱的可用性预计将在此期间为无线市场开闢新的成长途径。

- 研究市场的需求不断增长,推动不同地区的公司提供各种解决方案来占领市场占有率。例如,American Tower 提供分散式天线解决方案。此外,明尼阿波利斯市营运的明尼阿波利斯会议中心最近庆祝了成立30週年。该建筑占地 160 万平方英尺,设有 87 间会议室、两间宴会厅、一个拥有 3,400 个座位的固定座位剧院和 475,000 平方英尺的展览空间。借助美国塔公司的 DAS 解决方案,明尼阿波利斯会议中心能够为客人、供应商和员工提供卓越的无线体验。

- 疫情迫使许多商业建筑撤离或封锁,许多长期规划的室内建筑计划被搁置。大多数行业的企业都抓住机会解决停工前设施内可能存在的任何问题,并在员工、学生和顾客返回之前完成任何紧急的维修或维修。在此期间,特别关註解决因缺乏行动电话覆盖而引起的问题。在这次疫情期间,在建筑物内使用行动电话对于维持个人和专业关係以及保障公民安全变得更加重要。

- 儘管网路管理提供了显着的好处,但可靠性问题等固有挑战可能会阻碍预测期内的市场成长。僱用第三方网路基础设施供应商来託管关键业务基础设施需要相信该供应商将长期经营。如果供应商不再能够在市场上竞争,依赖他们的公司可能会被迫彻底更换其关键基础设施。

建筑无线市场的趋势

住宅用途预计将占很大份额

- 根据美国人口普查局的数据,2020年初美国新房住宅许可数量呈上升趋势,去年3月达到16.9万套的高峰。爱达荷州和犹他州每 1,000 人获准建造超过 11 套住房,是美国新建住宅率最高的州。

- 儘管受到新冠疫情的影响,但整个欧洲的住宅仍在增加。 ZAC Campus Grand Prac 综合开发项目(70 亿美元计划)、Milanosesto 综合开发项目(68.29 亿美元计划)、Camden Goods Yard 综合社区(8.41 亿美元计划)、Viaduct 综合社区(3.33 亿美元项目)萨克维尔路住宅计划是去年第三季在欧洲推出的最重要的多用户住宅计划的一部分。因此,预计住宅的增加将增加研究市场的需求。

- 根据中国建设业协会统计,去年中国竣工建筑大部分为住宅。住宅建筑占竣工占地面积的67%以上。随着国家经济的成长,人们从农村迁移到大城市,增加了这些地区住宅的需求。此外,用作投资性房地产的公寓也正在刺激需求。

- 据IBEF称,印度去年在房地产资产的投资为24亿美元,与前一年同期比较增长了52%。自2000年4月至去年9月,房地产业包括建设、开发和营运在内的外国直接投资总额已达551.8亿美元。房地产价格的大幅上涨可能为市场成长创造机会。

- 该公司为住宅提供多种解决方案。例如,VeriDAS Technologies 专门为多租户住宅和住宅社区提供室内无线系统。 VeriDAS 设计、安装、检验并支援无线住宅分散式天线系统 (DAS)。该公司的住宅公共DAS 解决方案符合地方政府、NFPA 和 IFC 关于室内紧急应变射频讯号强度、覆盖范围和容量的标准。

亚太地区成长强劲

- 例如在G-SRv6部署中,中兴通讯与中国移动合作,实现G-SRv6头压缩方案的首次试用。为了完成G-SRv6,两家公司将中兴通讯的高阶路由器与提供者边缘路由器(PE)和服务路由器(SR)结合在一起。这使我们能够为网路技术的发展做出贡献。商业和住宅建筑环境中对普遍且可靠的无线蜂窝连接的需求不断增长,推动了市场收益的成长。

- 对更广泛的无线连接的需求和网路技术的进步正在推动这一领域的需求。例如,电子与通讯总实验室近期建成了全球首个5G室内分散式天线系统,可在室内支援20Gbps的5G业务速度。预计此项技术的采用将有助于改善商业区的无线连线。

- 2022 年 8 月,香港 Comva Telecom 的子公司 Comva Networks 宣布已被中国移动选中,协助启动 5G 扩展微微型基地台的大规模部署。根据京信通信的新闻稿,此次部署将包括 20,000 个小型基地台基地台。该公司进一步表示,已与中国移动获得了该合约的两个竞标包,一个是单模增强微微型基地台,一个是双模增强微微型基地台。

- 根据政府新公布的通行权规则,通讯业者不再需要政府许可就可以在私人财产上建造手机讯号塔、电线杆或铺设电线。为促进通讯网路特别是5G服务的推广,政府公布了使用电线杆、人行天桥等安装小型行动无线电天线和铺设架空通讯电缆的规则和收费。然而,去年发布的《印度电信权利(修正案)规则》规定,通讯业者在私人建筑物或构筑物上架设行动讯号塔或电线杆之前,必须以书面通知相关政府。透过减少文书工作并同意在现有基础设施上安装较小的设备,供应商可以更轻鬆地提升和扩展他们的服务。

- 无线技术发展的主要驱动力是为了推动路由器技术的发展而製定的标准的不断发展。在过去的十多年中,无线路由器技术随着 IEE(美国电子电机工程师学会)标准的不断发展而稳步发展。网路的最大速度和传输容量通常会透过修改这些标准来增加。

室内无线产业概览

室内无线市场竞争适中,参与企业众多。市场上的参与企业正在扩大产品系列、拓展其地理范围并采用产品创新、併购等策略,主要是为了保持市场竞争力。

2022年10月,国内通讯设备製造商HFCL与Qualcomm Technologies Inc.合作,开始设计开发5G室外小型基地台产品。 HFCL配合其5G策略,对5G室外小型基地台产品的投资将加速5G网路的部署,增强5G用户体验,并充分利用5G频谱。

2022 年 10 月,ExteNet Systems 同意在美国所有米高梅酒店开发、建造和营运 ExteNet 创新的室内讯号和连接解决方案。这是该国最重要的计划,将为用户提供下一代连接。 ExteNet 专注于融合通讯基础架构解决方案,包括 LTE/5G 无线和光纤中立託管通讯基础架构。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况(涵盖新冠疫情的影响)

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

第五章 市场动态

- 市场驱动因素

- 资料消费量增加

- 对顺畅、不间断连结的需求不断增加

- 市场问题

- 隐私和安全问题

第六章 市场细分

- 按组件类型

- 天线

- 分散式天线系统 (DAS)

- 电缆

- 中继器

- 小型基地台

- 按最终用户产业

- 商业的

- 住宅

- 工业的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Pierson Wireless Corp.

- Cobham PLC

- AT&T, Inc.

- CommScope, Inc.

- Anixter Inc.

- Verizon Communications, Inc.

- Corning Incorporated.

- Ericsson Inc.

- TE Connectivity Ltd.

- Beatcom Incorporated

- Dali Wireless, Inc.

第八章投资分析

第九章:市场的未来

The In-Building Wireless Market is expected to register a CAGR of 13.2% during the forecast period.

Key Highlights

- Demand is anticipated for the worldwide in-building wireless market during the forecast period. This is mainly because there is a growing need for distinct and defined network coverage, followed by increasing public safety measures being implemented globally. The end-users are now actively hunting for smart technologies and devices to save them time and money due to rapid digital change. In addition, a second element creating new opportunities for market expansion is the developing smart and intelligent construction trend.

- In addition to the trend toward smart and intelligent buildings, the rise in business assurance for mission-critical applications, the need for efficient and robust in-building connectivity, which is influencing the use of in-building wireless solutions in the healthcare sector, and the growing expansion of cellular connectivity across rural areas are all essential factors accelerating the market's growth. Also, more research and development and the availability of unlicensed spectrum in the CBRS and MulteFire bands will give the wireless market new ways to grow during the time frame mentioned above.

- The rise in demand for the studied market is driving firms in the various regions to provide different solutions to capture market share. For example, American Tower provides distributed antenna solutions. Further, the City of Minneapolis manages the Minneapolis Convention Center, which recently marked 30 years in business. The 1.6 million square foot building includes 87 meeting rooms, two ballrooms, a 3,400-seat fixed-seat theater, and 475,000 square feet of display space. The Minneapolis Convention Center can provide an excellent wireless experience for guests, vendors, and workers thanks to an American Tower DAS solution.

- Many business buildings have been evacuated and sealed down due to the pandemic, putting many long-planned inside-building projects on hold. Businesses in most industries have seized the chance to address any issues that could have existed in their facilities before the shutdown and finish urgent renovations and repairs before staff, students, and customers return. During this period, addressing the problems caused by inadequate cellular coverage has received special attention. Because of the epidemic, cell phone coverage inside buildings is even more important to keep personal and professional relationships going and keep the public safe.

- Although network management provides excellent benefits, specific challenges, like reliability concerns, may obstruct the market's growth over the forecast period. Hiring a third-party networking infrastructure vendor to host critical business infrastructure entails trusting that the provider's business will last. In case of any failure by the providers to sustain competition in the market, the enterprises relying upon them may have to entirely replace critical pieces of infrastructure, without which it is not possible to conduct business.

In Building Wireless Market Trends

Residential is Expected to Hold the Major Share

- According to the US Census Bureau, in early 2020, the number of building permits for new residential construction in the U.S. rose, reaching a peak of 169,000 units in March last year. With more than 11 units approved per 1,000 population, Idaho and Utah have the greatest rate of new residential buildings in the United States.

- Despite COVID-19's effects, residential construction increased throughout Europe. The ZAC Campus Grand Prac Mixed-Use Development (USD 7,000 million projects), Milanosesto Mixed-Use Complex (USD 6,829 million projects), Camden Goods Yard Mixed-Use Community (USD 841 million projects), Viaduct Mixed-Use Community (USD 333 million projects), and Sackville Road Residential Community are some of the most significant multi-family housing construction projects launched in Europe during Q3 of last year. Therefore, it is anticipated that a rise in residential construction will increase demand for the studied market.

- According to the China Construction Industry Association, residential structures made up most of the previous year's finished construction in China. Buildings intended for housing accounted for over 67% of completed floorspace. As the country's economy grows, people migrate from rural areas to major cities, increasing demand for residential accommodation in these locations. Furthermore, apartments utilized as investment properties drive up demand.

- According to the IBEF, India invested USD 2.4 billion in real estate assets over the last year, a 52 percent increase year on year. From April 2000 to September last year, FDI in the industry, comprising construction, development, and operations, totaled USD 55.18 billion. If the price of real estate went up a lot, it would give the market a chance to grow.

- The company provides various solutions for residential use. For example, VeriDAS Technologies specializes in in-building wireless systems for multi-tenant housing and residential communities. VeriDAS is a company that designs, installs, validates, and supports wireless distributed antenna systems (DAS) in residential areas. The company's public safety DAS solutions for residential communities meet the standards of local governments, the NFPA (National Fire Protection Agency), and IFC for indoor emergency responder radio frequency signal strength, coverage, and capacity.

Asia-Pacific to Witness the Significant Growth

- The rise of collaborative networking technology can be linked to the growth of the APAC in-building wireless market.For example, with the deployment of G-SRv6, ZTE Corporation and China Mobile collaborated to accomplish the first trial of the G-SRv6 header compression solution. To complete G-SRv6, the firms combined ZTE's high-end router with a provider edge router (PE) and a service router (SR). This enabled the organization to contribute to networking technology developments. The increased demand for broad, dependable wireless cellular connectivity in commercial and residential building environments drives market revenue.

- The need for greater wireless connectivity, as well as advancements in networking technologies, are driving segment demand. For example, the Electronics and Telecommunications Research Institute recently built the world's first 5G indoor distributed antenna system capable of supporting 20 Gbps and 5G service speeds in interior locations. This introduction is expected to contribute to an improved wireless connection in commercial areas.

- In August 2022, Comba Network, a subsidiary of Comba Telecom based in Hong Kong, said that it had been chosen by China Mobile to contribute to the launch of significant deployments of 5G extended picocells. According to a press statement from Comba, this deployment included 20,000 small-cell base stations. In addition, the company stated that it had secured two bid packages in this deal with China Mobile, which included single-mode extended picocell and dual-mode extended picocell.

- According to the government's newly announced Right of Way Rules, telecom operators won't need permission from authorities to erect cell towers or poles or lay wires over private properties. To facilitate the rollout of telecom networks, particularly 5G services, the government has announced rules for using power poles, footover bridges, etc., for installing small mobile radio antennae or laying overhead telecom cables, along with fees. The Indian Telegraph Right of Way (Amendment) Rules, however, issued last year, state that before erecting a mobile tower or pole over a private building or structure, telecom operators must notify the competent government in writing. With less paperwork and the agreement to install the small equipment in existing infrastructure, the vendors will more easily enhance their services and expand.

- The main driving factor in wireless technology development is the constantly evolving standards created to advance router technology. Over the past ten years, wireless router technology has developed steadily, keeping up with advancements in IEE (Institute of Electrical and Electronics Engineers) standards. The top speeds and transmission capacities of networks are often increased by making changes to these standards.

In Building Wireless Industry Overview

The in-building wireless market is moderately competitive owing to the presence of multiple players. The players in the market are adopting strategies like product innovation, mergers, and acquisitions in order to expand their product portfolios, expand their geographic reach, and primarily to stay competitive in the market.

In October 2022, HFCL, a domestic telecom equipment manufacturer, partnered with Qualcomm Technologies to design and develop 5G outdoor small-cell products. In line with its 5G strategy, HFCL's investment in 5G outdoor small cell products will speed up the deployment of 5G networks, improve the 5G user experience, and make the most of the 5G spectrum.

In October 2022, ExteNet Systems has agreed to develop, build, and operate ExteNet's innovative in-building signal and connectivity solutions across all MGM properties in the United States. It is the country's most significant project and will provide users with next-generation connectivity. ExteNet specializes in convergent communications infrastructure solutions such as LTE/5G wireless and fiber-neutral host communications infrastructure.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview (Covers the impact due to COVID-19)

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Volume of Data Consumption

- 5.1.2 Increasing Demand for Smooth and uninterrupted Connectivity

- 5.2 Market Challenges

- 5.2.1 Privacy and Security Issues

6 MARKET SEGMENTATION

- 6.1 By Component Type

- 6.1.1 Antenna

- 6.1.2 Distributed Antenna Systems (DAS)

- 6.1.3 Cables

- 6.1.4 Repeaters

- 6.1.5 Small Cells

- 6.2 By End-user Industry

- 6.2.1 Commercial

- 6.2.2 Residential

- 6.2.3 Industrial

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Pierson Wireless Corp.

- 7.1.2 Cobham PLC

- 7.1.3 AT&T, Inc.

- 7.1.4 CommScope, Inc.

- 7.1.5 Anixter Inc.

- 7.1.6 Verizon Communications, Inc.

- 7.1.7 Corning Incorporated.

- 7.1.8 Ericsson Inc.

- 7.1.9 TE Connectivity Ltd.

- 7.1.10 Beatcom Incorporated

- 7.1.11 Dali Wireless, Inc.